Es geht erst los: SocGen erwartet Einbruch von 50 Prozent

Ich habe Andrew Lapthorne von der Societe Generale vor einigen Jahren am Rande einer Konferenz kennengelernt und halte ihn für einen brillanten Analysten. Wenig verwunderlich, dass er mit Albert Edwards zusammenarbeitet und mindestens genauso skeptisch ist. Leider bin ich nicht auf deren E-Mail-Verteiler und muss mich deshalb auf Zweitquellen wie Zero Hedge verlassen. So auch heute, wo ich kurz die entscheidende Aussage von Andrew Lapthorne bringe: An den Börsen dürfte es noch so richtig nach unten gehen:

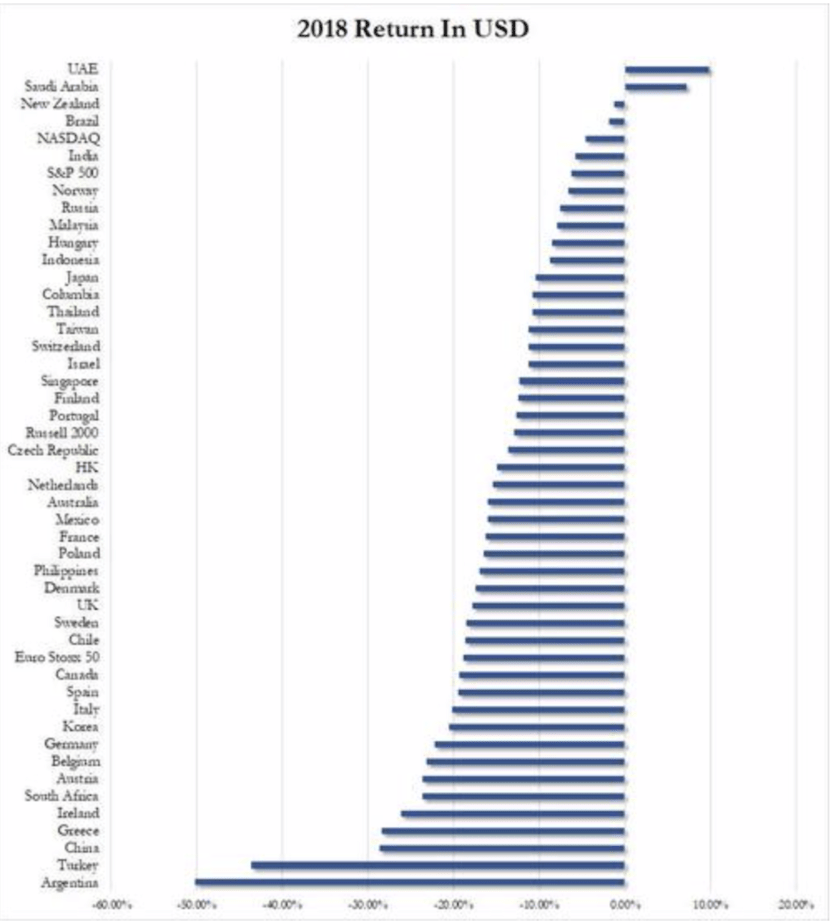

- “The SocGen strategist then lays out some facts about market performance last year, noting that overall the MSCI World finished the year down 10.4% with a negative total return of 8.2%, beginning its slide almost at the beginning of the year, with Emerging Markets fell 16.6% with a total return of -14.2%, with most equity markets losing similar amounts. The exception, according to Lapthorne was the US, “which ended the year in dramatic fashion”, with the S&P 500 having its worst December (-9.2%) since its inception in 1957 despite a massive 5% daily surge on the 26th December.” – bto: Das unterstreicht, wie groß die Probleme an den Märkten sind!

