Die deutsche Party endet – und mit ihr das finanzielle Netz der EU

Wir wollen es ja nicht wahrhaben. Gefallen uns in der Rolle des Landes, das vor Kraft nicht laufen kann und sich deshalb so ziemlich jeden ökonomischen Luxus leisten kann – Stichworte: Energiewende der extremen Form (alles aus), ungesteuerte Migration, Tod der Schlüsselindustrie, Rentenversprechen, …. – eine Liste, die sich problemlos erweitern lässt. Meine (recht einsame) Mahnung im Märchenbuch findet zwar Leser, aber nicht die breite Aufmerksamkeit, die wir brauchten, um unsere Illusions-Eliten aus ihren Träumen zu erwecken.

Der Blick von außen ist da leichter, als hätten sie mein Buch gelesen:

- “Europe’s strongest economy might have dodged a recession in the latter part of last year, but nonetheless, the party is well and truly over. We are entering a new era of more modest German growth, which could finally trigger a more balanced assessment of its economic model.” – bto: oder, um es in meinen Worten zu sagen: Die Illusion des Märchens platzt.

- “(…) it’s not hard to find a politician or economist who thinks Britain ought to be more ‘German’. Whether it’s Germans’ parsimonious attitude to saving, its reliance on good, solid manufacturing companies or its enormous trade surplus, a Teutonic economy seems to embody all sorts of perceived virtues.” – bto: Leider findet sich kein englischer Verlag für das Märchenbuch.

- “Unlike many developed countries, Germany is internationally competitive and highly productive, owing to tough decisions taken in 2004 to reform the labour market and its successful vocational training system. Along with an impressive regional economic balance, low unemployment, low house prices and a stock of innovative, home-grown firms, Germany delivers a high standard of living for most despite years of relative wage restraint.” – bto: Da würde ich dann doch widersprechen. Ich denke, den Bürgern wird zu viel weggenommen, der Staat konsumiert zu viel und investiert zu wenig.

- “(…) but there is another side of the coin. Its competitiveness, for one thing, is given a huge, artificial boost by using a devalued currency, the euro. But it also suffers from high regulatory and tax burdens that push its companies to over-invest abroad and under-invest at home.” – bto: was sie aber auch tun, weil sie wissen, dass es in Deutschland allein schon demografisch bedingt abwärts geht.

- “Effectively, this means the country is gradually running down its domestic production capacity in favour of producing elsewhere, a trend that manifests in Germany’s extraordinarily high current account surplus of 8pc of GDP (far in excess of eurozone rules).” – bto: Genauso ist es!

- “(…) Germany has been able to ride high on the back of China’s debt-fuelled growth. The Asian superpower is a huge market for German machine tools and cars and, since 2008, has been pumping up its economy with vast injections of credit. (…) That trend reversed painfully in the second half of last year. Industrial production went into recession and, overall for 2018, GDP growth fell sharply to 1.5pc. China stopped buying so many cars, other countries brought in new rules on emissions in response to diesel-gate and fears of an escalating global trade war eroded confidence. In other words, another much-lauded aspect of Germany’s success – its reliance on exports – turned from a boost into a drag. It’s all very well relying on foreign buyers to prop up your enormous manufacturing base, but it leaves your economy extremely vulnerable to swift turns in the fortunes of others.” – bto: Das habe ich auch in meinem Buch beschrieben. Wir hängen am Schuldentropf der Welt, vor allem an dem von China.

- “German consumers are, after all, notoriously tight. This is the flip side of the country’s strong export competitiveness: wages have been so constrained for over a decade, keeping unit labour costs low, that households have got into the habit of counting pennies.” – bto: Das liegt aber auch daran, dass die Abgabenbelastung viel zu hoch ist.

- “In the long run, there are more fundamental questions hanging over Germany’s economy. Its car industry, for example, is facing an enormous array of challenges that don’t exactly play to its strengths. The cars of the future are going to rely increasingly on batteries, artificial intelligence and semiconductors. German carmakers and their huge domestic supply chain, by contrast, excel in the mechanics of combustion engines. What’s more, the country’s vocational training system and heavy regulation haven’t exactly prepared its companies and workers to be nimble and adaptable.” – bto: was noch fehlt in dieser Auflistung: Wir zerstören die eigene Industrie und damit die Basis für den Wohlstand vorsätzlich.

- “For over a decade, Germany has been the powerhouse of Europe, enabling it to foot the bill for the disaster of the euro. It’s unlikely to go into dramatic decline, but its success and stability can no longer be taken for granted. (…) What we don’t know is what Europe looks like without an immovable German anchor at its heart.” – bto: Doch, das wissen wir. Pleite.

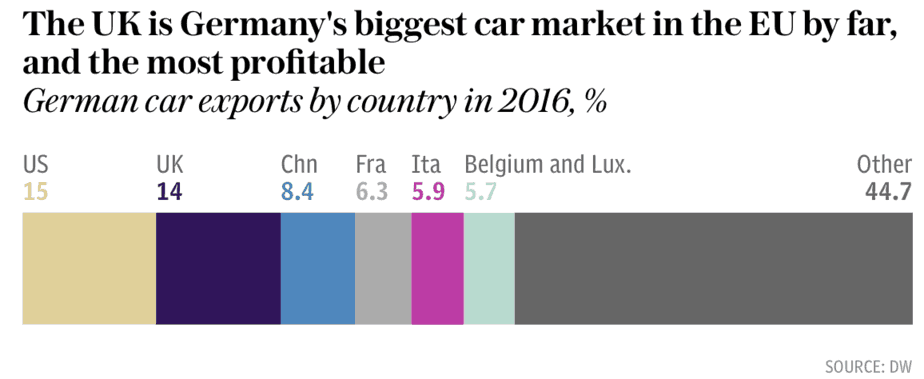

Dazu haben sie noch ein Bild, welches ganz nebenbei zeigt, wie sehr wir uns selber mit einem hard-Brexit in das Knie schiessen: