“Europe Is Booming, Except It’s Not”

Wir feiern die starke Konjunktur in Europa. Endlich hat auch die Eurozone die Krise überwunden, so heißt es überall. Super-Mario hat es geschafft und wir stehen vor einer Erholung, die endlich beweisen wird, dass der Euro und die Eurozone dauerhaft Bestand haben werden. Das ist natürlich Quatsch. Wir wissen das. Deshalb heute hier ein paar Fakten um den Aufschwung einzuordnen:

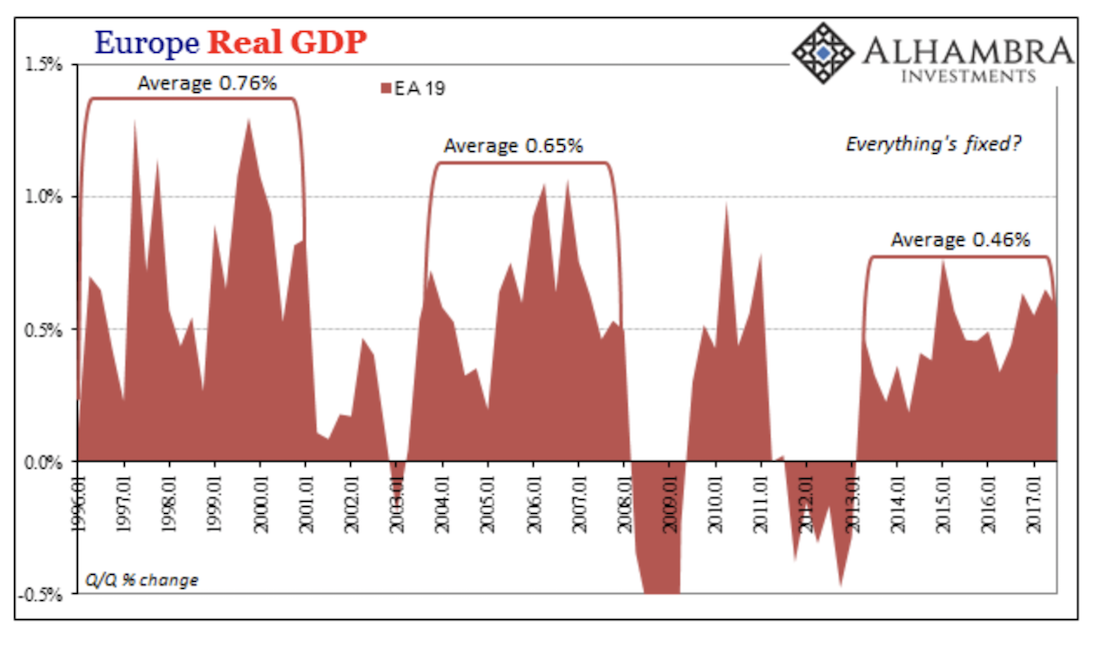

- “European GDP rose 0.6% quarter-over-quarter in Q3 2017, the eighteenth consecutive increase for the Continental (EA 19) economy. (…) At 0.6%, that doesn’t even equal the average growth rate exhibited from either the late 1990’s or middle 2000’s. Straight away one of the so-called better quarters is already below average by historical comparison. That would suggest Europe’s economy is still struggling.” – bto: Dabei sollten wir nicht vergessen, dass man genau dasselbe auch über die US-Wirtschaft sagen kann! Dennoch gute Darstellung:

