Druckt die Fed genug?

In der letzten Woche habe ich unter anderem besprochen, wieso die Börsen trotz des schlechten Umfelds steigen. Die einfache Antwort: Die Liquiditätsspritzen der Notenbanken fließen weniger in die Realwirtschaft als in die Finanzmärkte:

→ Börsenboom trotz Wirtschaftseinbruch – wie passt das zusammen?

Nur irgendwann zieht die Wirtschaft an und braucht Liquidität – oder aber die Staaten geben das Geld zu schnell aus im Kampf gegen das Armageddon, so zumindest die Sorgen von GoldmanSachs, von denen Zero Hedge berichtet:

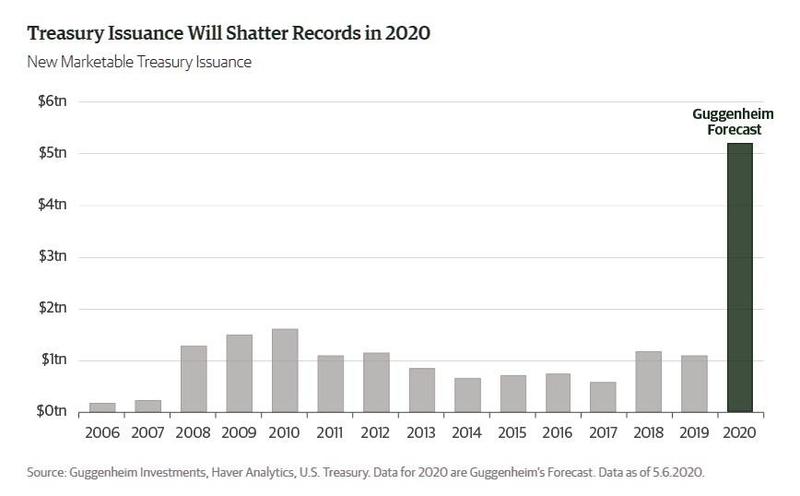

- “Last week, the Treasury shocked the world when it announced that in the current quarter (the 3rd of the fiscal year), the US will need to sell a mindblowing, record $3 trillion (pardon, $2.999 trillion) in Treasurys to finance the US money helicopter. This, after selling $807 billion in the first half of the fiscal year, and another $677 billion in the quarter ending Sept 30. And since it is just a matter of time before Congress has to pass yet another fiscal package which will be at least another trillion dollars, and up to $3 trillion if the Democrats get their wish, one can say that Guggenheim’s projection of over $5 trillion in debt issuance this calendar year will be wildly conservative.” – bto: Es ist die neue Recheneinheit: Billionen.

Quelle: Guggenheim, Zero Hedge

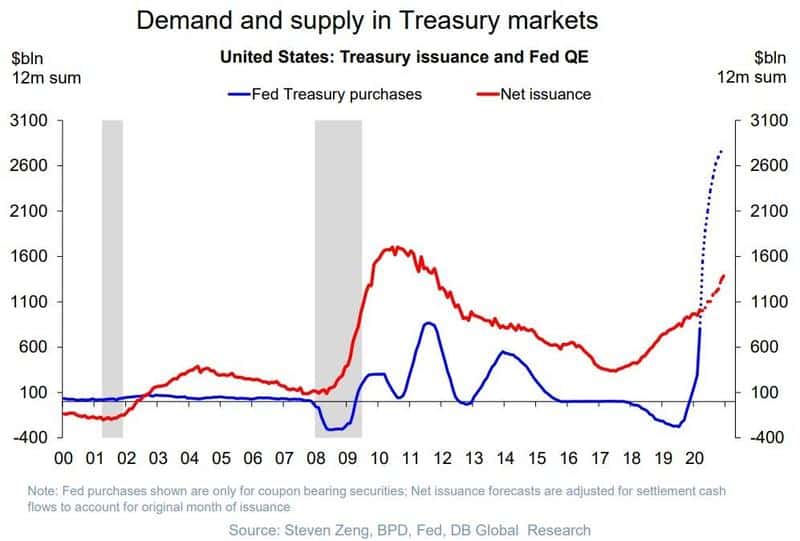

- “Now here’s the thing: as Deutsche Bank recently showed, so far this new debt avalanche was entire monetized exclusively by the Fed, whose debt purchasing operations have been far greater than the net Treasury issuance.” – bto: Es lag also daran, dass die Notenbank massiv interveniert hat. Nur die Frage, die naheliegt ist: Wie lange geht das so weiter bzw. wie viel muss die Fed monetarisieren?

