Eine andere Variante des Schuldentilgungsfonds für die Eurozone

Bekanntlich bin ich für einen Schuldentilgungsfonds auf EU-Ebene, in dem alle Euro-Staaten – gerade auch Deutschland – Staatsschulden in einem festen Wert relativ zum Vor-Corona-BIP abladen können. Dieser würde dann auf Ewigkeit angelegt, wenn nötig von der EZB refinanziert und nicht mehr der nationalen Staatsschuld zugerechnet.

→ Der Corona-Schock – die große Chance für Deutschland

Und zum Nachhören:

→ Schuldentilgungsfonds statt Merkel-Macron-Paket

In eine ähnliche Richtung geht dieser Vorschlag:

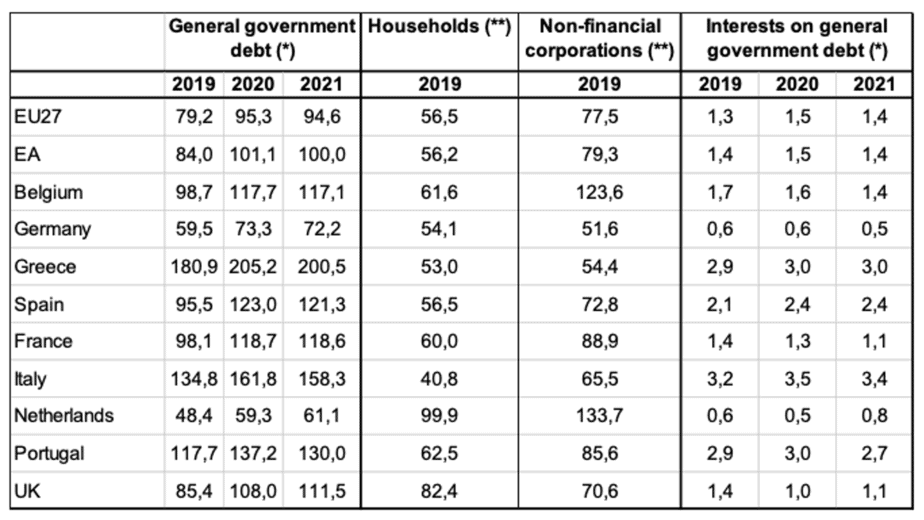

- “Following the health crisis, fiscal deficits and sovereign debts in the euro area are projected to deteriorate dramatically (Table 1). The increase in the average debt ratio in the euro area is estimated to be over 15%, bringing it over 100%. It will climb by about 20% in France and about 30% in Italy and Spain. Some countries, notably Belgium and France, also display a large increase in private sector indebtedness. The rise in private debt is relevant as it may foreshadow a future increase in sovereign debt, to the extent that the public sector is forced to take it upon itself to contain damage to the economy from insolvencies.” – bto: Das stimmt und unterstreicht, warum es grundlegend falsch ist, über Steuererhöhungen und Ähnliches bei uns nachzudenken. Wir brauchen ein Wohlstandsprogramm für Deutschland.

Table 1: Government, non-financial private sector debts and interests on general government (% of GDP)

Quelle: VoxEU

- “(…) what is not a feasible solution (…) is preventive debt restructuring country by country. This approach is predicated on the importance of moral hazard considerations in driving sovereign debts but is highly questionable both analytically and empirically. Indeed, there is scant evidence that countries’ debt policies are motivated by moral hazard.” – bto: also kein Schuldenschnitt, weil das nichts bringt. Dem folge ich zumindest so, wie es im Euro durchgeführt wird.

- “(the) massive private debt restructuring in Greece in March 2012 led to an increase in overall government exposure, owing to the need to fill the gap opened by vanishing private finance. As Greece had already lost market access, an increasing role in providing liquidity to the Greek financial system was then taken up by the ECB, through its emergency liquidity assistance – which thus evolved from an emergency credit line for individual banks in difficulty to an emergency macro-financing channel.” – bto: Klar, das Ganze war ja auch ein Programm zur Rettung französischer Banken.

- “While debt restructuring cannot be ruled out eventually as a component of actions to restore the market access of a country unable to service its public debt, the notion of preventive debt restructuring when granting ESM financial assistance should simply be removed from the table as utterly destabilising.” – bto: da – so der Autor – es sofort zur Ansteckung anderer Staaten führt.

- “In his influential presidential address to the American Economic Association, Blanchard argued that in the new environment of low interest rates expected to last for an indefinite future, policy trade-offs between debt stabilisation and output stabilisation with fiscal policy have shifted fundamentally in favour of the latter goal. Based on this analysis, Blanchard et al. have proposed substantial modifications of euro area fiscal rules that confine debt stabilisation to the backstage.” – bto: Weil die Zinsen ewig tief bleiben, kann man dauerhaft mehr ausgeben.

- “(…) the common currency is not available to individual euro area member states to stabilise their sovereign debt market without the consensus of (a majority of) the governing board of the ECB. Fear that such support may be withdrawn may generate a financial shock shifting the economy of a member state to a ‘bad equilibrium’ involving an investor run on his sovereigns and, as a consequence, fresh threats to the survival of the euro spreading contagion to other euro area members.” – bto: eine theoretische Angst, ist doch das Drohpotenzial der Schuldner erdrückend.

- “A way forward would be offered by engineering large transfers of euro area sovereigns from the ECB to the ESM, de facto keeping a substantial part of the debt out of the market for an indefinite future. The euro area would utilise the credit standing of its institutions to lower sustainability risks and debt service.” – bto: warum von der EZB zum ESM? Ich denke, es ist einfacher, wenn der ESM in die Schuldnerrolle eintritt, also statt des einzelnen Staates zum Schuldner wird. Aus Sicht der Gläubiger eine Verbesserung, weil das Kreditrisiko abnimmt. Mit Ausnahme der Niederlande und Deutschlands, die aber zusätzlich noch eine Garantie abgeben könnten, so erforderlich.

- “More specifically, the ESM would purchase the sovereigns held by the European System of Central Banks (ESCB) as a result of its asset purchase programmes (APP and PEPP). The default risk of sovereigns purchased from the ESCB would continue to remain with national central banks, as it is today, and would not be transferred to the ESM. At maturity, the sovereigns held by the ESM would be renewed into new securities with very long maturity, de facto turning them into ‘irredeemables’.” – bto: Der hintere Teil ist klar, im ersten verstehe ich die Logik nicht. Es wäre doch viel einfacher, die Staaten übertrügen ihre Verbindlichkeiten.

- “The purchases would be funded by the ESM by selling its own securities in financial markets. Like all outstanding ESM liabilities, these securities would be guaranteed by its sizeable (callable) capital. In addition, they would enjoy the guarantee of its member states already in place for ESM liabilities. This double guarantee, together with the de facto guarantee maintained by national central banks on their sovereign paper, should be more than enough to ensure the AAA rating for ESM securities without any special seniority privilege – a major drawback of the various proposals for a safe asset that were formulated in the past would thus be eliminated.” – bto: Das wäre in meinem Modell auch so, allerdings einfacher. Die neuen Anleihen kämen erst bei Fälligkeit der zuvor nationalen Anleihen ins Spiel.

Mein Modell, das nicht auf den Positionen der EZB aufsetzt, sondern allen Staaten einen gleichen Anteil mit Blick auf das BIP zubilligt, ist aus meiner Sicht besser, weil gerechter.

→ voxeu.org: „Managing post-Covid sovereign debts in the euro area “, März 2021