Die Lehren aus früheren Pandemien

Das ging schnell. Schon liegt ein Papier vor, das die Lehren aus 12 früheren Pandemien für die Realwirtschaft untersucht. Schauen wir uns das mal an:

- „(…) the most devastating pandemic of the last millennium, the Black Death, has attracted a great deal of attention. Economists and historians debate its pivotal role in economic, social, and political change, particularly in Europe. Events such as the Peasant Rebellion in England feature centrally in a narrative of rising worker power, and the data speak to a rise in labor scarcity seen in a positive deviation in the path of real wages. This shock left England with a 25% to 40% drop in labor supply, a roughly 100% increase in real wages, and a decline in rates of return on land from about 8% to 5%. But it is an open question how representative the macroeconomic responses in the case of the Black Death are of large pandemics in general.“ – bto: vor allem weil es damals zu einem dramatischen Bevölkerungsrückgang kam, den wir mit Corona glücklicherweise nicht erleben warden. Interessant sind sicherlich die gesellschaftlichen Folgen wie abnehmender Glauben.

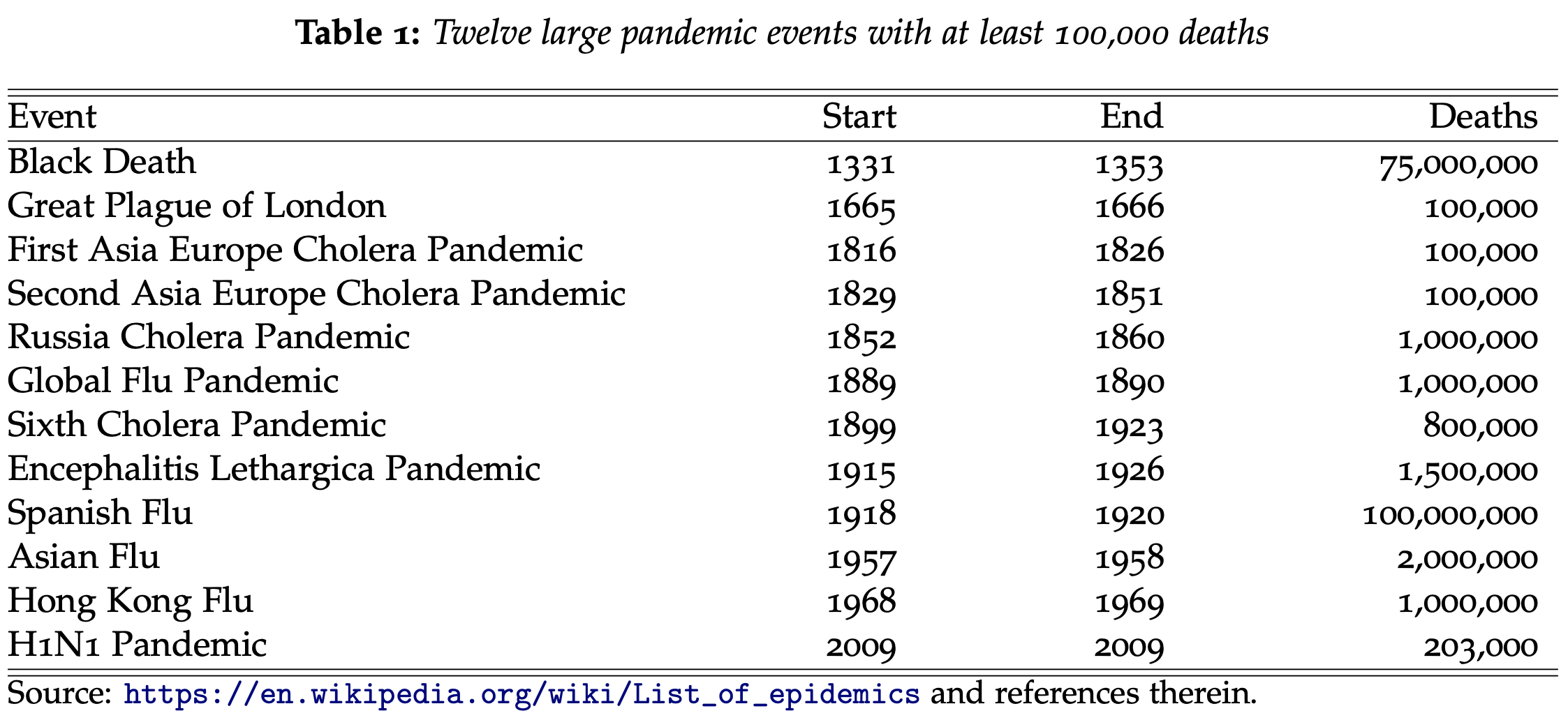

- „We study rates of return on assets using a dataset stretching back to the 14th century, focusing on 12 major pandemic episodes where more than 100,000 people died. We also look at some more limited evidence on real wages.“ – bto: Ich muss gestehen, mir war gar nicht bewusst, dass es alle 50 Jahre so etwas gibt.

Tabelle 1:

- „(…) COVID-19 is the most serious episode since the 1918 pandemic. Absent non-pharmaceutical interventions, these researchers estimate the death toll at 510,000 in Britain and 2.2 million in the U.S. Aggressive and recurrent suppression strategies would reduce the death toll only by a factor of 10 approximately, according to these authors. Worldwide, that could still leave COVID-19 as the second most devastating event of the past 100 years.” – bto: was natürlich bedeutet, dass man entsprechend massive weitere Auswirkungen zu spüren bekommt.

