Die Bilanz der Notenbank ist wichtig

Morgen (5. Februar 2023) ist Dr. Ingo Sauer erneut bei mir im Podcast zu Gast. Wir sprechen über die Bedeutung der Bilanz der Notenbanken für den Geldwert. Herr Dr. Sauer hat seine bisherigen Arbeiten zum Thema ergänzt und vertieft. Die Studie wird in diesen Tagen veröffentlicht und trägt den Titel: „The Lessons from 1923 for the Euro Area: Enlightening the Dark Side of (In-)Solvent Central Banks’ Balance Sheets“, Januar 2023

Bevor wir zu Dr. Sauer kommen, lohnt es sich, an Walter Bagehot (den legendären Herausgeber des Economist) zu erinnern, der bereits in seinem 1873 erschienenen Buch „Lombard Street – A Description of the Money Market“ als Kernprinzip für die Zentralbank forderte, dass diese Kredite nur gegen gute Sicherheiten geben dürfe. Er schrieb, dass „[d]ie einzigen Wertpapiere, die ein Notenbanker anfassen sollte, diejenigen sind, die leicht verständlich und verkäuflich sind.“

Und was passiert, wenn man sich nicht daran hält? Auszüge aus dem Buch von Dr. Sauer:

- „Unfortunately, the debate on the euro area’s price increases in 2022/23 turns out to be largely ‚overshadowed‘ by a mere quantitative – goods and labor market oriented – view on money and inflation, which blinds us from realizing the true inflationary risks that had built up on the asset sides of the Eurosystem’s central banks. In simple words, without considering – i.e. understanding the mechanics and the threat of – the Eurosystem’s insolvency, or the insolvencies of individual (Target-creditor) member banks after a breakup of the currency union, we can neither fight off or manage such a situation, nor can we prepare for the recapitalizations of our central banks that might become necessary in the near future.“ – bto: Kurz gefasst: Man kann nicht ohne Konsequenz beliebig Anleihen zu überhöhten Preisen kaufen.

- „In fact, the link between money and the exchange rate is arguably closer than the link between money and the price level. (…) In summary, we can argue that it is the unbacked nature of the increased money supply during phases of monetary financing which deteriorates the solvency of the central bank and thereby the rate of exchange. With the falling rate of exchange – which, inside a country, serves as a reference point for all price-setting decisions by suppliers – the price level adjusts correspondingly.“

- „The calculation of the solvency exchange rate (SolvFX), or defendable exchange rate, requires, however, to estimate the real financial strength of the central bank, i.e. the market value of its net assets. Fortunately, the general dividing line between valuable and questionable assets was straightforward for all four countries during the complete time periods since we can distinguish between well-secured claims against the private sector,on the one hand, and (forced) claims against the governments, on the other hand. Therefore (we) differentiate sharply between those well-secured private sector claims (mostly discounted bills or advances against collateral) and claims against the government (sovereign bonds, treasury certificates, or advances made to the government). The mere quantity of the latter positions, the central bank’s holdings of public debt, does, however, not reveal the complete picture because these claims can be valuable or completely worthless depending on the country’s capacity to service its debt. Therefore, in equation we simultaneously deflated all those claims against the government to their approximate market value by using the market information given in sovereign bond price quotations on various stock exchanges.” – bto: Wenn die EZB italienische Anleihen zu 100 kauft, die am Markt eigentlich zu 90 handeln, geht sie genau dieses Risiko ein.

- „Not surprisingly, the exchange rate that the central bank can defend (SolvFX) typically deteriorates as fast as the government is financed by the printing press or as fast as the central bank suffers additional losses. The deteriorating solvency signifies, in simple words, that the central bank loses control over some part of its money supply because the mismatch between the market value of its net assets (its ‚redemption potential of notes‘) and the note circulation increases. As a result, more ‚non-redeemable notes‘ permanently add pressure on foreign exchange markets and force the exchange rate down.” – bto: Es ist ein klassischer Bank Run, hier nun in Form der Flucht in andere Währungen.

- „(…) economists who rather position themselves in the Keynesian tradition, like Paul Krugman, made us perpetually aware that the quantity theory failed completely and is simply ‚utterly, totally wrong‘. In sharp contrast, economists who are more influenced by a (Chicago School) tradition of monetarism and the quantity theory, permanently warned us about the inflationary risks that we were running with these expansionary monetary policies. We think that both positions are correct depending on the state of the central bank’s (in-) solvency which is almost always neglected by both sides.“ – bto: Das ist interessant. Bei guter Solvenz kann man Geld drucken, ohne Inflation. Sinkt die Solvenz über einen Punkt, droht es anders zu kommen: Die Umlaufgeschwindigkeit steigt stark an, der Geldüberhang beschleunigt die Inflation.

