Globales Frachtgeschäft signalisiert Rezession

Kommt sie nun, die Rezession oder nicht? Blickt man auf die Entwicklung im globalen Frachtgeschäft, gibt es durchaus Anlass zur Sorge, wie der Telegraph berichtet:

- “Freight volumes are falling precipitously within the US and across much of the world as economic slowdown spreads, hitting levels that typically mark the onset of recession. The US rail transport group CSX Corp suffered its biggest share price drop since the Lehman crisis after slashing its outlook on Wednesday. The stock has fallen 12pc over the past two days.” – bto: ein klassischer Frühindikator für Rezessionen und Bärenmärkte.

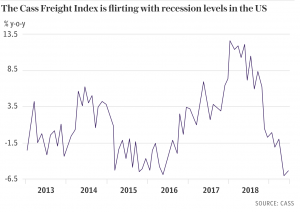

- “CSX is the fourth US freight group this week to warn on profits. (…) The US Cass Freight Index fell for the seventh month in June and is now down 5.3pc over the past year. More and more data are indicating that this is the beginning of an economic contraction, (…)” – bto: was für die Weltwirtschaft ein schlechtes Signal ist und damit vor allem für Deutschland.

Quelle: Telegraph

- “Cass said its European Airfreight Index fell to minus 7.9pc last month, while the data from the Pacific Rim is even worse. (…) Asian air freight dropped to minus 8.6pc, with the biggest shocks hitting Hong Kong, Shanghai and Incheon airports. “Even more alarming, the inbound volumes for Shanghai have plummeted. This concerns us since it is the inbound shipment of high value/low density parts that are assembled into the high-value tech devices that are shipped to the rest of the world, (…)” – bto: was eben für eine weltweite Abschwächung spricht.

- “The American Trucking Associations’ tonnage index fell 6.1pc in May. Spot contract rates for booking lorry space plunged 18pc in June. There has been a wave of truck foreclosures on small driver-owner firms caught in the squeeze. This is just one symptom of broader distress for the poorer half of US society. Interest rates on car loans have doubled over the past 18 months, while the delinquency rate has spiked to 4.8pc – a level unseen in modern times except in the aftermath of the subprime crisis.” – bto: Das ist die Folge von Krisenverschleppung statt – Lösung.

- “The sudden downward lurch in the US economy – until recently a pillar of strength – suggest that Donald Trump’s fiscal stimulus is wearing off fast. The Fed may have waited too long to act, given the lag effects of monetary policy.” – bto: Und damit fällt auch die Basis für die Börsen weg, die erst mal gigantische Mittel brauchen, um wieder durchzustarten.

- “The New York Fed’s gauge of recession risk a year ahead has rocketed to 33pc, a level that has invariably been followed by actual downturns over recent history. A US-China trade deal or swift action by the Fed may avert such an outcome this time, but the window is closing fast.” – bto: Und auch das wäre nur ein kleiner Zeitgewinn.