Die BIZ fragt: Kommt die Pleitewelle nach Corona?

Das Thema der Zombies hat uns immer wieder beschäftigt:

→ Zombies: Die EZB will sie nicht sehen

→ SPIEGEL: Von wegen „Schauermärchen“ über Zombies

→ Wir brauchen eine marktwirtschaftliche Lösung für die Zombies

Und auch die Bank für Internationalen Zahlungsausgleich (BIZ) hat dazu einiges geschrieben:

→ BIZ: Zombies sind ein massives Problem und Corona macht alles schlimmer

Nun mag man am 1. April versucht sein, das Thema als einen Aprilscherz abzutun. Leider ist dem nicht so. Die Corona-Krise beschleunigt die Zombifizierung – legen zumindest neue Daten der BIZ nahe:

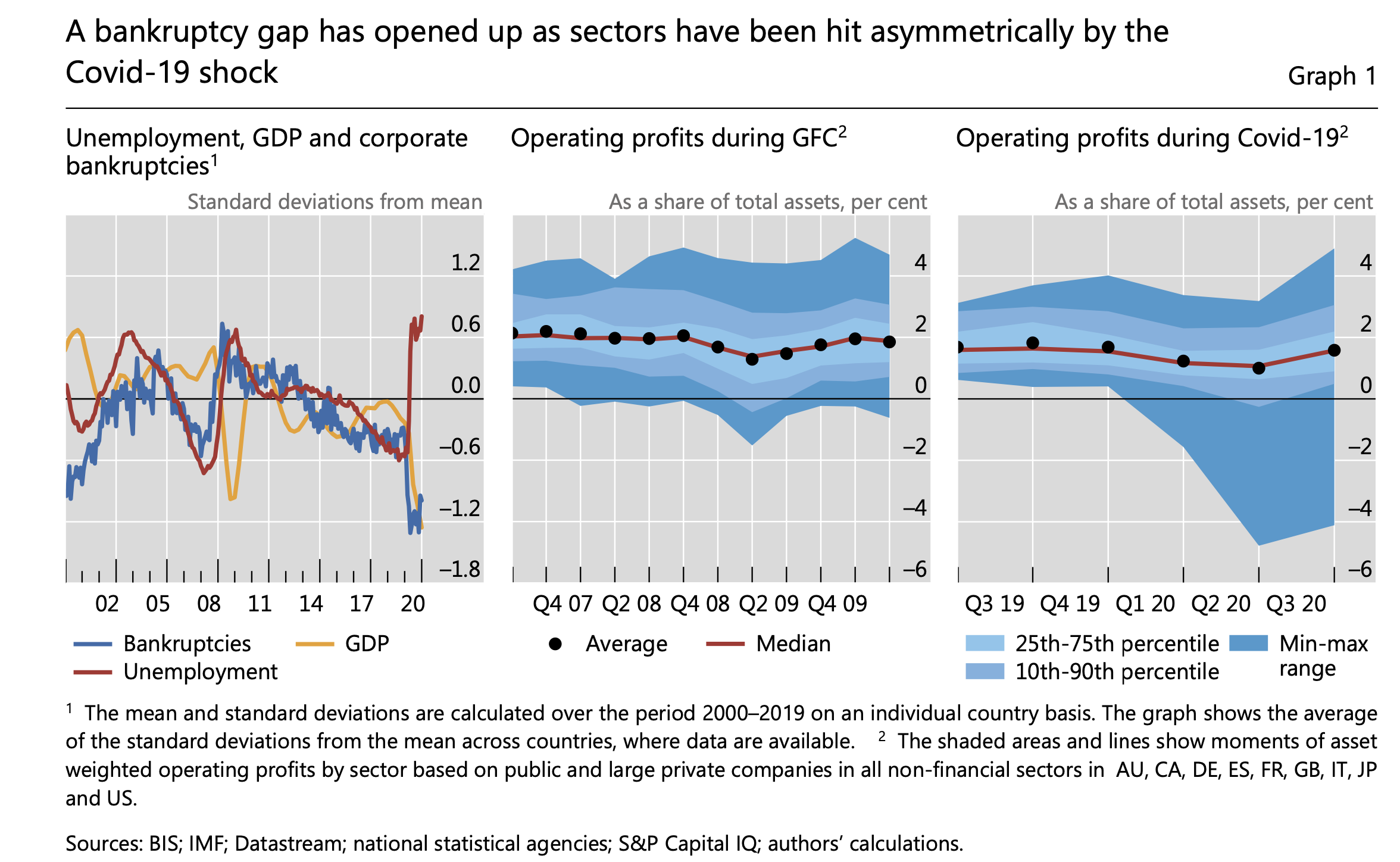

- “Not too long ago it was conventional wisdom that the global economy would transition from the “liquidity phase” to the ‘solvency phase’ of the Covid-19 economic crisis. A large wave of insolvencies was expected. So far, however, insolvencies have remained very low, and even fell in many jurisdictions during 2020. As a result, a gap has opened between previously reliable predictors of bankruptcy rates based on economic activity and actual realised bankruptcies. We refer to this phenomenon as the ‘Covid-19 bankruptcy gap’.” – bto: Es ist eine schöne Bezeichnung: die Pleite-Lücke.