- „The concerns about the immense monetary expansions in the Eurosystem are legitimate, useful and appropriate but, if, and only if, we learn to focus on the accumulated assets held by the Eurosystem (‚the ECB‘) and their individual default risks, instead of the typical concerns about a potential excess demand on goods markets.“ – bto: Und darum sprechen wir darüber im Podcast.

- „If, however, at some later point in time, the risks accumulated by these monetary expan- sions at the central bank’s balance sheet turn into losses (which hopefully does not happen next), the resulting inflation would make the quantity theory look good at the end. The central bank’s (in-) solvency thereby closes the gap between the two great traditions in monetary theory. At first, the Keynesian perspective seems to be correct because all excess liquidity will end up in hoards which keep filling up further – as long as the financial strength of the central bank can hold that liquidity back from ‚flooding‘ foreign exchange markets. Only after this liquidity overburdens the deteriorating and fragile central bank’s ‚asset side dam‘ (mostly built on defaultable public debt) it will unfold its inflationary effects – predominantly – via its pressure on foreign exchange markets. This eminently important mechanism is not well understood in economics but, it is precisely this resulting pattern of initial monetary expansions and relatively long lags – before the exchange rate and the price level following suit – that can be observed for many strong and hyper-inflations. The initial financial strength of the central bank (its ‚asset side dam‘), that only bursts after overburdening it, gives these erratic patterns some meaning and makes their time inconsistencies consistent.“ – bto: Der Dammbruch ist ein schönes Bild, es geht eben sehr lange gut, aber wenn es knallt, kann man nichts mehr dagegen machen.

Kommen wir zum Euro:

- „Our politicians, who are always interested in tapping the financing opportunities of their central banks, will not realize by themselves – or broach the issue of – the inflationary effect of central bank losses. Therefore, we desperately need clear statements (or at least a debate) from (inside) our profession about the inflationary effect of central bank losses.“ – bto: Sie denken, dass es keine Rolle spielt. Das hören sie ja auch von vielen Ökonomen.

Jetzt wird es ernst:

- „(…) the Eurosystem’s ‚toxic‘ assets do not just represent a ‚missing brake‘ but an ‚accelerator (pedal)‘ on the road to inflation. To combat this additional and more severe inflationary force it is not sufficient to decrease the mere supply of money if the financial strengths of the issuing member banks are not reinforced at the same time.“ – bto: Damit braucht es genau das, was die Staaten nicht mehr haben: fresh money.

- Und die Notenbank kann auch nicht einfach nur Anleihen ausgeben, um die Geldmenge zu reduzieren: „Any debt-instrument (like bond issues) used to redeem or to absorb ‚notes‘ from circulation represents a pledge to pay back more notes in the future. In our words – from a solvency-perspective on central banks – nothing is gained by exchanging one liability (notes) into another liability (such as bonds, which at the end imply more circulating notes in the future). If a central bank becomes vulnerable for a certain mismatch between assets and liabilities this solvency-problem cannot be solved by swapping ‚notes‘ into ‚pledges of more notes‘.“ – bto: Das bedeutet, dass die Idee der Inflationsbekämpfung mit der Ausgabe neuer Anleihen durch die Notenbank das Problem der fehlenden Solvenz verschärft.

