Ein Jahrzehnt zum Vergessen – nur nicht an den Börsen

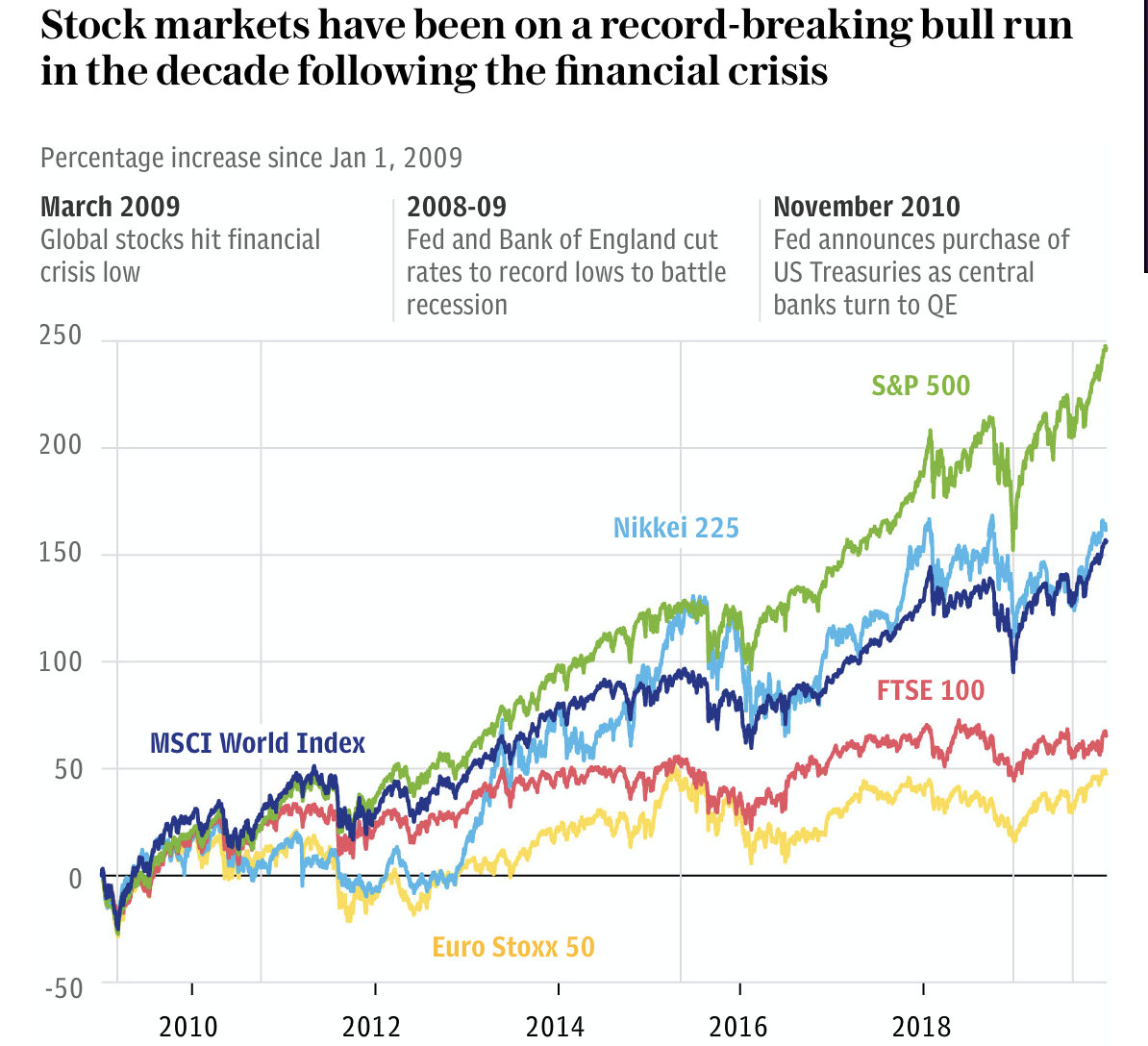

Letzte Woche habe ich auf das vergangene Jahrzehnt zurückgeblickt. Ein Jahrzehnt, das aus realwirtschaftlicher Sicht – auch, wenn wir es in Deutschland anders wahrnehmen – enttäuscht hat. Ganz anders war es an den Börsen, getrieben von der Liquiditätsflut der Notenbanken. Bekannt, dennoch nett, es nochmals zusammenzufassen:

