FANGs – ein Nachtrag

Ich habe mich schon vor einigen Wochen skeptisch zu den FANGs geäußert:

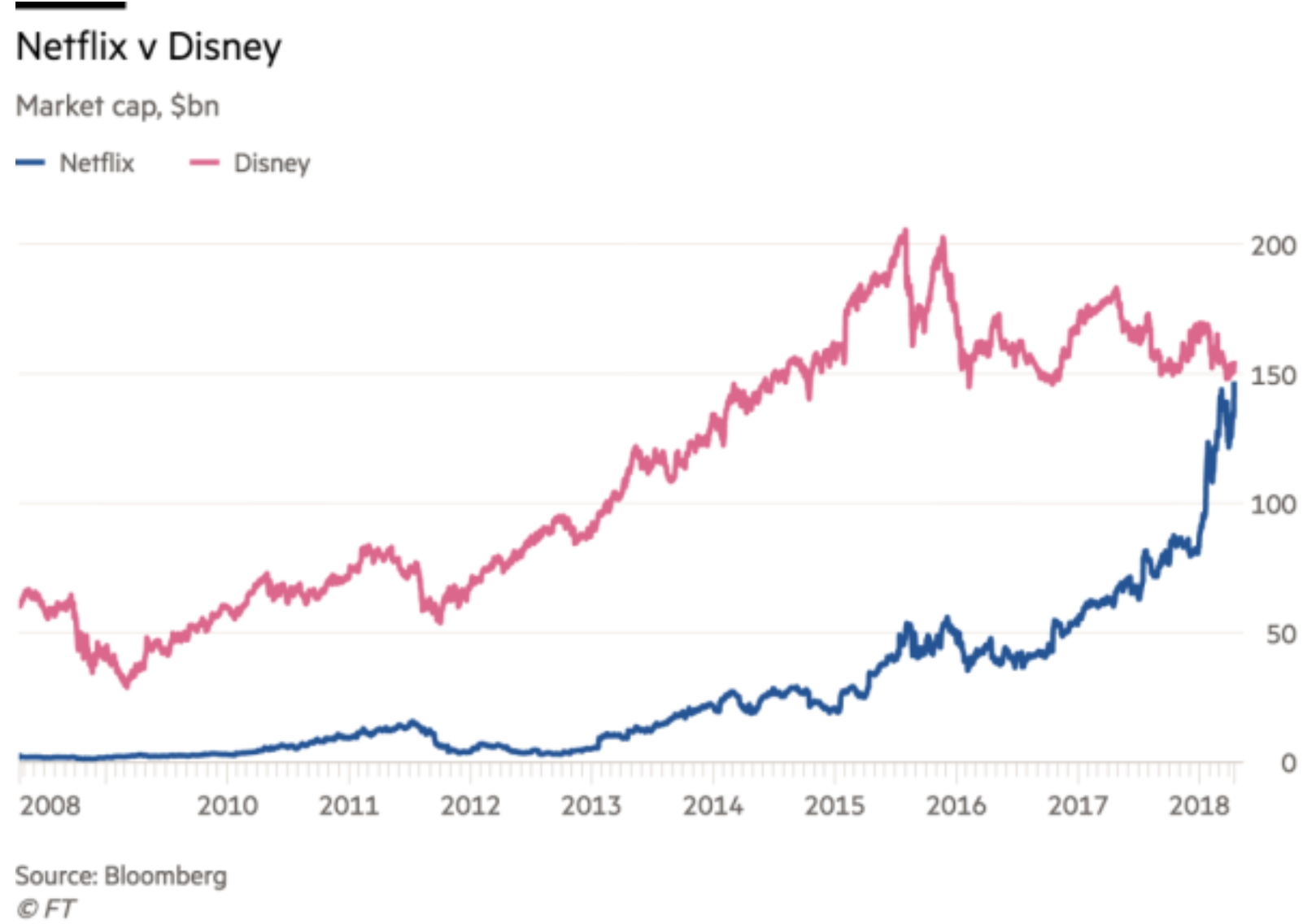

Man kann mit Blick auf die beeindruckende Entwicklung von Netflix nur sagen, wohl zu früh!

Quelle: FINANCIAL TIMES

Dazu schreibt der beeindruckende John Authers in der FT:

- “It trades at 213 times earnings and 11.4 times sales. (…) Disney is not directly comparable but has strong similarities, and trades at 17 times earnings, and 2.8 times sales. It generates a slightly higher return on equity than does Netflix, which is a junk-rated credit.” – bto: beeindruckendes Vertrauen der Märkte in Netflix.

