Exportweltmeister ohne Gewinn

In meinem kommenden Podcast (8. August 2021) ist Moritz Schularick mein Gast. Er forscht und lehrt am Institut für Makroökonomik und Ökonometrie der Rheinischen Friedrich-Wilhelms-Universität Bonn. In seiner Forschung beschäftigt sich Schularick mit der monetären Makroökonomik, der internationalen Ökonomik und der Wirtschaftsgeschichte. Seine Studien zu den Ursachen von Finanzkrisen und zur Transformation des Finanzsystems gehören zu den international meistzitierten makroökonomischen Aufsätzen des letzten Jahrzehnts.

Grund genug für mich einige seiner Studien, die bei bto in der Vergangenheit bereits vorgestellt wurden, erneut zu diskutieren. Heute eine Studie zu den Erträgen unseres Auslandsvermögens:

Ein Team von Ökonomen hat sich den Erfolg der deutschen Kapitalanlage im Ausland gründlich angeschaut. Wer es gern dynamisch erklärt haben möchte, dem empfehle ich die Aufnahme der Präsentation von Professor Schularick – einem der Autoren – im ifo Institut.

Die Studie kann man auch nachlesen: → EXPORTWELTMEISTER: THE LOW RETURNS ON GERMANY’S CAPITAL EXPORTS

Es lohnt sich, die Studie zu lesen, wenn man bereit ist, sich mit einer der prominentesten Ursachen für unser geringes Vermögen – Stichwort „Märchen vom reichen Land“ – zu beschäftigen. Zunächst die Feststellung: Die Dimensionen sind gigantisch!

