GaveKal sieht “Panik” an den Märkten

GaveKal ist einer der intelligenteren Analysten der Märkte. Leider sind die meisten Beiträge nicht offen zugänglich, weshalb ich auch diesmal über Zero Hedge zitieren muss. Es geht um die Frage, was uns die Entwicklung der Anleihenmärkte und des Goldpreises sagt. GaveKal meint: Panik.

- “One of the core tenets of my approach to portfolio construction is that to hedge the equity portion of my portfolio, I know I can use gold if the economy is in an inflationary period, and long-dated US treasury bonds if it is in a disinflationary interlude.” – bto: Da die Bonds enorm zugelegt haben, könnte man auf Deflation setzen. Andererseits ist es aber auch so, dass Gold in vielen Währungen gerechnet neue Höchststände erreicht hat.

- “If gold has outperformed the 10-year US treasury over the previous five years, I can stop asking questions and hedge with gold. Conversely, if the bond market has outperformed, I can go ahead and hedge with long bonds, providing its valuation is not too demanding.” – bto: Also dient die vergangene Entwicklung zur Prognose des besten Hedges. Das fand ich interessant, denn ich hätte eher gedacht, man muss das machen, was keiner macht.

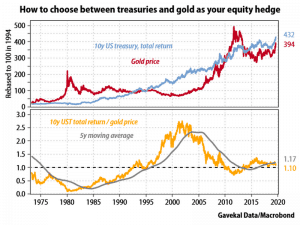

- “Now please take a look at the chart below. The upper pane shows the price of gold plotted against the total return index of the 10-year treasury. The lower pane shows the ratio of the two series. Looking at the ratio, it is clear that from 1971 to 1984, investors should have used gold as their hedge. From 1985 to 2002 they should have chosen US long bonds; then from 2003 to 2012 gold, and from 2014 to May 2019 US long bonds once again.” – bto: Also ist es ein deflationäres Umfeld, was in das Bild der Eiszeit passt.

Quelle: GaveKal via Zero Hedge

- Oder doch nicht? “Since May 2019, when the treasury total return/gold ratio fell below its five-year moving average, I have been recommending that investors switch from overvalued bonds to gold as the preferred hedge for their equity exposure. Usually, these two assets—long-dated US treasuries and gold—tend to be negatively correlated. When treasuries are going up, gold tends to go down, and vice versa.” – bto: Nur im Jahre 2019 scheint das nicht zu gelten.

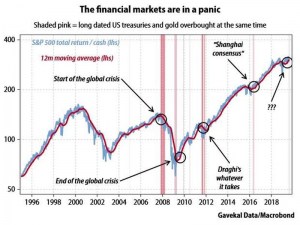

- “(…) I reached for the history books to see when in the past both treasuries and gold have looked overbought at the same time. Specifically, I looked for other occasions when the three-month rate of change for each asset was above its respective standard deviation at the same time. The conclusion is striking: we are in a panic.” – bto: Und er bringt dann auch die Beispiele der Vergangenheit:

- “The beginning of the global financial crisis.

- The end of the global financial crisis.

- The bond market meltdown in peripheral Europe which prompted Mario Draghi’s ‘whatever it takes’ put.

- The slowdown in China which led to the G20 ‘Shanghai agreement’.

- The latest panic.” – bto: Jetzt muss man sagen, dass es nicht immer große Krisen waren, es waren aber durchaus turbulente Zeiten an den Märkten. Ich finde, die haben wir jetzt auch wieder.

Quelle: GaveKal via Zero Hedge

- “Each previous panic was dealt with by governments and—more importantly —central banks, including the Chinese central bank, ganging up to stop the rout. (…) it is hard to believe that the latest episode will be halted (…).” – bto: Munition alle, China wird nicht helfen.

- “I maintain my call to hedge the equity risk in a portfolio with gold, since bondholders are most likely to be the victims of the next crisis. Indeed, I believe that in the next crisis, trading in some bond markets may be discontinuous, as in Argentina in recent days. In the coming crisis, I fear there may be very little to choose between some European bond markets and Argentina.” – bto: Na ja, ich würde sagen, die Hauptrisiken liegen in den Märkten für BBB-Anleihen.

- “(…) they should concentrate their equity holdings in high quality stocks relatively immune from the vagaries of governments, and hedge them with gold. Praying might also help.” – bto: Es ist klar, dass wir nun die Helikopter und MMT bekommen. Allerdings stellt sich die Frage, ob das wirklich so gut ist und vor allem, ob es die gewünschte Inflation schafft.