Quelle: Alhambra

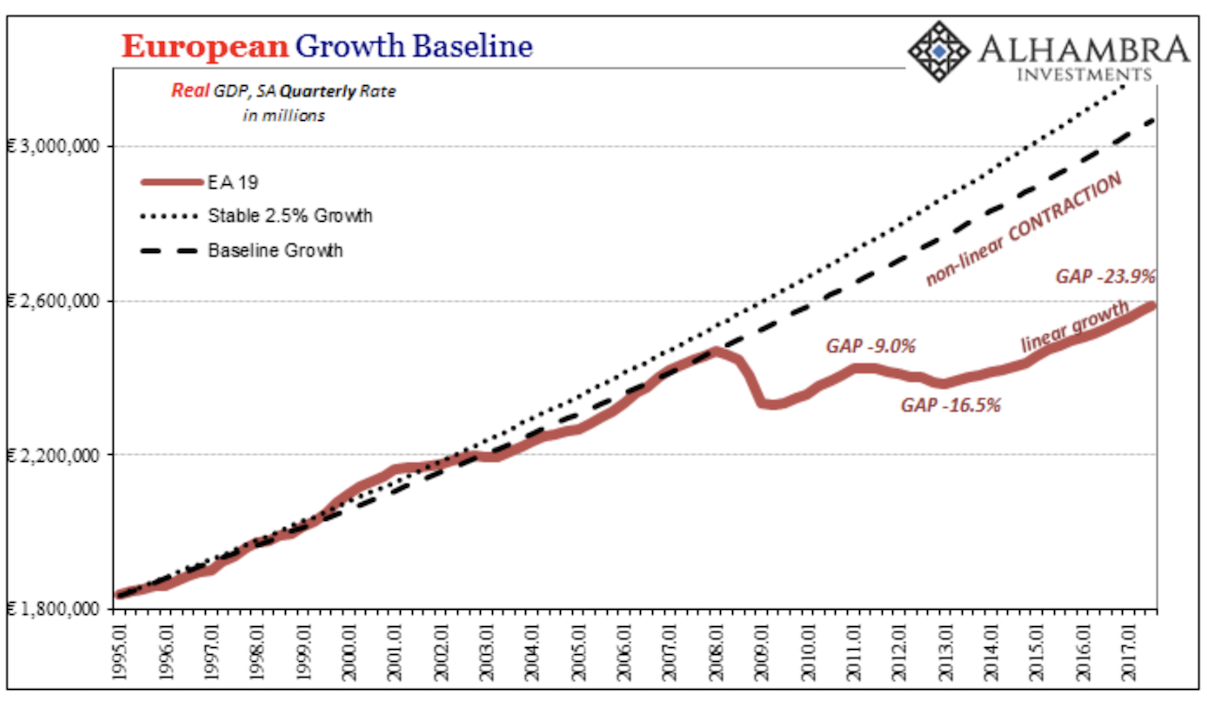

- “Because even these positive quarters are never all that positive, there can never be enough momentum let alone growth to make up for when there was clear, linear contraction. The economy shrinks and though GDP turns positive afterward, even for eighteen straight quarters, the shrinking isn’t actually concluded.” – bto: Das Chart ist eine sehr gute Beschreibung unseres Problems. Wir haben nicht zum Vorkrisen-Trend zurückgefunden und nun kommen die Folgen von Demografie, Produktivität und Krise, die das Potenzialwachstum weiter sinken lassen.

Quelle: Alhambra

- “The gap to Europe’s pre-crisis baseline is actually substantially larger now after four and a half years of steady “growth” than at the bottom of the re-recession trough reached in Q1 2013.” – bto: Bevor jetzt alle rufen, dies liegt an der verfehlten Rettungspolitik, ich denke, es ist einfach normal, wenn man die fundamentalen Faktoren betrachtet.