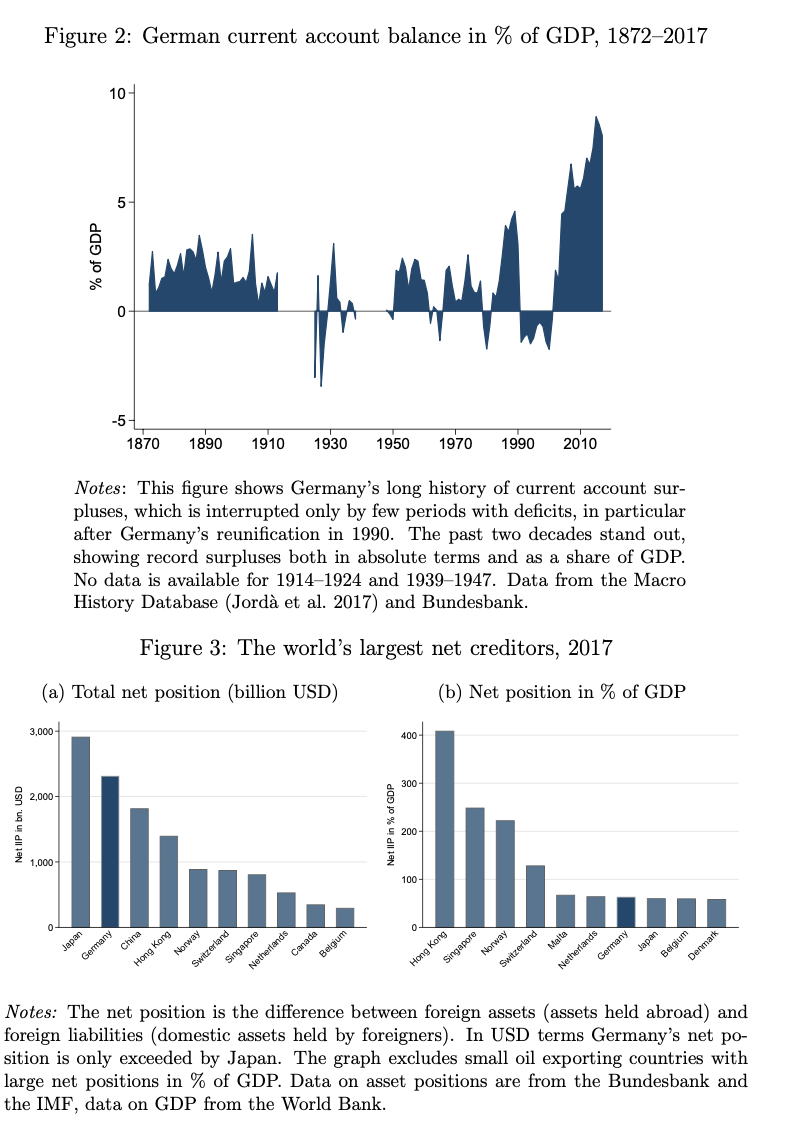

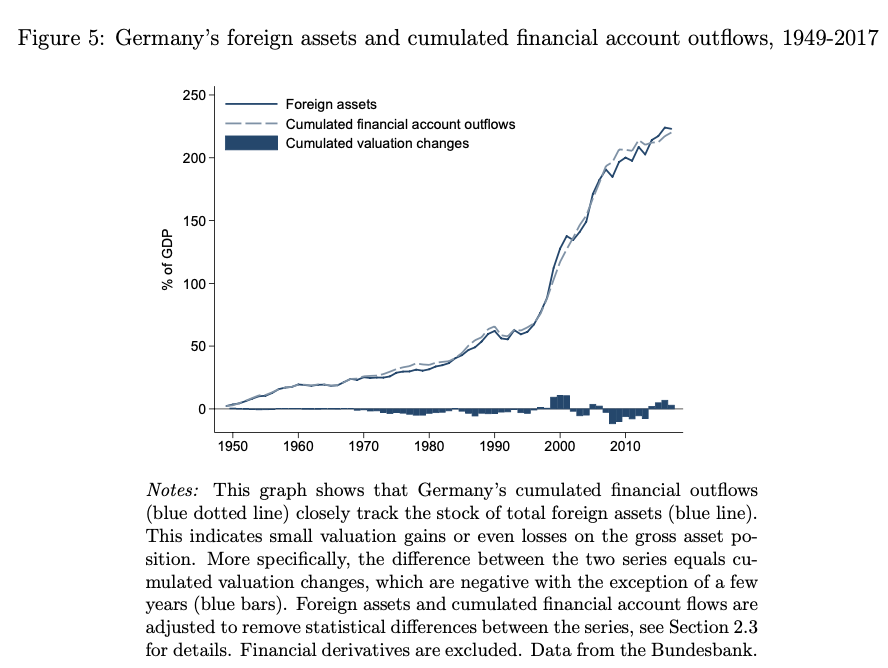

- “(…) the last decade is characterized by exceptionally high surpluses, even by historical standards. The recent surpluses were about three times higher relative to GDP than in gold standard times and during the so-called economic miracle in the 1950s and 1960s. As a result of consistently high capital exports, Germany ranks among the worlds top external creditors, both in absolute numbers and relative to GDP, as Figure 3 shows.” – bto: Das ist unser aller Vermögen und deshalb betrifft es uns alle, was wir daraus machen!

- “Furthermore, Figure 4 shows that Germany not only has a large net position but also a large gross position. Both the asset and liability positions rose strongly since the mid- 1990s and now amount to 256 % and 197 % of GDP respectively. While they initially grew in tandem leaving the net position at relatively small levels, the gap has been increasing since the mid-2000s and especially in recent years. While the net position has been positive over the entire post-war period with few exceptions, it currently stands at above 50 % of GDP. This reflects Germany’s sustained past current account surpluses.” – bto: Hier zeigt sich die ungesunde Hatz auf den Exportweltmeistertitel!

