ETF als Risiko für das Finanzsystem?

Schon früher habe ich auf die Risiken von ETF – also börsennotierten – Fonds hingewiesen. Diese können Aktienindizes abbilden, aber auch bestimmte Gruppen von Aktien nach Themen oder Sektoren und natürlich auch Anleihen und andere Assetklassen. Dabei unterliegen die Käufer oftmals der Illusion täglicher Handelbarkeit und damit der Liquidität. Über längere Sicht führt das dazu, dass die meisten weniger mit der Anlage verdienen, als man meinen könnte, weil sie zum falschen Zeitpunkt kaufen oder verkaufen. Kurzfristig kann es sein, dass im Falle einer Stresssituation am Markt, der Preis dieser Fonds deutlich vom Wert der dahinterliegenden Assets abweicht, einfach weil der Verkaufsdruck zu groß ist. In diesem Fall drohen den Verkäufern empfindliche Verluste. Damit nicht genug, es besteht die reale Gefahr, dass der Verkaufsdruck dazu führt, dass es auch an anderen Märkten zu Panik kommt und so eine kleine Störung sich zu einem echten Crash auswächst.

Grund genug scheinbar für den European Systemic Risk Board, sich das Thema genauer anzusehen, und für bto, das Ergebnis dieser Untersuchungen hier zu diskutieren:

- „Exchange-traded funds (ETFs) are one of the most popular financial innovations of recent decades. They are hybrid investment vehicles that track an index or a basket of assets, combine features of open-end and closed-end mutual funds and are continuously traded on liquid markets. (…) ETFs have grown substantially in size, diversity, scope, complexity and market significance in recent years. (…) they represent, on average, more than 30% of the daily trading volume in US stock markets (…) The growth of ETFs has been accompanied by an expansion in the range of underlying assets tracked by ETFs to also cover equities, bonds, commodities, currencies and even indices, such as the VIX. In Europe, around 70% of ETFs track equity indices (see Chart 5), but the share of ETFs tracking other financial assets, in particular fixed-income securities, has been growing in recent years (…).” – bto: und dies aus gutem Grund. Sie sind meist deutlich günstiger als andere, aktiv gemanagte Fonds, wobei man aufpassen muss, können doch auch ETF aktiv gemanagt sein. Der wichtige Unterscheidungsfaktor ist die tägliche Handelbarkeit, die eben zur Liquiditätsillusion führen kann.)

- „While most ETFs track liquid equity indices, one of their key features relates to their capacity to also replicate baskets of less liquid assets in the form of more liquid tradable securities, but this liquidity transformation could be subject to frictions. ETFs that track an index of relatively illiquid assets (e.g. corporate bonds in emerging markets) create a mismatch between the expected liquidity of ETF shares and the underlying assets. There is evidence that the higher liquidity of ETFs shares vis-à-vis the underlying assets can attract investors who would not otherwise be willing to be exposed to the more illiquid underlying assets (…) ETFs that are more liquid than their underlying securities (i.e. positive relative liquidity), are particularly attractive to short-term investors. Accordingly, they document that relative liquidity is inversely related to the average holding duration of ETFs.” – bto: Wir haben also vermutete Liquidität mit tatsächlicher Illiquidität und so schon einen offensichtlichen Faktor für potenzielle Probleme. Allerdings dürften die nicht so bedenklich sein, solange es sich um Nischenmärkte handelt.

- “ETFs are originated upon the initiative of a sponsor, who also defines the objective, investment strategy and management of the ETF. (…) At the time of originating the ETF, the sponsor defines not only the objective of the ETF but also how that objective will be achieved: with full physical replication of the underlying index, with a sample of the securities in the underlying index, with derivatives or with a synthetic replication (which also involves the use of derivatives).” – bto: soweit, so klar. Ich selber empfehle immer replizierende Fonds, einfach, weil die Derivate ein zusätzliches Risiko gerade bei Marktstörungen darstellen.

- “Once the ETF with physical replication is originated, it exchanges ‘creation units’, i.e. a number of ETF shares, with the authorised participants (APs) for a basket of underlying securities, the creation basket, or for an equivalent amount of cash that the ETF provider uses to buy the basket. (…) Typically, the sponsor of the ETF contacts different APs and offers them its originated ETF. At present, there is no regulatory restriction on the minimum number of APs that an ETF must have.” – bto: Man kann sich das System als Dienstleister vorstellen, der den Fonds entsprechend abbildet und dafür eine Gebühr bekommt.

- “Since APs are commercial investors that bear risk when trading or holding ETFs, they do not have any particular commitment to the ETF sponsors or to their customers. Indeed, they do not have any obligation to create or redeem ETFs or to provide liquidity. They do not receive any fee from ETF sponsors or investors for their role as creators and redeemers of ETF shares. Basically, APs enter into these transactions seeking arbitrage profits.” – bto: Das heißt im Klartext, sie haben keine Verpflichtung, einen Markt zu machen. Im Gegenteil, sie würden sogar von Marktstörungen profitieren, wenn sie wissen, dass der Preis des ETF deutlich vom Wert der Assets abweicht.

