Ende der Eiszeit in Sicht?

Ist die „säkulare Stagnation“ überwunden oder widerlegt? Ist die Eiszeit-These doch falsch und wir stehen vor einem neuen Boom? Zieht der neue Kondratieff – anders als frühere Zyklen – auch eine völlig überschuldete Welt aus dem Morast? Geht es ohne eine Beseitigung der faulen Schulden? Ist also die Kernthese von bto falsch? Können wir einfach aufhören und lieber durch ewig steigende Aktienkurse reich werden?

Es sieht ganz danach aus. In meinem Buch Eiszeit beschreibe ich ja verschiedene Szenarien (Depression, lange Stagnation, Hyperinflation), aber nicht die wundersame Selbstheilung der Wirtschaft.

Tja, ein Irrtum?

Gleich mehrere Autoren haben sich mit der positiven Wende beschäftigt. Zunächst Mohamed El-Erian, früher Pimco, jetzt Berater der Allianz in der FT:

- “(…) could this global economic uptick be even more consequential? Could it be part of a paradigm change that sees the advanced world leave behind it too many years of low and insufficiently inclusive growth? And, if so, what are the market implications?” – bto: Das ist in der Tat eine Frage grundsätzlicher Tragweite.

- “For the first time in a while, all of the world’s most systemically important engines of global expansion — including China, Europe, Japan and the US — have been shifting into higher gear. Rather than being finance-driven, growth is being increasingly underpinned by fundamental economic forces. Within the process itself, a virtuous cycle between consumption, corporate investment and trade is gaining traction. Pro-growth policies (particularly in the US), ample liquidity (including on account of continued large asset purchases by the Bank of Japan and the European Central Bank) and, in Europe, an endogenous economic healing process have been the main contributors to the world’s improved economic prospects.” – bto: wobei man natürlich schon anmerken muss, dass dies auch die Folge einer weiter stark gestiegenen Verschuldung ist.

- “(…) it has led economists to improve their short-term forecasts and markets to build on an already impressive multi-year rally in risk assets. But it is yet to translate into a materially improved medium-term growth path, nor has it significantly reduced worries about elevated financial asset prices and debt. Indeed, one of the most consequential questions facing the US and global economy is whether this could be more than just a short-term uptick in growth.” – bto: In der Tat ist das die entscheidende Frage. Kann man wirklich sagen, dass es eine Wende ist, oder ist es eine Erholung im langfristigen Abwärtstrend?

- (…) the global economy has been on a road to a ‚T-junction‘ whereby the current finance-reliant growth paradigm would give way to one of two very different outcomes (…) either higher and more genuine growth that would validate elevated asset prices, facilitate the ‚beautiful normalisation‘ of monetary policies and reduce political tensions — or periodic recessions that would lead to financial instability, a higher risk of policy mistakes and greater political polarisation.” – bto: Das ist die Kernfrage: Besteht die Eiszeit weiter oder aber ist es eine wirkliche Trendwende?

- “(…) the probability of a better turnout (…) has materially improved. It is an outlook that would favour risk assets, helping not only to validate their existing levels but also provide a basis for future gains, albeit more volatile and less pronounced than in 2017. It would also call for commodities to outperform, (…) And it would result in higher yields on government bond (…).” – bto: Ich denke, es wäre schon ein Wunder, könnten die fundamentalen Daten die Marktwerte rechtfertigen. Ich erinnere an die Analyse zur Bewertung des S&P von GMO.

- “(…) they will have a greater chance of becoming reality provided the world avoids a major non-economic shock (with North Korea and the Middle East being the main risk areas), a policy mistake (with the simultaneous normalisation of monetary policies by four systemically important central banks constituting a challenge), and a market accident (with the over-promise of liquidity being the main risk).” – bto: was natürlich auf dem Niveau einer Hoffnung ist. Es ist hier nicht belegt, dass es wirklich entsprechende Wirkung hat.

Ein anderer Autor der FT steigt tiefer in die Analyse ein:

- “In the last few years, it has become widely accepted that the global economy has been mired in a depressed condition that Lawrence Summers has called secular stagnation. (…) it soon gained traction among central bankers, whether or not they chose to admit it. The equilibrium real interest rate, r*, was revised downwards almost everywhere. As a result, policy rates were held ‚lower for longer‘, and global central bank balance sheets continued to expand rapidly. Furthermore, the financial markets responded accordingly.” – bto: Hier wird ein klarer Zusammenhang zwischen These, Handeln und Folgen hergestellt.

