GMO: magere Aussichten für die US-Börse

Regelmäßig bringe ich an dieser Stelle die Analysen von GMO. Ich mag die analytische Herangehensweise, wohl wissend, dass es nur strategisch und nicht taktisch hilft. Diesmal erläutern die Analysten, weshalb mit US-Aktien garantiert nur Verluste gemacht werden können:

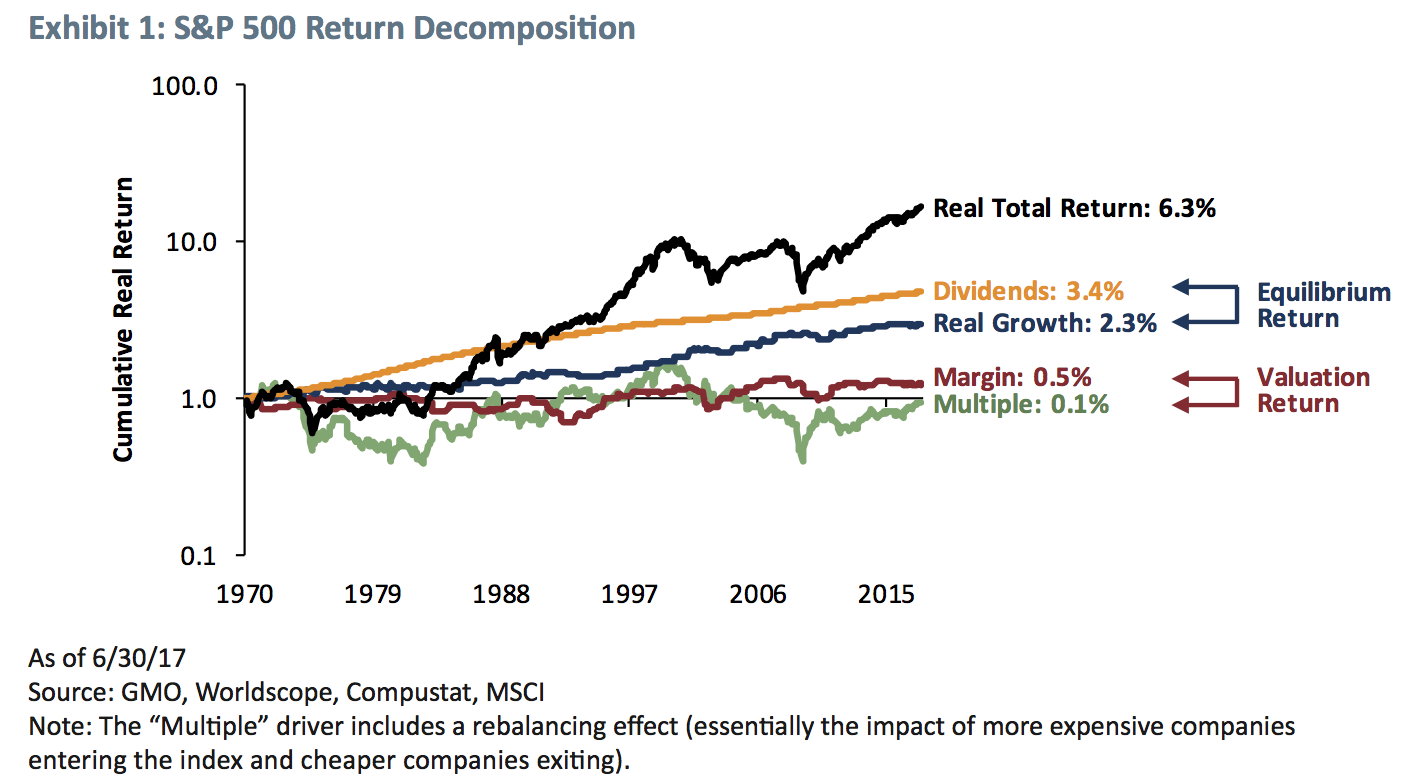

- “For any equity market, the return achieved can be broken down into four component parts. In the long term, the return is almost exclusively driven by dividends (growth and yield). (…) The two other ways to make money from owning an equity asset class are from multiple (P/E) or margin expansion (collectively we call these elements the valuation components).” – bto: Das leuchtet ein, weil sowohl Margen wie auch Multiples nicht ewig wachsen können.