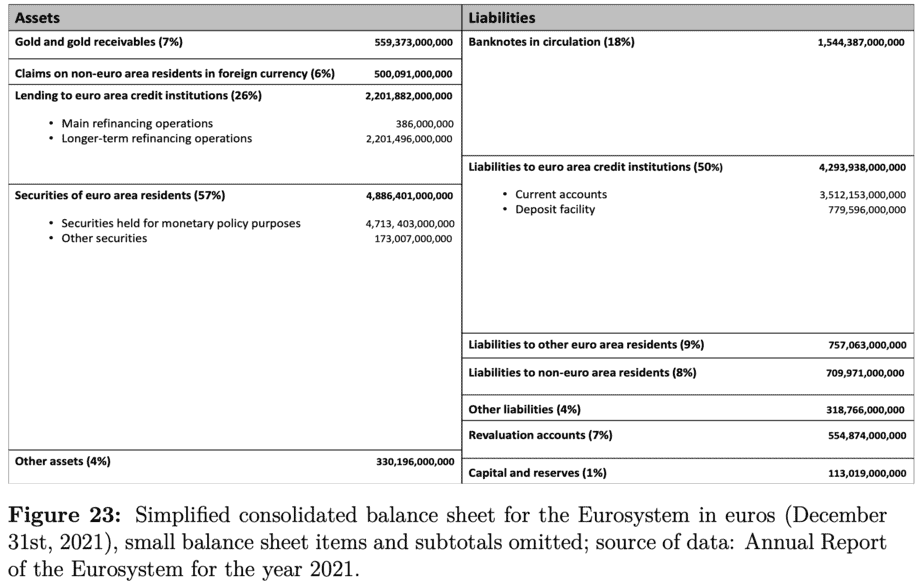

- „In subsection 9.1 we analyzed the solvency of the Eurosystem as a whole (…) In summary, we revealed that the euro is largely backed by two highly risky positions. The first, ‚lending to credit institutions‘, consists mostly of long-term claims secured by questionable collaterals against commercial banks (many of those in countries like Italy, Spain, Greece, or Portugal). The second position, ‚securities of euro area residents,‘ consists of around 50% of government bonds from countries which are already in financial difficulties. The massively increased size of the balance sheet makes every percentage loss from either of these positions relatively large compared to the equity positions of the Eurosystem.“ – bto: … weshalb ja einige Notenbanken bereits über die Notwendigkeit eines Zuschusses vom Staat diskutieren.

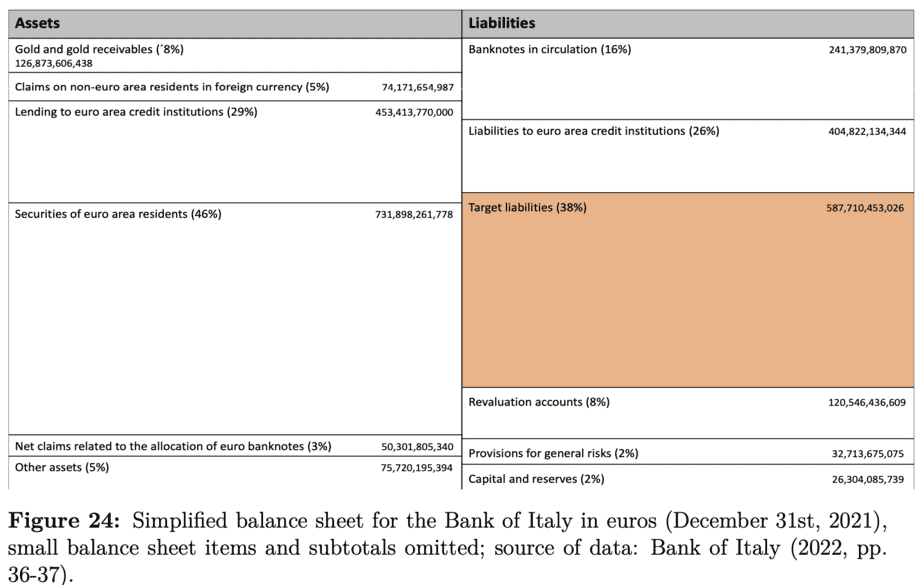

Und so sieht es in Italien aus:

Quelle: Dr. Ingo Sauer

- „Italian central bank became – through this very process – a powerful debtor in the euro area and can threaten the Target surplus countries or their central banks with an exit strategy that immediately puts all Target claims and the survival of the entire Eurosystem at risk. Therefore, the fundamental problem of Italy’s Target liabilities is, in simple words, that the country does not have to fear bankruptcy as much it had to fear it without such liabilities. If Italy goes bankrupt, then its central bank will face bankruptcy, too, and through the Target liabilities of the bank, the losses are transmitted to the other national central banks. This asymmetry represents a clear divergence between decision and liability because Italy can rely on plenty of financial assistance from the Eurosystem and the member states (specially the Target surplus countries) and increase its government spending with less prudence than without being such a powerful debtor. The main Target surplus countries like Germany can hardly allow an Italian bankruptcy to happen as this puts the complete currency union, and the complete Target claims from the Bundesbank, at risk.“ – bto: Das nutzen die Italiener gekonnt aus. Clever.

- „The public debt (on the asset side) could be reduced or canceled if simultaneously the Target liabilities (on the other side of the balance sheet) are also reduced or canceled. Canceling the public debt held by the Bank of Italy would be an enormous relief for the state finances as it lowers the overall public debt considerably. Indeed, Italy could leave the currency union and/or declare bankruptcy for the Bank of Italy in the process of the mentioned sovereign debt restructuring.” – bto: Und es verlieren die dummen Deutschen. Wie super.

Quelle: Dr. Ingo Sauer

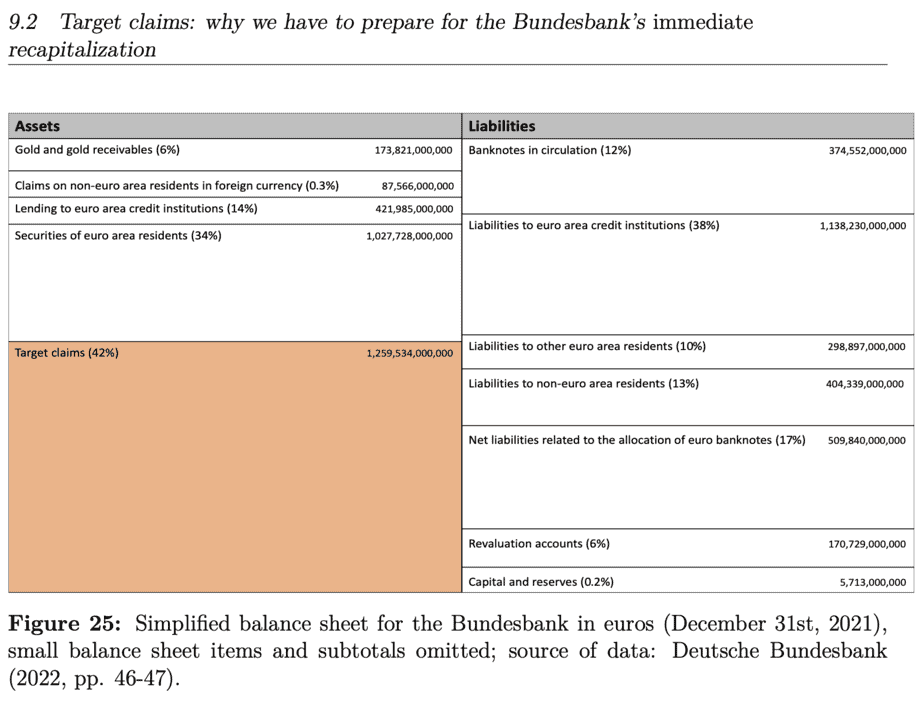

- „The point is that, due to the missing settlement mechanism in the Eurosystem, the important Target deficit countries like Italy transformed a significant part of their debt held by private investors to debt held by their own central banks. Loosely speaking, they used the ‚printing press‘ from the Bundesbank to pay for the purchase of their debt. The Bundesbank is therefore, in economic terms, the real creditor behind the debt purchased by the Bank of Italy, but it has no such powers like private bond holders.“ – bto: … und damit wir alle.

- „(…) what could happen if the Bundesbank would incur such losses? Technically, the bank would be insolvent because its equity principally consists of the ‚revaluation accounts‘ which amounts to only around 6% of its balance sheet total. As we extensively discussed already in the literature review, many economists, among them the figurehead for the Target imbalances, believe that it would not be necessary to recapitalize the Bundesbank in order to guarantee a stable new currency (the new ‚mark‘) – but, based on our research, the Bundesbank’s immediate recapitalization would be absolutely inevitable to launch such a stable new currency. The recapitalization of the Bundesbank would, however, imply an eminently expensive procedure. Even if the loss of Target claims amounts only to (e.g.) 50% of the maximum potential loss, it is still about 600 billion euros, which is approximately one and a half times Germany’s federal budget for an entire year (around 400 billion euros for 2021). Therefore, the government would have to issue an enormous additional debt in order to recapitalize the Bundesbank.“ – bto: Dann wird der Traum der Linken wahr, endlich kann man wieder eine Vermögensabgabe machen. Problem dürfte dann aber sein, dass es der Linken politisch nichts nutzt. (Was zu hoffen wäre.)

- „Needless to say that for several countries the Eurosystem’s refusal to act as a market maker for their bonds would imply higher interest rates and funding difficulties but exactly these incentives are needed to bring down (newly issued) government debt to sustainable levels. If, under those conditions, some countries had to renegotiate their debt with the Eurosystem and other bondholders, we would get closer to – not further away from – a viable solution to secure our currency.“ – bto: Ja, aber das ist natürlich pure Theorie. Die politische Praxis steht dem entgegen.

- Und wie geht es weiter? „(…) if the euro becomes a weak currency, the upcoming economic (energy) crisis in Europe will make monetary financing and a delayed recapitalization of the Eurosystem – or the national member banks’ recapitalizations after a breakup – a seductive option for policymakers because they can secure their (governments’) financing without imposing the necessary tax increases or austerity programs. Furthermore, any urgent necessity – be it the import of absolutely necessary foodstuffs during the winter of 1919 in Germany, the import of energy during the winter(s) to come in the euro area, or the distribution of subsidies to socially mitigate escalating energy prices – legitimates the (mis-) use of the central bank as a ‚lender of last resort‘.“ – bto: Wenn die These von Dr. Sauer stimmt, stehen wir unweigerlich vor einer Hochinflationsphase. Der Kipppunkt bleibt offen. Wir wissen nicht, wann der Damm bricht.