Quelle: Deutsche Bank, Zero Hedge

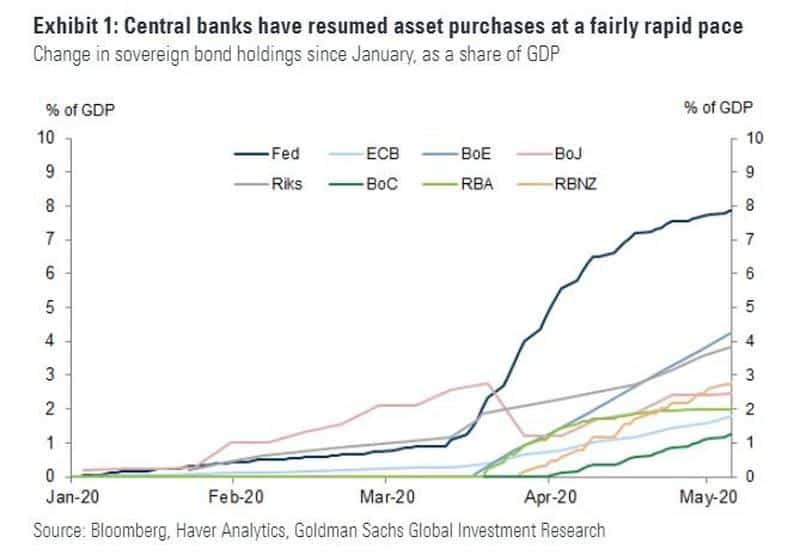

- “$30BN per week in TSY monetization is nowhere near enough to consume the trillions in Treasury issuance that is about to hit. In fact, all else equal, the Fed will very soon have to find a pretext to aggressively ramp up its treasury purchases. As Goldman writes overnight, putting the problem in its proper context, “Central banks have been purchasing sovereign bonds at a rapid pace, faster than past QE programs in most cases. These purchases are occurring against a backdrop of a surge in fiscal deficits, which will require enormous amounts of additional sovereign supply to finance them.”– bto: Deshalb kann es nur eine Antwort geben – die Monetarisierung über die Notenbanken. Denn steigende Zinsen ziehen den Stecker für das überschuldete Finanzsystem und die ebenfalls überschuldete Realwirtschaft.

Dazu dann das Bild, das zeigt, wie die Notenbanken so richtig auf das Gaspedal steigen. Man beachte auch, wie wenig die EZB relativ beschleunigt hat:

