EU: Das Kapital stimmt ab

Bekanntlich rate ich seit Langem zu einer Diversifikation der Geldanlage raus aus Europa:

→ „Anleger, raus aus Europa!“

Ich bleibe auch dabei, dass es auf Dauer nur mit immer größeren Eingriffen möglich sein wird, dass verfehlte Konstrukt des Euro “zu retten”, weshalb auch Kapitalverkehrskontrollen abzusehen sind. Besser, man bereitet sich vorher darauf vor.

Aus Sicht der Briten ist klar, dass sie sich über eine Umschichtung von Kapital aus der EU in Richtung UK freuen:

- “Ursula von der Leyen has invoked the nuclear option of the Lisbon Treaty. By threatening to activate emergency powers under Article 122 she has told the world that Europe is no longer a safe place for private capital or inward investment. (…) A regime that behaves like this is liable to impose capital controls without compunction, or block energy flows through the interconnectors, as has been threatened three times already (I keep count). And as we have seen, anything can be politicised, even random stochastic blood clots. Will global pharma ever build a plant again on EU territory after this episode?” – bto: Das ist in der Tat die Frage, die auch ich schon in meinem Kommentar für manager-magazin.de vor einigen Wochen aufwarf.

- “If these daily antics from Brussels and Berlin continue, the eye-wateringly large capital outflows from the eurozone that have already been occurring may accelerate into something closer to outright capital flight.” – bto: Kapitalflucht aus dem Euro. Richtig so.

Quelle: The Telegraph

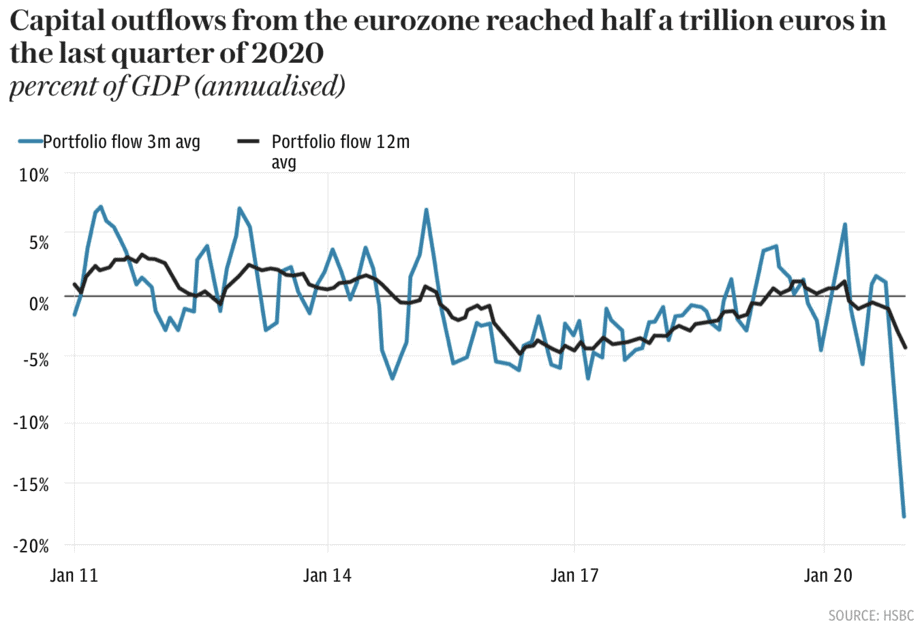

- “HSBC says outflows reached half a trillion euros in the fourth quarter, an annualised pace of 20pc of GDP. It quickened to €250bn (£214bn) in the single month of December. The scale is breathtaking. It happened before the vaccine debacle condemned Europe to an extra quarter of economic recession and social despair. ‘Relative to GDP, these outflows were the largest we have seen going back 20 years,’ said Paul Mackel, HSBC’s currency chief. Hedging contracts have prevented this setting off a disorderly slide in the euro but that does not change the fundamental picture.” – bto: Ich würde auch sagen, dass jene, die es können, ihre Mittel in das Ausland verfrachten. London dürfte da gegenüber anderen Zentren wie der Schweiz gewinnen.

- “You can interpret these outflows in many ways but one thing they are not is a vote of confidence in eurozone growth and recovery, or indeed the political management of the EU. The exodus is likely to gather pace this quarter as American reflation and the vast funding needs of the Biden treasury suck capital out of the global system.” – bto: Das sehe ich auch so: Und die Zukunft liegt ganz klar nicht in Europa.

