Der “faire Wert” für Gold?

Bekanntlich halte ich viel von Gold als Beimischung im Portfolio mit dem Ziel einer Versicherung gegen Unfälle im Finanzsystem. Doch wie viel sollte man für Gold bezahlen. Die Deutsche Bank ging der Frage kürzlich nach (via Zero Hedge):

- “(…) gold has traded in a rather somnolent fashion, range bound between $1,100 and $1,300 over the last few years, failing to break out on either side.” – bto: Das geschah auch, weil es immer wieder merkwürdige Verkaufsaufträge gegeben hat.

- “But is that a fair price for gold? That is the question Deutsche Bank (…) set out to answer (…) – bto: Beim letzten Mal hat die DB 750 US-Dollar prognostiziert, im Herbst 2015 und danach gab es eine schöne Rallye.

- “(…) gold’s nature is far more mercurial. Gold can be many things to many different people – a store of value, a financial asset, a medium of exchange, a currency, an insurance policy against disruptive events or global uncertainty (…) the value of gold is more likely to be determined on a relative basis depending on the individual’s perception of gold.” – bto: Deshalb gibt es auch Beobachter wie William Buiter von der Citigroup, die allen Ernstes von einer Blase bei Gold sprechen, die schon 6000 Jahre andauert.

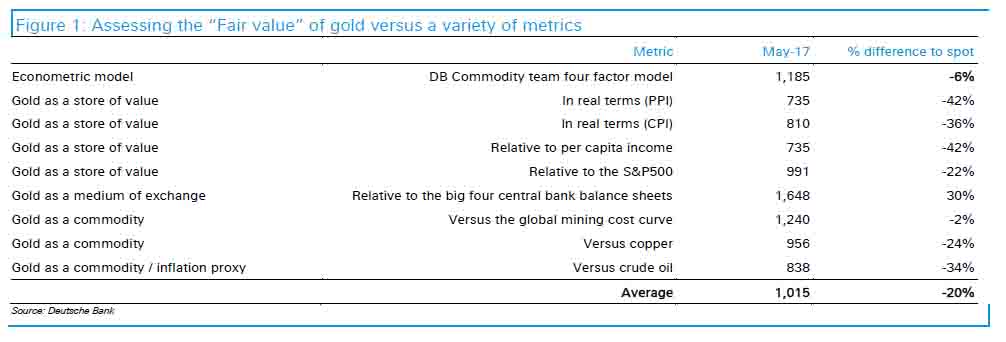

- “(…) in our table below the average of all the selected metrics would suggest that gold should trade around USD1,015/oz, with relative G7 per capita income valuing gold at USD735/oz, whilst the bloated size of the big four central bank balance sheets suggesting that gold should travel at USD1,648/oz.” – bto: hier die (leider schlecht lesbare) Übersicht der DB:

- “DB’s take: the reason why gold is trading with a roughly 20 % premium to ‚fair value‘ is because ‚there is a heightened perception of risk or uncertainty in the broader markets‘.” – bto: und das wohl nicht zu Unrecht!

- “At first glance the price of gold relative to the marginal producer on the cost curve would provide a perfect yardstick to determining the fair value of gold. There are however two fundamental problems with this method. The first is that the conventional supply demand analysis does not work very well for gold. Partly due to its value and enduring nature (and high incentive to recycle), very little gold is actually consumed or lost every year. Thus every year, we add to the stocks of gold, with the industrial surplus being ‚consumed‘ by financial investors. We would argue that even the jewellery market is not ‚pure‘ consumption and the motivation is linked to a store of wealth.” – bto: Das klingt nachvollziehbar, weshalb es eben kein gewöhnliches Gut ist.