Quelle: GoldmanSachs, Zero Hedge

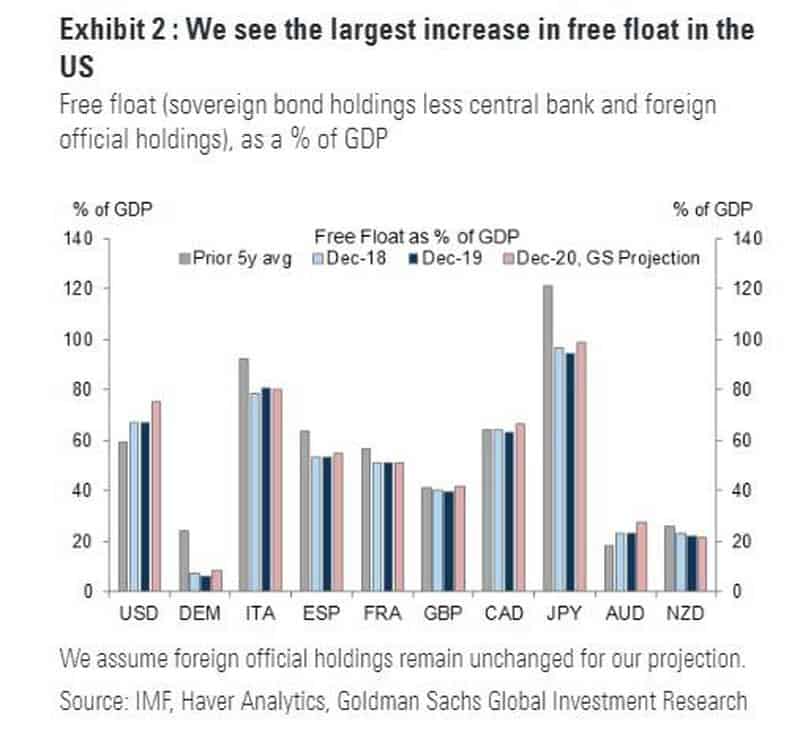

- “(…) after all helicopter money, (…) only works when there is coordination between the Treasury and the central bank. And while until now Fed purchases have generally offset Treasury issuance, that coordination is about to end. As Goldman puts it, ›Central bank buying should absorb a substantial amount of upcoming issuance, though we expect increases in ‚free float‘ across most markets, most notably in the US, which adds to the medium-term case for higher yields and steeper curves there.‹” – bto: Und das darf es m. E. nicht geben, weil dann die Zinsen steigen würden.

- “Goldman estimates this so-called free float, defined as the amount of sovereign debt outstanding less central bank and foreign official holdings, across major DM markets, and shows it in the chart below. Through the end of last year, free float was on a downward trend in Germany and Japan, as ECB and BoJ purchases absorbed the bulk of new supply. In contrast, free float had been trending higher for much of the year in the US and UK.” − bto: in Deutschland wegen der abnehmenden Neuverschuldung und der EZB, in Japan wegen der BoJ.

Quelle: GoldmanSachs, Zero Hedge

Ich kann mir schwer vorstellen, dass der Freefloat irgendwo hochgeht. Die Notenbanken müssen alles tun, um einen Zinsanstieg zu verhindern. Sie werden einfach mehr kaufen.

