Draghis Wette: Italien wird gewinnen – denn EU und EZB bezahlen den Einsatz

Die Zahlen sind seit dem Bloomberg-Artikel weiter gestiegen, ist aber egal, geht es doch um die Grundaussagen:

- “Mario Draghi is using his position as Italian prime minister to deliver the one thing he could never conjure up when he was head of the European Central Bank: massive fiscal stimulus. In his first few months in office he’s already on track to run through over 70 billion euros ($84 billion) in support for the economy. Combined with stimulus measures passed by the previous government, that adds up to over 170 billion euros to protect the country’s families and businesses from the pandemic. The government says that will push this year’s budget deficit to 11.8% of output the government says, making it the biggest stimulus effort in Europe.” – bto: Es ist das Beste, was man machen kann. Wer in der Eurozone nicht Vollgas gibt, ist dumm. Italien ist längst so hoch verschuldet, dass es entscheidet, was gemacht wird. Deshalb verfolgt Draghi im allerbesten Sinne die italienischen Interessen, und er kann dabei sogar noch auf wohlwollende Unterstützung der EU zählen, ist doch ein prosperierendes Italien – wie künstlich und wenig nachhaltig auch immer – Voraussetzung dafür, dass dem Projekt noch Zeit gekauft wird.

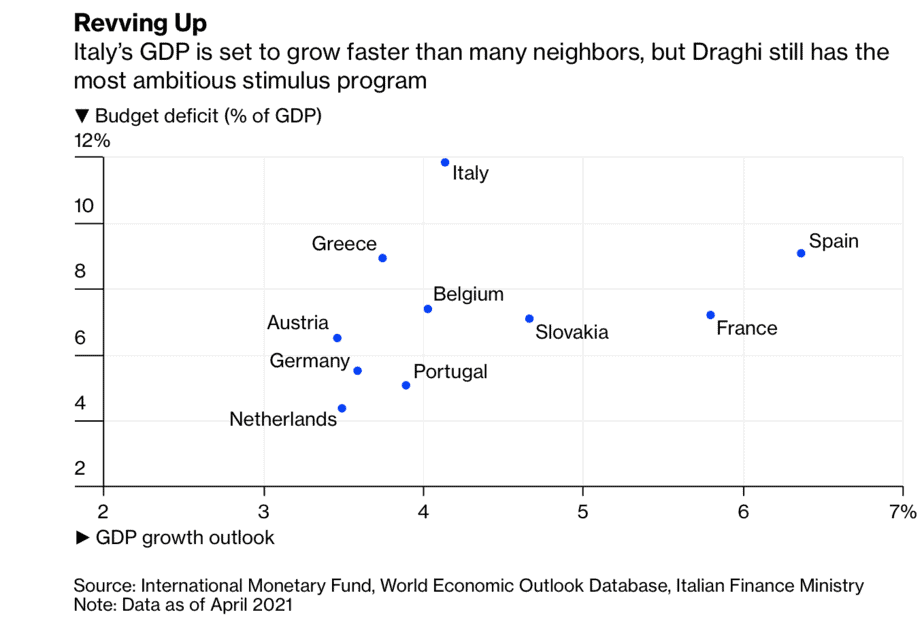

- “Italy’s GDP is set to grow faster than many neighbors, but Draghi still has the most ambitious stimulus program.” – bto: Dabei muss man im Hinterkopf haben, dass der Absturz erheblich war.

- “That all-in strategy is the most audacious manifestation yet of a sea change in fiscal philosophy in Europe since the austerity-driven response to the sovereign crisis a decade ago. Draghi’s determination to make growth as the lodestar of his policy cements Italy’s place alongside France in brushing off potential constraints on spending (…).” – bto: Auch das verständlich. Warum sollten nur die Franzosen Schulden machen, wie sie wollen?

- “The extra spending will push Italian debt near to 160% of output this year, higher even than the 159.5% touched after the devastating impact of World War I. (…) With European fiscal rules suspended until 2022, the door is wide open for countries that want to provide large-scale stimulus and Italy is due to get more help when about 200 billion euros in European recovery funds starts to come through later this year.” – bto: Die Sparsamkeit ist Geschichte, denn jetzt werden alle die Ausgaben erhöhen. Nur bei uns will man unbedingt Steuern erhöhen, statt Vermögen zu bilden.