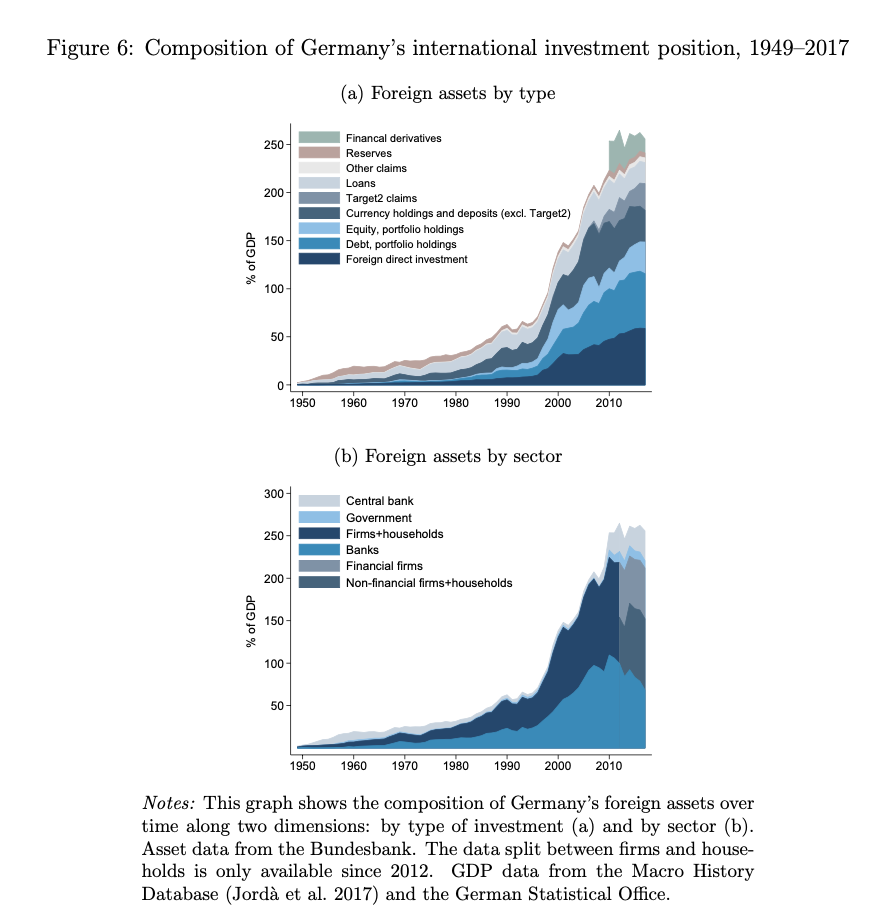

- “How does Germany’s international investment position (IIP) compare to accumulated capital exports? In a simple framework, one can think of Germany’s external asset portfolio as a savings account. Adding up all the payments that have flown into this account corre- spond to the historical book value of gross investments. The difference between historical costs and market value then reflects valuation gains on that portfolio. In other words, the larger the difference between the accumulated flow measure and the current market value of external investments, the higher the capital gains. Figure 5 demonstrates that the value of Germany’s (gross) foreign asset position very closely tracks the cumulated current accounts. This implies that the valuation gains, i.e., the wedge between historical flows and current market value, cannot have been large. In light of the multi-decade asset price boom that has characterized the world economy in the past decades this is clearly noteworthy.” – bto: “clearly noteworthy”, dass ich nicht heule. Es ist ein Ausweis außerordentlichen Versagens und es betrifft – ich wiederhole mich – uns alle!

- “Germany today is the world’s foremost exporter of savings. More than 300 billion Euros of German savings are sent abroad every year. Despite the heavy losses on American and other investments in the 2008 crisis, Germany has exported 2.7 trillion Euros in the past decade alone, equivalent to about 70% of GDP. These capital outflows came from German banks, firms, and households. Unlike in China or Japan, the public sector has played only a secondary role in the build-up of Germany’s foreign asset stock, despite the Bundesbank’s much-debated Target2 claims within the Eurosystem (2018, Target2 claims accounted for about 10% of Germany’s total external assets).” – bto: Das ist doch schon mal eine Aussage! 2.700 Milliarden wurden in das Ausland exportiert. Und was haben wir daraus gemacht?

- “Various voices in the domestic debate view Germany’s capital outflows favorably. Often-heard arguments include the potential for international risk sharing and as a hedge against adverse demographic trends, in line with the traditional textbook view. An aging country like Germany (…) can benefit from investing abroad and achieve better investment returns in younger, more dynamic economies abroad. Storing wealth abroad will also help for risk sharing and consumption insurance, for example when German households are hit by a recession while other countries are not, resulting in stabilizing capital income transfers from abroad.” – bto: Wie beim privaten Sparen setzt das aber voraus, dass man sich gut um seine Ersparnisse kümmert und das Geld intelligent anlegt!