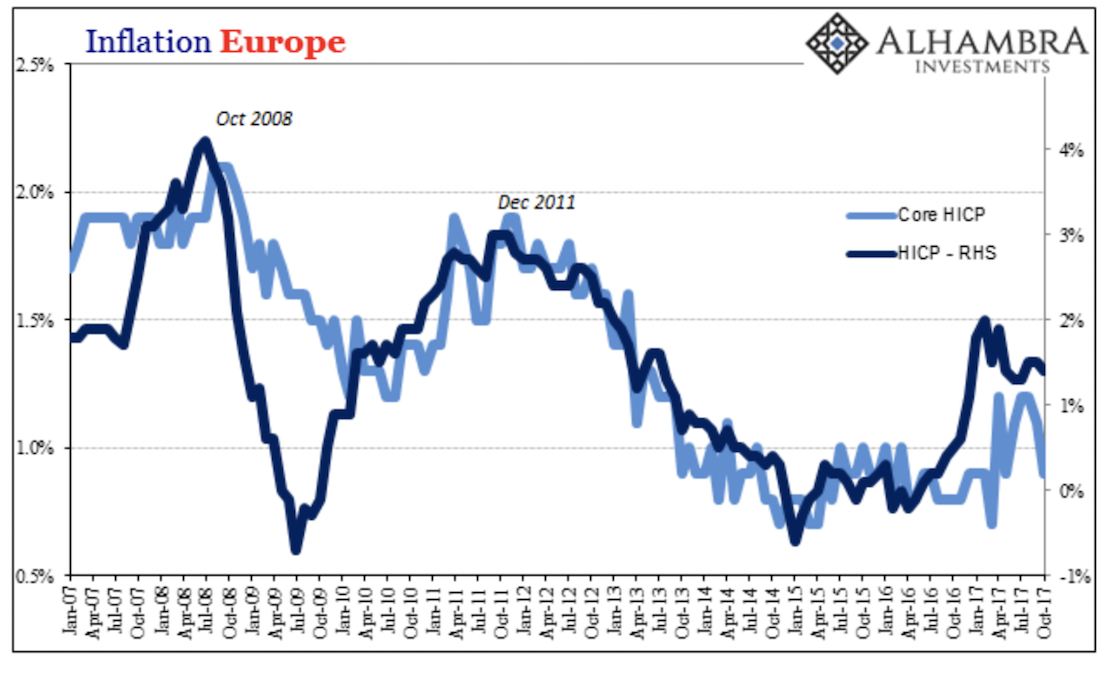

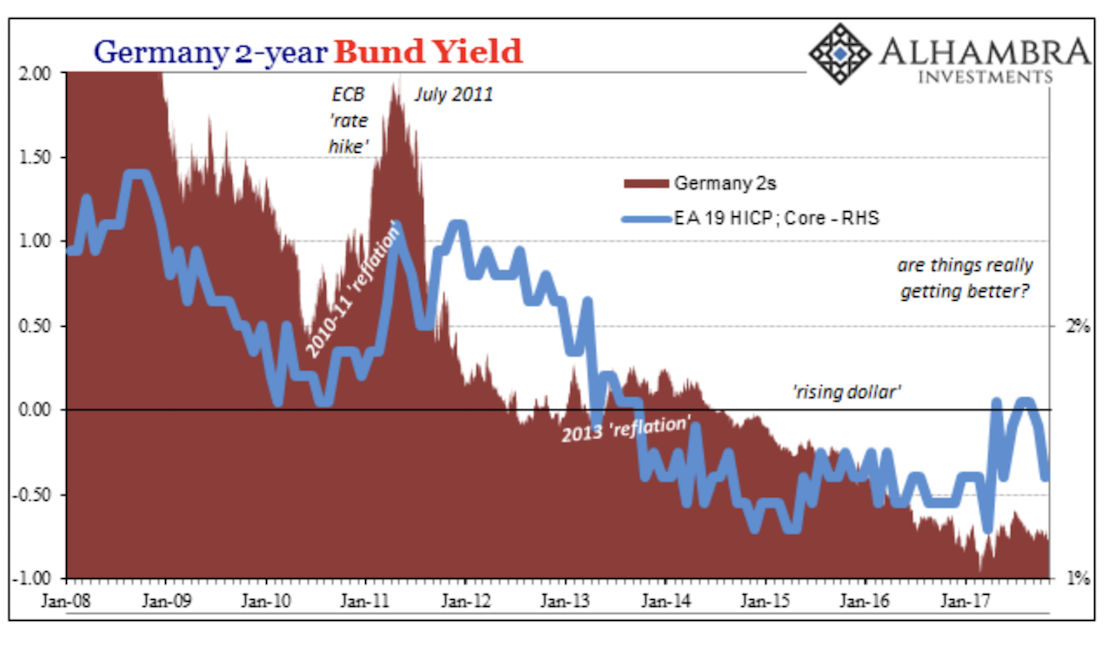

- “From the perspective of steady growth and successful monetary policy, ECB officials might expect that inflation would start to behave according to the central bank’s target. It hasn’t, and the latest results for October 2017 suggest even more problems along these lines.” – bto: was eine sehr wichtige Nachricht ist. Wie gesagt, es kann sein, dass das mit der Inflation sich doch noch ergibt – teureres Öl? –, aber die fundamentalen Fakten sind auch hier eher deflationär bisher.

