Zwingt die Fed Börse und Wirtschaft in die Knie?

Der schlechteste Dezember an der Wall Street seit 1931. Das schlechteste Jahr für Finanz-Assets in den letzten 117 Jahren. Alles nur, weil die US-Notenbank Fed etwas auf die Bremse geht. Und das auf eine neue Art: Zinserhöhung und Schrumpfung der Bilanz. Letzteres gab es noch nie, was nur vordergründig damit zu tun hat, dass es auch noch nie eine solche Bilanzverlängerung gegeben hatte. Dabei nahm sich das QE der Fed noch als minimal aus im Vergleich mit dem, was hier in der Eurozone und in Japan passiert.

Ambroise Evans-Pritchard hat das vor Weihnachten nochmals auf den Punkt gebracht und zwar, bevor der US-Präsident zum Angriff auf die Fed blies:

- “Monetary tightening by central banks is like trying to pull a brick across a rough surface with elastic: nothing happens; still nothing happens; then it leaps up and hits you in the face. The US Federal Reserve’s Jay Powell may have a broken nose after asserting stubbornly this week that he would continue shrinking the Fed’s balance sheet by $50bn a month, even though the world economy is coming apart at the seams. (…) It is the double-barreled nature of this tightening that makes it so potent, and so unpredictable for a global financial system that has racked up $12.8 trillion of offshore dollar debt and has never been more leveraged to US borrowing costs.” – bto: die “kleine Nebenwirkung” der Rettungspolitik der letzten zehn Jahre.

- “No central bank has ever tried to reverse quantitative easing on such a large scale. Former chairman Ben Bernanke – who joked that QE seemed to work in practice, even though it did not work in theory – advised his ex-colleagues to leave the balance sheet well alone. (…) The markets have taken the latest monetary twist badly. The S&P 500 index on Wall Street has dropped to a 15-month low. Yields on 30-year US Treasuries have crashed below 3pc, down 48 basis points since early November. This is a drastic ‘flattening’ of the US yield curve. It is flashing a red alert for recession within months.” – bto: wobei die Eignung als echter Krisenindikator umstritten ist.

- “Powell basically told you the ‘Fed Put’ is dead, (…) He has shown a lack of sensitivity to market stress – a surprise given his background in finance rather than academia.The Goldman Sachs Financial Conditions Index in the US has jumped 100 basis points since early October – 185 points since February – and points to a credit shock. The growth rate of real M1 money for non-financial businesses has turned deeply negative for the first time since the onset of the Lehman crisis.” – bto: Und wir wissen ja, unser System setzt zwingend Kreditwachstum voraus, um zu funktionieren.

- “The Fed squeeze is hitting the world on two fronts at once. It is draining dollar liquidity and bleeding the offshore dollar funding markets in Europe and Asia. (…) European banks lack access to stable dollar deposits and rely on short-term funding from the wholesale capital market to plug the gap, leaving them ‘particularly vulnerable to bouts of stress.’ The STOXX 600 Banks index in Europe has crashed by 18pc over the last three months.” – bto: was damit zu tun hat, dass die Banken noch immer krank sind und dringend ordentliche Zinsmargen brauchten, um wieder auf Kurs zu kommen. Das können sie im aktuellen Umfeld jedoch vergessen.

- “The Fed is also raising the cost of global borrowing. Three-month LIBOR rates used to price $9 trillion of contracts worldwide have doubled over the last year to 2.78pc. Hong Kong’s HIBOR rates are rising in lockstep, setting off a property slump in the enclave. The dollar shortage has led to a credit crunch in emerging markets.” – bto: Hier rächt sich, dass die Welt auf die Finanzkrise mit einer massiven Verschuldung reagiert hat.

- “The World Bank estimates that emerging markets make up 59pc of global GDP (PPP basis), up from 37pc in 1990. (…) Together these countries are a big enough force to throw the world economy into a downturn. This is already hitting Germany and the eurozone through trade export channels. The risk for the US is that global strains eventually boomerang back into its own economy.” – bto: Es trifft eine hoch verschuldete und fragile Weltwirtschaft.

- “Growth of the world’s broad M3 money supply has dropped below 5pc – led by China – and is approaching the nadir of 4.5pc seen in August 2008 just before the storm broke. The ECB is cutting off stimulus at a time when Italy and Germany have one foot in recession, prompting a wave of criticism. (…) Risk spreads for blue chip companies in Europe have jumped 80 basis points this year. For junk-rated firms the spike is almost 260 points. Italy’s banks are shut out of the capital markets.” – bto: Jeder Anstieg der “risikofreien” Zinsen muss zu einem überproportionalen Anstieg der risikobehafteten Zinsen führen, weil die Kreditrisiken wieder da sind. Bei bto oftmals diskutiert.