- “The (…) more important factor suppressing bankruptcies has been the ample supply of credit, facilitated by unprecedented monetary and fiscal support. This has been pivotal in preventing insolvencies, because it is ultimately insufficient cash flows that give rise to bankruptcies. After all, firms go bust when they cannot pay their bills. Ample credit during 2020 stands in sharp contrast to the Great Financial Crisis (GFC) when credit conditions were exceptionally tight.” – bto: Das ist in der Tat ein Unterschied. Es ist ja auch eine andere Krise, die vor allem aufgrund des Krisenmanagements der Regierungen entstanden ist.

- “Whilst the increase in credit has prevented business firms’ insolvency in the short term, it has also increased their indebtedness. In an optimistic scenario, with the global vaccine roll-out being successful, business models of the vast majority of firms in the hardest hit sectors will continue to be fundamentally sound and cash flows will recover to pre-Covid-19 levels. The risk of a significant rise in ‘zombification’ will be low under this scenario. However, firms’ indebtedness will be higher, and this might result in changes of firm ownership from equity holders to creditors.” – bto: In einem meiner Podcast vor einigen Wochen hatte ich deshalb auch über die Lösungsmöglichkeiten gesprochen und bereits in meinem Buch “Coronomics” eine Entschuldung angemahnt.

- “Perhaps the more worrying scenario is the combination of higher debt levels and depressed earnings for credit dependent firms in some sectors, as suggested by consensus forecast estimates for 2021. Under this scenario, firms in the airline, hotels, restaurants and leisure sectors would remain highly dependent on additional support to avoid insolvency. These risks could be compounded if vaccines are less successful in containing the spread of Covid-19. Prolonged weakness in these sectors could in turn spill over into the more leveraged commercial real-estate sector.” – bto: Gerade der letzte Punkt ist besonders wichtig. Denn die These, dass die Gewerbeimmobilien davon nicht getroffen sind, halte ich für gewagt.

- “This gap is illustrated by the left-hand panel of Graph 1, which shows that bankruptcies (blue line) tend to increase when unemployment (red line) is high and when GDP growth is weak (yellow line) – as was the case during the GFC. This stands in sharp contrast to 2020, when bankruptcies declined as unemployment spiked and GDP growth collapsed.” – bto: Und das ist ja zunächst erfreulich, damit hier keine Missverständnisse aufkommen!