- “(…) outside the US it was mostly a very ugly year, with double-digit losses were common and several indices including Germany and Japan are in bear market territory (the two outliers were, curiously, the UAE and Saudi Arabia).” – bto: Warum ausgerechnet diese Märkte gestiegen sind, verschließt sich mir auch.

Quelle: Zero Hedge

- “Taking an even bigger step back, and looking at an interval of two decades, Lapthorne writes that some index returns are “downright embarrassing:”MSCI Eurozone for example first passed its current price level in July 1998! For many equity investors compounding dividends has been their only return over the last 10 and 20 years!” – bto: Ich bin auch ein Freund der langfristigen Kapitalanlage in Aktien, aber das gibt schon zu denken.

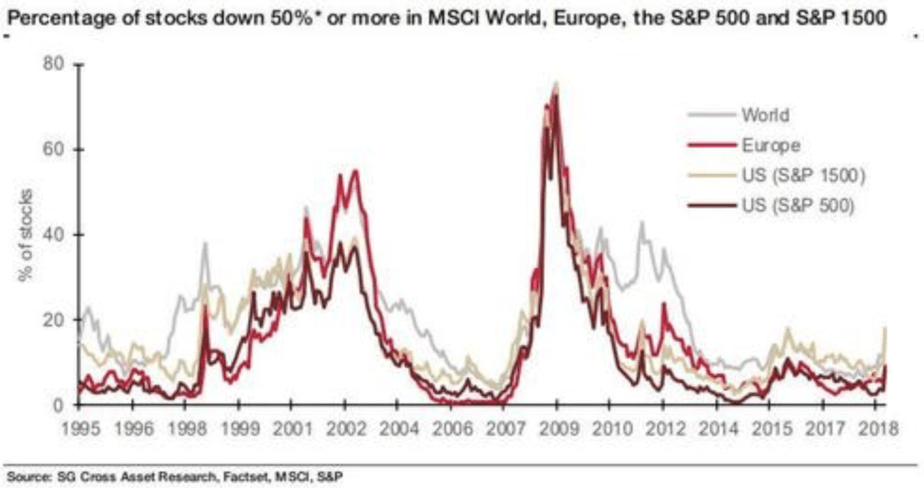

- “Which brings us to the core question of Lapthorne’s note today: where does the market stand today, to which he has an ominous response: ‘despite all the despairing headlines and disappointing returns seen last year, it looks like we are only at the beginning of the sell-off.’ And just to make sure SocGen clients are even more depressed, Lapthorne reminds us that while the investing public is fixated on prices being down 20% or more, ‘during a proper bear market it is common to see one third of stocks lose 50% or more.’” – bto: was naturgemäß starker Tobak ist.

- “Finally, the SocGen strategist shows the chart below which reveals the interesting observation that while the US equity market has done well on a headline basis, ‘the number of stocks down 50% or more in the S&P 500 is on a par with MSCI Europe at 9% and when we go lower down the market cap scale into the S&P 1500, 18% are down 50% or more from their three year highs.’” – bto: Das Chart zeigt aber auch, dass es noch deutlich bergab gehen kann, weil in früheren Baissen die Hälfte der Aktien 50 Prozent oder mehr verloren.