Quelle: Alhambra

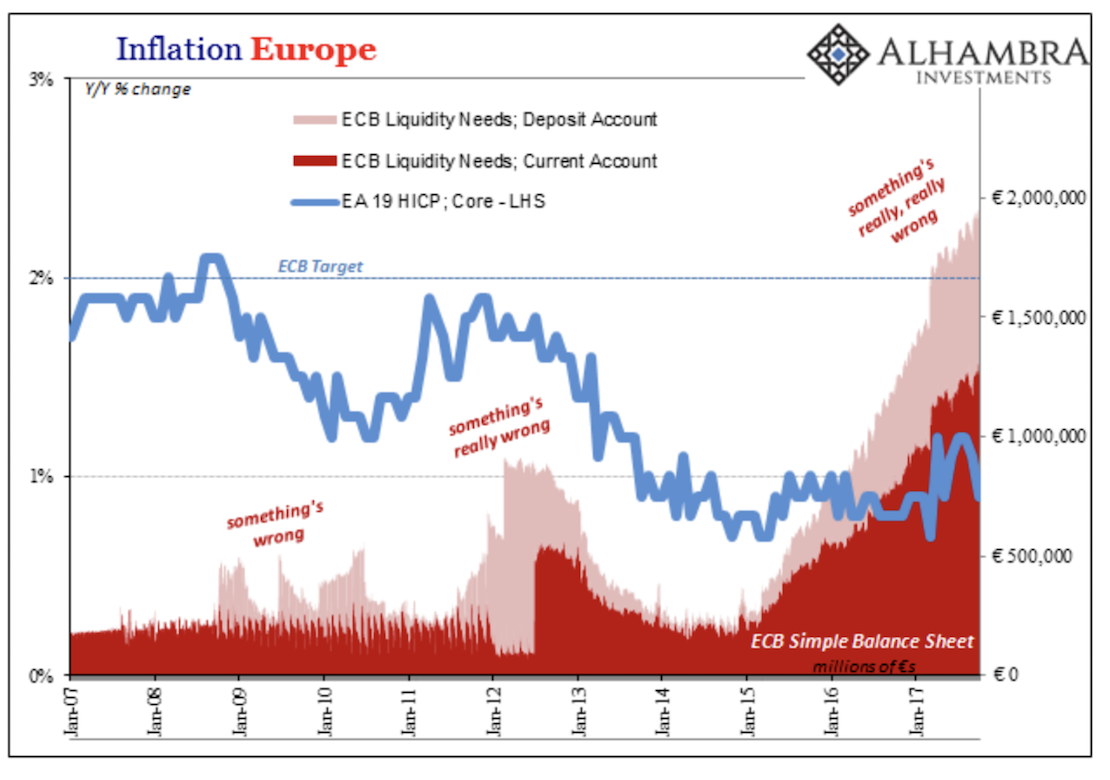

- “The core rate at just 0.9% indicates more so the opposite possibility, continuing the global “conundrum.” Despite ongoing massive ECB intervention supposedly in euro “money”, these operations bear no correlation at all with inflation and therefore effective monetary conditions in the real economy. The lack of inflation continues to advise the non-linear contraction scenario described above with regard to the GDP gap.” – bto: Nun wissen wir ja, dass es vor allem um die Rettung der Eurozone und weniger um die Bekämpfung von Deflation geht.

Quelle: Alhambra

- “The issue is, as always, monetary definitions, which in Europe, as everywhere else, is more than an academic matter. The ECB through its various LSAP’s through the years created bank reserves as a byproduct and nothing more. These are but one form of bank liability and a mostly useless and inert one at that. It is little wonder that the real economy fails to respond to what in the mainstream is wrongly characterized as “money printing”; and therefore why there continues to be expectations consistent with money printing but widespread results contrary to that process.” – bto: wie hier gezeigt, wonach QE eben kein “money printing” ist, solange das Kreditwachstum nicht befördert wird.

Quelle: Alhambra

- Even though the ECB will be tapering its bond purchases, and therefore bund purchases, too, German federal yields are trading in the “wrong” direction from what QE tapering is supposed to reflect. In fact, more negative 2s is instead indicative of higher liquidity preferences, which, for the terms of this discussion, is consistent with a struggling economy unable to generate momentum (and therefore core inflation). That’s why the “yield” moves contrary to fewer ECB purchases because that factor doesn’t matter nearly as much as the other.” – bto: was eine wichtige Nachricht ist. In den USA steigen die Kurzfristzinsen, während die langlaufenden nicht so zulegen. Eine immer flachere Zinskurve gilt als Warnsignal.

“Europe is booming because Europe has to be booming. Except that it isn’t; not even close.” – bto: nett gesagt.

→ Alhambrapartners: “Europe Is Booming, Except It’s Not”, 6. November 2017