Immobilien global im Boom

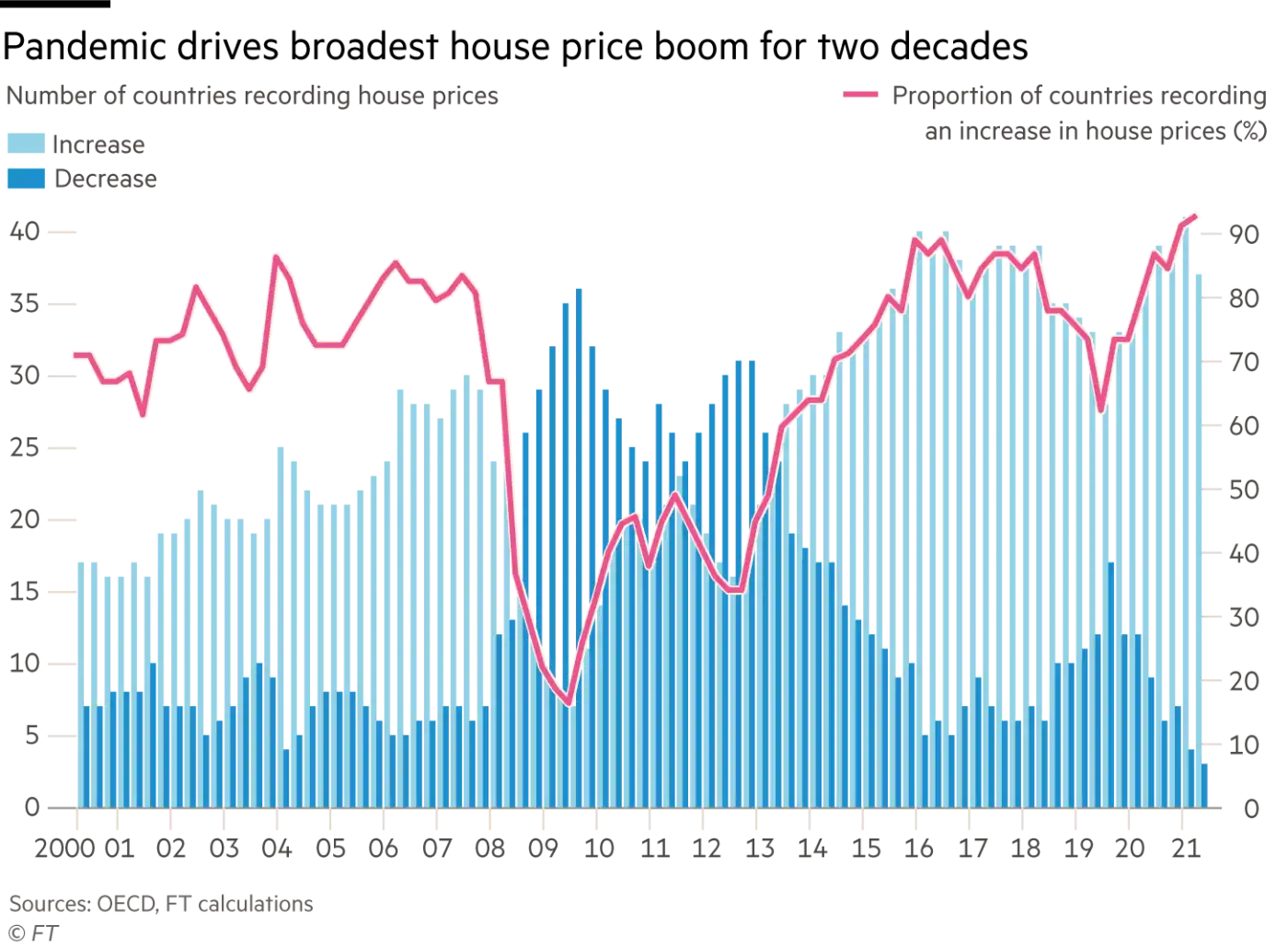

Wir wissen, dass es einen klaren Zusammenhang zwischen Kreditwachstum und Immobilienpreisen gibt. Das ist klar sichtbar seit Jahrzehnten. Doch aktuell scheinen wir einen wahren Boom zu erleben, getrieben von dem noch billigeren Geld im Zuge der Corona-Krise. Die FINANCIAL TIMES (FT) spricht vom breitesten Boom seit 20 Jahren:

- “Of the 40 countries covered by OECD data, just three experienced real-terms house price falls in the first three months of this year — the smallest proportion since the data series began in 2000, analysis by the Financial Times found. Historically low interest rates, savings accumulated during lockdowns and a desire for more space as people work from home are all fuelling the trend, analysts said.” – bto: was auch klar ist, weil wir weltweit faktisch eine Geldschwemme haben.

- “Annual house price growth across the OECD group of rich nations hit 9.4 per cent — its fastest pace for 30 years — in the first quarter of 2021, as economies rebounded from last year’s severe coronavirus-triggered recessions.” – bto: Dies ist problematisch (Ungleichheit) und ein Indikator für breitere Inflation.

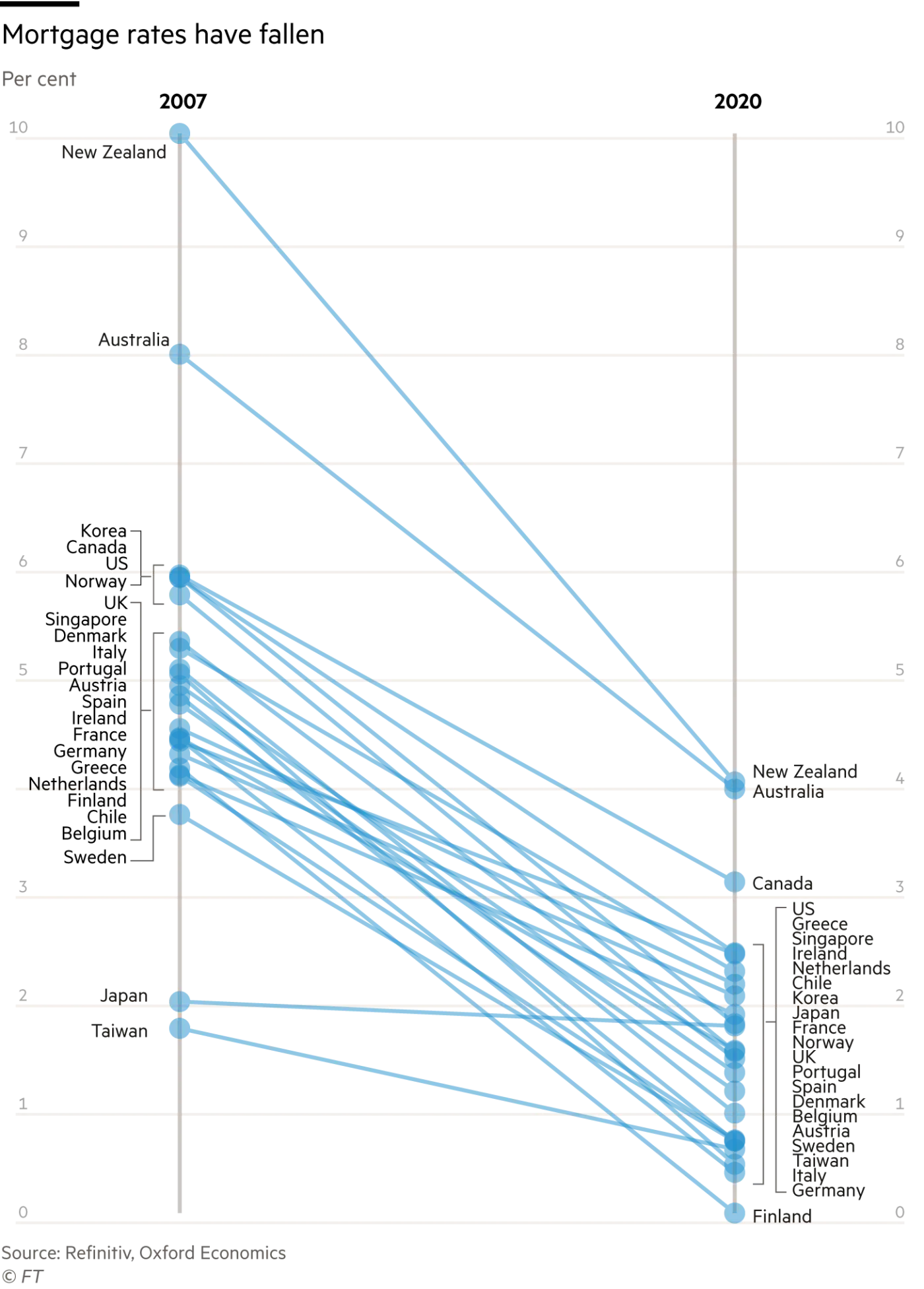

- “‘Extremely accommodating financial conditions’ with record-low interest rates had helped boost house prices at an unusually fast pace during a period of weak economic activity, Borio said. Low borrowing costs make house purchases more affordable relative to rent and to other investments. In addition, many households, particularly those that were already better off, have accumulated large savings since the start of the pandemic as lockdowns limited spending while some jobs were protected. ‘A lot of this additional income has been allocated to the housing market,’ said Martínez-García.” – bto: Es ist sehr simpel. Aber es ist eben eine seit Jahren laufende Entwicklung. Und das ist die Abbildung, die ich für so relevant halte, dass ich den Artikel hier bespreche.

Quelle: FT

- “Average house prices across the OECD are growing faster than incomes, making housing less affordable. They are also rising faster than rents. Adam Slater, lead economist at Oxford Economics, said properties in advanced economies were about 10 per cent overvalued compared with long-term trends. That makes this boom one of the biggest since 1900, he calculated — although nowhere near as big as the run-up to the financial crisis.” – bto: Das mit den Trends ist so eine Sache, wenn der Trend eine konstante Höherbewertung relativ zum BIP/Einkommen bedeutet. Denn so ein Trend kann per Definition nicht ewig anhalten und ist im konkreten Fall dem zunehmenden Leverage der letzten 40 Jahre geschuldet.

- “Credit growth is lower than before the global financial crisis, suggesting ‘a lower risk of a bust compared to, say, 2006-2007’, he said. Mortgage growth was driven largely by people with strong financial positions, and across most advanced countries households were less indebted than before the financial crisis, suggesting a lower risk that the situation would follow the same path with a wave of defaults and fire sales.” – bto: Das mag schon sein, dennoch ist der Leverage im System weiter gestiegen und damit die Anfälligkeit.