FT: Italien sollte die Finanzierung sichern

Ich denke, in Italien laufen die Vorbereitungen für den Euroaustritt auf vollen Touren. Ist auch nachvollziehbar, da

- das Land davon profitieren würde,

- es gut vorbereitet sein muss,

- man besser erpressen kann, wenn die Drohung glaubhaft ist.

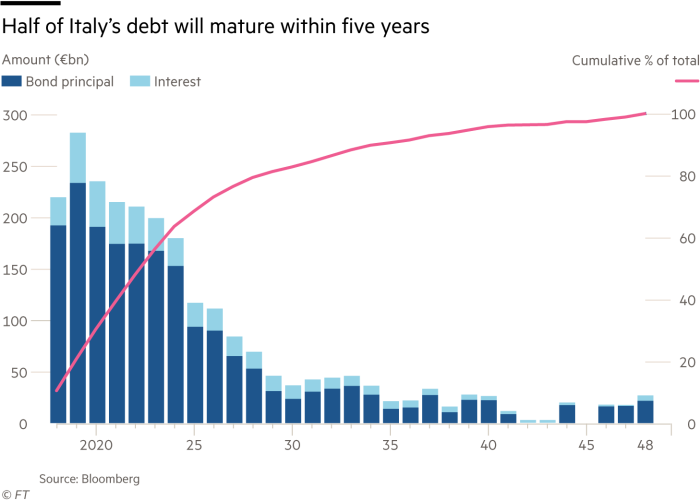

Also wird die Parallelwährung kommen. Und die neue Regierung muss den möglichen Druck der Märkte (Oettinger!) reduzieren, in dem sie die Finanzierung sichert. Dies bedeutet vor allem Laufzeiten weiter verlängern.

Die FT dazu:

- Die neue Regierung sollte “In terms of economic policy, they should begin to do what they have promised to do, and improve on their promises in the process. As we showed last week, the flagship proposals are not without merit. Some version of Five Star’s income guarantee proposal (which may not be a true universal basic income as it is billed) would be a good improvement on Italy’s current regressive welfare benefits. As for the League’s flat tax — really an income tax cut — there is a case for reducing Italy’s steep taxes on labour (…).” – bto: Da bleibt die Zeitung konsistent. Die Ideen der neuen Regierung sind nicht so falsch.

- “(…) a full and literal implementation of these and associated proposals would explode the deficit, costing more than €100bn or 6-7 per cent of gross domestic product. That would be beyond unaffordable. But a good start on the policy reforms could be made by introducing them in attenuated form, at a gradual pace (…).” – bto: was sicherlich möglich ist.

- “The question is whether the Italian government will be allowed even a sensible deficit increase. It faces two potential obstacles. One is the EU’s fiscal rules. (…) The other obstacle could be the bond markets. (…) But it still needs to find about €200bn in financial markets every year (…).” – bto: wobei die EZB und die Banca d`Italia die größten Käufer sind.

Quelle: FT

- “The past few years were a missed opportunity to stretch out the maturity of its debt more drastically while borrowing costs were at record lows. Suppose only one-thirtieth, say, of the Italian debt stock had to be rolled over every year; then even its current 130 per cent debt-to-output ratio would be safe from self-fulfilling refinancing crises.” – bto: Deshalb ist es so wichtig, die Laufzeit der Schulden zu verlängern.

- “The Italian government should swiftly explore debt swaps with bondholders to exchange soon-to-mature debt with very long-term debt. More radically, it can wield the prospect of a unilateral maturity extension, perpetuating the pre-existing (typically low) interest charges. That is because virtually all its pre-2013 bonds had terms defined not by contract but by a national law that explicitly authorises the government to extend maturities unilaterally. Even today, this still covers about half of the outstanding debt. Most of the rest (issued since 2013) includes the eurozone’s new ‚collective action clauses‘, which also could be used to attempt a reprofiling, though with more difficulty.” – bto: was doch eine brillante Idee wäre! Man kann einseitig die Laufzeiten verlängern.

FT: “Such operations might come at some cost, and be challenged by bondholders — albeit only before Italian courts. It would be worth it if it secured the government room for manoeuvre without being pressured by lo spread. If the new ruling parties really do not want to be a slave to financial markets, they should explore these options without delay.”

→ ft.com (Anmeldung erforderlich): “Rome must make its own room for manoeuvre”, 6. Juni 2018