- “(…) we can (ex post) always decompose returns into these factors. Exhibit 1, we show a return decomposition for the S&P 500 since 1970 (…) over the long term, the returns achieved have been delivered largely by dividends:” – bto: was ebenfalls klar ist. Multiples und Margen können immer nur temporär wirken. Deshalb auch dieses klare Bild:

Quelle: GMO

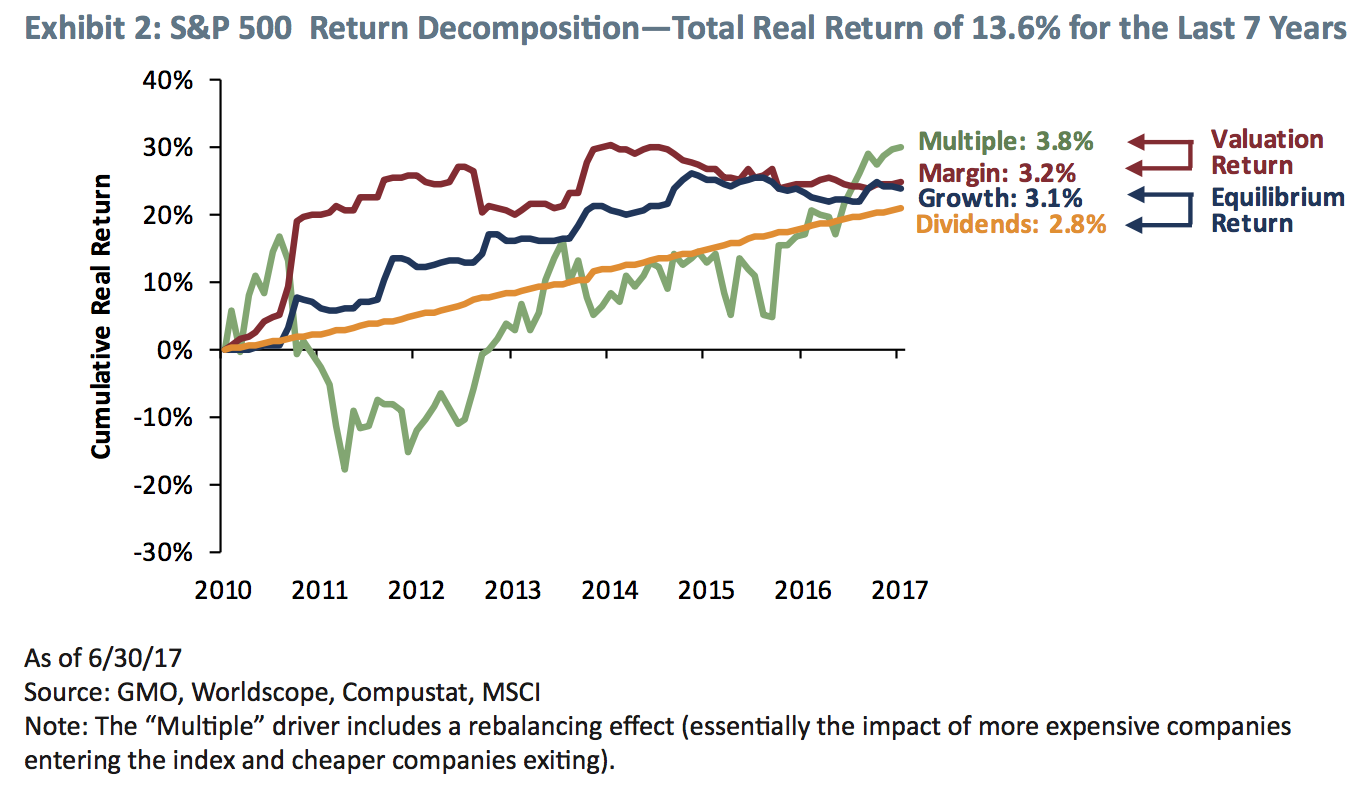

- “Using this same decomposition over the last seven years, we see quite a different story. Earnings and dividends have grown as one would expect, but P/E and margin expansion have significantly contributed to returns with multiple expansion actually providing the biggest boost of the four.” – bto: was per Definition nicht ewig so weiter gehen kann.