Quelle: Zero Hedge

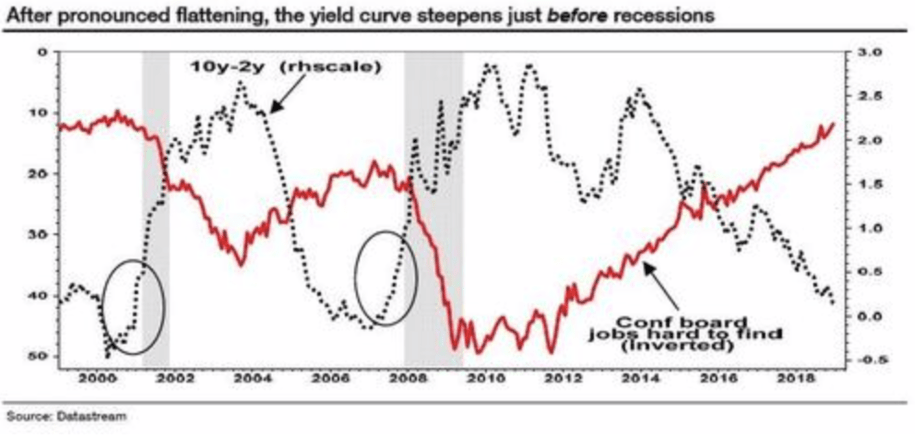

Wichtige Voraussetzung für einen Einbruch an der Börse ist auch eine entsprechende konjunkturelle Entwicklung. Hier kommt der berühmte Kollege von Lapthorne ins Spiel: der Permanenten-Bär Albert Edwards. Dieser erinnert daran, dass die Notenbank Fed immer zu spät auf die Rezession (die sie mit ihrer Liquiditätsverknappung mit ausgelöst hat) reagiert:

- “SocGen’s Albert Edwards (…) warns that the Fed is now too late to save the economy, to wit: ‘the Fed eases immediately prior to a recession’, which is also why the steepening yield curve we are experiencing now is a far more ominous reversal to the recent flattening trend than if the curve had merely continued to flatten.” – bto: Das ist der Punkt, wonach die Fed eben zu spät dran ist. Muss sie vielleicht auch.

- “(…) last Friday’s ’abject capitulation from Fed Chair Powell’ was surprising, and while the SocGen strategist agrees that there was a level of equity market weakness that was always going to generate a re-introduction of the fabled Fed put, Edwards says that he ’thought it would take a lot more than a 20% decline in equity markets for Powell to re-embrace the Fed put like a long-lost friend’, especially after Powell’s post FOMC reiteration that QT was on autopilot. As a result, the subsequent collapse of expectations of Fed tightening has resulted in a far steeper yield curve.” – bto: was ja eigentlich gegen eine Rezession spricht, wurde doch immer in der flachen Kurve/der Umkehrung das Risiko gesehen.

- “(…) why the SocGen permabear is convinced an ‘imminent recession’ is coming: ‘this curve steepening, after a period of pronounced flattening, is a good indication of imminent recession despite continued strength in the labour market.’” – bto: Da muss ich gestehen, dass mich das nicht überzeugt. Ich sehe zwar auch eine Rezessionsgefahr, doch so klar positionieren wie Edwards würde ich mich da nicht.

Quelle: Zero Hedge

- “(…) according to historical precedents, ‘the market has decided the Fed tightening cycle is over, and historically the market has been pretty accurate in its predictions. Da muss ich gestehen, dass mich das nicht überzeugt. Ich sehe zwar auch eine Rezessionsgefahr, doch so klar positionieren wie Edwards würde ich mich da nicht.’ Hence Edwards’ ‘relaxed attitude’ about further yield increases was ‘vindicated when the US 10y bond yield recently broke above the upper bound of the downward channel’.” – bto: Damit wurden die Zinsen erneut zu einer Belastung für die immer höher geleveragete Wirtschaft.