Quelle: BIZ

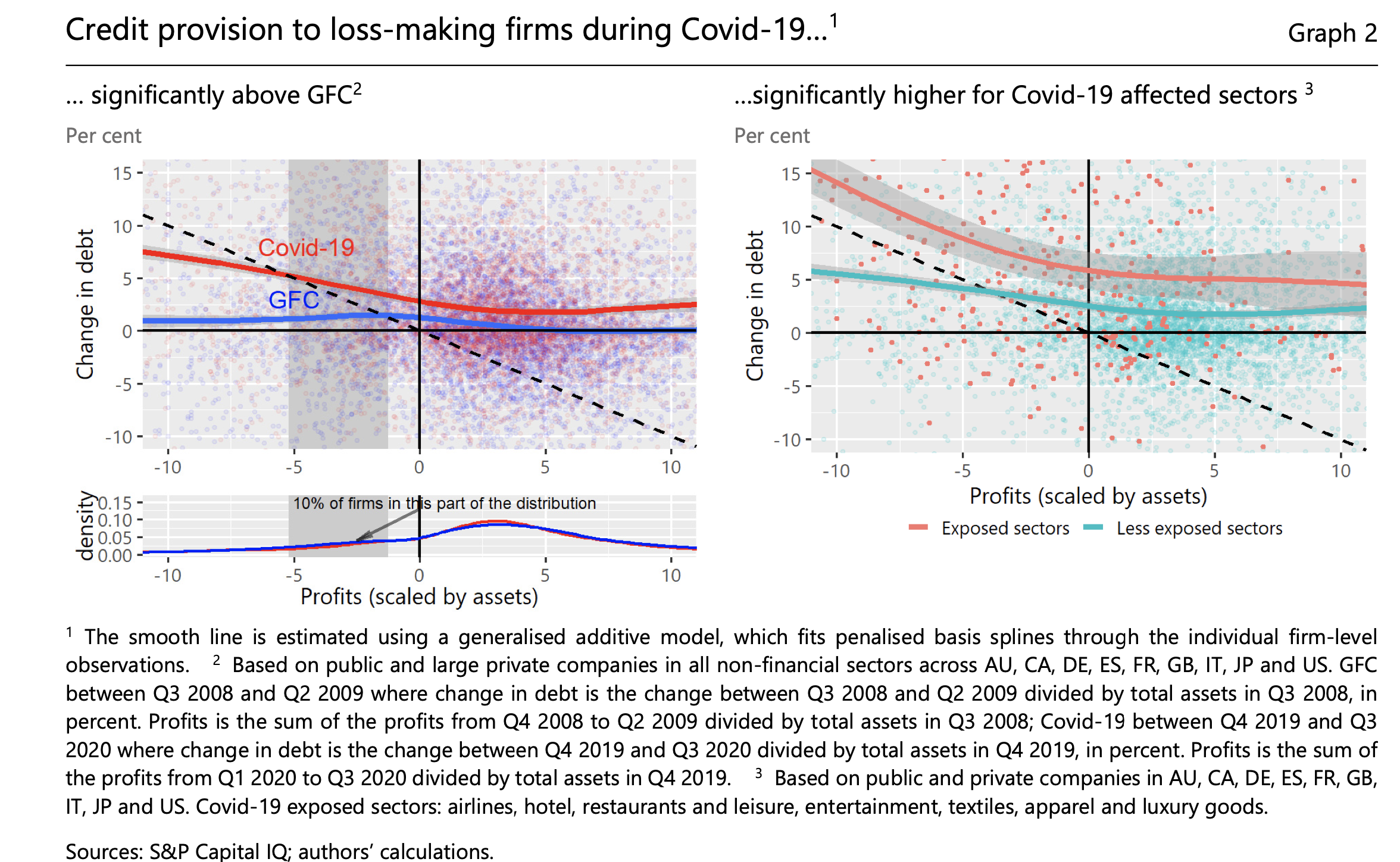

- “Ample credit has plugged the cash-flow gap for many firms. This appears to be an important determinant of the bankruptcy gap: after all, firms ultimately go bust when they cannot pay their bills. Ample credit to loss-making firms over the past year stands in sharp contrast to tight credit conditions during the GFC (Graph 2, left-hand panel). The red dots in the upper left-hand panel plot accumulated operating profits over the first three quarters of 2020 against the increase in debt over the same period, for more than 11,000 firms across nine advanced economies. We fit a curve through the dots to visualise the non-linear relationship between profits and increases in debt (red line). The rising slope of the red line in the upper-left quadrant shows that debt has increased strongly in loss-making firms.” – bto: weil es um die Beschaffung von Liquidität ging. Dies hat aber zur Folge, dass die Solvenz doppelt sinkt: aufgrund geringerer Einnahmen und höherer Schulden.

Quelle BIZ

- “Strikingly, borrowing for many loss-making firms has exceeded their accumulated losses. This is shown by the red line in the left-hand panel of Graph 2 lying above the dotted 45 degree line for much of the upper-left quadrant. Even for heavily loss-making firms, debt has increased significantly on average. This borrowing has clearly been quantitatively important in plugging the gap left by negative cash flows in these firms.” – bto: Die Schulden stiegen um mehr als die kumulierten Verluste? Da haben viele gedacht, sie nehmen, was sie bekommen können, denn wer weiß, wie schlimm es noch kommt? Aber das ist natürlich eine Last für die Zukunft.

- “By contrast, credit was far harder to come by during the GFC. The blue dots plot accumulated operating profits over the three quarters following the collapse of Lehman Brothers at the height of the GFC. (…) This inability to cover losses with credit is likely to have driven many firms into insolvency.” – bto: Hier vertrete ich die These: weniger als eigentlich erforderlich (Zombies).