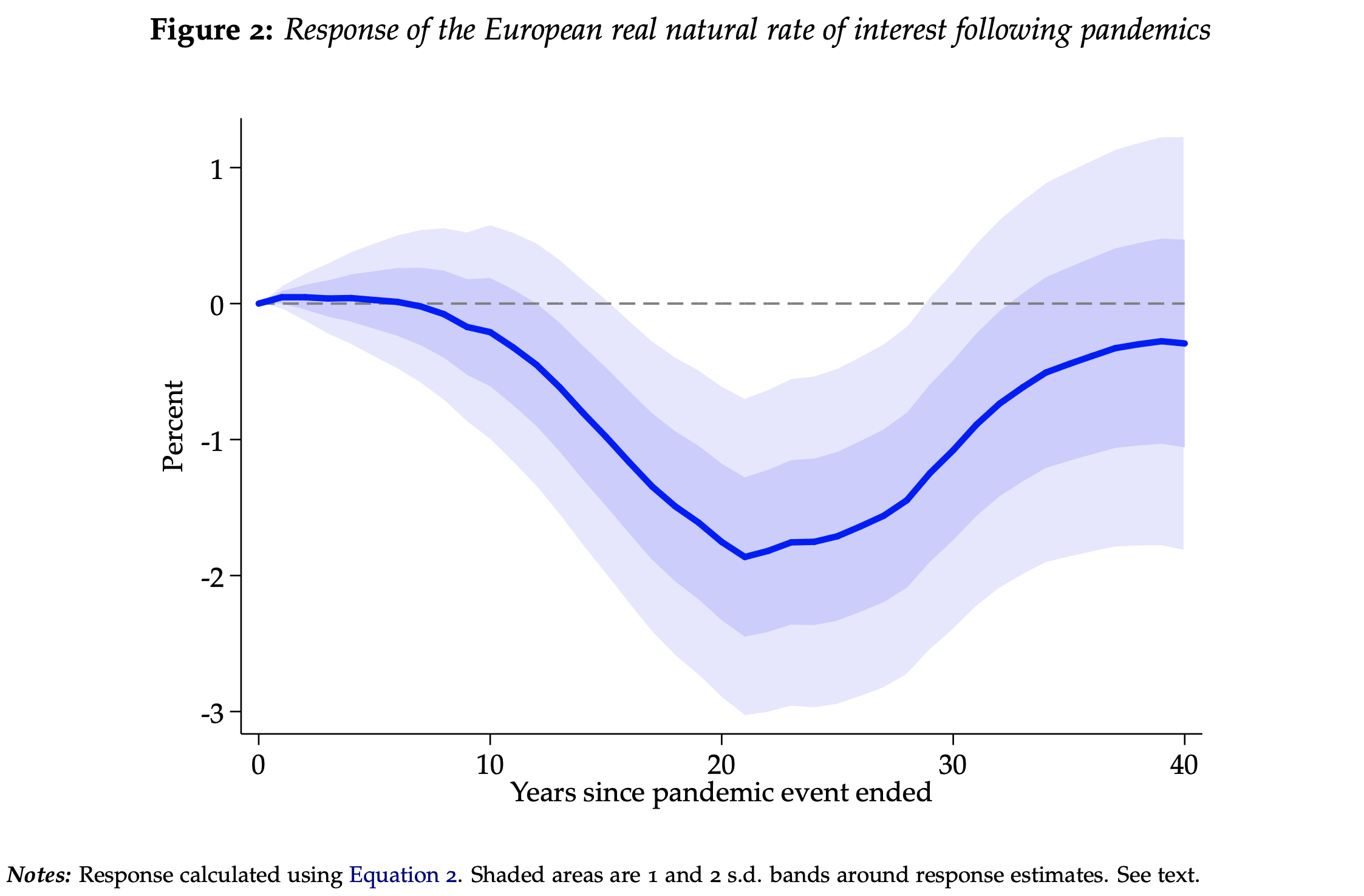

- „Our main interest will be in the response of the real natural rate of interest to a pandemic shock. (…) the natural rate of interest is the level of real returns on safe assets which equilibrates savings supply and investment demand—while keeping prices stable—in an economy. Such an ideal equilibrium variable can therefore serve as a useful barometer of medium-term fluctuations in economic dynamism.“ – bto: Steigende Zinsen sind also mehr wirtschaftliche Aktivität, sinkende Zinsen abnehmende wirtschaftliche Aktivität.

- “Figure 2 contains our main result, and displays, the response of the natural rate to a pandemic, 1 to 40 years into the future. Pandemics have effects that last for decades. Following a pandemic, the natural rate of interest declines for decades thereafter, reaching its nadir about 20 years later, with the natural rate about 2% lower had the pandemic not taken place. At about four decades later, the natural rate returns to the level it would be expected to have had the pandemic not taken place.” – bto: Das bedeutet, es gab für mehrere Jahrzehnte eine Dämpfung der wirtschaftlichen Aktivität. Es wäre die Vertiefung und Beschleunigung des japanischen Szenarios. Undenkbar, dass das unsere Gesellschaft durchhält.

- „These results are staggering and speak of the disproportionate effects on the labor force relative to land (and later capital) that pandemics had throughout centuries. It is well known that after major recessions cased by financial crises, history shows that real safe rates can be depressed for 5 to 10 years, but the responses here display even more pronounced persistence.“ – bto: schlimmer als Finanzkrisen. Wow.

