Der Kondratieff-Zyklus spricht für einen neuen Rohstoffpreisboom

Am kommenden Sonntag (28. Mai 2023) beschäftigen wir uns im Podcast mit den langen Wellen der wirtschaftlichen aber auch der gesellschaftlichen Entwicklung. Zur Einstimmung gibt es in dieser Woche einige Beiträge zum Thema. Hier ein Aufsatz von Longview Economics, der die Entwicklung der Rohstoffpreise anhand der langen Wellen analysiert:

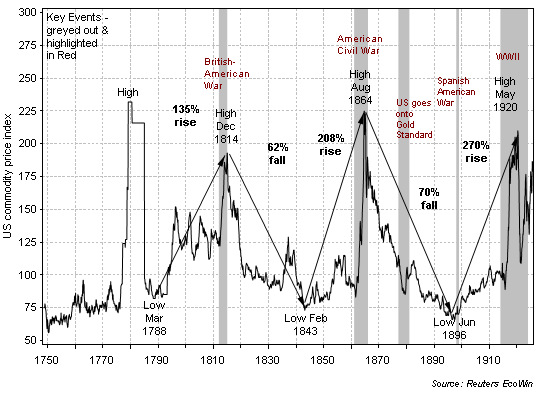

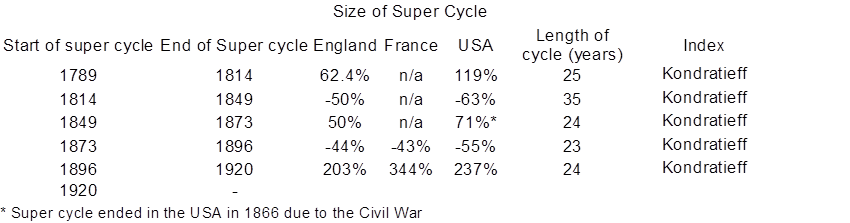

- „Russian economist Nikolai Kondratiev found clear evidence of a long wave in commodities from 1789 through to the early 1920s (his thesis having been written in the 1920s). His analysis was based on commodity price indices for England, France and the USA. (…) His evidence supports cycles of 23 to 35 years in length with rising cumulative price waves of between 50% and 350% and bear markets of between 40% and 63%.“ – bto: Das ist natürlich sehr „deterministisch“. Deshalb kann man das nur mit Vorsicht nehmen, dennoch aber interessant.

Longview nutzt das, um einen Ausblick auf die Rohstoffmärkte zu wagen:

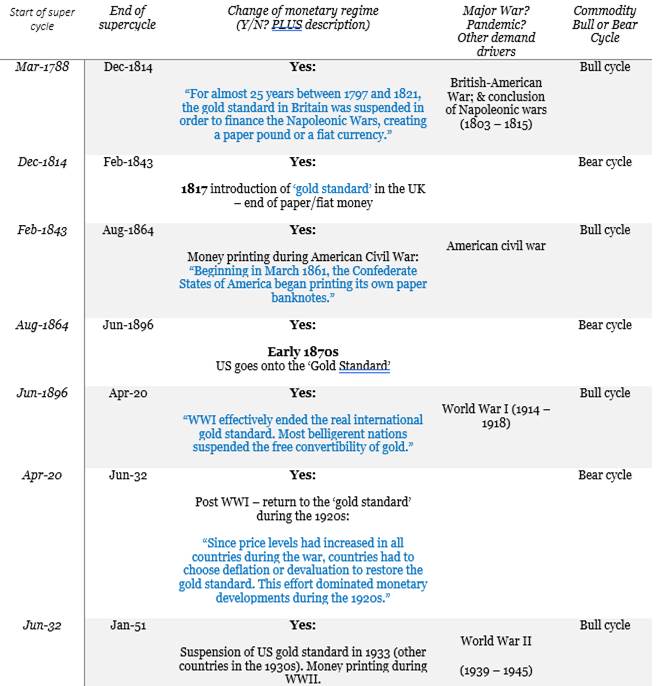

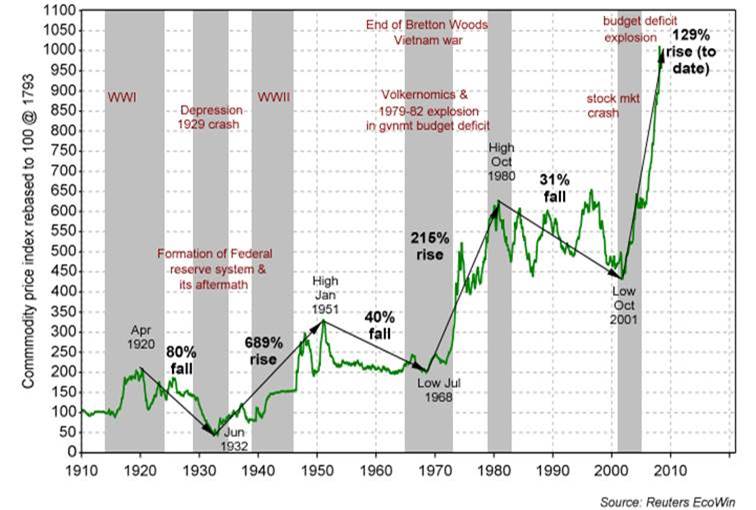

- „The main driver of commodity bull and bear cycles is the monetary regime – and specifically switches in that regime. Those switches occur at/close to almost all shifts in commodity super cycle regime from bull to bear and vice versa. In 1933, for example, just after the start of the 1932 to 1951 commodity bull cycle, President Roosevelt took America off the gold standard, kick-starting money creation and a period of QE. Towards the end of that commodity bull cycle (and towards the end of WWII), the major world economies agreed to join the Bretton Woods monetary system (thereby tying those countries directly, for the US, and indirectly, for everyone else, to gold – i.e. as an anchor). A commodity bear cycle then ensued through to 1968 (with Bretton Woods ending in 1971). (…) The key implication, though, is that liquidity and money creation (or, conversely, anchored money) are the main (or one of the main) drivers of commodity price cycles (both Bull and Bear).“ – bto: Und die Frage ist nun, wo stehen wir? Haben wir die Phase der Liquiditätsflut hinter uns, erhöhen doch die Notenbanken die Zinsen? Oder stehen wir im Gegenteil vor einer neuen Flut an Liquidität?