Die Ergebnisse zusammengefasst:

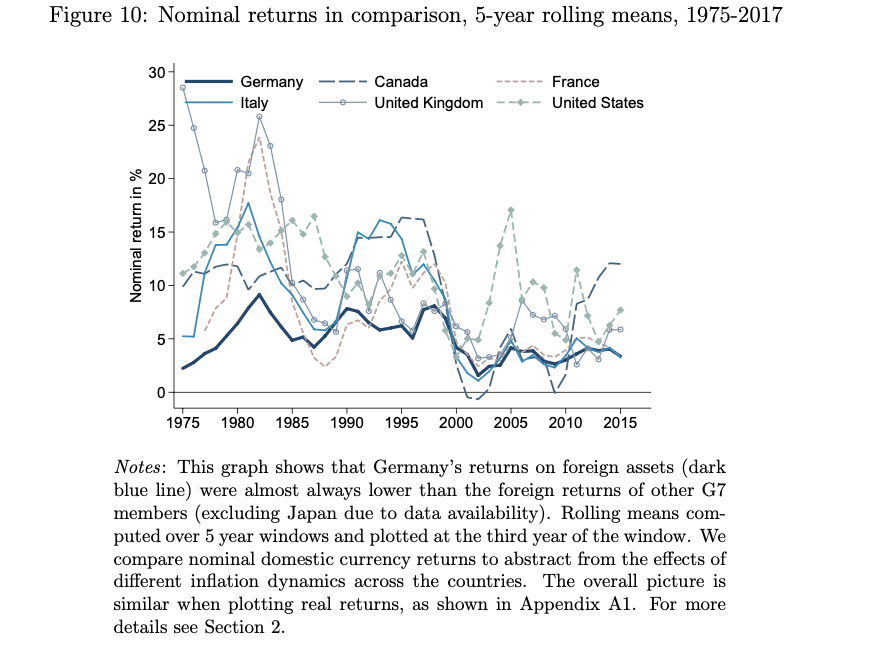

- “First, we find that the returns on German foreign assets are considerably lower than those earned by other countries investing abroad. Since 1975, the average of Germany’s yearly foreign returns was about 5 percentage points lower than that of the US and close to 3 percentage points lower than the average returns of other European countries. Germany fared particularly bad as an equity investor where investment returns under-performed by 4 percentage points annually.” – bto: Wenn ich 100 Euro anlege, werden daraus bei zehn Prozent pro Jahr von 1975 bis heute 7290 Euro, bei 5 Prozent pro Jahr 898 Euro – 6391 Euro Unterschied!

- “Second, we find that Germany earns significantly lower foreign returns within each asset category, after controlling for risk. This suggests that Germany’s weak financial performance abroad is not merely the result of a more conservative investment strategy that focuses on safer assets. The low German returns compared to other countries also cannot be explained by exchange rate effects (appreciation), nor by the recent build-up of Target2 balances. Instead, valuation losses are a big part of the explanation. The valuation of Germany’s external asset portfolio has stagnated or decreased, while other countries witnessed considerable capital gains, on average. Germany’s frequent investment losses are remarkable given that the world economy has witnessed a spectacular price boom across all major asset markets over the past 30 years.” – bto: In der Diskussion beim ifo Institut wird in diesem Zusammenhang erwähnt, dass es auch die Unternehmen sind, die falsche Investitionen tätigen und so im Ausland viel Geld verlieren. Man denke an ThyssenKrupp in Brasilien und an Bayer mit Monsanto.

