In Italien beginnt das Ende des Euro

Heute werden uns zwei Themen beschäftigen. Zunächst das einfachere, nämlich die Zukunft der Eurozone nach der Regierungsbildung in Italien; heute Nachmittag dann die Aussichtslosigkeit im Nahen Osten angesichts der demografischen Entwicklung in der Region, die alles verspricht, nur keinen Frieden.

Beginnen wir mit Italien. Da reagieren demnächst ausgesprochene Euroskeptiker, um nicht zu sagen -gegner, und es passiert nichts. Die Zinsen bleiben tief, der Euro gewinnt gar zum ersten Mal seit Tagen wieder gegenüber dem US-Dollar dazu. Alles paletti also?

Natürlich nicht. Was sich dort anbahnt, hat das Zeug, den Euro innerhalb der nächsten zwei Jahre zu vernichten. Nein, das ist keine Prognose. Da halte ich mich daran, entweder das Ereignis oder den Zeitpunkt vorherzusagen, aber niemals beides zugleich.

Was meinen denn die Angelsachsen – okay, die sind ohnehin euroskeptisch, weil sie was von Wirtschaft verstehen – zu dem Thema? Zunächst Ambroise Evans-Pritchard (AEP) vom Telegraph:

Zunächst erinnert er daran, dass die Italiener allen Grund haben, nicht zufrieden zu sein:

Quelle: The Telegraph

Dann geht es um die politischen und wirtschaftlichen Konsequenzen:

- “The formation of such a government – which could still unravel at the last moment – will stiffen German resistance to any form of EMU fiscal union or debt pooling. It effectively dooms the Macron plan for a eurozone budget, leaving monetary union almost unworkable in the next global downturn.” – bto: Das stimmt. Wenn es eine neue Rezession gibt – und die ist nur eine Frage der Zeit –, hat die Eurozone außer der EZB nichts zu bieten, was die Region, die fundamental völlig aus dem Ruder läuft (es gibt keine Konvergenz, sondern zunehmende Divergenz!), nicht auf Dauer “retten” kann.

- “Earlier proposals by the two parties included the creation of a parallel currency or “fiscal certificate”. The more sophisticated Lega variant would be based on perpetual treasury notes to cover €70bn (£61bn) of tax rebates and funds owed to state contractors. It is a way to inject liquidity into the economy, and to reintroduce the lira by stealth.” – bto: Die Parallelwährung habe ich auf bto schon im Oktober 2017 diskutiert. Ich finde es SUPERsmart und denke, es wird der Weg sein. → Kommt in Italien die Parallelwährung? Dazu der Telegraph richtig: “The scheme would – if ever enacted – subvert the monetary control of the European Central Bank and destroy German political consent for the single currency. It ultimately renders the euro structure untenable.” So ist es.

- “It is a hazardous moment for Italy to start awakening the global bond vigilantes. The ECB is to wind down its debt purchase programme by the end of the year, depriving the Italian treasury of a backstop buyer for its debt. The country has to refinance debt equal to 17pc of GDP this year, one of the highest ratios in the world.” – bto: Es wird eben klar, dass der Euro zu Ende ist.

- “The markets have so far reacted calmly. Risks spreads on Italian 10-year bonds have risen just 18 basis points to 138 over the last week, but this may prove complacent.” – bto: Warum wohl? Wir wissen es! Es gibt einen mächtigen Freund in Frankfurt, der nicht Geldpolitik betreibt, sondern Euro-Schulden-Sozialisierungs-Politik durch die Hintertür.

- Konkreter: “A study by HSBC concluded that the ECB has mopped up half the gross supply of Italian debt during the QE phase and shaved at least 100 basis points off Rome’s borrowing costs, flattering the fiscal profile. The underlying picture has been deteriorating, adjusted for the cycle. The economy looks stronger than it is because a depreciation allowance of up to 250pc led to a temporary surge in investment, drawing forward fiscal stimulus from the future.” – bto: Dazu wurde Geld geschaffen, was auch bei uns gilt. Nur so zu Erinnerung.

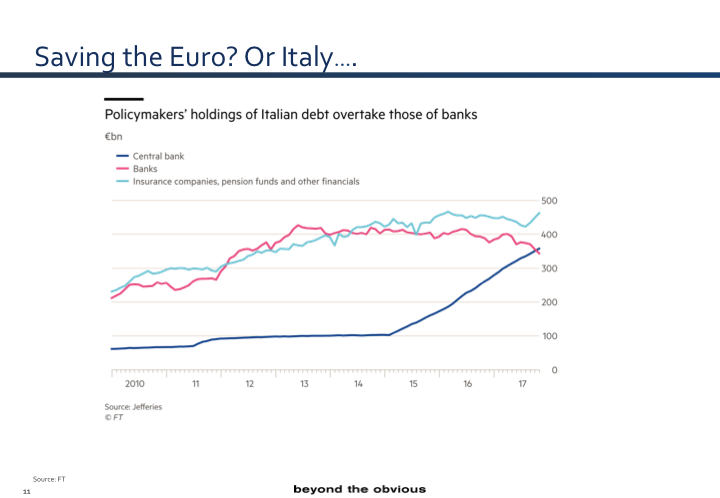

Hier ein Chart, das ich schon mal bei bto hatte:

Quelle: FT

Da ist es doch sofort klar, weshalb die Märkte positiv reagieren. Der Euro ist sicherer geworden, weil Eurogegner demnächst regieren, muss doch die EZB noch mehr tun, um ihn zu erhalten!