Quelle: Zero Hedge

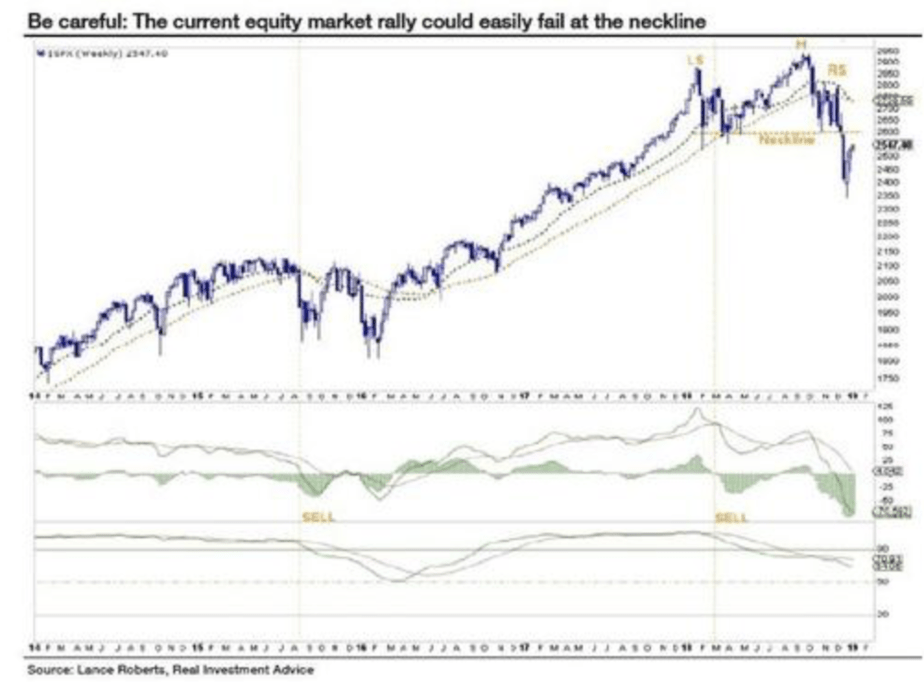

- “(…) Edwards notes that SocGen’s head of Technical Analysis, Stephanie Aymes believes that the current rebound in the S&P and the 10y bond yield is ‘merely a dead cat bounce and investors should prepare themselves for the next leg down.’” – bto: Auf jeden Fall spricht vieles dafür, zunächst einmal vorsichtig zu sein.

- “Edwards (…) asks (…) : ‘If we are indeed nearing the point where the Fed stops tightening (both QT and Fed Funds), should this offer investors confidence that an equity bear market can be avoided?’ and explains that this is not the case because ‘payrolls often accelerate just ahead of a recession’ (…) Payrolls, a lagging indicator, offer no help in predicting recessions.” – bto: Das wiederum ist bekannt. Der Arbeitsmarkt läuft immer hinterher.

Quelle: Zero Hedge

- “(…) while a bounce from deeply oversold levels was expected “until the neckline of the recent head and shoulders formation” which in turn would take the S&P up to around 2600, it is this level “which could prove insurmountable resistance.” He then claims that after that, there are two other massive hurdles to clear: first is the 50% retracement level of the fall from the 2935 peak, which will take us back to 2650, and second, the 200 day moving average of 2740 could also prove heavy resistance.” – bto: Nun mag man das glauben oder nicht, viele Marktteilnehmer glauben daran, was dafürspricht, es doch ernst zu nehmen.

Quelle: Zero Hedge

- “Many investors have a big downer on technical analysis. As a fundamental analyst, many of my readers become apoplectic with rage (or just plain disappointed) when they see I have put a technical chart in my weeklies. (…) But let me repeat: I believe that if an equity bear market is unfolding, it will be the technical analysts and not the macro-analysts that will inform us, and a collapse in the markets will precede a recession, just as it did in 2007.” – bto: Und es gibt noch einige mehr, die aufgrund der Börsenformation vor einem Einbruch, und zwar heftig, an den Märkten warnen.

- “There remains an ongoing bullish bias which continues to cling to the belief this is ‘just a correction’ in an ongoing bull market. However, there are ample indications, as stated, that the decade long bull market has come to its inevitable conclusion.” – bto: wobei wir uns dann noch am wenigsten um die Börsen Sorgen machen müssen, wenn die Illusion/das Märchen/die Lüge von der bewältigten Krise endet.

→ zerohedge.com: “”We Are Only At The Beginning”: Why SocGen Expects A 50% Drop”, 2. Januar 2019

→ zerohedge.com: “The Chart That Convinced Albert Edwards A Recession Is “Imminent””, 10. Januar 2019