Quelle: GMO

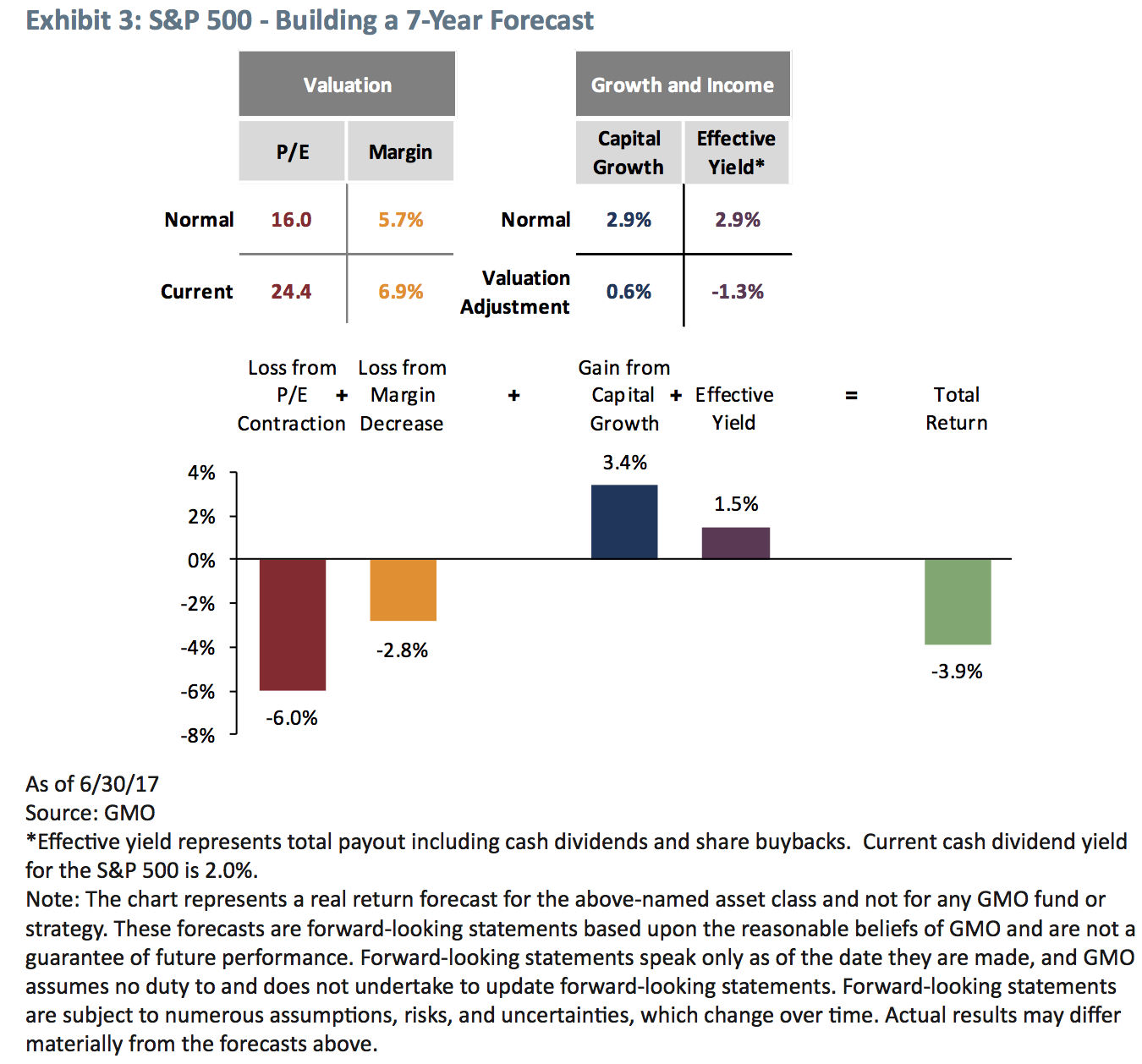

Die Historie ist ja recht nett in der Analyse. Wichtiger ist jedoch die Vorhersage künftiger Erträge. Auch dazu kann man diese Zerlegung der Treiber von Aktienrenditen nutzen. Bei Boston Consulting (BCG) habe ich mit Kollegen ein ähnliches Verfahren entwickelt. Wir nannten es TSR-Decomposition (TSR = Total Shareholder Return). Schauen wir uns an wie GMO es macht:

- “To go (…) to a framework for forecasting returns requires some statement about the way the four elements will evolve over time. (…) We assume that whatever level P/Es and margins are trading at today, that at the end of seven years they will mean revert to equilibrium levels. [bto: Bei BCG haben wir eine Konvergenz über 40 Jahre angenommen, was aber bei einem degressiven Verlauf nicht so viel anders ist.] (…). We then factor in earnings growth and income (dividends and buybacks) that we receive as equity owners.” – bto: also der Versuch, echte Erträge zu prognostizieren, verbunden mit einer Anpassungserwartung der Bewertungskomponente.

