Die Welt vor dem Dollar-Squeeze?

Heute Morgen hatten wir die aktuellen Schuldenzahlen des IWF. Hier noch in Ergänzung ein Blick auf das Nebenproblem der hohen Schulden in US-Dollar von Schuldnern (und Kreditgebern) die nicht aus dem Dollarraum kommen. Pointiert wie immer Amroise Evans-Pritchard im Telegraph, der das Thema auch mit den Finanzmärkten verbindet:

-

“It is worth thumbing through the IMF’s Global Financial Stability Report for a glimpse of the Gothic horror story that lies ahead of us. ‚Term premiums could suddenly decompress, risk premiums could rise, and global financial conditions could tighten sharply,‘ it said. ‚Liquidity mismatches and the use of financial leverage to boost returns could amplify the impact of asset price moves. Although no major disruptions were reported during the episode of volatility in early February, market participants should not take too much comfort,‘ it said. The report is a forensic study of perilous excess. The US stock market has broken with historic valuations and risen to 155pc of GDP, up from 95pc even in 2011. Margin debt on Wall Street – a bellwether of speculation – has rocketed to $550bn (£387bn). The Fund warned of late-stage credit cycle dynamics much like 2007, and behaviour ‚reminiscent of past episodes of investor excesses‘.”

Quelle: The Telegraph

- “The world is therefore ever more sensitive to rising borrowing costs. It lacks the fiscal buffers to cope with a shock. Countries may be forced into contractionary ‚pro-cyclical‘ policies, the fate of Greece, Spain, Portugal, and Italy in the EMU austerity tragedy. It may soon happen on a global scale.” – bto: So ist es. Geleveraged bis zur Decke.

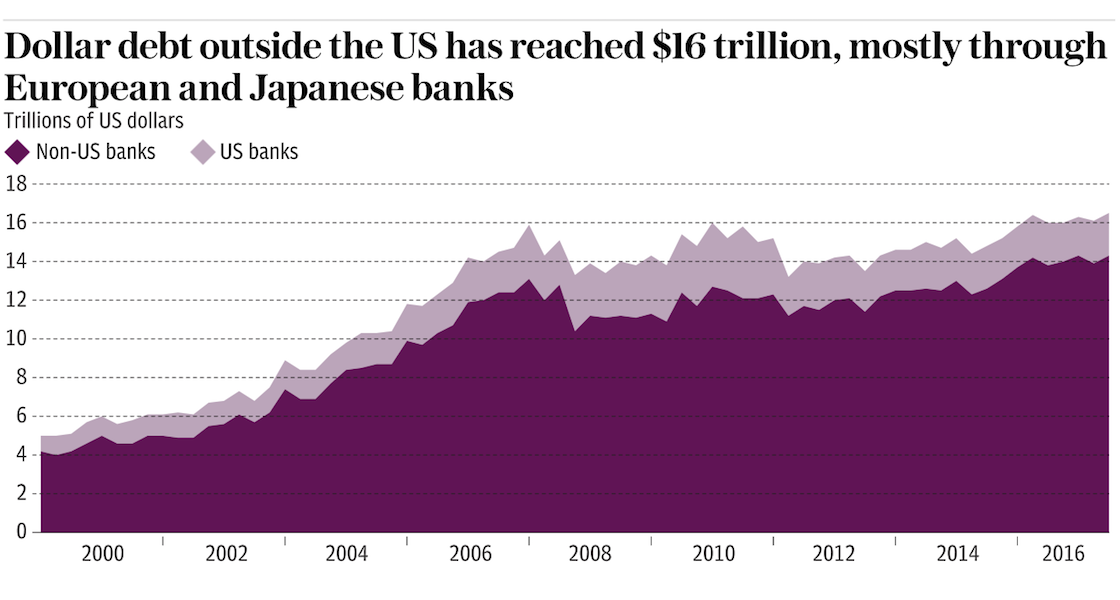

- “Offshore dollar loans have risen fourfold to $16 trillion since the early 2000s, or $30 trillion when equivalent derivatives are included. “The international dollar banking system faces a structural liquidity mismatch,” said the Fund. The world has a vast ‚short position‘ on the dollar. This is harmless in good times but prone to a sudden margin call – akin to late 2008 – as the Fed raise rates and drains dollar liquidity. Much of this lending is carried out by European and Japanese banks using short-term instruments such as commercial paper and interbank deposits, leaving them ‚structurally vulnerable to liquidity risks‘. French banks have shockingly low dollar liquidity ratios.” – bto: Und dann müssen wieder wir – wie schon im Falle Griechenlands! – französische Banken mit deutschen Steuergeldern retten!

Quelle: The Telegraph

- “The IMF says markets should not be beguiled by the current calm in the currency swap markets, used to hedge this edifice of dollar lending. (…) The Fund warned that banks may find that they cannot roll over short-term dollar funding currently taken for granted. ‚Banks could then act as an amplifier of market strains. Funding pressure could induce banks to shrink dollar lending to non-US borrowers. Ultimately, there is a risk that banks could default on their dollar obligations,‘ it said.” – bto: Beruhigend klingt das nicht.

- “So there you have it. While the IMF is coy, the awful truth is that the world is just as vulnerable to a financial crisis as it was in 2007. The scale is now larger. The authorities have fewer safety buffers, and far less ammunition to fight a depression. This time China cannot come to the rescue. It is itself the epicentre of risk.” – bto: Darum auch die Hoffnung, Deutschland würde so richtig in die Vollen gehen …