- “The consequences of a mushrooming third wave in an unvaccinated population, with no herd immunity until September, is to protract what Keynes called the ‘long dragging conditions of semi-slump’ for many more months, inflicting such damage that the recovery may be sickly even when it finally comes.” – bto: Es ist ein Desaster, geschuldet ausschließlich der fehlenden Kompetenz der Akteure.

- “Yet Europe is ‘going small’ even though the output gap in the eurozone is still a dire 8pc of GDP, reaching 10pc in Italy and Spain (IIF data). It is Atlantic decoupling like never before in modern times. (…) It is no longer implausible to imagine Britain leaving Europe far behind over the course of 2021, a remarkable thought given the counter-story in the British lay press that post-Brexit trade has been a calamity.” – bto: Das glaube ich ohnehin. Ich denke, die Briten haben einige Trümpfe in der Hand.

- “The pound has hit a one-year high of €1.17 against the euro this week and is nearing the top end of its post-referendum trading range. (…) data is detecting a marked shift into UK assets by global fund managers. ‘It is not just a one-off story after the Brexit deal. It has been going on since last year. Funds are rotating back into UK equities (…).’” – bto: was auch deshalb richtig ist, weil britische Aktien deutlich günstiger sind.

- “That does not in itself validate Brexit, but the spectacle of cross-Channel decoupling will profoundly change the global discourse on the UK leaving the EU. The real test comes later during the hard grind of the 2020s. But my hunch is that the first year of independence will be much better than almost anybody expected.” – bto: Das ist sicher. Und angesichts der Aussichten bezüglich der politischen Führung in Deutschland und der EU stehen die Chancen für uns schlecht, dass es in den kommenden Jahren für Europa besser aussieht.

Passend dazu John Authers in seinem Newsletter am letzten Donnerstag:

- “One of the strongest market trends of the last 12 months appears to have broken. The euro is no longer on a consistent upward path compared to the dollar, and this has ramifications for virtually everything else. (…) There is a lot of pseudo-science in technical analysis, which can make analyzing chart patterns look much more complicated than it is. But the tale of the euro is clear. It has just dropped below its 200-day moving average for the first time in 10 months, is at its lowest since last November, and is no higher than it was in July. Optimism about a stronger euro is being put to a rigorous test.” – bto: Mit Blick auf den völlig ungeeigneten “Wiederaufbaufonds” haben die Märkte das Spiel des starken Euro gespielt. Dabei war allen klar, dass das nicht funktionieren kann.

- “The clearest reason is the virus, which still dominates all of our lives. (…) Europe succumbed to its second wave a little ahead of the U.S., but this is the first time since Covid-19 appeared that new cases have risen in the EU while falling in America. This is plainly concerning.” – bto: Es ist die Folge des Komplettversagens. Denn Tote von heute sind die Folge politischen Versagens.

- “The second big reason is wrapped up in the bond market and expectations for inflation. Treasuries tend to yield more than German bunds, and hence attract funds to the U.S., strengthening the dollar. This differential plummeted in the first month of the Covid scare — but at 2 percentage points it is now roughly back to where it started last year. The dollar has strengthened with it. The market has more confidence in the Federal Reserve’s ability to create inflation than it does in the European Central Bank’s, and so the dollar is rising.” – bto: Ich würde sagen, nicht nur das. Die Märkte erkennen, dass das europäische Projekt, so wie es gemanagt wird, immer mehr in den Niedergang führt.

- “So, the narrative has turned against the EU. (…) The future of the euro for the next month or two — or, in other words, the chance that it settles into another declining phase and really messes up the calculations of the many people who were positioned for a steadily weakening dollar this year — probably depends on whether the EU can visibly sort out its vaccine program.” – bto: Das Impfdesaster ist ein Symbol für die strukturelle Krankheit der EU.

- “Last week’s AstraZeneca suspension and the increasingly nasty nationalist rhetoric over how to improve vaccine supplies have unquestionably shaken confidence in the EU, and with it the euro. (…) Immunity appears not to last forever, and so speed is of the essence if the continent is to achieve the herd immunity that would stop the virus from spreading. (…) If the EU can turn around its vaccine campaign, the chances are that the euro can turn around as well. But the narrative is getting entrenched, and it needs to turn the story around soon.” – bto: Wer glaubt das? Ich nicht.