- “While he was driving the monetary policy engine at the ECB, Draghi at times voiced his frustration that governments weren’t doing more with fiscal policy to support demand. Now that he has control of the fiscal levers in the EU’s third-biggest economy, he’s helping to drive the bloc more into line with a push across the advanced world to prioritize extraordinary stimulus as the central response by governments to an exceptional economic crisis. (…) The prime minister’s answer suggested having embraced his fiscal gamble, he’s going all in.” – bto: Recht hat er.

Nur wird es was bringen? Die FINANCIAL TIMES (FT) zeigt die Grenzen auf:

- “The government of Italian prime minister Mario Draghi is putting the finishing touches to an investment and economic reform programme that is to be powered by some €200bn in EU grants and loans. This is likely to be the largest national allocation from the EU’s €750bn post-pandemic recovery fund for the bloc’s 27 member states.” – bto: Relativ zum BIP bekommt Polen allerdings noch mehr.

- “The tasks that face Draghi are formidable. Much attention focuses on Italy’s public debt, which stood at 155.6 per cent of GDP at the end of last year. In fact, Italy manages its debt skilfully and has taken full advantage in recent years of exceptionally low borrowing rates on financial markets. Still, the debt remains a latent threat to Europe’s currency union, as demonstrated by the 2011 crisis of Italian sovereign bonds.” – bto: Das Problem gibt es nur noch theoretisch. Die EZB finanziert alles, was erforderlich ist.

- “A more serious issue is stagnant productivity (…) productivity rose between 1995 and 2019 by little more than a quarter of the eurozone average. GDP per capita fell to 10 per cent below the eurozone average from 9 per cent above. Yet in that quarter of a century, some Italian governments made reform efforts that were more intensive than those of many other EU countries. Except for during the past decade, a lack of investment was not the problem.” – bto: Das ist übrigens auch der Eindruck, den man bekommt, wenn man im Norden des Landes unterwegs ist.

- “(…) the reason why these efforts achieved little boils down to the weakness of the rule of law and of political accountability in Italy. This sets the country apart from its eurozone peers and is Draghi’s biggest challenge. The clearest example is tax evasion, which is a mass phenomenon in Italy. The gap between theoretical and actual VAT revenue, for instance, is between 6 and 8.6 per cent in Spain, France and Germany. In Italy it is 24.5 per cent. Mass tax evasion harms public services, corrodes trust in the state and reduces political accountability. The vast majority of Italian firms and citizens would prefer a country where tax compliance is the norm. But once low levels of compliance set in, tax evasion becomes a rational strategy. In that context, paying all of one’s taxes means subsidising delinquents and receiving fewer public services than one’s tax bill would justify. People respond by evading taxes themselves.” – bto: Auch das habe ich persönlich erlebt, als ein Top-Manager mir freudig sagte, dass man schon auf Inflation setzen müsse, denn sein Vermögen sei in einem Steuerparadies versteckt.

- “They know tax compliance is preferable but are unwilling to make the first step. The logic of this cost-benefit calculation also explains the diffusion of corruption and organised crime in Italy, as well as the comparatively low reliability of company accounts. Each of these phenomena contributes in turn to depressing productivity, chiefly through their effects on the size and capitalisation of companies. Politics in Italy can play a positive role by sending signals to citizens that genuine change is coming and society as a whole will gain. This requires political programmes based on reliable analyses of Italy’s decline and attractive visions of the common good.“ – bto: Ich bezweifle, dass viele Staatsausgaben zu diesem Bewusstseinswandel führen.

- “These are problems that the EU grants and loans to Italy cannot in themselves solve. Nor will the planned EU supervision of the way that Italy uses the funds be sufficient to put Italy decisively on the right track. The heart of the question, as so often in Italy, will be the implementation of investment plans and reforms that look good on paper but need to be put into actual practice. Draghi, his ministers, business leaders and citizens must show that they will make efficient use of the EU money. The wellbeing of the Italian people and the future of the EU depend on it.” – bto: Ich denke eher an den Ökonomen Fabrizio Zilibotti, der nüchtern festhält, dass Italien und Spanien eine Kultur der Abhängigkeit hegen und pflegen:

→ Italien und Spanien haben eine Kultur der Abhängigkeit

Welche Schlussfolgerungen sollte Deutschland aus dieser Entwicklung ziehen? Nun, auf keinen Fall die, zur Sparsamkeit zurückzukehren! Besser 25.000 Euro für jeden Bürger und ein heftiges Sanierungsprogramm, Schuldentilgungsfonds auf EU-Ebene und natürlich Steuer- und Abgabensenkung.

→ bloomberg.com: „Draghi is betting the house with Europe`s biggest stimulus plan“, 17. April 2021