Die Logik hinter dem Handelskrieg

John Authers von Bloomberg hat die, wie ich finde, beste Analyse zum US-China-Handelskonflikt geschrieben, deshalb heute Thema bei bto:

Zunächst weist Authers darauf hin, dass Donald Trump seinen Erfolg als Präsident an der Entwicklung der Wall Street misst, was auf den ersten Blick nicht nur dumm ist, sondern auch dagegen spricht, sich mit China so sehr anzulegen. So oder so gibt es laut Authers drei Probleme mit der Fixierung Trumps auf die Börse:

- “First, the odds are stacked against Trump from the start. He began with stocks already fully valued, and with interest rates low and bound to rise. (…) the S&P 500’s valuation when Trump took office at the start of 2017 was almost identical to its valuation when Herbert Hoover took office in 1929: 28 times cyclically adjusted earnings, according to Yale University economist Robert Shiller. It has since risen further, which is an impressive testament to investors’ optimism (…)” – bto: Klartext: Nach unten ist viel mehr Luft als nach oben.

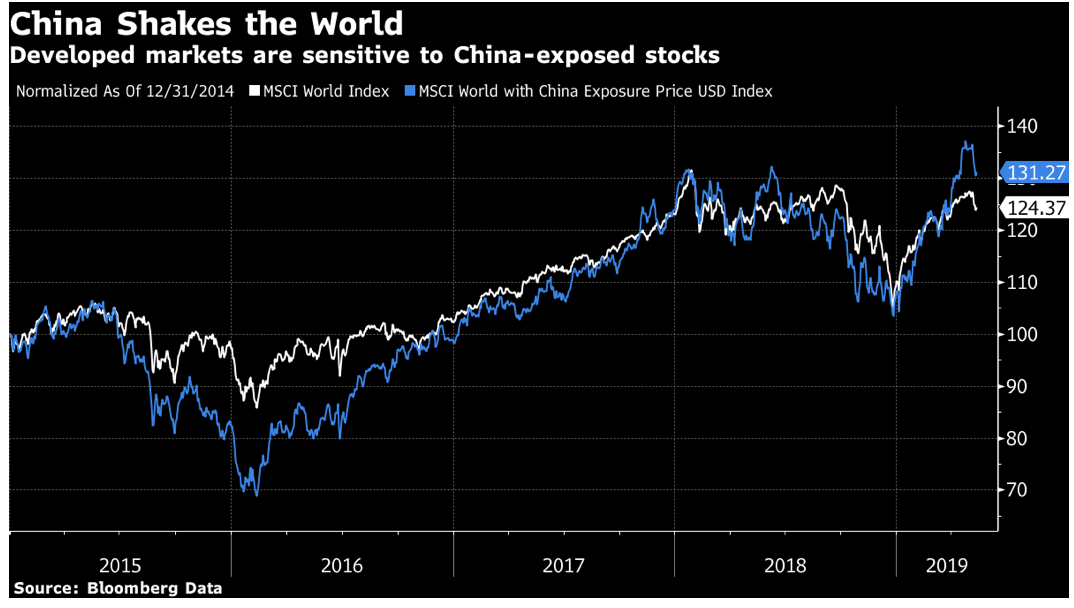

- “Second, at least two other organizations have more power over markets than the White House. They are the U.S. Federal Reserve and the Chinese Communist Party. (…) Moves in China’s domestic economy have an outsized effect on stocks in the developed world.” – bto: was vor allem auch für den DAX gilt.

Quelle: Bloomberg

- “Third, a higher stock market is not what the people who voted for Trump wanted. (…) After years of intensifying inequality, higher share prices would tend to exacerbate inequality. Higher wages and more jobs, which is what the Trump electorate needs, tend to cut into profit margins and reduce share prices while raising interest rates.” – bto: Das habe ich auch immer nicht verstanden. Wenn man sich auf die Ärmeren konzentriert, weshalb dann die Börse im Fokus?

Doch nun zu der Frage, weshalb Trump sich dennoch so aggressiv im Handelskonflikt mit China aufstellt, gefährdet es doch – wie wir sehen – die Börsenentwicklung?

- “Because higher tariffs offer him the chance to square this circle. By raising tariffs he puts pressure on China to stimulate its economy. That, in turn, will tend to lead to a recovery in U.S. share prices. It did so quite spectacularly in 2016. By amping up global tensions, pushing down on risk asset prices and raising uncertainty, Trump also puts pressure on the Fed to cut rates.” – bto: Er zwingt also die beiden Hauptakteure zu einer stimulierenden Politik. Das ist natürlich auch ein Blickwinkel.

- “Getting tough with China involves doing exactly what he said he would do, which is always popular with the electorate. (…) Plenty of forces are pushing the two sides toward an eventual deal anyway. (…) Amping up the stakes at this point was good politics and even — despite appearances — aided in the apparently impossible job of pushing up a stock market that already appears to be amply fully valued.” – bto: In der Tat hat die Börse es lange implizit unterstützt, weil sie eben nicht negativ reagiert hat.

- “The problem is that China knows how to respond. China can see all of this, and it knows it can attack the presidential weak spot by acting in a way that damages the Dow. Hence, it not only retaliated with tariffs of its own, but announced them just as the New York market was about to open, at night in China, for maximum effect.” – bto: Dennoch kann sich China keine Rezession leisten, weil es dann zu erheblichen Problemen käme. Weniger noch als der US-Präsident.

- “What (China) could do is weaponize its foreign-exchange reserves and start selling some of its holdings of U.S. Treasuries. This would have the effect of forcing U.S. bond yields and borrowing costs higher. But it would also tend to reduce the value of China’s remaining hoard of Treasuries.” – bto: Und hier könnte die US-Fed theoretisch voll gegenhalten, schafft sie doch das Gut, gegen das die Chinesen verkaufen müssen.

- “Armed with this logic, the market may well decide that the hostilities will go no further. But if investors truly want that outcome, they may find it necessary to put more pressure on Trump by selling stocks. It may be obvious that a resolution will result, but markets will have to go through the process of a big sell-off to get there.” – bto: was dann bedeuten würde, dass man in diesen Verkauf hineinkaufen sollte. Aber zur Spekulation, nicht aus langfristigen Gründen, bleibt der Markt doch teuer und damit die langfristigen Ertragsaussichten mau.

→ bloomberg.com: “China May Have Miscalculated Trump’s Weak Spot”, vom 14. Mai 2019