- “The Federal Reserve has a difficult balancing act to perform. It (…) is wedded to a ‘New Neoclassical Synthesis’ model with three blind spots: it misses global undercurrents; it ignores monetary data; and it fails to adjust for the Faustian costs of ‘intertemporal’ robbery – stealing growth from the future, until the future catches up with you. All three of these indicators are issuing critical warnings, if only the Fed could see them.” – bto: Für die “intertemporal robbery”, ich würde es Ponzi-Schema nennen, ist die Fed nun wahrlich nicht alleine verantwortlich. Es ist offizielle Staatsdoktrin in der westlichen Welt allen Beteuerungen der Politiker zum Trotz.

Dass Ambroise Evans-Pritchard mit seiner Meinung nicht alleine dasteht, sieht man an einem Kommentar aus der FT, der die Bank of America zitiert: “We strongly believe liquidity & credit = ‘glue’ for bull market & both have cracked in 2018; central bank asset purchases of $9.1tn 2010-17 coincided with $1.4tn credit inflows; 2018 both in decline, and central bank balance sheets to contract 2019.” – bto: Und das Chart ist interessant:

Was dann auch erklären dürfte, weshalb es an den Märkten in diesem Jahr rückwärts ging:

Quelle: FT

Was auch die allseits beliebten FAANGs erwischt hat:

Quelle: FT

Doch vielleicht gibt es ja Hoffnung. Zumindest kurzfristig, denn mehr als eine Verzögerung der Krise durch noch mehr billiges Geld und noch mehr Schulden ist ohnehin nicht drin. Die Fed sendet nach den Turbulenzen an der Börse erste Entspannungssignale:

- “The US Federal Reserve has called off the hounds. China has abandoned efforts to purge financial excess, reverting to stimulus on multiple fronts. Policy pirouettes by the world’s twin superpowers mark a critical moment in the tightening cycle, with sweeping implications for global asset markets and for the health of the international economy over the next year.” – bto: Das wird zumindest aus den jüngsten Signalen gelesen.

- “It has echoes of the Fed retreat in early 2016 when China’s currency scare threatened to spin out of control. On that occasion the Yellen Fed came to the rescue and shelved plans for higher interest rates, launching a 25pc surge in the MSCI index of world equities over the following twelve months.” – bto: Und da würde ich sagen, dass es diesmal nicht so kommen muss. Die Notenbanken haben ihr Pulver schon sehr umfangreich genutzt. Was nun kommt, sind geldpolitische Extremmaßnahmen. Und die kommen erst, wenn es lichterloh brennt.

- “(…) Fed chairman Jay Powell went out of his way to soothe markets on Friday (…) The new line is clearly a concerted Fed message. A day earlier Robert Kaplan from the Dallas branch said he was watching ‘very, very carefully’ lest QT causes liquidity to evaporate and leads to a crunch. It is the reassurance that skittish investors have been waiting for after a $20 trillion slide in global equities and signs of seizure in the credit markets.” – bto: Es kann aber auch nur eine Bärenmarktrallye sein. Zu früh, um einen neuen Boom auszurufen.

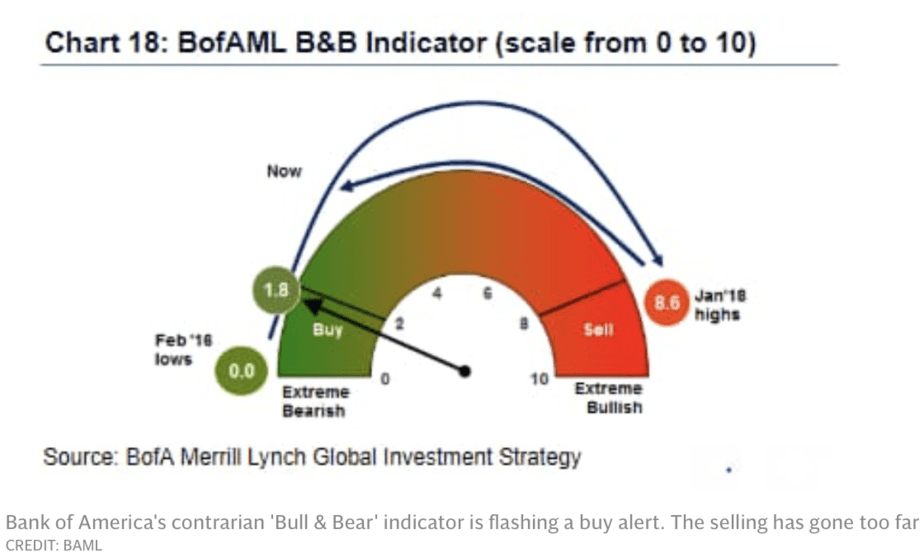

- “Bank of America’s Michael Hartnett issued a tactical buy alert for the first time since the Brexit referendum in June 2016. His ‘Bull & Bear Indicator’ had earlier dropped to an ‘extreme’ pessimism reading, a level that typically leads to a snap-back rally in risk assets over the following three months. It did not work in 2008 however. Markets continued crashing.” – bto: Ich denke, es gibt eine Rallye, ob diese allerdings drei Monate hält? Ich würde auf jeden Fall Risiken weiter abbauen.

- “Mr Hartnett said Wall Street and global markets have not yet seen the ‘big low’ of 2019. Panic capitulation still lies ahead as the profit cycle turns. But for the brave and nimble he recommends a short-term foray into Chinese and German equities, energy stocks, US small cap stocks, and emerging market currencies, all deemed “very oversold.” – bto: Das ist pure Spekulation und keine langfristige Geldanlage.

- Dazu kommen die Probleme in China: “In supporting chorus, the Chinese have cut the required reserve ratio for banks a fifth time. (…) it will take several months for the new stimulus to reach China’s real economy. This time recovery will be weaker than in past episodes. Debt saturation – and stalled reform – has choked the economy. (…) China is no longer the global Wunderkind of the early 2000s but at least investors can glimpse a light at the end of the latest tunnel.” – bto: Auch China kann die Probleme nur vergrößern, wenn es Zeit kauft. Dennoch tut es das.

- Das wahre Problem für die Märkte war der starke US-Dollar: The ‘broad’ dollar index has soared to an 18-year high.The squeeze has been slow torture for a world financial system that has never been more dollarised or more sensitive to US borrowing costs, especially in those emerging markets that were flooded – nolens volens – with cheap dollar debt during the QE years.” – bto: Es war auch eines der Ziele der US-Notenbank, den Druck auf die Exportländer zu erhöhen über einen billigen Dollar am Anfang der Krise. Diese haben gegengehalten und sich hoch verschuldet.

- “Offshore dollar debts worldwide have ballooned to $12.8 trillion (BIS data). Roughly $4 trillion of contracts outside the US are priced off three-month Libor rates alone, which have doubled over the last year. The strains reached breaking point in the fourth quarter. Dollar funding markets in Asia and Europe began to dry up. High-yield credit spreads have surged by over 260 basis points in Europe, where bank stocks have been in free-fall.” – bto: weil wir immer zwei Effekte haben. Zum einen den Anstieg des allgemeinen Zinsniveaus, zum anderen der Anstieg der Spreads wegen der “Rückkehr” des Kreditrisikos.

- “No central bank has ever tried to exit QE on such a scale before. There is deep confusion over how QE works and how it interacts with the financial system. Monetarists accuse Fed officials of ignoring the ‘quantity theory of money’ anchored even in the works of John Maynard Keynes, relying instead on incoherent ‘creditist’ assumptions.” – bto: wobei man schon sagen muss, dass in unserem System das privat geschaffene Kreditgeld das dominante ist.

- “The central question now facing markets is whether the Fed is (…) preparing to halt the tightening cycle altogether, a move that would send the dollar tumbling and act as powerful global stimulus. (…) It has become clear over the Autumn that America itself cannot handle rising real yields since US corporate debt ratios are at a record high.” – bto: natürlich nicht. Das System ist völlig overleveraged! Es geht nur mit immer tieferen Zinsen weiter.

- “When the US dollar starts to weaken, the world is happy again (…) When this process gathers pace the dollar typically goes into a fast and accelerating downward slide. This in turn sets off a recovery in gold, oil, commodities, and battered markets in Asia, Latin America, and Africa.” – bto: vielleicht sogar in Deutschland. Wenn dann auch noch der Handelskrieg abgeblasen würde, könnten die Märkte wirklich zulegen. Zeitweise.