Goldman Sachs: Überblick über die globalen Stützungsmaßnahmen

Goldman Sachs mit einem sehr interessanten Überblick über die Maßnahmen der Regierungen der Welt, um die Folgen der Corona-Krise abzudämpfen und die Wirtschaften zu stabilisieren:

- “Standard budgetary measures such as the cyclically adjusted budget balance do not provide a clear answer to this question because they understate the important role of existing programs and automatic stabilizers in economies with sizable social welfare systems, such as Europe. As a simple alternative, we propose the change in the overall budget deficit relative to the change in the output gap, both scaled by GDP and compared with the pre-pandemic level. This counts any widening of the deficit—whether through discretionary spending packages, tax cuts, or existing programs—as support for the economy, while conditioning on changes in the output gap as an adjustment for the cycle.” – bto: Das klingt nach einer pragmatischen und einleuchtenden Vorgehensweise.

- “Our results show that Japan, Australia, and Canada have provided similar levels of support as the US since the pandemic began, although the US looks likely to pull ahead this year. Support has also been sizable in the UK but more limited in the Euro area, especially in Spain.” – bto: Daran ändert auch der “Wiederaufbaufonds” nichts.

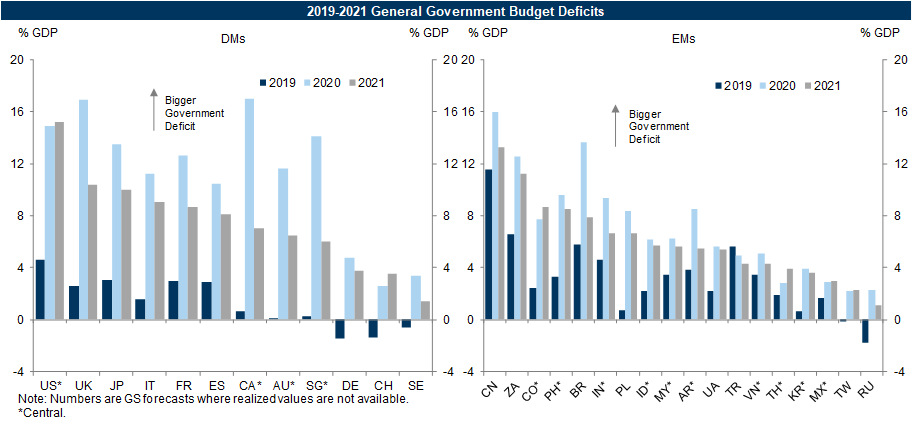

- “The simplest measure of fiscal support is the raw budget deficit as a share of GDP. Exhibit 1 compares our expectations for budget deficits in 2020 (light blue bars) and 2021 (grey bars) with 2019 (dark blue bars). Indeed, the large light blue and grey bars in the left panel imply significant support across large DMs through 2020 and 2021.” – bto: Das ist auch richtig, aber wurde es richtig eingesetzt? Und wie gehen wir hinterher mit den Schulden um?

Abb. 1: Staatsdefizite

Quelle: Goldman Sachs Global Investment Research

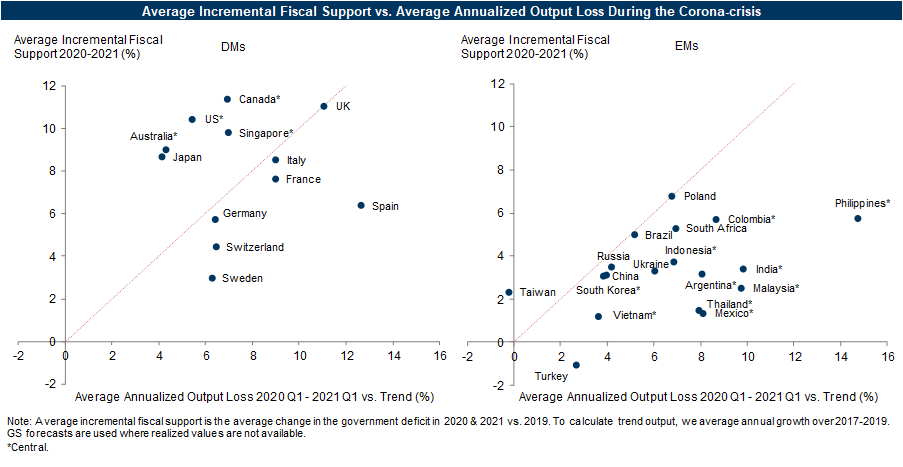

- “(…) we propose an extremely simple alternative: the change in the overall budget deficit relative to the change in the output gap, both scaled by GDP and compared with the pre-pandemic level. This counts any widening of the deficit—whether through discretionary spending packages, tax cuts, or existing programs—as support for the economy, while conditioning on changes in the output gap as an adjustment for the cycle. Moreover, our focus on changes in the output gap sidesteps the most difficult measurement issues, which revolve around the starting level of spare capacity before the pandemic.” – bto: Man beachte, wie nahe Italien an der Kurve liegt und wie weit entfernt Spanien.

Abb. 2: Defizit-Veränderung und Output-Gap

Quelle: Goldman Sachs Global Investment Research

- “Next, we calculate the difference between the average expected increase in the budget deficit and the average expected output loss (or the vertical distance from the 45-degree line) as a measure of a country’s “extra” fiscal support. Exhibit 3 plots the extra fiscal support for all countries in our sample. Consistent with conventional wisdom, our results do show that fiscal policy has eased the most relative to output loss in the US (+5pp differential) but Australia (+4.7pp), Japan (+4.6pp), and Canada (+4.5pp) are not far behind. While the UK eased fiscal policy roughly one-for-one with its output loss, continental European countries are all below the 45-degree line, only marginally so in Italy (-0.4pp) and Germany (-0.7pp) but more substantially so in France (-1.3pp) and especially Spain (-6.2pp).”

- “The EU is not as far behind the US as other measures such as the cyclically adjusted deficit or a tally of discretionary packages would suggest. Nevertheless, the level of support does look lower, especially in Spain. Along with the slower vaccination start, this could weigh on the early part of the European recovery. And emerging economies have provided only limited support, as one would expect given their more binding fiscal constraints. EM recovery therefore depends more on a pickup in global demand for goods and tourism services, as well as continued progress in containing the pandemic.” – bto: Man sieht aber auch hier, wie die Struktur von EU und Euro hemmt, statt zu helfen.

→ gs.com: “Global Economics Comment: Fiscal Easing: The US Is Not Alone”, 15. März 2021