- “Stock markets appear to be becoming detached from economic reality, top City investors fear. A decoupling between stock prices and the economic fundamentals was exemplified in the stellar performance of stocks last year. The MSCI World Index – which tracks global stocks – rocketed 25pc last year, adding almost $10 trillion in value. But final 2019 growth figures are expected to show the world economy expanded at its slowest pace since the crash with more sluggish figures pencilled in for 2020 and 2021.” – bto: Na und, sagen da viele. Das Geld ist da, was soll schief gehen. Die Wirtschaft wird schon kommen und wenn nicht, dann gibt es noch mehr Geld. This time its different.

Quelle: Telegraph

Wer hätte gewusst, dass Japan einer der besten Märkte war? Europa ist klar: Das ist Europa. Genügt eigentlich schon als Begründung. FTSE 100 Index sollte gut dastehen in den nächsten zehn Jahren. Stichwort erfolgreicher Brexit.

- “‘The reason for that gap is you’ve had economic growth that has been generally modest and you’ve had equities that are propelled further by this continuous central bank liquidity, first through lower interest rates and then quantitative easing.’ There is a ‘battle’ in markets between the economic fundamentals that would point to lower stock prices and the flood of stimulus provided by central banks (…) That could worsen after central banks turned the stimulus taps back on in 2019.” – bto: Es geht nach oben, am besten immer schneller.

- “Slashing rates to record low levels, and in the case of the ECB into negative territory, after the crisis has transformed the calculations made by investors.(….) ‘there is no alternative’ (…) traders now use TINA to describe the philosophy that stocks rule the roost in the ultra-low rate world.” – bto: Und das muss doch Anlass zur Sorge geben! Denn nur in dem Szenario einer baldigen Inflation kann man es als Flucht in Sachwerte erklären.

- “It is a daunting task for central banks to wean the market off its stimulus addiction more than a decade on from the Great Recession. (…) ‘Can they get out of this corner that they have painted themselves into?’ Slok asks. ‘We are all hoping it will be a smooth exit whereby gradually things will normalise over some period but the risks continue to be substantial.’” – bto: Es ist unvorstellbar, wie so ein Exit funktionieren soll, deshalb laufen die Vorbereitungen für die Helikopter ja schon.

- “‘The nightmare of all central bankers is we get an unwanted spike or increase in inflation,’ warns Slok.” – bto: wobei klar ist, dass die Notenbanken dann die Zinsen unten halten, um die Schulden zu entwerten. Welche Alternative hätten sie denn? Es wäre der ultimative Margin Call. Die deflationäre Depression wäre da.

- “Whilst most economists believe inflation has been tamed, the world’s biggest asset manager, BlackRock, warned last month that the threat that blighted the 1970s could rear its head again. It believes the primary risk to the global economy in 2020 is a ‘stubborn mix of slower growth and rising inflation’. Price rises could be accelerated by a ‘supply shock from deglobalisation’ amid the return of protectionist trade policies around the world, the investment mammoth warned.” – bto: Die Politik sorgt dafür durch die Entwertung vorhandener Assets im Kampf gegen den Klimawandel.