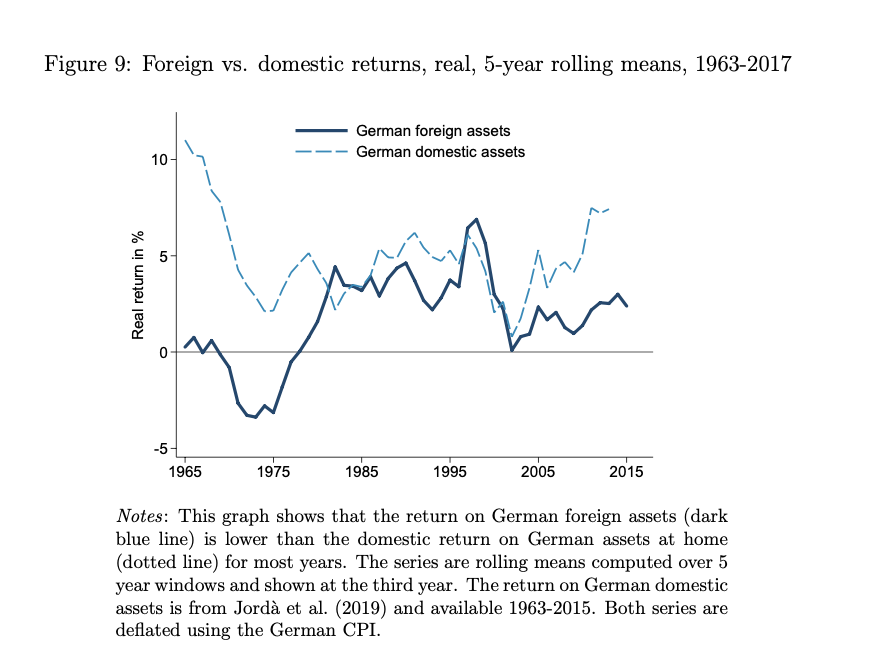

- “Third, German returns on foreign investment were considerably lower than the returns on domestic investment. This is an important insight for the policy debate on the merits of domestic vs. foreign investment. The difference was particularly pronounced in the last decade, when the average return on a domestic portfolio of German bonds, equity, and real estate was about 4 percentage points higher per year than the returns on Germany’s foreign assets.” – bto: Nun könnte man meinen, dass dies klar ist, weil man näher dran ist und es besser managed. Andererseits haben wir wie angesprochen einen weltweiten Boom der Vermögenswerte erlebt. Da muss man schon besonders doof sein, um so schlecht abzuschneiden.

- “Fourth, we find little evidence that foreign returns have positive effects for consumption insurance. The return on Germany’s external assets is highly correlated with German economic activity – even more so than domestic returns – and, thus, provides no hedge against domestic consumption shocks. Moreover, 70 % of Germany’s foreign assets are invested in other advanced economies that face similar demographic risks. In the past decade, less than 10 % of capital flows went to younger, more dynamic economies outside of Europe or North America, despite the fact that emerging markets now account for more than 50 % of world GDP.” – bto: Wobei die Assetmärkte gerade in den Industrieländern hochgegangen sind, die Schwellenländer underperformen schon eine Weile. Das heißt, die intellektuell eigentlich falsche regionale Allokation hätte in den letzten Jahren eine super Rendite erbringen müssen. Hat sie aber nicht.

- “Table 1 summarizes the main findings of the paper. The table ranks countries by their average return on foreign investments (…) Germany has the worst investment performance among the G7-countries. In the full country sample from 1975 to 2017, Germany ranks 12th, with only Finland performing worse. The picture looks similar if we consider the past decade (2009-2017), where Germany ranks on the 10th place. The same is true when we use real returns, deflating each country’s foreign asset returns with domestic inflation rates.“