Doch wie geht es jetzt weiter? Dazu zwei verschiedene Sichtweisen, die ich beide für interessant halte. Zunächst nochmals AEP:

- “Mr Salvini has concluded – after watching the Greek fiasco – that it is too dangerous for a debtor country to leave the euro alone, but he has not altered his view that monetary union is the work of the devil. He has merely shifted tactics. The Lega now aims to bring about ‚Italexit‘ by subtle means, subverting EMU from within. ‚The euro is and remains a failure. It is clear in our minds that the system of monetary union is destined to end, and therefore we wish to prepare for that moment,‘ he said. ” – bto: Es geht also darum, die Eurowährung als Ganzes zu beenden (zumindest in der heutigen Form) und das so, dass die Schuldfrage bei jemandem anderen hängen bleibt. Na, schon eine Idee?

- Zunächst also die bereits angesprochene Parallelwährung: “These preparations are sketched into the Lega – Grillini document. It calls for a study of “minibots”, perpetual treasury notes used to inject liquidity, initially by covering €70bn of state arrears to households and contractors.” – bto: Übrigens eine wirklich gute Idee, nicht ganz so weit weg vom Wolffson-Plan.

- “While there is no public clamour for the lira, there is no love for the euro either. It is widely felt that monetary union is a German regime that has trapped their country in a bad equilibrium, depriving them of the sovereign tools needed to confront the post-Lehman slump and to protect their banking system.” – bto: Natürlich wird uns Deutschen keine gute Rolle zugedacht, was vor allem an der verfehlten Politik der Regierungen unter Frau Merkel liegt.

- Die Lösung: “His goal is to set off a chain of events that leads to German withdrawal as the ‚cleanest‘ way to end what he calls the “infernal instrument of the euro”.” – bto: Das ist so richtig. Wir sollten austreten, bevor es Italien tut. Mein Credo seit Jahren: → „Lasst uns aus dem Euro austreten, bevor Italien es tut“

Also, Erpressung, die wir nicht mitmachen. Ich denke ja, Frau Merkel und Co. werden sich für Europa auch wegen der Migrationsproblematik in jeder Hinsicht erpressen lassen.

Wolfgang Münchau war in der FT noch etwas subtiler mit seinen Szenarien. Schauen wir sie uns noch zur Abrundung an:

- “Should we be worried? The answer is yes, but not for the reasons widely assumed. Italy’s new leaders have studied carefully the confrontation between Greece and the rest of the eurozone three years ago. They will not start their period in office by breaking the EU’s fiscal rules. They will not threaten to leave the euro. But we should think of this as a tactical retreat. None of the problems for Italy in the eurozone have been solved. There will be no big structural reforms, and no material reforms in eurozone governance either.” – bto: Genau, so ist es!

- “The two parties campaigned on a platform of radical change to Italy’s economic and social policies and on immigration. The League wants a flat income tax. Five Star campaigned on a universal basic income. Both parties want to undo the pension reforms of 2011. The League wants a feasibility study for a “mini-BOT”, a debt instrument secured on future tax revenues that should be acceptable as a means of payment — in other words, a parallel currency. Think of it as a way to exit the eurozone without exiting the eurozone.” – bto: brillant und richtig!

- “There are two ways for the new government to meet the targets. The first is to water down the election promises, the second to implement them later. The first would risk a breach with the voters, the second a battle with the EU. The coalition would have to do both. (…) Five Star and the League would self-destruct if they failed to deliver what they promised to their voters. The most likely policy evolution of this administration would, therefore, be a period of reluctant compliance with EU rules, followed by three conflicts.” – bto: Es dauert noch einige Zeit, aber es wird kommen.

- “Italy will ask for a change in the European treaties. I am certain that the EU would reject such a request. We should perhaps stop obsessing about whether Emmanuel Macron and Angela Merkel can agree eurozone reforms: the French and German leaders probably will. But I doubt whether they can co-opt the new Italian prime minister into a deal if they reject Italy’s request to relax the fiscal rules.” – bto: Wir machen es, aber nicht die Holländer. Danke dorthin!

- “The second is the so-called mini-BOT. Five Star is notably cool on the idea, but the League sees it as a useful way to circumvent fiscal rules. The idea failed in Greece through lack of preparation. But if it is technically feasible, the political temptation in this case would be overwhelming. For as long as Italy refrains from calling it a parallel currency, I see nothing the EU can do to block it.” – bto: Wann hat die EU schon was blockiert, wenn es um Geld ging? Siehe Staatsfinanzierung in Irland durch die Notenbank. Hauptsache die Gurken haben die richtige Größe.

- “It would be naive to think of the election of two anti-establishment parties in the eurozone’s third-largest economy as immaterial. Italy after all is not Greece. And the League and Five Star constitute a far greater challenge to the EU consensus than Syriza.” – bto: stimmt!

Ach wie gut, dass der Maestro selbst weiß und sagt, weshalb es schiefgehen wird: “The worry is that Italy has continued to suffer chronic capital flight even during the economic recovery. The proceeds from QE have been recycled out of the country into accounts in Germany or Luxembourg. The Bank of Italy owes €426bn to its ECB peers through the internal Target2 payment system. This was supposed to self-correct. It has not done so. Alan Greenspan, former chairman of the US Federal Reserve, said the Target2 imbalances show that the architecture of the euro is ‚not conceptually stable‘ and he is watching the figures closely. ‚It’s something that’s not going to work out well,‘ he said.” – bto: “conceptually unstable”! So muss man das Desaster mal benennen!

→ telegraph.co.uk: “Eerie calm in markets as Italy’s rebel leaders march on Rome”, 13. Mai 2018

→ ft.com (Anmeldung erforderlich): “Italy looks for ways out of its eurozone fix”, 13. Mai 2018