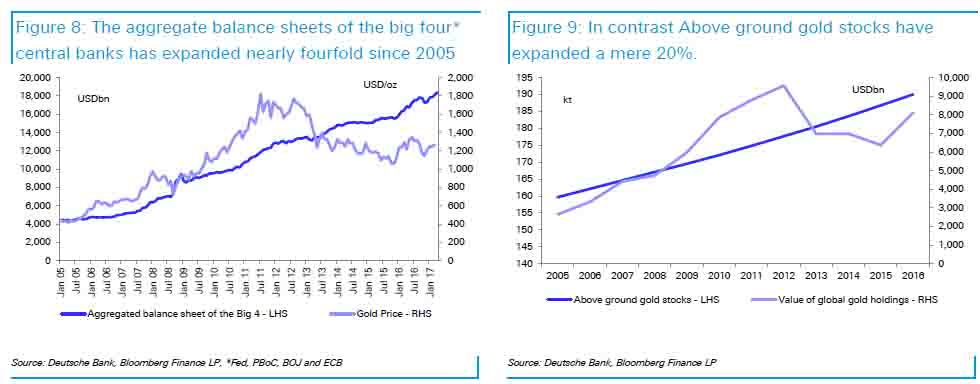

- “(…) gold is a purer form of money because it actually costs something to produce, compared to fiat currencies which cost very little. However, the concept of relative scarcity or abundance comes into play. If the rate at which fiat currencies have been printed exceeds that rate at which gold has been mined, then ceteris paribus, gold should become scarcer and rerate versus fiat currencies. Since 2005, central bank balance sheets have expanded nearly fourfold. In contrast the global above ground stocks of gold have expanded a mere 20 %. The gold price has rerated accordingly, but not enough to keep the value of gold at parity with the global (big four central banks to be precise) money stock. The average ratio since 2005 between global money stocks and the value of global gold stocks is c.1.8x. In order for gold to get back to this level, the price should appreciate to USD1,648/oz, nearly USD300/oz above the current spot price.” – bto: Das kann so sein, muss aber nicht sein. Sonst müssten eigentlich alle Güter so reagieren, was sie ja nur zum Teil tun, siehe Aktien.

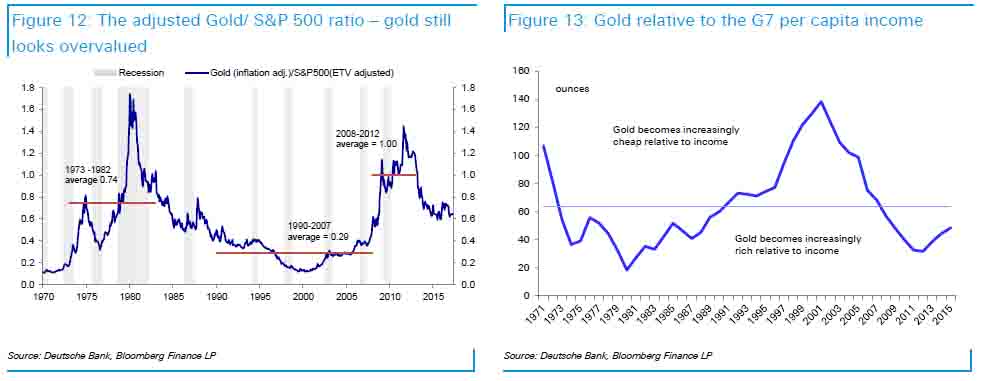

- “In terms of the relationship between gold and the S&P500, we have adjusted both for inflation and applied a further equity time value adjustment. Both should rise with inflation, but the S&P 500 should rise more and its retained and reinvested earnings should generate real EPS growth. We find that the adjusted gold to S&P500 ratio at 0.65x is still above its historical average of 0.54x. To bring this ratio back to its long run average would require the gold price to fall to USD990/oz. The average G7 per capita income since 1971 could buy just over 62 ounces of gold. Currently the average per capita income can purchase 47 ounces which implies that gold should trade at USD740/oz.” – bto: Bei der Relation zu Aktien gehe ich nicht ganz mit, weil der Zeitraum zu kurz ist. Ich denke nicht, dass Aktien, verglichen mit Gold, wirklich billig sind.

→ www.zerohedge.com: Deutsche Bank Calculates The ‚Fair Value Of Gold‘ And The Answer Is…“,

1. Juni 2016