- “If someone comes to you and says, ‚I think US equities will deliver 10 % real per year from now on‘ you can ask them how. Does he think P/Es and margins will continue to expand? Does he have some rampantly bullish view on growth? Or perhaps an odd view on yield?” – bto: Das ist in der Tat der Charme dieses Ansatzes.

- “We update this model every month and you can see the current dilemma in Exhibit 3.” – bto: Das Dilemma besteht darin, dass die Bewertung so weit vorangelaufen ist, dass man eben nicht mehr von großartigen künftigen Erträgen ausgehen kann:

- Fazit GMO: “From our perspective, one has to make some fairly heroic assumptions to believe that the S&P is even remotely close to fair value. Holding all else constant, an equilibrium P/E of 31 would make the S&P look fairly valued today. However, to believe that a ‚normal‘ market valuation is 28 x earnings brings us back to the logic provided in the dot com bubble (…) Similarly, we are just o the highs of the highest profit margins we have seen in the post WWII era. Equilibrium levels for profit margins would have to be almost doubled to make today’s elevated levels look fairly valued, again holding all else constant.” – bto: “equilibrium” meint hier den erforderlichen Wert am Ende des 7-Jahres-Modellierungszeitraums.

- Danach zeigt GMO die – auch Lesern von bto wohlbekannten – Analysen von Shiller und Hussmann, die eine deutliche Überbewertung des Marktes zeigen, um von diesem Blickwinkel nochmals die hohe Bewertung und damit die sicheren Verluste bzw. mageren Ertragsaussichten für die kommenden Jahre zu untermauern.

- Was zur Schlussfolgerung führt: “From a fundamental perspective, what justifies owning this market? Using our framework, you need to believe that growth in earnings and dividends are going to be significantly higher than what they have been historically. This argument seems like an enormous stretch to us. Earnings and the dividends from earnings have their roots in the growth of the economy, and it certainly does not appear as though the US economy is going to be rocketing back to the type of growth that we saw in the 60s and mid-90s.” – bto: Und das ist, wie wir wissen, wegen der demografischen Entwicklung und der kargen Produktivitätszuwächse unmöglich. Eiszeit!

- “If you believe that P/Es and margins are going to stay high, allowing for earnings and dividends to do their normal thing, thus generating a decent return, you again are making some extraordinary assumptions that are certainly not based in anything related to the historic record of P/Es and margins.” – bto: weil sie eben nie stabil auf überhöhtem Niveau blieben. Selbst in den außerordentlichen letzten Jahrzehnten gab es deutliche Korrekturen.

- “If you believe P/Es and margins are going to expand from today’s levels, creating another seven years similar to those we have just experienced, it becomes difficult to argue with you, as at this point you are defying all reason and logic.” – bto: vor allem weil beides eben schon auf (fast) Rekordwert liegt.