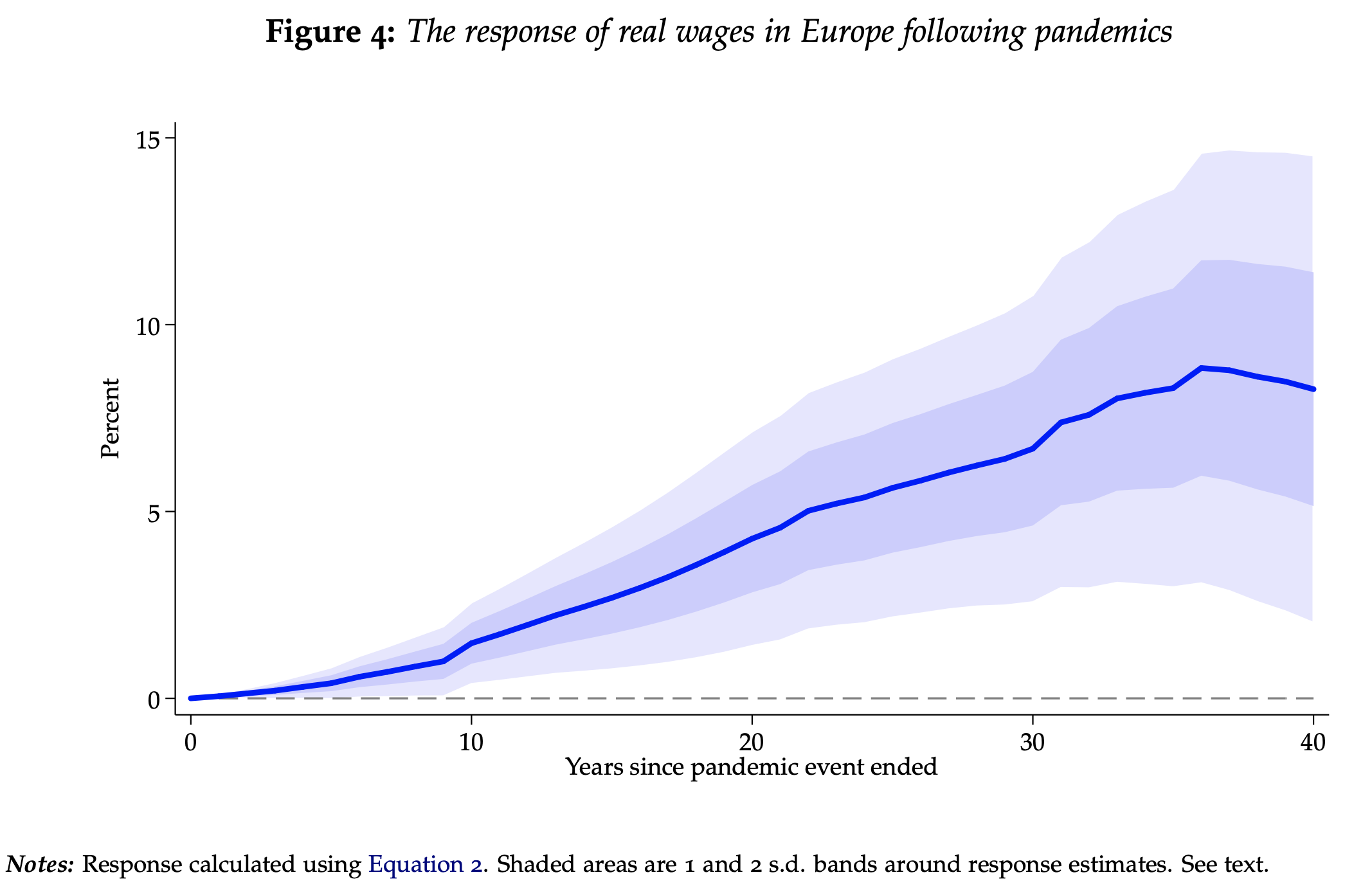

- „The response of real wages is almost the mirror image of the response of the natural rate of interest, with its effects being felt over decades. The figure shows that real wages gradually increase until about three decades after the pandemic, where the cumulative deviation in the real wage peaks at about 5%. (…) In equilibrium, this went hand in hand with lower returns to capital.