- “Netflix policy is to find one analyst and get them to conduct the conversation. (…) This quarter’s chosen analyst, Benjamin Swinburne of Morgan Stanley, was described in this Business Insider story last week as ‚one of the company’s biggest bulls on Wall Street‘, who thought that the company was ‚not even close to being finished growing‘. Obviously he has been proven right to be bullish in the past few months.” – bto: Ich denke an die Wettbewerber wie Amazon, die mit viel Power in den Markt gehen.

Doch nun zu den FANGs als Gruppe, auch John Authers, aber in einem früheren Beitrag:

- “March concluded with the downfall of the Fangs (…). They led the market for several years and then suddenly they crumbled. But if that was the Fangs’ downfall, it could have been far worse. This is how the NYSE Fang+ index (which also includes Tesla, Apple, and the Chinese internet groups Alibaba and Tencent) has fared compared to the S&P 500:” – bto: Er hat natürlich recht. Wenn man auf die Gesamtperformance blickt, ist es nur ein kleiner Verschnaufer.

Quelle: FINANCIAL TIMES

- “Unfortunately, there is still a lot of room below. History, and the Fangs’ accounts, suggest that their dominance will pass. That is the main takeaway from the analysis of the Fangs (concentrating on Facebook, Apple, Amazon, Netflix and Google) by the Holt team at Credit Suisse.” – bto: HOLT ist ein Instrument zur Bewertung von Unternehmen, das ich in meiner Zeit bei BCG intensiv genutzt habe. HOLT gehörte sogar mal zu BCG und wurde dann gespalten. Der Beratungsteil blieb bei BCG, während der Stock-Picking Teil sich selbstständig machte und später bei der Credit Suisse landete.

- “CFROI refers to the Holt cash flow return on investment measure of profitability. And as these charts show, the Fangs have made a lot of money in the recent past:” – bto: Die FANGs haben also zu Recht so gut performt, allerdings gibt es immer die (berechtigte) Annahme, dass sich Übergewinne nicht ewig verteidigen lassen.

Quelle: FINANCIAL TIMES

- “What is interesting, compared to history, is that the biggest creators of value, or economic profit as measured by Holt, are far less concentrated now than they used to be. Hence they make up a smaller proportion of the overall market. This is because more companies are managing to exceed their cost of capital, which may in turn be because of measures that make it cheaper to run a large company. Also note, however, that only three of today’s top five companies are Fangs. Microsoft (which some might include as a Fang) and Johnson & Johnson make the list:” – bto: was wiederum interessant ist! Denn dies bedeutet, dass wir es eben mit einem Markt zu tun haben, der gesamthaft verzerrt ist. Warum sind denn J&J und Microsoft auf der Liste? Weil sie hohe, stabile Cashflows erwirtschaften. Dafür zahlt man im heutigen Umfeld besonders viel.

Quelle: FINANCIAL TIMES

- “History also suggests that most companies will not sustain abnormally high levels of Economic Profit in the long-term. And here, irrespective of the FAANGs’ competitive positioning today, the historical evidence is pretty damning. Over the last 68 years, 49 companies have made it into the top 5 value-creators in the US market and have held onto that position for an average of only 6.5 years — the biggest exceptions being IBM (35 years in the top 5), General Electric (26 years), General Motors (24 years), Altria (23 years) and Exxon (16 years). In Europe ex UK, over a shorter 34 year period of HOLT data, the data shows even more churn in the top 5 (30 different names) with Nestle, Unilever, Roche and Novartis making it into the top 5 for over 10 years, and the average tenure in Europe otherwise stands at 5.5 years.” – bto: was der Beweis ist, dass es eben doch eine Konvergenz gibt und außergewöhnliche Bewertungen und Gewinne nicht nachhaltig sind!

Authers: “It may have felt like it for a day or two, but what we have just witnessed was NOT the Fall of the Fangs. That dramatic event still lies ahead. And it may yet be a Wagnerian drama when it arrives.” – bto: und dann für den ganzen Markt.

→ FT (Anmeldung erforderlich):”Authers’ Note: Fangs ain’t what they used to be”, 14. April 2018

→ FT (Anmeldung erforderlich):”Authers’ Note: Turn and face the strange”, 18. April 2018