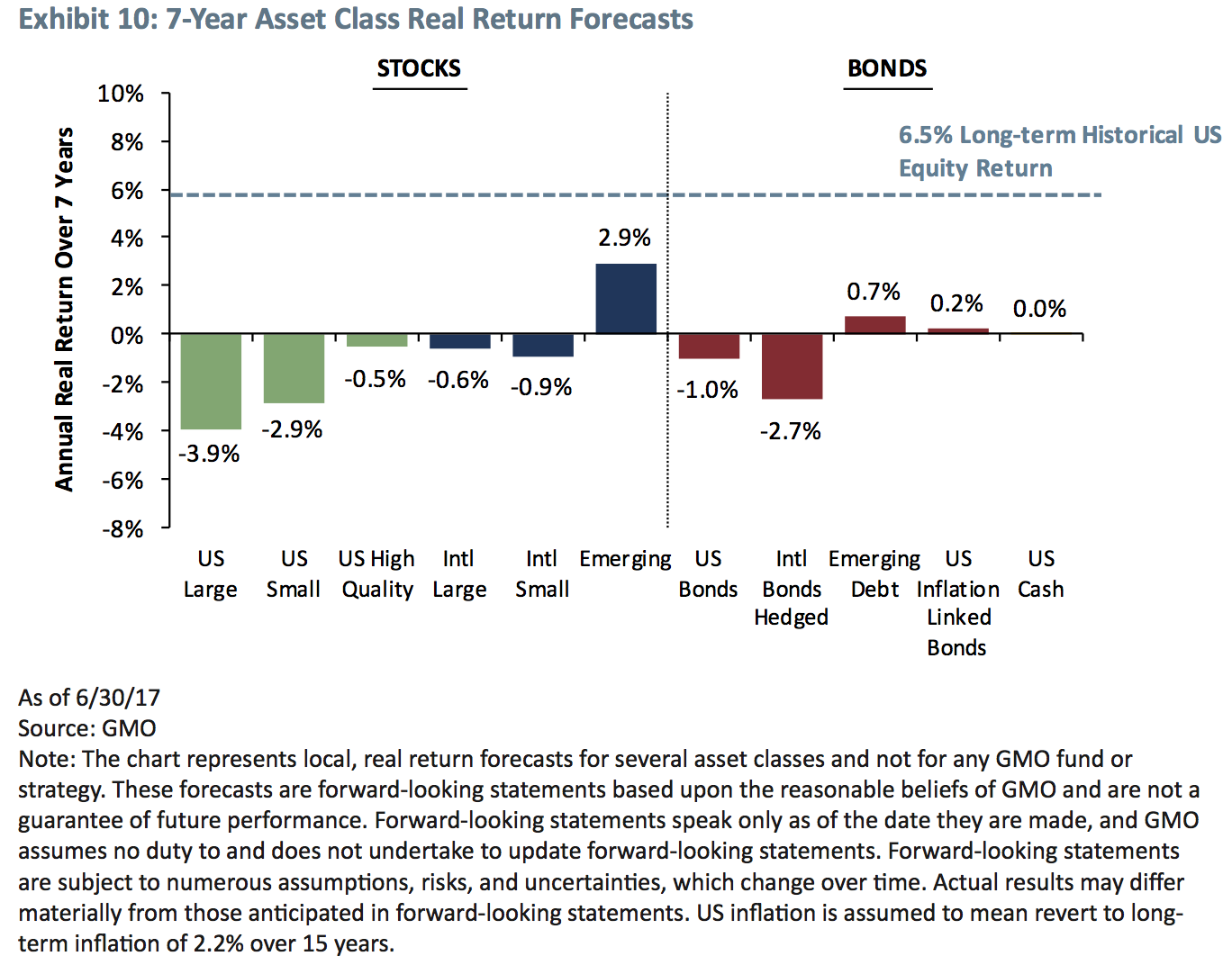

- Doch wohin dann mit dem Geld? “The cruel reality of today’s investment opportunity set is that we believe there are no good choices from an absolute viewpoint – that is, everything is expensive (see Exhibit 10). You are reduced to trying to pick the least potent poison.” – bto: was sich übrigens mit der Analyse aus dem Blickwinkel von Qualität deckt, die ich vor einigen Monaten hier und bei der WiWo vorgestellt habe.

- Womit klar ist: “The last thing you should want to do is concentrate your portfolio in the world’s most expensive assets.” – bto: Diversifikation senkt das Verlustrisiko, verspricht aber keine großen Erträge! Egal, es geht um Vermögenserhalt.

- “Though emerging equities are expensive in absolute terms, they provide a very strong return relative to US equities. (…) We all know the trouble emerging equities have had over the last several years – concerns for an economic slowdown in China, a depression and never-ending political turmoil in Brazil, Russia’s recent significant recession after the price of oil collapsed to name a few. There are numerous reasons to be worried about emerging. But again, the key question is ‚What’s in the price?‘ And to us, emerging market equities look poised to significantly outperform developed market equities. And if you look at the emerging value universe, the forecast looks even better, rising to 6.2 % real. (…) For a relative investor, we believe the choice is clear: Own as much international and emerging market equity as you can, and as little US equity as you can. ” – bto: Es gibt auch fundamentale Gründe, z. B. die demografische Entwicklung, gerade in einigen aufstrebenden Ländern wie Vietnam.

- “In absolute terms, the opportunity set is extremely challenging. However, when assets are priced for perfection as they currently are, it takes very little disappointment to lead to significant shifts in the pricing of assets. Hence our advice (and positioning) is to hold significant amounts of dry powder, recalling the immortal advice of Winnie-the-Pooh, ‚Never underestimate the value of doing nothing‘ or, if you prefer, remember – when there is nothing to do, do nothing.” – bto: Schöner kann man kein Plädoyer für Cash abgeben!

Und hier der Link zur gesamten Studie: