Die “Alles-Blase” muss platzen

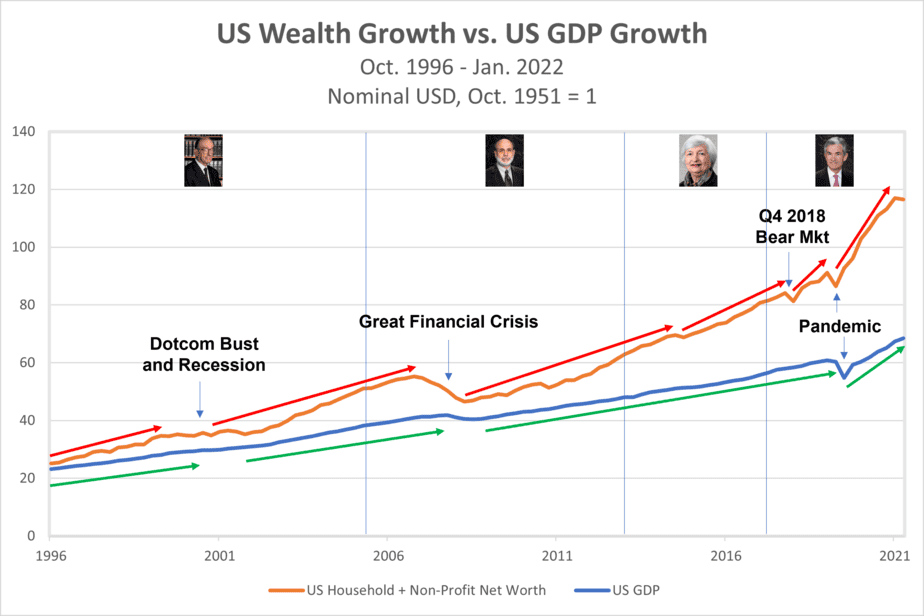

Ben Hunt wirft einen Blick auf die zunehmende Diskrepanz zwischen der wirtschaftlichen Entwicklung und der Bewertung an den Vermögensmärkten. Was über Jahrzehnte – wie zu erwarten – parallel lief, entwickelt sich seit Jahren auseinander. Wir kennen diese Beschreibung von Piketty, der allerdings nicht versteht, was passiert…

- „As a people, you can’t be a lot richer than your economy grows without stealing that wealth from someone else. Maybe it’s stolen (sorry, I mean extracted or taxed or traded for) from people in other countries through colonial terms of trade. Maybe it’s stolen (sorry, I mean pulled forward) from future people in your own country through artificially low interest rates, monetized debt-driven stimulus, and an increasingly levered financial system supporting increasingly non-productive mal-investment.“ – bto: So ist es. Es ist die Folge des missbrauchten Instruments der Gelddruckmaschine.

- „ (…) I believe that a modest national debt and modest leverage in the financial system are good things, not bad things. I believe that a gold standard is a pretty terrible way to run a monetary system. I believe that deficit spending is entirely justified across a pretty wide range of national exigencies. (…) I believe that central banks play a crucial and necessary role in the modern world.“ – bto: Das alles – denke ich – ist Konsens. Die Frage ist hier die Dosierung.

- „About halfway through Alan Greenspan’s 20-year (!) Fed chairmanship, the Maestro had a revelation: blessed by the Great Moderation (high productivity and low inflation expectations), the Fed could use monetary policy as a political tool to make us richer than our economy could grow, without re-triggering wage/price inflation in the broader economy. By keeping interest rates lower than what would have been considered ‘normal’ over the prior few decades and by relaxing regulatory constraints on derivative securities, banking regulations and the like, Greenspan believed that he could inflate home prices and financial asset prices without hitting wages and prices more broadly. (…) This was the birth of our insanely financialized world.“ – bto: Und damit die Basis für Blasen, Krisen und zunehmende politische Instabilität.

Quelle: Epsilon Theory

- „Ben Bernanke was the first to double down on Greenspan’s epiphany, and he achieved that acceleration by expanding the instruments by which monetary policy could inflate financial assets directly. The most obvious new instrument was what became known as ‘quantitative easing’ or QE, which covers a wide range of balance sheet actions. In simplest terms, QE just means buying enough stuff (‘large-scale asset purchases’, in the lingo) to drive the price of that stuff up and the yield of that stuff down. This has two big effects.“ – bto: Die Frage ist, ob es wirklich einen Effekt hat. Denn es bedeutet die Änderung eines Aktivums für die Banken – von Anleihen zu Reserven.

- „First, if you buy enough of something that’s fundamental or a reference point for how all borrowing is priced, like US Treasuries, then artificially pushing the price up and the yield down on that fundamental thing should make all borrowing cheaper. This is the essence of pulling forward investment from the future. (…) if the country is in the middle of the worst Depression since the 1930s and everyone is losing their job and no one is buying a new car, then pulling forward some investment from the future so that the present day doesn’t absolutely collapse makes a lot of sense!“ – bto: 2008 war das nun wirklich nicht auszuschließen.

- „Second, artificially pushing the price up and the yield down for something that is fundamental to every investment portfolio, like US Treasuries, means that all of the retirees and pension funds who buy US Treasuries and are counting on that yield as income to fund their retirement or their obligations are going to be forced to buy riskier assets, like mortgage-backed securities or dividend-paying stocks, to get that same level of income. This is called the ‘portfolio channel effect’ in the official lingo, but you may also hear it referred to as ‘financial repression’, especially if you get to the point of a yield or interest rate of zero, so that savers don’t get any income at all from holding their government bonds. And if you have negative interest rates, such as have been commonplace in Europe over the past 5 years or so, then savers and retirees are truly forced to do something substantially risky with their money.“ – bto: Im Falle der Gefahr einer Depression ist das gerechtfertigt, aber ansonsten? Hmm.

- „ (…) I think that QE1 saved the world. I think that QE1 was exactly why central banks were invented in the first place – to provide emergency liquidity in incredible quantities when everyone else is too scared to do it. (…) The problem was QE2 and QE3 and QE-infinity. The problem was turning a $2 trillion balance sheet with the completion of QE1 into a $9 trillion balance sheet today! The problem was turning a one-time straight-in-the-heart shot of adrenaline into a permanent intravenous mainline of adrenaline.“ – bto: Das stimmt sicherlich und schuf die Basis für noch größere Probleme.

- „And then came the economic response to Covid, which was not only a resumption of full-bore QE and balance sheet expansion (about $2 trillion worth), but also the largest pulling forward of wealth for direct distribution to the already well-off of any government program in the history of man.“ – bto: Es war nochmals das Aufblasen einer riesigen Vermögenspreisblase.

- „Again, I am 1,000% in favor of emergency government action to save an economy in general and to save jobs in particular. What our government did in reaction to the Covid recession and bear market was not that. The Paycheck Protection Program (PPP), for example, distributed about $800 billion directly to American businesses, ostensibly to cover the cost of maintaining workers on payrolls. In truth, only about one-quarter of that money supported jobs that would have otherwise been lost. More than 70% of the PPP distributions, more than half a trillion dollars, went to the richest 20% of American households. That’s separate from the $680 billion in Federal unemployment benefits and $800 billion in ‘economic impact payments’ (stimulus checks), both of which also saw substantial, although less than PPP, wealth payments flow directly to already well-off households that were in no danger of losing a job or, really, suffering any sort of economic hardship from the Covid pandemic. For millions of Americans, particularly relatively wealthy Americans like lawyers and doctors and bankers and accountants and consultants and financial advisors, 2020 wasn’t a difficult year financially, it was their best year ever.“ – bto: Kann ich bestätigen, von dem was ich aus der Branche höre.

- „ (…) TRILLIONS of non-emergency dollars spent by the Fed to artificially lower the price of money and inflate financial assets and channel mal-investment and create the worst decade of productivity growth in the history of the United States and make us FEEL rich without BEING rich … yeah, THAT is what causes inflation.“ – bto: Das erklärt es in der Tat sehr gut.

- „Greenspan’s magic trick – inflating wealth without sparking inflation in the real economy – is dead. It doesn’t work anymore. There’s no more room for monetary policy to create ‚free‘ wealth, for these growth lines to separate further. There’s only room for these lines to converge, and the only realistic way for that to happen is for the wealth growth line to go down. A lot. Remember, a bear market is only a little notch in that line. A nationwide collapse in home prices, like in 2008-2009, is only a modest dip.“ – bto: Ich denke wir können glücklich sein, wenn die Vermögenspreise nominal gleich bleiben und die Inflation in der Realwirtschaft die Lücke schließt.

„Roughly speaking, we need a wealth destruction event that’s equivalent to the 2008-2009 Great Financial Crisis just to get the ratio of wealth to GDP back to pre-pandemic levels.“

- „ (…) if the political consequences of the wealth destruction required to eliminate inflationary pressure and expectations are too unbearable, then you can instead simply mandate the effects of inflation away through wage/price controls and related policies (effective nationalization of large swaths of economic activity, for example). But those are your choices. Neither is attractive. At least with the former – wealth destruction to get at the heart of what creates inflation – you can recover and grow your way back to a more equitable and more vibrant society. The latter, though – wage/price controls and outright nationalization or pseudo-nationalization of entire economic sectors – man, you never recover from that.“ – bto: Es ist sicherlich kein wachstumsfreundliches Szenario und macht damit das Problem noch schlimmer.

- „Unfortunately, I think the political consequences of the wealth destruction now required to control inflation authentically ARE too unbearable for every status quo political institution, (…). I think by far the most likely path forward is greater and greater political lashing-out into worse and worse policy positions, both economically and culturally.“ – bto: Die Eurozone wird voranmarschieren.

→ epsilontheory.com: „Hollow Men, Hollow Markets, Hollow World“, 9. Juli 2022