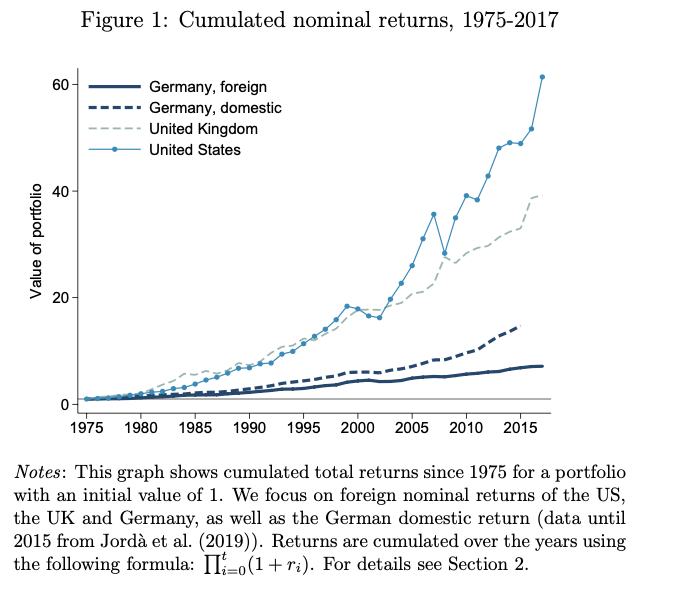

- “The cumulative effects of these bad investment returns are quantitatively large, as can be illustrated with a simple counterfactual exercise. In the decade since the 2008 financial crisis alone, Germany could have become about 2 to 3 trillion Euros richer had its returns in global markets corresponded to those earned by Norway or Canada, respectively. This implies a (hypothetical) wealth loss of 70 to 95 % of German GDP (see Section 5 for details). On a per capita basis, this implies an amount of 28.000 to 37.300 Euros of foregone wealth for each German citizen (compared to the performance of Norway and Canada). These numbers are only an illustrative thought experiment, but they highlight the economic magnitude of high vs. low returns on foreign investments. (…) Figure 1 compares the total return performance of German foreign investments, US and UK external assets, as well as a portfolio of domestic German assets (stocks, bonds and houses). Assume you invested 1 Euro in global capital markets in 1975 and that you reinvest any dividends or interest gains. As of 2017, you would own 40 to 60 times of that initial investment had you followed the investment strategy of the UK or the US. In comparison, the initial investment only increased by a factor of 7 using the returns on German foreign assets (before inflation).”

Welche Rolle die Qualität der Geldanlage hat, ist übrigens auch daran ersichtlich, dass die USA seit Jahren ein Handelsdefizit fahren, sich also im Ausland verschulden und dennoch meist ein positives Auslandsvermögen haben. Nur wenn der Dollar stark aufwertet wie in den letzten Jahren, gibt es temporär ein negatives Auslandsvermögen. Bis zur nächsten – unweigerlich – kommenden Dollar-Abwertung. Insofern ist Donald Trump auf dem Holzweg mit seinem Blick auf das Handelsdefizit der USA.

Woran liegt es?

Da lohnt der Blick auf die Struktur des Auslandsvermögens und auf die Verwalter unseres Auslandsvermögens. Wiederum aus der bereits zitierten Studie:

- “The rise in the overall level in assets was largely driven by increases in foreign direct investment and portfolio investment reflecting increasing international financial integration. Reserve assets on the other hand made up 20 – 30 % of all assets until the 1970s and have become almost irrelevant today. Target2 balances have been increasing in recent years but only represent about 10 % of all assets. As Target2 balances do not generate income, they could potentially bias our estimated downwards, and throughout the paper we will pay close attention that our findings are unaffected by this.” – bto: Es liegt also nicht daran, dass wir auf die TARGET2-Forderungen keine Zinsen bekommen. Schon so sind unsere Erträge schwach.

- “In addition to the composition by functional category, one can also decompose the foreign asset position by domestic sectors. Here, the balance of payments distinguishes between four broad sectors: banks, firms and households, the government, and the central bank. In more recent data, the non-bank private sector is further split into financial firms and non-financial firms plus households. The panel shows that the increase in gross position since the 1990s was mainly driven by banks increasing their exposure relative to GDP. However, since the financial crisis the banking sector reduced its exposure. This decline has been partially offset by non-financial firms.” – bto: Dass unsere Banken nicht gerade Weltklasse sind, wissen wir schon lange. Es genügt auch ein Blick auf die Ranglisten der größten Banken der Welt, um zu erkennen, dass das Finanzwesen nicht gerade eine Stärke der Deutschen ist. Dies ist als solches nicht schlimm, nur muss man sich dann Profis holen.

Und das Ergebnis ist ernüchternd.

Zum einen würden wir mehr verdienen, wenn wir unsere Ersparnisse im Inland anlegten:

Zum anderen sind wir im internationalen Vergleich einfach nur schlecht:

Was zur Frage führt: Woran liegt es? Darüber kann man nur spekulieren. Die Forscher haben es bewusst um die Folgen von Währungsaufwertungen korrigiert. Es liegt also wirklich an der Art der Geldanlage. Wir können oder wollen es offensichtlich nicht richtig machen. Deshalb sollten wir zwei Dinge tun:

- weniger im Ausland anlegen,

- unsere Anlagen im Ausland besser managen.