Immobilienpreise vor strukturellem Rückgang?

Bereits vor einigen Monaten habe ich eine interessante Studie der Deutschen Bank zu den langfristigen Renditen verschiedener Vermögensklassen an dieser Stelle diskutiert:

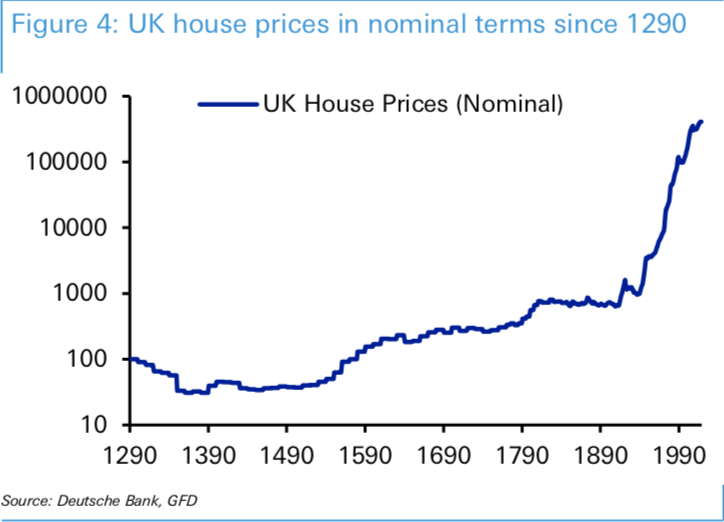

In dieser Studie wird auch die langfristige Performance der Immobilienpreise in Großbritannien betrachtet – mit einer sehr interessanten Erkenntnis. Über Jahrhunderte haben die Immobilienpreise stagniert oder waren gar rückläufig. Richtige Preissteigerungen gab es erst, als die Bevölkerung aufgrund besserer medizinischer Versorgung und Zuwanderung deutlich wuchs und mit der Abkehr vom Goldstandard.

Quelle: Deutsche Bank

Dazu schreibt die Bank: “Unparalleled inflation also occurred in asset prices in the twentieth century especially during the 1950-2000 period. UK housing is the longest time series we have for any traditional asset within our database. It took 649 years for nominal prices to rise 887% up until 1939 (0.4% annualised). However in the last 79 years, prices have risen 41,363% (8% annualised). As the real adjusted series shows, this is not simply an inflation story. Between 1290 and 1939, the real adjusted price of a UK house actually fell -49% over the 649 year period. In the last 79 years real prices have climbed 834% (3% annualised). Perhaps UK housing is the ultimate asset where population growth has shown how easy it is to create inflation. As a small island with heavy controls on new homebuilding, high population growth and limited extra housing supply has put massive upward pressure on prices over the last several decades, especially post WWII.” – bto: Deshalb haben die Autoren die Abkehr vom Goldstandard – wie bereits im Oktober diskutiert – im Zusammenhang mit dem Bevölkerungswachstum als unumgänglich beschrieben, weil es nur so ohne heftige Deflation ging.

Das wirft natürlich Fragen nach der Zukunft auf, die sich auch die FT stellt:

- “Just because the period in which most of us have become adults has been one of almost nonstop property price growth does not mean that it makes sense to extrapolate that growth indefinitely. It might not. The latest Deutsche Bank Long Term Asset Return Study (written by Jim Reid and his team of analysts) takes a proper look at the evidence. It turns out that fast-rising house prices in the UK are a relatively recent phenomenon.” – bto: und deshalb sicherlich nicht gesichert für die kommenden 100 Jahre.

- ” What changed in the middle of the last century? And will it change back? The answer to the first question brings us to demographics. The world began to change in 1796 when Edward Jenner introduced the first vaccine for smallpox (the major killer of the time) and so created a dramatic rise in life expectancy and the beginnings of a rise in the number of people in the world: the global population rose by a mere 0.17 per cent a year until 1820 but 0.98 per cent a year from then to 2000 (this rise was what allowed the industrial revolution to happen, by the way). However, it is the past 70 years — the ones most of us use as our map for the future — that have been genuinely dramatic: from 1950 to 2000 the global population more than doubled, from 2.5bn to around 6.1bn.” – bto: und damit alle Probleme: Wohnraum, Umwelt, …

- “If you had looked properly at birth rates in the G7 in the postwar period you would not have been surprised that inflation and unemployment rose in the 1970s as the baby boomers began to both ‘jostle for their first jobs’ and to consume global resources on a huge scale (…). You would have expected stock markets to start to boom in the 1980s as those same boomers moved into their thirties and forties and started to pour cash into investments to finance their retirements. And you surely would have known that all those babies growing up in the affluent stability of the postwar world would want to form their own households and would be encouraged by rising global affluence to want to do so in bigger and better houses than their parents.” – bto. was aber die Frage aufwirft: Was nun, wenn der Trend sich umkehrt?

- “As prices rose baby boomers figured that homes looked like a hot tip of an investment and, enabled by the rise of the fiat money system, bought more. Nearly half the 2.5m buy-to-let investors in the UK now say they are ‘pension pot’ investors. They own one house to live in and another as an investment. Perhaps, ‘housing is the ultimate population-sensitive asset’.” – bto: Das klingt ganz so!

- “Is it possible that we might be moving into an age of static to falling house prices? It is. Listen to the pessimists and you might think the global population will soon double again. But the rate of growth peaked long ago (in 1968 at just over 2 per cent a year). It is now down to more like 1 per cent. The main driver behind the extraordinary past 70 years is receding: the baby boomers are more likely now to be sellers than buyers.” – bto: und das vor allem in Deutschland, wo die demografische Situation so viel schlechter ist!

- “(…) the fast rise in house prices has created a class of winners and another of losers. The losers have had enough — and our cash-strapped government is now on their side. So second-homebuyers have been hit with council tax rises and an additional rate of stamp duty (an extra three percentage points). Buy-to-let investors have seen a sharp reduction in the scope of the tax relief available to them on their rental income as well as a shift in power back towards tenants, stricter affordability requirements on their mortgage applications and a raft of new energy efficiency rules and licensing laws. (…) There are also calls for new wealth taxes on all UK property — or sharp rises to council taxes at the top end. All four major UK parties are now showing interest in land value taxes and in scrapping what tax exemptions there are left for property owners.” – bto: Und bei uns wird es erst recht so sein!

- “(…) prime London house and flat prices are down 30 and 25 per cent, respectively, since their peak several years ago and most data now show nationwide prices rising slightly less than inflation. There’ll be volatility here for a while (…) But if prices revert to very long-term means, the period in which all our celebrities have made their property fortunes is going to turn out to have been a huge historical anomaly. I wonder what the ones who are being asked ‘property or pension’ in 30 years will say.” – bto: sich ärgern, wie die Käufer heute in Nebenzentren.

→ ft.com (Anmeldung erforderlich): “Will UK house prices ever rise again?”, 15. November 2018