- “The question is whether this era is now beginning to change. (…) we do not yet know is whether this marks the end of secular stagnation. Perhaps it is just a strong cyclical boom that will soon peter out. The evidence that secular stagnation is morphing into a new era of secular expansion is early and fragmentary.” – bto: Das ist aber wichtig, wenn man die Geschichte vom „Melt-up“-Boom erzählen möchte.

- “(…) the year ended with global activity growing at an annualised rate of about 5 per cent, the strongest rate recorded in the recent growth surge. (…) Growth is now about double the rate recorded at the low points experienced during the oil and China-related slowdown in 2015-16. Furthermore, the latest estimate is more than 1 percentage point above the underlying trend, indicating that spare capacity in the global economy is now being absorbed at a fairly rapid rate.” – bto: Das würde dann aber wirklich Inflation bedeuten und damit entweder eine noch stärkere finanzielle Repression oder ein Umfeld steigender Zinsen, was dann die Wirtschaft und die Börsen abknipst.

- “The global growth rebound that started in March 2016 has certainly been helped by cyclical factors that are unlikely to be fully maintained. The combined easing of monetary policy by the Federal Reserve and the PBOC in 2016 was crucial, as was the fiscal injection in China and the end of the collapse in energy investment. Global financial conditions eased markedly as investor confidence increased, and survey indicators of business and consumer confidence sky-rocketed.” – bto: Es ist und bleibt das billige Geld, was die Entwicklung treibt.

- “Those who believe in secular stagnation remain extremely sceptical about the ability of the global economy to remain healthy during a phase of monetary tightening. They still have plenty of evidence on their side. The symptoms of secular stagnation – lower underlying growth rates and reduced levels of equilibrium interest rates (r*) – has been around for much more than a decade, and it is foolish to believe that it can be seriously challenged after a few months of solid global growth.” – bto: So sehe ich das als anerkannter Skeptiker auch :-)

- “Still, optimists can point to a few pieces of evidence that suggest the situation may be improving a bit. (…) the 4.5 percentage points decline in global real interest rates since the early 1980s has been driven almost entirely by two factors – a decline in the expected rate of productivity growth, and a drop in global investment relative to savings. Secular stagnation has many other causes (such as declining population growth) but it is unlikely to be overcome without a rise in productivity growth and capital investment in the advanced economies.” – bto: Genau darauf habe ich immer wieder hingewiesen, auch in der Eiszeit.

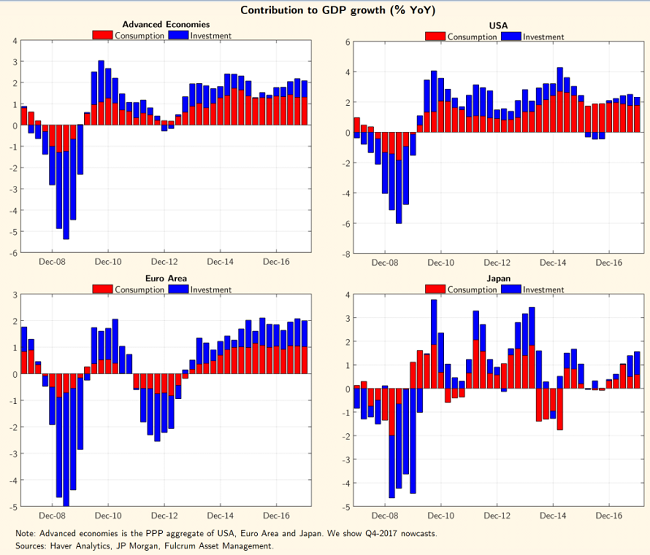

- “On productivity, there has been a very slight improvement (…) Though still tiny, it is at least moving in the right direction, after many years of inexorable decline. Furthermore, there has been a return to more normal growth rates in total factor productivity in the US, the economy at the leading edge of the global recovery. (…) Turning to capital investment, incoming data has started to improve impressively. The graphs below show the contribution of consumption and total investment respectively to GDP growth in the major economies since the Great Financial Crash.”

Quelle: FT

- “The contribution of investment fell to zero in 2015-16, when concerns about secular stagnation were at their peak. Since then, capital investment has turned upwards, especially in the non residential sector that had previously been the main drag on the recovery. In the second half of 2017, total investment in the US, the Eurozone and Japan all increased at quarterly annualised real rates of 8-10 percent, a vast improvement on anything seen since 2010. (…) it does offer some hope that the lengthy drought in capex in the major economies may at last be coming to an end.” – bto: Ja, das wäre es. Allerdings ist gerade das Investitionsverhalten sehr volatil. Zu früh, das Ende auszurufen, würde ich sagen!

→ FT (Anmeldung erforderlich): “Can secular stagnation morph into secular expansion?”, 7. Januar 2018