- “If ETF shares trade at a premium compared with the net asset value, the AP can sell ETF shares in secondary markets, buy the underlying securities, and create ETF units by delivering these securities in creation baskets at the end of the day. Conversely, if ETF shares trade at a discount, the APs can buy ETF shares in secondary markets, redeem creation units at the end of the day, and eventually sell the underlying securities that they have thus acquired (…) these arbitrage trades may create risks, which APs will be willing to bear only if they can expect a sufficiently large return.” – bto: Auch dies leuchtet ein, sorgt aber in normalen Zeiten dafür, dass der ETF sich nicht zu weit vom Wert der dahinter liegenden Assets entfernt.

- “ETF liquidity in regulated secondary markets is provided by Official Liquidity Providers (OLP), which are financial institutions (usually APs) that are committed to the exchange, not to the ETF sponsors. (…) A substantial part of trading with ETF shares in Europe takes place in OTC markets. (…) Hence OLPs have a limited role in ensuring liquidity of ETF shares overall.” – bto: Das verstärkt die Anfälligkeit für Turbulenzen an den Märkten.

- Damit nicht genug: “In recent years, a sizable number of ETFs replicate an index not by investing in its constituent securities, but via more complex replication methods that rely on derivatives. (…) roughly half of the ETFs in the EU currently feature complex structures. However, taking into account the total market value rather than the number of physical ETFs, they appear to dominate the EU market (…).” – bto: Wir haben also folgendes Zwischenfazit: Die ETF haben keinen Marktmacher und niemanden der verpflichtet ist, Liquidität sicherzustellen. Sie sind zunehmend komplex und zudem überproportional über Derivate abgebildet, die wiederum in Märkten gehandelt werden, die anfällig für Störungen sein könnten.

- „Even though derivative-based ETFs physically hold some of the assets they track (so that they cannot be defined as synthetic), they rely on derivatives to achieve their investment objectives: leveraged ETFs seek to increase exposure to the underlying index via derivatives such as futures to increase their leverage (…) inverse ETFs aim at generating an opposite exposure to a given market, and structured ETFs consider any other underlying index or price to track, such as volatility in a market, inflation spreads or the replication of a hedge fund (…) This can exacerbate their gains and losses over longer time horizons.” – bto: Das ist ja auch das Ziel der Aktion! Nur geht mit dem höheren potenziellen Ertrag eben auch ein entsprechendes Risiko einher.

Womit wir zur Betrachtung der „systemischen Risiken“ von ETF kommen: „The increasing availability of ETFs can affect investors’ behaviour, by allowing them to pursue new strategies to seek return, manage risk and access new asset classes. Such changes in investors’ behaviour may in turn impact the functioning of financial markets, particularly in times of market stress. Empirical research has so far identified three effects.“ – bto: Und damit ist klar, dass es im Falle von Stress im System eine potenziell Stress erhöhende Wirkung haben kann.

- “First, ETFs are associated with greater co-movement of asset prices: stocks tend to co-move more with their respective indices once they are included in ETF portfolios. This increase in the co- movement of asset prices may pose systemic stability issues, as it makes it more likely that many investors face losses simultaneously, therefore potentially leading to waves of insolvencies and synchronised sales.” – bto. Und das wirkt sich auch auf anderen Märkten aus, weil dann jene, die auf Kredit gekauft haben, sich woanders Liquidität beschaffen müssen.

- “Second, there is evidence that ETFs are associated with increased price volatility of the constituent securities: the high liquidity and continuous trading of ETFs enable investors, including noise traders, to take large short-term directional positions on entire asset baskets. The unwinding of these positions in the ETF market can eventually result in crashes. Insofar as these are transmitted to the index itself as a result of arbitrage, they can increase both the volatility of the index and the correlation of individual security prices with the index. This may become problematic especially in times of financial stress, when ETF shares tend to become less liquid, particularly ETFs with illiquid underlying securities and those traded over the counter (OTC).” – bto: Das ist nun wirklich nicht überraschend. Letztlich sind ETF institutionalisiertes Herdenverhalten.

- “Third, the arbitrage mechanism between ETFs and their constituent securities may operate imperfectly: ETF prices can deviate significantly from those of the constituent securities, especially at high frequencies, for illiquid assets and during periods of financial stress. (…) In these situations, the order flow may have a strong adverse impact on ETF prices, which could lead investors to ‘lose faith’ in the liquidity transformation provided by ETFs and engage in potentially destabilising fire sales. (…) an amplification of ETF price swings may in principle create systemic risk insofar as leveraged financial institutions hold material ETF positions on their balance sheets, while the opposite may occur if these financial institutions are exposed mostly to the risk arising from constituent securities.” – bto: Wie so oft kann man nur feststellen, dass seine eigentlich eine Frage des Leverages ist. Je mehr Marktteilnehmer mit immer größerer Verschuldung agieren, desto größer die Gefahr von abrupten Reaktionen.

