Energie ist Wohlstand

Steve Keen hat sich in einem Beitrag auf seiner Patreon-Seite mit den möglichen Folgen eines Energieembargos für Deutschland auseinander gesetzt und kommt dabei zu einer deutlich bedenklichen Einschätzung:

- “The Ukraine War has emphasised Western Europe’s dependence upon Russian energy exports, and a group of mainstream economists decided to consider what might happen to the German economy if Russia effectively reduced the supply of energy to Germany by 10%. Their conclusion, in a working paper entitled ‘What if? The macroeconomic and distributional effects for Germany of a stop of energy imports from Russia’ (in German, with an English appendix), was comforting: a 10% fall in energy would only reduce GDP by one sixth as much: ‘economic losses from a -10% energy shock could be up to 1.5% of German GNE … GNE losses of an embargo on Russian energy are small’.” (Bachmann et al. 2022a, pp. 2,8).” – bto: Bekanntlich hat Scholz darauf abschätzig reagiert und dann ging es erst richtig los mit der heftigen Diskussion unter den Ökonomen.

- “In a Vox editorial, Bachmann and his co-authors observed that there had been “Public fear-mongering about the catastrophic consequences of an energy embargo from lobby groups and affiliated think tanks“. But they rejected this “fear mongering” because it “does not hold up to academic standards” (Bachmann et al. 2022b).” – bto: Persönlich erscheint mir das Experiment einfach zu gefährlich.

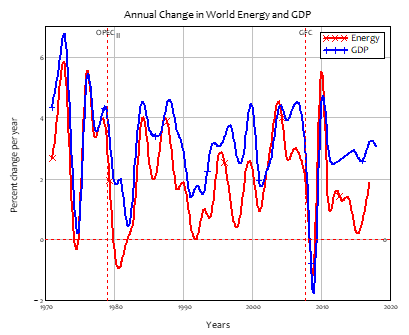

- “Which is a pity, because the empirical data shows that, at the global level, the relationship between changes in energy and changes in GDP is 1:1. Figure 1 plots the annual change in energy against the annual change in global GDP between 1970 and 2017, and one fits the other like a glove. If energy falls by 10%, then on the historical record, GDP will fall by the same amount.” – bto: wobei man damit nichts über die Kausalität aussagt. Es kann ja sein, dass das BIP auf die Energienachfrage wirkt, das Angebot aber nicht gleichermaßen.

Quelle: Steve Keen

Er erklärt dann, dass nach dem Modell der Ökonomen Löhne und Gewinne auf null fallen müssten und der Anteil der Energie auf 100 Prozent des BIP, was offensichtlich falsch ist, weshalb eben der Einfluss von Energie auf das BIP deutlich geringer sei.

- Um dann zum Kern des Problems zu kommen: “The real problem though, is the Neoclassical theory of production and distribution. (…) The key one for this paper is that the Neoclassical model assigns a trivial role for energy in production. Bachmann notes that in the simplest version of the model, the so-called “Cobb-Douglas Production function … a drop in energy supply of … 10% … reduces production by … 0.4%.” – bto: Deshalb kommt man auch zu einem geringen gesamtwirtschaftlichen Schaden.

- “But even a huge reduction in energy—an 80% fall—would, according to the Cobb Douglas Production Function, cause a fall in GDP of less than 10%.” – bto: Das ist ja schon merkwürdig.

- “(…) even in the case of an extreme scenario of cutting all Russian energy imports and not being able to substitute for any of them and an extreme tripling in the share of energy imports (which reflects a very low elasticity of substitution), the GNE loss would only be 1.5%. This is sheer nonsense. In the real world, energy is critical (…).” – bto: Aber vielleicht erklärt das ja unsere Energiewende …

- “of course energy is ‘an extreme bottleneck in production’. Energy enables workers and machines to turn raw materials into useful products, and without energy, nothing will happen. As I put it in an academic paper, ‘labour without energy is a corpse; capital without energy is a sculpture’ (Keen, Ayres, and Standish 2019). You also can’t substitute for energy: if you don’t have energy, then you can’t use something else to make the machines work.” – bto: Das leuchtet mir ein.

- “Practically, this means that, if Russia does block energy supplies to Germany, there will be a substantial fall in German GDP.” – bto: Das denke ich auch.