Die Blase ist erst am Anfang – meint Dylan Grice

Vor einigen Tagen hatte ich an dieser Stelle ein Interview mit Dylan Grice bei the market besprochen. Wenig später erschien ein Gastbeitrag von ihm ebenfalls dort. Da ich ihn interessant fand, hier meine Highlights daraus:

- “Stimulus today is excessive and credit conditions loose in part because central banks are relaxed towards the risk of CPI inflation. On this they might be right. But they are similarly relaxed over obvious signs of overheating in financial markets, and on this we are sure they are wrong.” – bto: Natürlich treiben die Notenbanken seit Jahren die Assetpreis-Inflation!

- “The historical precedents we explore below do not bode well. We think it likely that we’re in the foothills of a policy mistake of epic proportion which will have potentially devastating consequences.” – bto: Ich glaube nicht, dass es ein “Fehler” ist, sondern ein Vorsatz.

- “Jerome Powell was recently asked by Harvard’s Greg Mankiw on CNBC’s Squawk Box about how the Fed were thinking about the risks of inflation. The answer was comprehensive and is worth reproducing almost verbatim: ‘The big picture is still that we’ve seen (…) three decades, a quarter of a century, of lower and more stable inflation and we’ve seen really the last decade be characterized by global disinflationary forces and large advanced economy nations struggling to reach their 2% inflation goal from below. So that, I think, is the broader setting. In addition, the pandemic itself has produced lower inflation readings (…) as we look forward we’ll probably see an increase in readings but that’s really not going to mean very much, it won’t be very large or persistent in all likelihood, it’s just a function of those readings falling out (…) if the economy reopens, there’s quite a lot of savings on peoples’ balance sheets, there’s monetary policy, there’s fiscal policy, you could see strong spending growth and there could be some upward pressure on prices. Again, though, my expectation would be that that would be neither large nor sustained (…) We have had inflation dynamics in our economy for three decades which consists of a very flat Phillips curve, meaning a weak relationship between high resource utilization, low unemployment and inflation, but also low persistence of inflation, critically (…) of course those dynamics will evolve, but it’s hard to make the case why they will evolve very suddenly, in this current situation. I described our new framework and our guidance, in major part we are looking at actual inflation, we want to see actual inflation, and part of the reason for that is that all during the long expansion, many of us – and that includes me – were writing down a return to 2% inflation, and maybe a mild overshoot, year after year after year. And year after year inflation fell short of that. So we have tied ourselves to realizing actual inflation for example, that’s the way our rate guidance works is, you’d have to see inflation reach 2% – not in a forecast, but actually. So we are looking at actual inflation.’” – bto: Die Fed schaut also nicht auf künftige Inflationsraten, sondern nur auf die heutige. Damit kann sie natürlich deutlich überschießen, weil es eben eine Weile dauert, Inflation wieder unter Kontrolle zu bekommen.

- “He seems determined that there will be no such error on his watch. (…) We predict a different error, that of focussing so exclusively on the CPI that harder to interpret indicators of building financial risk are ignored. We believe history is on our side given it is an error economists have made repeatedly.” – bto: Natürlich genügt es nicht, auf die Konsuminflation zu blicken, wenn man die Stabilität des gesamten Finanzsystems im Blick haben sollte!

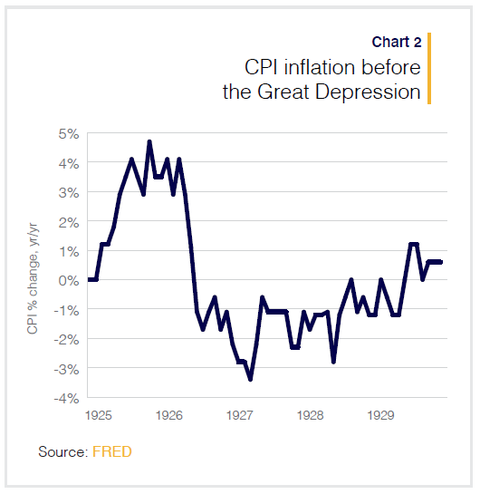

- “Indeed, one of the original architects of the idea that the stability in the CPI was a necessary and sufficient condition for stability in the economy was the economist Irving Fisher, who first articulated his plan for stabilizing the price level in 1913, the year of the Fed’s creation. Not coincidentally, that was the very same Irving Fisher who would later predict that stock prices had «reached what looks like a permanently high plateau» just nine days before the Great Crash of 1929. And in this context one can clearly understand the man’s optimism. After all, in preceding years, CPI inflation had exhibited precisely the kind of calm, reassuring steadiness which Fisher’s theories predicted would guarantee economic, and even social stability (Chart 2).” – bto: Das ist schon beeindruckend. Es gab auch damals keine Inflation und das bei einer boomenden Wirtschaft. Das massive Kreditwachstum wurde als unproblematisch angesehen, wie wir wissen zu Unrecht. Zu Fishers Ehrenrettung muss man allerdings noch anmerken, dass er durchaus brillant war. Ich denke an die Debt-Deflation-Theory of Great Depressions. Auch der Chicago-Plan ist interessant.