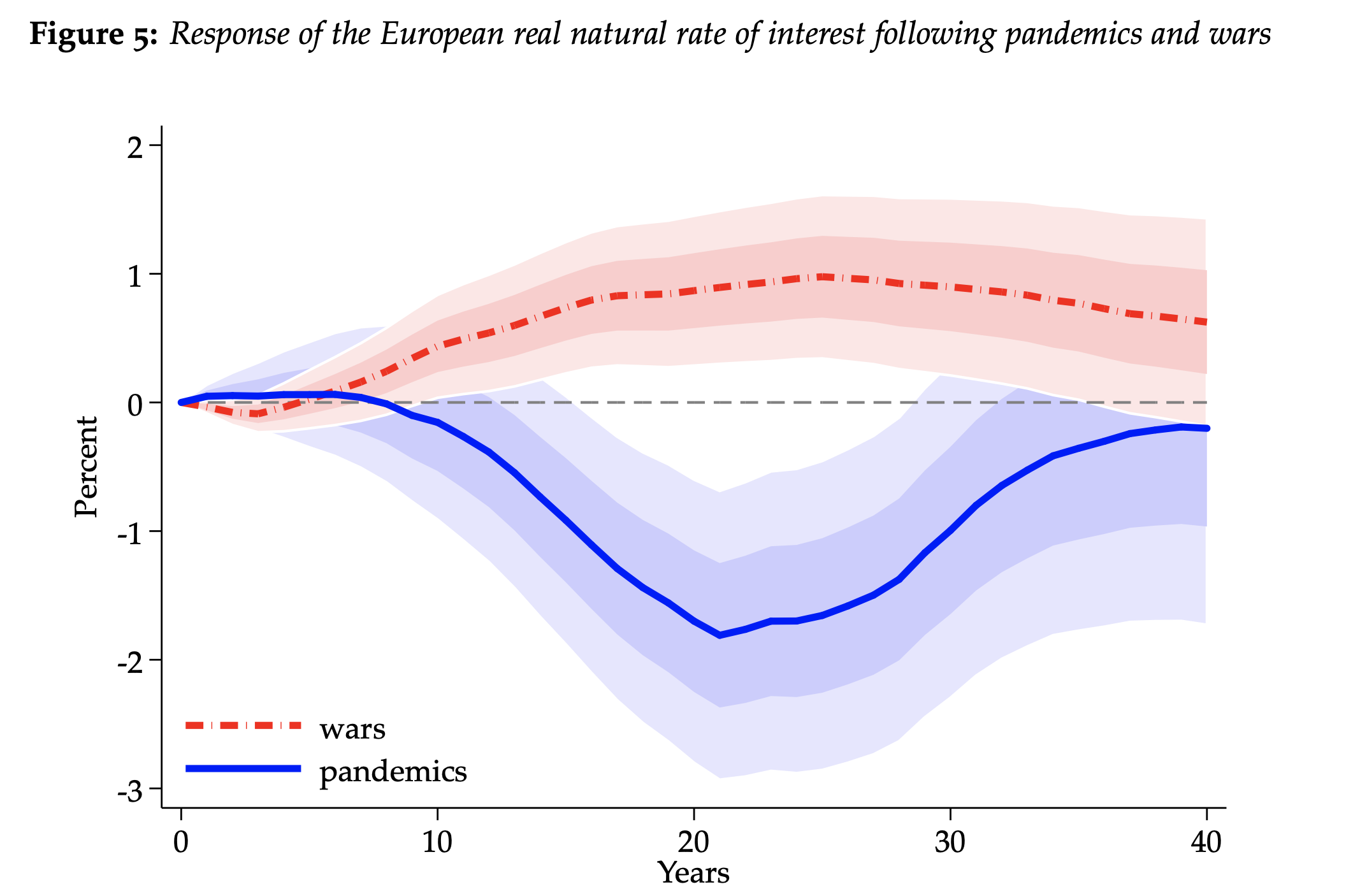

- As we anticipated, the effect of war activity goes the other way: wars tend to leave real interest rates elevated for 30–40 years and in an economically (and statistically) significantly way.“ – bto: weil dann die realwirtschaftliche Nachfrage zunimmt. Auch das leuchtet ein, muss man doch Zerstörungen reparieren.

- “(…)if the trends play out similarly in the wake of COVID-19—adjusted to the scale of this pandemic—the global economic trajectory will be very different than was expected only a few weeks ago. If low real interest rates are sustained for decades they will provide welcome fiscal space for governments to mitigate the consequences of the pandemic. The major caveat is that past pandemics occurred at time when virtually no members of society survived to old age. The Black Death and other plagues hit populations with the great mass of the age pyramid below 60, so this time may be different.“ – bto: weil unsere Politiker eine künstliche Zerstörung mit dem Thema Klimawandel erreichen werden. → Federal Reserve Bank of San Francisco: “Longer-run economic consequences of pandemics”, März 2020