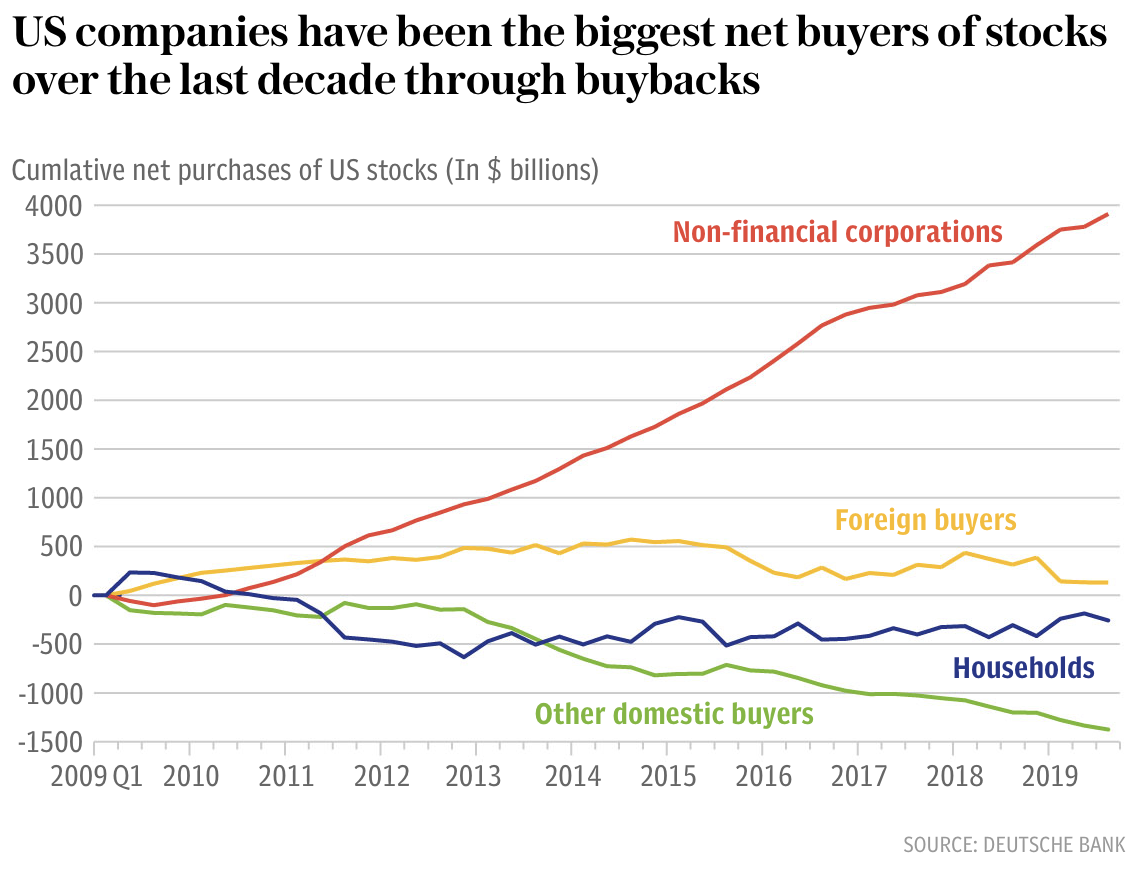

- “Central bank’s bond-buying programmes, stock buybacks and passive investing are the three key players underpinning this indiscriminate buying.Share buybacks (…) have become a favourite way to return cash to investors by managements, particularly in the US.” – bto: Und das Chart hier ist wirklich beeindruckend:

Quelle: Telegraph

- “The spectacular rise of passive investment funds has also driven indiscriminate buying of stocks regardless of valuation. (…) $1.5 trillion has been pumped into passive funds – which track an index or portfolio, such as the FTSE 100 or S&P 500, rather than stock pick like active managers. ‘One implication is that the next bear market could turn quite nasty if the usual bear-market herd behaviour takes hold.’ Michael Burry, who rocketed to fame as one of the first investors to spot the subprime mortgage crisis as depicted in The Big Short, has warned passive investing is a ‘bubble’ as stocks are pushed higher by huge waves of cash rather than analysis of their valuation.”

Da stehen wir also nach zehn Jahren Kampf gegen das – am Ende wohl – Unvermeidliche. Hält es noch weitere zehn Jahre? Ich bezweifle es.