Die Studie blickt dann noch auf die sich aus den o. g. Risiken ergebenden weiteren Risiken für das Finanzsystem:

- „First, ETFs can contribute to systemic risk by inducing investors to take correlated exposures that may trigger a chain reaction with systemic risk implications. In this case, however, the focus should be more on the ability of financial intermediaries to take correlated exposures (in the form of ETF exposures or any other financial instrument) and fund them via increased leverage, rather than on the role played by ETFs themselves.” – bto: was natürlich stimmt. Das eigentlich funktionierende Modell der ETF mit der im Prinzip guten Idee, gerade für Privatinvestoren einen kostengünstigen Weg der Geldanlage zu eröffnen, kann natürlich entsprechend anders genutzt werden und zu einem Mittel der aggressiven Spekulation werden. Was dann allerdings wieder auf die Privatinvestoren zurückwirkt.

- “A further issue is whether ETFs are subject to counterparty risk that may raise systemic risk concerns. Synthetic ETFs are exposed to the risk that the swap counterparty is unable to fulfil its obligation to deliver the index return, while physical ETFs are exposed to counterparty risk through securities lending transactions, with the potential, in both cases, to generate fire sales in times of financial stress.” – bto: was letztlich den gerade gemachten Punkt nochmals unterstreicht.

- “Finally, (…) a technical failure or a high-profile case of financial misconduct affecting a single issuer may trigger mistrust among investors for the whole segment and thus generate widespread fire sales and large ETF price drops.” – bto: Das wäre aber dann ein breiteres Thema des ganzen Finanzsystems.

Zur Illustration analysieren die Autoren die erheblichen Verluste, die Investoren mit ETF erlitten haben, die auf eine anhaltend tiefe Volatilität wetteten. Das hat allerdings nichts mit dem Instrument, sondern mit den eingegangenen Risiken zu tun.

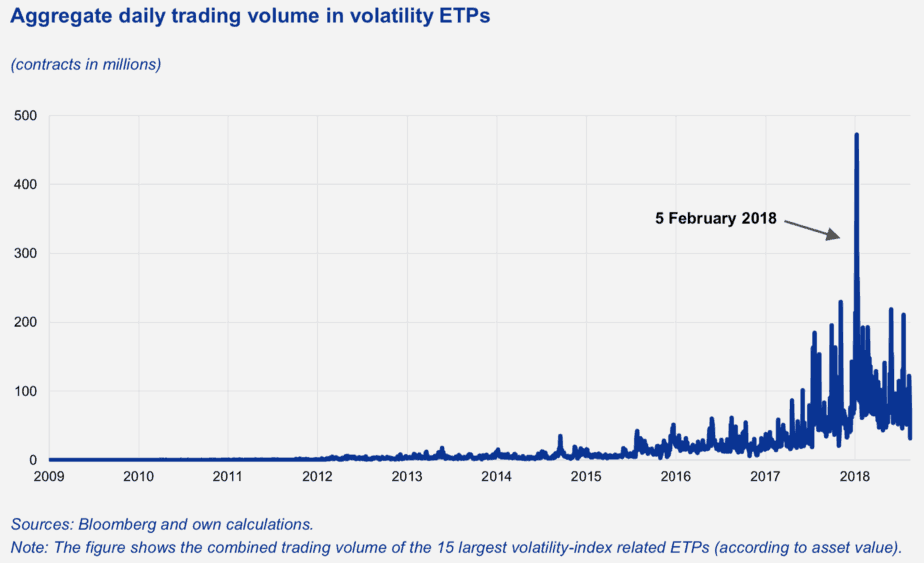

- „A striking recent example of the effects of procyclical trading by leveraged and inverse ETFs occurred at the time of the ‘volatility blow-up’ of 5 February 2018. On that date trading by volatility-related exchange-traded products (ETPs) generated adverse price responses in the underlying markets, eventually leading to the implosion of one of the ETPs, the Velocity Shares Daily Inverse VIX Short Term (XIV). The perverse feedback loop between volatility ETPs and the VIX was triggered by the sudden jump in the VIX on that day, following a long period during which the VIX had been extremely low. This led to substantial losses in short VIX ETPs, especially those providing exposure to the VIX based on short-term futures contracts (see Chart A). Two ETPs (tickers XIV and SVXY, issued by Credit Suisse/Velocity Shares and Pro Shares respectively) lost roughly 95% of their value on that day. Conversely, leveraged long VIX ETPs, such as TVIX and UVXY, more than doubled their values on 5 February 2018.” – bto: Das ist beeindruckend und zeigt die Gefahr radikaler Spekulation. Aber so ist es nun mal. Hat aber nichts mit dem Instrument zu tun.

Wie das Handelsvolumen damals in die Höhe schoss, zeigt diese Abbildung. Genauso wird es immer sein, wenn Investoren Panik bekommen. Geringe Liquidität, offene und verkappte Risiken mit Dopplungseffekt dürften auch bei normalen ETF in der nächsten Krise für einige unangenehme Überraschung sorgen.

Quelle: ESRB