Es ist leichter Schuldenkrisen zentralistisch zu lösen

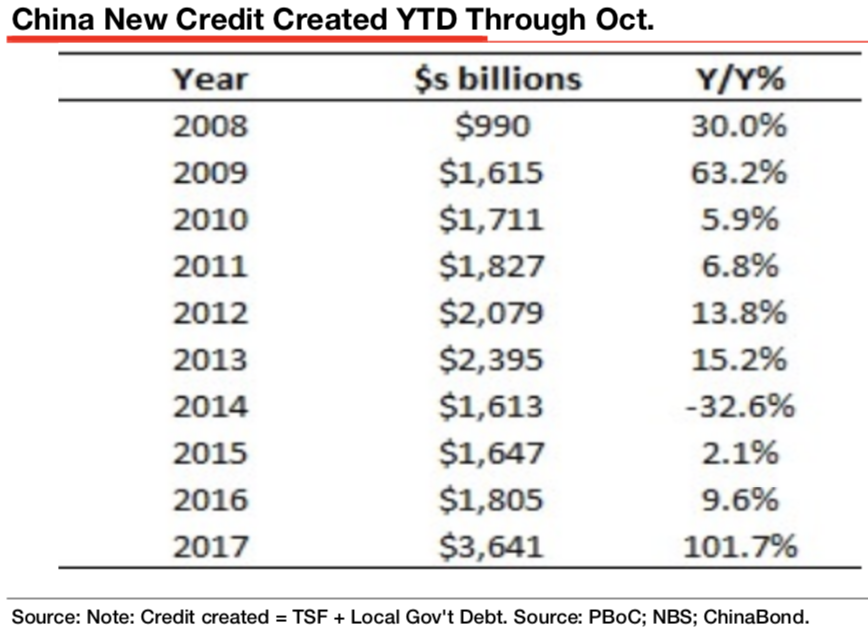

Dass China und damit die Weltwirtschaft vor einer erheblichen Anpassung stehen, ist bekannt. Besonders dramatisch ist die Abhängigkeit des Landes von einer immer schneller steigenden Verschuldung. Zugleich nimmt die Wirkung der neuen Schulden auf das Wirtschaftswachstum immer mehr ab:

Quelle: Société Generale

Üblicherweise werden Reformen und vor allem eine Öffnung der Märkte gefordert. Michael Pettis, intimer Kenner Chinas und immer wieder auch bei bto zitiert, hält das für einen Fehler:

- “China needs reform. (…) Chinese leaders should strengthen the role of markets and liberalize legal, financial and other institutions governing the economy. Their to-do list is virtually gospel by now: free up trade and investment, unshackle the exchange rate and ease capital controls.” – bto: so zumindest die offiziellen Empfehlungen.

- “Such reforms are (…) critical to solving China’s biggest problem: its debt, which has skyrocketed to well over 260 percent of GDP from 162 percent in 2008. (…) The hope is that reforms will boost productivity enough to allow China to outgrow its debt burden before that crisis hits.” – bto: aus den Schulden herauswachsen? Na, das haben wir auch schon woanders gehört …

- “China is unlikely to suffer a financial crisis, and this is precisely because of the government’s ability to restructure banking-sector liabilities at will.” – bto: Das ist das Kernargument der Optimisten, dem man sich nicht unbedingt entziehen kann.

- “Once a country’s debt burden is high enough to create uncertainty about allocating future debt-servicing costs, the debt itself becomes an obstacle to growth. This process — known as “financial distress” – is well-understood in finance theory but is still unfamiliar to many economists.” – bto: besonders hier in Europa! Es ist doch klar, dass die Allokation der Verluste eine erhebliche Wirkung hat.

- “In the past two centuries, there have been dozens of cases of overly-indebted countries whose policymakers have promised to implement liberalizing reforms meant to allow the country to outgrow its debt. None has succeeded. No excessively indebted country has ever outgrown its debt until a meaningful portion has been forcibly assigned to one economic sector or another.” – bto: Hallo Brüssel und Berlin!! Ich fürchte, die anderen, wie vor allem die Franzosen, wissen das und haben auch schon eine Idee, wer die Verluste tragen soll!

- “Mexico restructured its debt at a discount in 1990, thereby forcing the cost onto creditors. Germany inflated the debt away after 1919, forcing the cost onto pensioners and others with fixed incomes. A decade ago, China forced the cost onto household savers through negative real interest rates.” – bto: Und diesmal werden es die deutschen Gläubiger in der Eurozone und in China wird es wohl der Staat sein?

- “If it is going to regain sustainable growth, China, too, must deleverage. The only healthy way to do so is first, to force local governments to liquidate assets and assign part of the proceeds to debt reduction, and second, to wean China off its dependence on excessive investment by transferring wealth from local governments to households, so they can consume more.” – bto: Das leuchtet ein und es kann gut sein, dass die chinesische Regierung dies auch versteht.

- “Even those countries that have avoided financial crises have nonetheless had to deleverage, but have done so in the form of ‚lost decades‘ of very low growth – most notably the Soviet Union in the two decades after 1967 and Japan in the two decades after 1990. In each case, the country’s share of global GDP collapsed by 60-70 percent. This is not a desirable alternative to crisis.” – bto: Und nun macht es die Eurozone genauso. Wie dämlich!

- “China’s financial sector is dominated by speculative investingand capital flight. Meanwhile, heavy state influence has distorted corporate governance and kept afloat insolvent companies. Under such conditions, opening up the financial sector would only further accommodate distortions and worsen the misallocation of investment.” – bto: Das leuchtet ein, weil es eben das Fehlverhalten nicht stoppt, sondern auf andere Art und Weise fortsetzt.

- “(…) while standard macroeconomic reforms may work in theory — albeit under an unrealistic set of assumptions – they’ve never worked in practice. Rather than eliminating the controls that protect China from a financial crisis, leaders should confront their debt problem head-on and begin deleveraging.” – bto: Auch das gilt doch gleichermaßen in Europa!

Fazit: “A more liberal China may be desirable in the abstract – but not until a more controlled China gets a handle on its debt problems.” – bto: Und hier haben wir unser Problem. Wir sind in der Eurozone zu viele verschiedene Länder. Es kann also gar nicht geordnet enden.

→ Bloomberg: “Maybe China Shouldn’t Open Up”, 26. November 2017