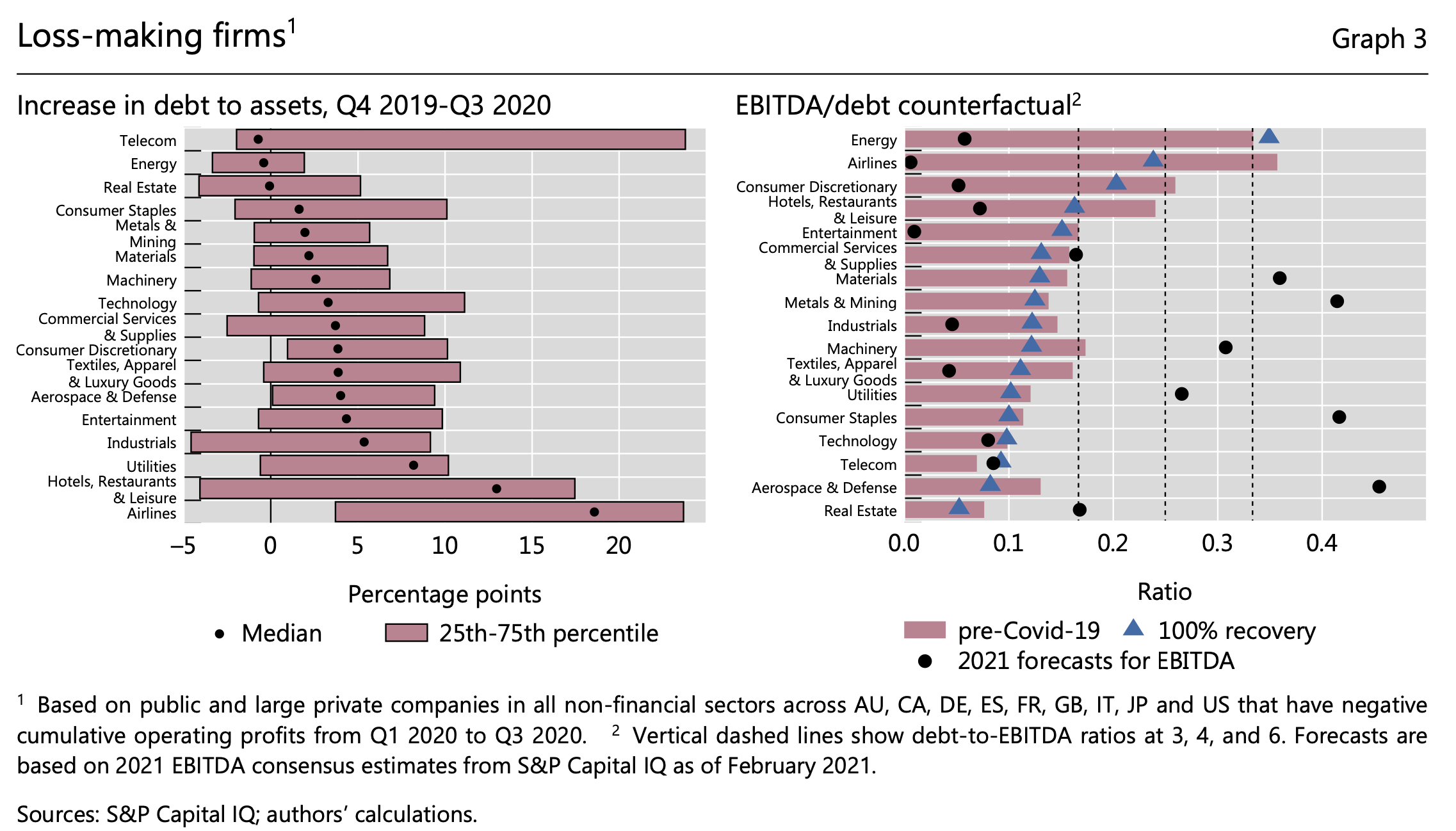

- “The extension of credit to loss-making firms has clearly helped prevent the initial liquidity crunch from quickly morphing into widespread solvency problems. However, it remains uncertain whether this transition has been cancelled or postponed. Ample credit has resulted in sharp increases in firm indebtedness over the past year (Graph 3, left-hand panel). For example, in the airline and hotel, restaurant and leisure sectors, the median leverage in loss-making firms has increased by nearly 20 and 15 percentage points respectively. Going forward, the path of future cash flows will be a key factor in determining whether higher debt ultimately makes firms vulnerable to insolvency.” – bto: Deshalb denke ich, wir brauchen eine Lösung für diese Verschuldung.

Quelle: BIZ

- “(In )the second scenario (…) earnings reach their current consensus forecasts for 2021. Under this scenario, firms in the airline, hotels, restaurants and leisure sectors see a much more pronounced fall in their ratio of earnings-to-debt (Graph 3, right-hand panel, black dots), as would firms in the entertainment, industrial and textile and apparel sectors. Loss-making firms in these sectors are likely to remain highly dependent on continued support if bankruptcies are to be avoided over the coming year. In such a scenario, zombification risks in these sectors could be higher.” – bto: Und weil man die Folgen von Pleiten aus politischen Gründen unbedingt vermeiden möchte, ist das Risiko erheblich!

- “Higher leverage, the uncertain outlook for cash flows and the role of credit in suppressing bankruptcies to date all shine a spotlight on banking sector buffers. As the economic outlook improved in the second half of 2020, banks reduced their quarterly provisions, and some even took negative provisions. That said, these reductions remained substantially smaller than the amount of loan loss reserves added during the previous three quarters. The spotlight also falls on financial conditions, which affects a firm’s ability to refinance higher debt loads, and government loan guarantees. Businesses that can succeed may need help as they undergo debt restructuring and repair their balance sheets.” – bto: Wir brauchen ein Programm zur Entschuldung der Unternehmen.

→ BIS: “Liquidity to solvency: transition cancelled or postponed?”, 25. März 2021