Die Zombies kommen ins Schwitzen

So ist das mit den Zombies. Dreht man den Geldhahn zu, ist der bisher Scheintote auch offiziell tot. So könnte es den europäischen Zombies ergehen, wie die Bank of America vorrechnet. Natürlich wird es nicht soweit kommen, wird doch die EZB rechtzeitig zur Hilfe eilen. Dennoch sind die Überlegungen zumindest interessant:

- “Although some months away, 2019 will be the first time in four years that European markets will have to manage without the helping hand of ECB asset buying. (…) The total amount of fixed-income redemptions in Europe (sovereigns +IG credit + HY credit) will jump by 20% next year to €1.1tr. Private investors will likely have to swallow a lot more bonds next year.” – bto: Das müsste, wenn Angebot und Nachfrage eine Rolle spielen, zu höheren Zinsen führen.

Quelle: BofA, Zero Hedge

- “To be sure, there is an easy way to find buyers for the €1.1 trillion in debt: just push the yields much higher. Alas, here lies the rub, because the upcoming jump in interest expense is precisely the silver bullet that will lead to a mass zombie genocide, or as Martin puts it, ‚we fear another issue in a world where central bank asset buying has ground to a halt‘ – that issue is what happens when ‚misallocation of capital‘ comes home to roost.” – bto: Genauso ist es!

- “QE has driven such a powerful reach for yield over the last few years – whether it be from high-grade into high-yield, from senior bonds into subordinated debt, or from eligible assets into non-eligible ones – that levels of spread compression have been pulled to incredibly low levels. And when the riskier appear riskless, capital allocation decision cannot function properly.” – bto: Es ist schlimmer. Es ist gar keine Allokation bzw. die bewusste Falschallokation.

- “(…) Europe has a conspicuously large number of ‚zombie‘ companies – defined as those with interest coverage ratios less than 1x. He was right, and Europe’s zombies have Mario Draghi to thank. Last July, 9% of Stoxx 600 companies were zombies. (…) a combination of easy monetary policy and bank regulatory forbearance had allowed these issuers to ‚live another day‘, when in normal times they would have defaulted.” – bto: Und damit haben sie das Wasser für alle vergiftet.

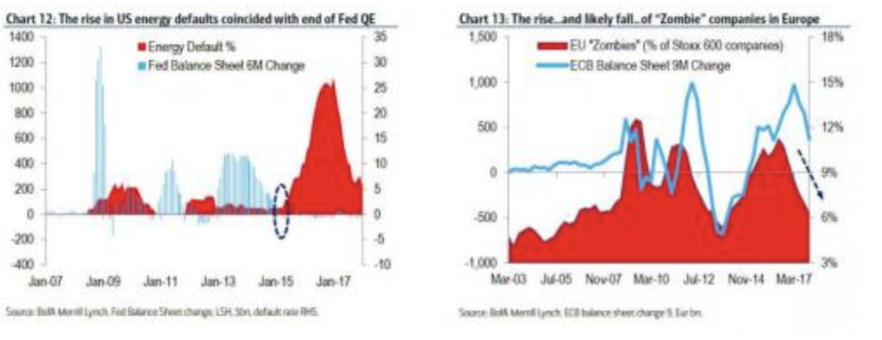

- “(…) the 6m change in the Fed’s balance sheet versus US high-yield energy defaults. Interestingly, as the rate of growth in the Fed’s balance sheet slowed to zero in March 2015, US high-yield energy defaults began to rise. The growth of US high yield energy debt had been tremendous between 2012 and 2014 – with the market almost doubling in size – as the shale phenomenon took off. Overlending in the sector thus became problematic.” – bto: O. k., damit wird das bewiesen, was man eigentlich erwarten muss.

Quelle: BofA, Zero Hedge – leider schlechte Qualität.

- “(…) we find a reasonable link between the rate of growth of the ECB’s balance sheet over time and the growth rate of European zombies. Or simply said, “when the ECB has been supporting markets through periods of QE, zombies have been growing in Europe, as companies have used the cheap liquidity to ‚live for another day‘. But when the ECB has been shrinking its balance sheet (LTRO roll-offs etc.) the number of zombie companies has declined – and the default rate has consequently risen.” – bto: Und deshalb kann die EZB die Zinsen gar nicht erhöhen. Das macht nur der Markt selbst und dann kann die EZB nur noch die eigene Existenz verwetten, um das System eine Runde weiter zu bringen. Die EZB wird es tun.

- “In a year where ECB balance sheet growth will likely be over, the chart below implies that the liquidity support for zombie companies will fall away. And other things being equal – just as was the case in late 2011/early 2012 – the number of ‚zombies‘ will decline through the process of higher default rates in Europe.“ – bto: Ich denke, die EZB wird alles tun, um das zu verhindern. Am Ende vergeblich.

Quelle: BofA, Zero Hedge – leider schlechte Qualität.

- “And so we’re left with a paradox… that in 2019, just as the ECB endorse the strengthening of the Eurozone recovery by stopping QE, Europe may experience a ‚flash‘ jump in default rates, as ‚zombies‘ disappear. ‚Misallocation of capital‘ may again come home to roost(…).” – bto: weil man eben auf Dauer die Marktwirtschaft nicht aushebeln kann!

- Wenig tröstlich ist es in den USA wenig besser: “(…) the BIS which one year ago warned that no less than 20% of US corporations are ‚challenged‘ and at risk of default once rates start rising. Which simply means that thousands of defaults are imminent once rates truly spike after the next central bank policy mistake.”

Quelle: BIZ, Zero Hegde

So ist es. Wir brauchen immer billigeres Geld, um unseren Schuldenturm zu erhalten. Wahnsinn.

→ zerohedge.com: “Europe’s ‚Zombies‘ Brace For Mass Extinction In 2019″, 6. März 2018