„From Zirp, Nirp, QE, and helicopter money to a better monetary system“

Thomas Mayer vom Flossbach von Storch Research Institute wirft einen weiteren Blick auf das Helikopter-Geld. Dabei betrachtet er nicht nur die Wirkung, sondern auch die Frage, ob es der Einstieg sein könnte für einen Systemwechsel. Bekanntlich ist er ein Befürworter einer Variante des Vollgelds, die den privaten Geschäftsbanken die Möglichkeit nimmt, Geld zu produzieren. Schon im Oktober 2015 schrieb er in der F.A.S.: „Mit Helikopter-Geld ruinieren wir auch noch den Rest, was von unserem Geldsystem übrig ist. Richtig. Aber dadurch wird auch ein Neuanfang möglich. Giralgeld würde dann nicht mehr durch Kreditvergabe der Banken als privates Schuldgeld, sondern direkt vom Emittenten geschaffen. Würden wir dann noch den Wettbewerb der Emittenten um die Produktion des besten Geldes zulassen, hätte die Geldkrise einen Sinn. Und ein gutes Ende.“

Hier nun die ausführliche Erklärung, wie es funktioniert:

- Zunächst nochmals die Erklärung, was denn Helikopter-Geld ist: „The helicopter is a useful methaphor. In our present reality, however, it seems more plausible to use banks for the distribution of helicopter money. It is conceivable that the central bank pays reserve money into the accounts of public entities with the instruction to banks to create book money against it for the government. The latter could then distribute the money through its budget.“ – bto: klar. Letztlich geht es nur über den Staat.

- Zwar ist eine direkte Finanzierung von Staaten der EZB verboten. Dies gilt nicht für die Verteilung von Geld an die Bürger: „‚Helicopter drops‘ of money have not been included in the ECB’s statutes as an instrument of monetary policy. However, Article 20 of the statues says that ‚the Governing Council may, by a majority of two thirds of the votes cast, decide upon the use of such other operational methods of monetary control as it sees fit, respecting Article 2‘ (i. e., price stability).“

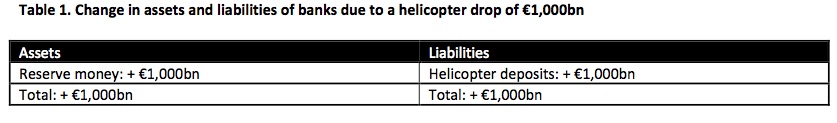

- Die Zuführung von Helikopter-Geld würde sich so in der Bilanz niederschlagen (nichts anders als eine Bilanzverlängerung); mehr Einlagen, aber auch mehr Verbindlichkeiten:

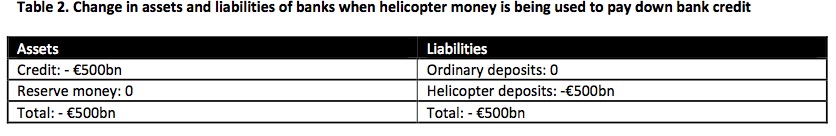

- Nun kommt es darauf an, was die Bürger mit dem Geld machen. Mayer rechnet mal 50/50 für Konsum und Schuldentilgung: „Suppose, people use half of the drop to spend and the other half to pay down their bank debt. When people return €500bn of helicopter deposits to cancel € 500 bn of credit they took out earlier, both credit and helicopter deposits decline by this amount. As a result, the balance sheet of the banking sector and with it the volume of total deposits declines by the same amount. This creates room for the central bank to drop another € 500 bn of helicopter money by paying reserve money to banks to fill up again the helicopter deposits of each resident. If again half of the drop were used to pay down debt, room for a further €250bn drop would be created that the central bank could now fill.“ Die Bilanz der Banken sähe nach der ersten Runde so aus:

- Jetzt kommt der Knüller durch den Übergang auf das Vollgeld-System: „Theoretically, the process can be repeated until the debt of non-banks is eliminated and bank credit to non-banks is replaced completely by reserve money on the asset side of banks. Thus, when people always use part of the helicopter drop to repay debt, credit to the non-bank sector would be replaced by central bank money as cover for deposits. This is what Irving Fisher in the 1930s called a ‚100 % Money‘ regime, also known as full reserve banking or ‚positive money‘. The debt relief triggered by the helicopter drops would itself most likely raise spending by the non-bank sector, leaving aside the other half assumed to be spent directly.“ – bto: Das wäre die „wundersame“ Schuldentilgung durch den Systemwechsel. Ein sehr eleganter Weg der Schuldentilgung. Meine Frage ist immer: Wäre das inflationär? Schließlich würde die Umlaufgeschwindigkeit des Geldes vermutlich wieder steigen.

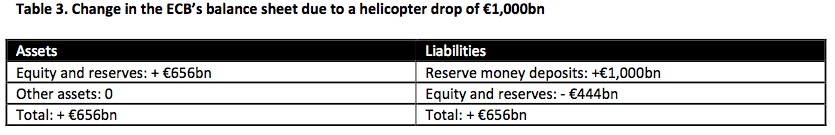

- Gewinner wären alle Schuldner inklusive des Staates. Verlierer die Notenbank, allerdings nur auf dem Papier: „The central bank would be a loser, but only in accounting terms. Since the helicopter money would be created by the ECB ‚out of nothing‘ without acquiring an asset, the money injection would have to be financed by a reduction of capital and reserves. The ECB has presently about € 444 bn in capital, general reserves, and revaluation reserves, which would turn into a negative position of € 656 bn to cover the € 1,000 bn of additional money.“ – bto: wobei die EZB die anderen Vermögensgegenstände einfach höher bewerten könnte und/oder die zukünftigen Geldschöpfungsgewinne aktivieren. So sähe die Bilanz der EZB dann aus:

- „Any other company would of course be bankrupt when its liabilities exceed its assets. But a central bank is different, because it does not have to repay its liabilities in the form of central bank money. Hence, it can operate with a negative equity position without much difficulty.“

- „The only risk is that people would lose faith in money that is not covered by claims on other assets. But as long as inflation is low, a loss of confidence is unlikely. In order to avoid the false comparison with a bankrupt company, the central bank could rename equity and reserves on the asset side to ‚good will‘, or it could classify it as future income from money issuance (seigniorage).“ – bto: Hier macht Mayer den Punkt. Die EZB kann bilanzieren wie sie will.

- Auf jeden Fall kommt es zu dem von Mayer gewünschten Systemwechsel: „When the central bank issues money on the basis of Good Will, it creates ‚reputation money‘, i.e., money no longer backed by credit but by the reputation of the central bank as an issuer of solid money. Hence, with the introduction of helicopter money the monetary system changes from a pure credit money system to a mixed system with credit and reputation money. The more helicopter money is issued the more is the character of money shifted towards reputation money.“

- Mayer führt dann noch aus, wie neue Wege der Gelderzeugung (Crypto-Money) den Wechsel beschleunigen könnten. Im Original nachlesen. Was jedoch wichtig ist, ist die Frage der „Kontrolle“ der Notenbanken, damit diese nicht zu viel neues Geld schaffen und so die Reputation verspielen. Hier setzt er auf Wettbewerb: „Competition among different issuers of reputation money would be the best, if not only, way to arrive at sound money. Users of money are interested in its ‚inner value‘, i. e., in its long-term purchasing power. Hence, issuers of reputation crypto money could compete for the best algorithm of money issuance for the stabilization of the ‚inner value‘ of their money.“

„To conclude, helicopter money is a double- edged sword. On the one hand, it could facilitate the change-over from our present credit money system to an alternative money system, in which money is no longer created as private debt but as an asset backed by the reputation of the issuer. (…) On the other hand, helicopter money could lead to a loss of confidence in the existing money and a money crisis, if it is used by inflation targeting central banks to force inflation higher. Most likely, we shall first have to pass through a money crisis on our way to a new and better monetary system.“

Hier der Link zum Dokument: