Der Zusammenbruch der SVB einfach erklärt

Es wurde und wird viel geschrieben über den Zusammenbruch der SVB. Die BlackSummit Financial Group hat es in einer Mail gut zusammengefasst:

- The Quality of the Assets Was Not the Issue

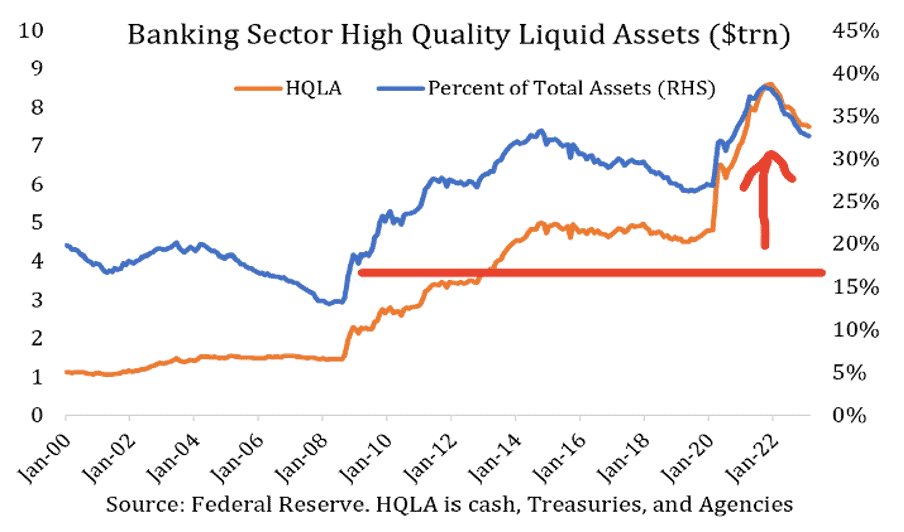

- „This wasn’t a story of questionable loans or securities that didn’t hold their weight. The bank parked the majority (over 95% per its Balance Sheet as of Dec 31, 2022) of its deposits into US Treasuries and Agency bonds that are backed by the federal government. While every investment has some form of risk, credit risk wasn’t the concern here. The banking sector in large isn’t anywhere close to the kind of position it was in 15 years ago. High-quality assets, namely Treasuries and government-backed agency securities are a much greater mix of balance sheets now compared to then.“ – bto: Es ist eben ein anderes Risiko und zwar jenes, dass die Marktwerte der Assets angesichts steigender Zinsen nicht stimmen.

Asset Quality Is Much Better Than Pre-GFC, Source: Joseph Wang

2. So What Was the Issue?

- „Silicon Valley has positioned itself as the preeminent financial institution serving venture capitalists, nascent tech companies, and high-net-worth individuals. It developed a specialty around an industry that 40 years ago when SIVB was founded, was not something a lot of bankers wanted to touch because of unfamiliarity, unique attributes, newness, and other traits. But the competency and relationships SIVB built served them well. The stock compounded over 18%, in line with the Nasdaq, from the Financial Crisis to two Fridays ago, which includes the stock getting cut in half before the events of last week.“ – bto: Das ist natürlich eine beeindruckende Performance. Das Team war also nicht so schlecht, mit Ausnahme eines erheblichen Managementfehlers, der sich als tödlich erwies.

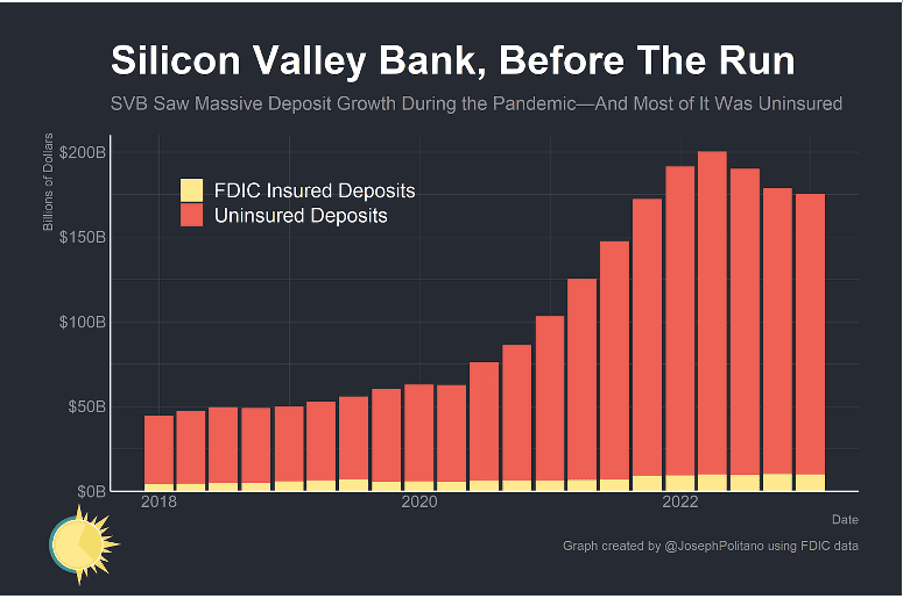

- „That is even more so the case in the boom sparked by the Covid recovery. Everything tech-oriented and tech-adjacent saw booming valuations, easy funding rounds, and business plans approved regardless of how cash burning or flimsy the economic case was. (…) The cash poured into venture and tech companies who deposited it at SIVB; since 2019 deposits at the bank tripled while across the industry they only rose 37% during the same period.“ – bto: Die Bank war also der Parkplatz für die eingesammelten Milliarden. Sie vergaß aber, dass die Milliarden auch wieder abfließen, weil ihre Kunden – die Start-ups – das Geld zur Finanzierung ihres Aufbaus verbrauchten.

Deposits Have Tripled at SIVB Since 2019, Source: Joseph Politano

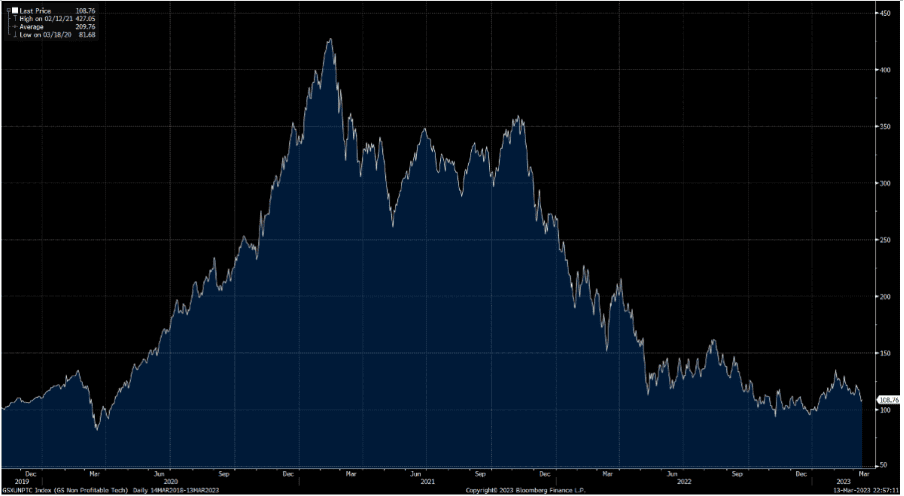

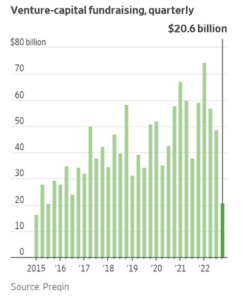

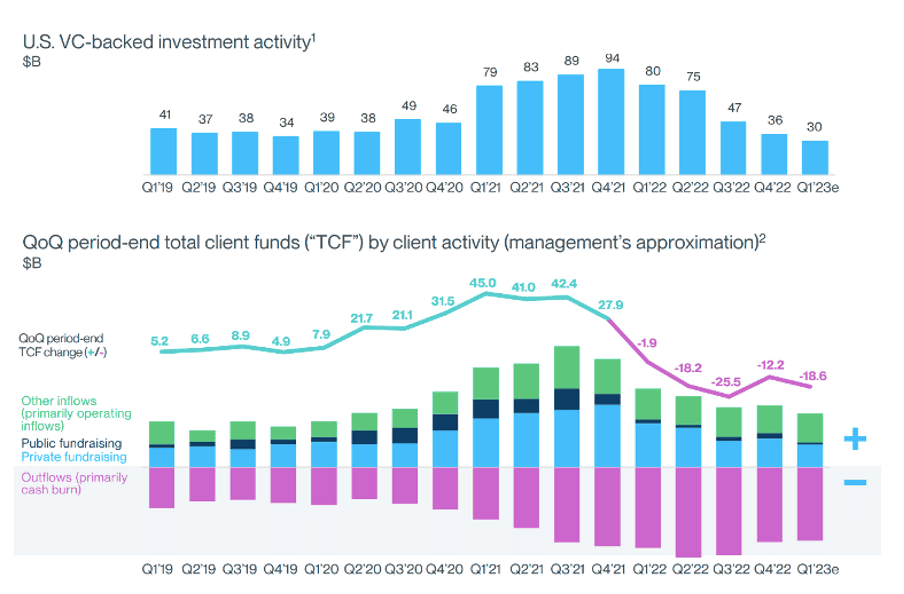

- „But after the Covid boom came the Covid bust where the biggest losers have unquestionably been the most speculative and economically dubious companies. Goldman’s Unprofitable Tech Index tells the story well (Figure 3). It’s no surprise then that VC fundraising across the market fell off a cliff (Figure 4).“ – bto: Das heißt: Es kam kein frisches Geld hinzu, während das vorhandene Geld abgerufen wurde.

The Unprofitable Tech Burst, Source: Goldman Sachs

Quelle: BlackSummit

VC Funding Last Q Was Lowest in Almost a Decade, Source: WSJ

- „A slowdown in VC fundraising meant fresh deposits weren’t coming in to replenish SIVB. And cash burn remained extremely elevated. Per an investor presentation from management last week cash burn from SIVB’s clients was still twice as high as pre-2021 levels and VC funding was due to fall an additional 15-20% from last quarter (i.e. from already depressed levels).“

Companies Continued to Burn Cash While New Funds Weren’t Coming in Fast Enough, Source: SIVB

- „SIVB management determined the imbalance between inflows and outflows of funds required some sort of action. The bank announced that it would sell $21B of securities off its books (marked as Available for Sale (AFS) on its Balance Sheet) but would do so at a loss of $1.8B. All of the bonds it had purchased with the surge of deposits had fallen in market value due to rising rates all across the bond market; a sale of common and preferred shares would occur as well in order to shore up its capital position following the loss.“ – bto: Im Prinzip ist das wie ein Margin Call. Man muss Assets verkaufen, um die Auszahlung zu leisten. Kann man die nur mit Verlust verkaufen, wird es ein Problem.

- „(…) emotions took over, with VCs recommending their companies to withdraw cash because ‚there was no downside to removing their money from the bank.‘ The next day $42B was taken out of SIVB as fear spread from one firm and one VC to the next, without ever giving a second thought to the self-fulfilling stampede they were causing. Hysteria took over. Everyone went for the door at the same time and by mid-day Friday, the FDIC had closed the bank and put it in receivership.“ – bto: Und die so smarten Investoren in Start-ups sowie die Gründer waren zunächst so dumm, hohe Beträge an die Bank zu geben und dann einen Bank-Run auszulösen, das muss man auch dazu sagen. Darunter – so die Gerüchte – so illustre und bekannte Namen wie Peter Thiel.

- What Could Have Been Done?

- „First, and perhaps most importantly, there’s been a surprising and disappointing amount of discourse stating that where SIVB erred was in borrowing short and lending long. This, we would point out, is the very definition of a bank; it is the nature of the business model. To point to this as an issue is to point a finger at all banks. Further, not a single bank is set up or could be set up to survive a full-fledged spontaneous bank run. Human emotion and psychology cannot be hedged away.“ – bto: Dennoch haben Banken extra Risikomanagement-Tools, um genau das zu verhindern.

- „(…) the further anyone digs into SIVB over the last couple of years, the more apparent that the distinguishing characteristics of the bank were ones of mismanagement, particularly with regard to risk. Banking 101 is about matching up assets and liabilities so that your duration exposure on either side of the balance sheet is not imbalanced from the other. But with VC funding being the dominant vertical served, SIVB had to know the deposits sitting in its accounts weren’t destined to be long-term liabilities. Yet most of its assets were put in longer-duration Treasuries and MBS. While these instruments bore little credit risk as discussed above, they did possess substantial duration risk if rates rose. Some duration is ok, but too much could be a death sentence with a deposit base that is expected to be withdrawn so that venture companies can cover things like payroll and operating expenses. Further, virtually none of the portfolio was hedged from interest rate risk…” – bto: Eine große Zinswette, die schiefgegangen ist.

- „A counterpoint to the hedging argument is that by entering into an IR swap, SIVB would essentially be foregoing any return. To that I would say if the goal is to make money on the direction of bond prices they should be a hedge fund; some level of hedging to line up with the deposit base would be prudent.“ – bto: Natürlich!

- „Further, inflation has been the biggest macroeconomic story of the past year or so and anyone with a Bloomberg terminal could have told you the direction monetary policy was headed with the way inflation data was coming in. And yet, the bank continued to increase its duration quarter after quarter.“ – bto: Sie haben also gegen die Fed gewettet…

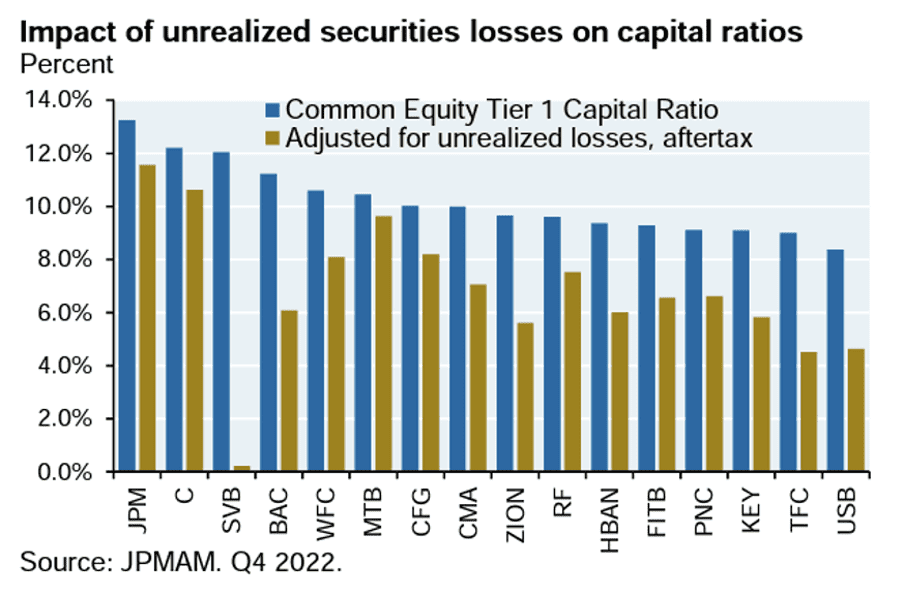

- „Other banks saw this risk and made cautious and calculated decisions to watch their duration exposure. Instead of reaching for yield by moving further out in time or buying riskier debt, M&T Bank made the astute observation that if they were wrong, an equity raise would squash any extra yield picked up. Instead of reaching for yield, they parked more funds at the Fed. M&T’s wisdom is clearly evident in Figure 7 and in stark contrast to SIVB. While Figure 7 clearly shows there would be a notable impact on the capital position of the banking sector if unrealized losses were considered, SIVB clearly stands out unique in the management of its portfolio.“ – bto: … wobei man von Management wohl nicht sprechen kann…

One of These Is Not Like the Other, Source: JP Morgan

4. Did it Need a Bailout?

- „(…) depositors have been made whole at SIVB (as well as at Signature Bank of NY which went into receivership on Sunday) while equity and debt holders have been wiped out. A new credit facility by the Fed was created, and backstopped by the Treasury, to extend credit to regional banks against collateral at full par value. The actions constitute a bailout but not exactly in the same terms as what we saw in 2008. There is no federal ownership of a bank. There is no TARP. Taxpayer funds aren’t being used to support stocks. But it still represents public authorities influencing events to prevent the full pain induced by the private sector. It’s clear based on press reports that the FDIC, Fed, and Treasury all preferred a buyer to step up and purchase the bank while guaranteeing all deposits, but that option didn’t materialize in time.“ – bto: Einfach deshalb, weil die Risiken zu groß sind bezüglich der Zinswette.

- „Did it have to happen this way? (…) there was zero chance all uninsured deposits would have been lost. In fact, there are plenty of credible and plausible scenarios by which 80% more of uninsured deposits would have fully paid out. Maybe not all at once, but enough capital would have been available Monday morning so that business could resume for all stakeholders.“ – bto: … weil die Qualität der Assets stimmte.

- „Presumably, this was done to prevent a wave of bank runs from ensuing first thing Monday morning across the country. How likely that threat was can’t be known but the hysterics by many over the weekend certainly weren’t helping to calm the situation down. For whatever it’s worth, several major regional bank CEOs said they were not seeing unusual withdrawal activity on Monday. Whether that would have happened without these actions is a counterfactual no one can prove.“ – bto: Es wäre nicht begründet gewesen. Aber vielleicht wäre es begründet, die Start-ups und ihre Kapitalgeber neu zu beleuchten und zu bewerten?

Das meinte ein anderer Kommentator im englischen Telegraph:

- „Yet the debacle has also shone a particularly harsh light on the arrogance and hubris of a technology sector where valuations have been pushed to ridiculous levels by cheap and seemingly limitless money. That era should have come to an abrupt end the moment the Federal Reserve started raising interest rates. Like the cartoon character Wile E. Coyote, it nevertheless kept on motoring, seemingly oblivious to the fact that tighter money would knock a giant hole in valuations.” – bto: Das ist ein zweifellos richtiger Punkt.

- “If interest rates go up, asset values by definition go down to reflect the higher yield environment. A day of reckoning awaits for many of the candyfloss companies, and their venture capital backers, that rode the cheap money wave. They are about to get their comeuppance.“ – bto: Und das hat natürlich breitere Auswirkungen.

- “But what SVB has done is demonstrate just how vulnerable a world awash with debt is to any tightening in interest rates. It seems as if central banks have got themselves into a position where they cannot properly address inflationary pressures without destabilising the entire system. It’s always the same old story. When the tide goes out, you get to see who’s been swimming naked, and it’s rarely a pretty sight.” – bto: Deshalb werden die Notenbanken nicht hart genug gegen Inflation vorgehen.