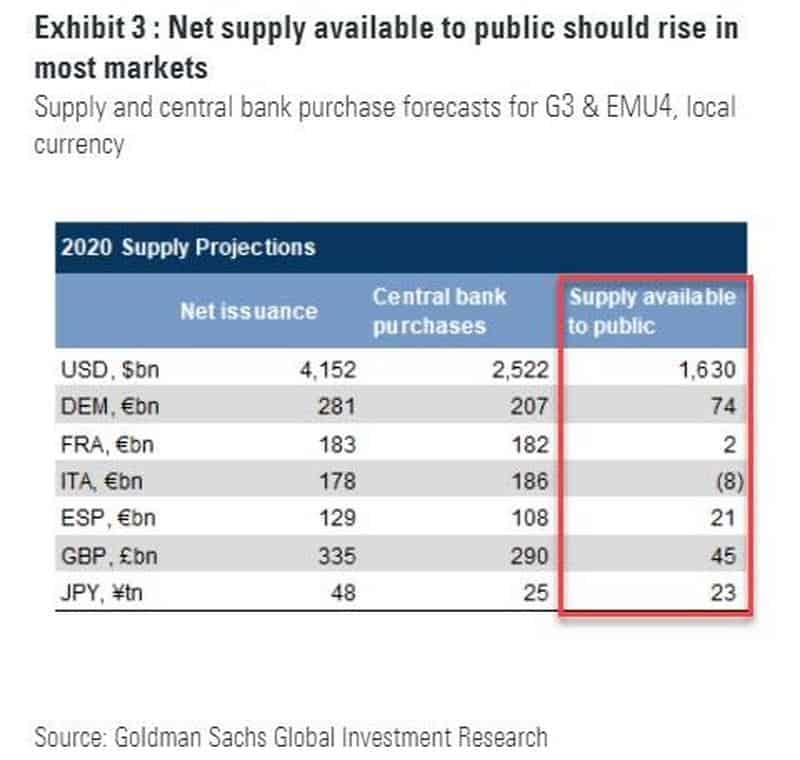

- “In Exhibit 3, Goldman lays out its expectations for total purchase amounts on a net basis along with net supply. It finds the largest increase in free float in the US, as Fed purchases continue to slow; in fact according to Goldman calculations the US public (now that foreign investors have hit the breaks on US TSY purchases), will be on the hook to fund the $1.6 trillion needed to bridge the full amount of US funding needs. A similar picture emerges in the Euro area, where supply is also expected outpace ECB purchases, particularly in Italy, Spain and France (absent further increases in ECB purchases). Bizarrely, a similar picture emerges in Japan where even the always ravenous BoJ is expected to absorb a large portion (about ¥25tn) of incoming supply in the upcoming year as Japan is boosting its debt sales by 18.2 trillion yen ($170 billion) to fund a spending package equivalent to a fifth of its annual economic output; but according to Goldman, the scale of supply is likely to exceed even the BOJ’s QE purchases.” – bto: Es wird “gedruckt”, was das Zeug hergibt und das ist auch richtig so. Denn die Alternative ist der Kollaps. Wobei die Frage natürlich berechtigt bleibt, wie man aus dem Problem wieder herauskommt. Außerdem fasst Zero Hedge hier falsch zusammen. Denn wie man sieht, werden Frankreich und Italien faktisch schon zu 100 Prozent von der EZB finanziert:

Quelle: GoldmanSachs, Zero Hedge

- “(…) even with central banks unleashing $7.9 trillion in QE so far in 2020 (according to Bank of America calculations) of which the Fed accounts for over $2.8 trillion in debt purchases alone, this won’t be enough to monetize the tsunami of debt that is coming to fund the biggest global rescue operation in history, and if investors find that suddenly the bond market has to clear without the only true backstop – the central bank – willing and able to mop up all the supply, a critical precondition for the continuation of “helicopter money”, the outcome could be disastrous.” – bto: eben, weil dann das Zinsniveau steigt, was alles trifft und zudem die Kreditqualitätsfrage wieder auf den Tisch kommt. Denn wenn die Fed weniger als das Neuemissionsvolumen an Staatsanleihen kauft, kauft sie auch keine Unternehmensanleihen geschweige denn Junkbonds.

- “Goldman’s own calculations suggest that the shortfall net of the Fed’s ongoing QE tapering could be as much as $1.6 trillion. (…) As a result, Powell faces a two-fold problem: since the Fed chair has taken negative rates off the table, Powell has no choice but too boost QE again, and unleash another firehose of debt monetizing liquidity in the financial system. However, any such reversal to the Fed’s current posture of shrinking QE will be met with howls of rage, especially among what’s left of the conservative political establishment. Which means that, just like in March when the Fed used the first pandemic-induced market crash to unleash unlimited QE, the Fed will soon have to go for round 2 and spark a new market crash, one which it then uses as an alibi for the next massive liquidity injection. Failing to do that, watch as the dollar takes off as markets sniff out that another major dollar squeeze is imminent. And since this will accelerate the liquidity crunch, one way or another, the coming $1.6 trillion in Treasury issuance – which has already been generously greenlighted by Congress – will serve as a trigger for the next market shock, one which the Fed will quickly reverse by expanding the already unlimited QE by trillions on very short notice.” – bto: weil eben die Liquidität nicht für den Finanzmarkt da ist, sondern in die Realwirtschaft fließt, als Staatsausgaben.

Und dann? Es kann nur über den großen Reset funktionieren. Den großen realen Schuldenschnitt, der niemandem wehtut, gibt es natürlich nicht. Aber es könnte klappen.

→ zerohedge.com: “Goldman Spots A Huge Problem For The Fed”, 17. Mai 2020