- „Wars are a regular feature of commodity price spikes. Times of war usually generate extra demand for various commodities (in terms of supplying the war effort). They also often lead to commodity supply chains being cut off for certain key countries/constituencies, thereby creating supply shortages in various parts of the world. Wars also often trigger a change in the monetary regime (and generally more money printing), usually so the government can print money to pay for the war.“ – bto: Ich erinnere an die Podcastepisode über die Thesen von Zoltan Pozsar (#184 Der absolute Wirtschaftskrieg).

- „Bouts of asset price and/or debt deflation often occur during, or at the start of, commodity super cycles (bullish ones). That is, the policy makers’ collective response to asset price and debt deflation has historically been to create more money (and reduce interest rates) to offset the deflationary effect on falling asset prices and/or banking crises. The subsequent new liquidity helps fuel commodity price gains (and ultimately broad-based consumer price inflation). This occurred from 1932/33 onwards (start of the 1932 – 1952 commodity super cycle), when President Roosevelt came off the gold standard and the Fed started a QE program. The US experienced a similar phenomenon in the 2000s (noughties), with asset price deflation initially (TMT bubble bursting) and then debt deflation (banking bust 2007 – 09) kicking off zero interest rates, QE and a new commodity super cycle.“ – bto: … der aber 2008 den Höhepunkt erreichte, bevor es wieder bergab ging.

- „Capex is another key factor which contributes to commodity super cycles. In particular an absence of capex is common in the years preceding a commodity bear cycle.“ – bto: Wir haben gerade im Energiebereich erhebliche Unterinvestitionen gesehen.

Commodity Super Cycles 1750 – 1920

Quelle: Longview Economics

Und hier die Beschreibung der Änderung der monetären Rahmenbedingungen:

Quelle: Longview Economics

- „Nikolai Kondratiev’s estimates of the cycles (calculated in the 1920s) are laid out in table 3 below. (…) The peak and trough cycle dates are very similar to those in the first table (table 1). On occasions they are different by a few years. That likely reflects the use of different data series to calculate the cycles.“

Kondratiev’s Commodity Super Cycles (1788 – 1920): based on US, English & French cycles

Commodity Super Cycles: 1900 – present

Quelle: Longview Economics

Quelle: Longview Economics

Und wie geht es jetzt weiter?

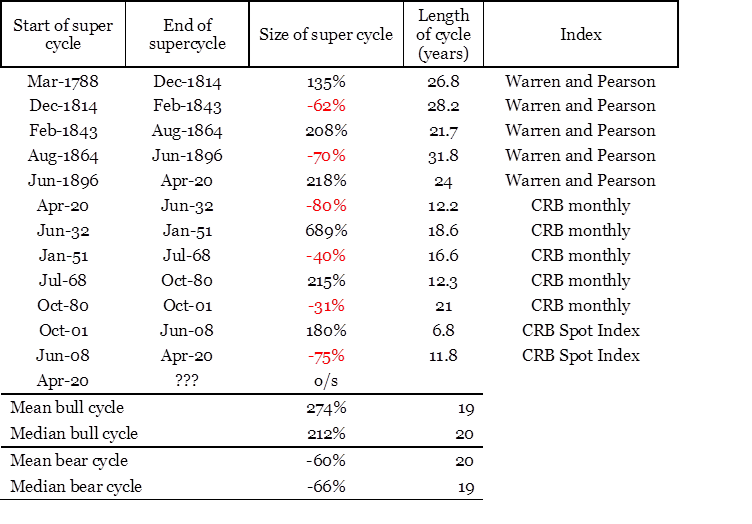

„Our estimates of the dates and sizes of commodity super cycles are listed below.“:

Da fragt man sich natürlich, wie so eine Expansion überhaupt möglich sein kann, bekämpfen wir doch gerade die Inflation. Nun, die zunehmenden geopolitischen Spannungen sprechen dagegen. Aber auch die Aussichten für die Inflation, zumindest nach Analyse von Longview Economics:

- “(…) given how sharply money supply measures have slowed in the US, UK & Eurozone, then over coming months (…) many Western central banks, start stimulating aggressively. (…) Whether or not that switch occurs, though, is critical as to whether we have begun a new Commodities Super Cycle in 2020. Without a further bout of aggressive stimulus into a downturn, the analysis and history of prior commodity super cycles suggests that it’s unlikely that there will be a further major surge in commodity prices and headline CPI. (…) If, however, as seems more likely, central bankers remain reactionary, and look to the lagging data like CPI and employment for their steer on how to guide monetary policy, then an aggressive policy reaction (in response to weak inflation and a recession) seems likely. In that scenario, this commodity super cycle, which began in 2020, should continue.” – bto: Das Szenario ist also, dass wir eine Krise bekommen und daraufhin die Geldschleusen noch einmal so richtig geöffnet werden.