Quelle: the market

- “A little-known backdrop to the 1920’s ‘Go-Go’ years is that the Federal Reserve was then embarking upon a policy experiment. The growing consensus amongst economists, both in the United States and abroad, largely influenced by Irving Fisher’s ideas, was that central banks should focus entirely on delivering CPI stability.” – bto: Und heute wird das als Zwei-Prozent-Ziel verkauft.

- “John Maynard Keynes himself was convinced of the wisdom of the new philosophy, hailing ‘the successful management of the dollar by the Federal Reserve Board from 1923 to 1928’ as a ‘triumph’ for currency management. Unsurprisingly, perhaps, Keynes failed to see the crash coming with any more clarity than Fisher had.” – bto: Man hat eben nicht auf die Assetpreisinflation geblickt.

- “Of all the retrospectives on the 1930s Great Depression, most have focused on the aftermath of the crash, and in particular the tightness of monetary policy which likely exacerbated it, but few seem to have given much thought to the policies which preceded the crash, or the extent to which those policies where responsible for its subsequent savagery. This is probably why the mistake was repeated.” – bto: und zwar mehrfach und immer größer. Das muss man erst mal hinbekommen!

- “In June 1999, as the Nasdaq bull-run was turning into a euphoric parabolic, then-Fed Chairman Alan Greenspan soothed growing concerns thus: ‘It is (…) up to us at the Federal Reserve to secure the favourable inflation developments of recent years and remain alert to the emergence of forces that could dissipate them. (…) There was no bubble according to Greenspan, only prosperity. Replicating the thought process of Fisher seventy years earlier, the possibility that the Fed were stimulating a mania wasn’t even entertained. How could monetary policy be too loose when inflation was so low?’”– bto: Genau diese Argumentation bekommen wir auch heute zu hören. Zugleich haben wir die Klagen über die “Ungleichheit”, die immer mehr zunimmt.

- “Only a few years later, in 2006, as a grotesquely inflated U.S. housing market was already rolling over, beginning a descent which would lead to a generational global economic collapse, Ben Bernanke was famously oblivious to the risk: ‘The effect of the troubles in the subprime sector on the broader housing market will likely be limited, and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system.’ Bernanke had acquired the nickname Helicopter Ben after a speech pointing out – correctly – that in most circumstances, there was no limit to the inflation a central bank could create.” – bto: Das ist zutreffend; zunächst eher bei den Vermögenspreisen, danach auch bei den Konsumentenpreisen.

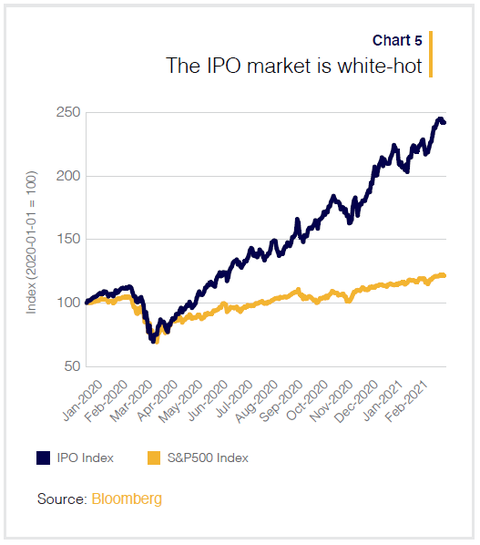

- “As the stock market made new all-time highs, Tesla’s market capitalization in early February surpassed that of the entire S&P 500 energy sector as stock prices hit all-time highs. The SPAC market is hot. The IPO market is hot (chart 5), credit markets are hot (chart 6), commodity markets are hot, the crypto markets are hot. Everything, it seems, is hot.” – bto: Es ist eben eine Assetpreisinflation!

Quelle: the market

→ themarket.ch: „The Bubble is Just Beginning“, 16. März 2021