Demografie, Zins, Inflation und Ungleichheit

Die demografische Entwicklung wird die Wirtschaft in den kommenden Jahrzehnten prägen. Schon früh habe ich darauf hingewiesen, dass der Rückgang der Erwerbsbevölkerung und der Anstieg der Abhängigen tendenziell inflationär wirkt:

→ Führt die Alterung zur Inflation?

Dabei wird es nicht bleiben. Die Demografie stand hinter Zins- und Inflationsrückgang in den letzten Jahrzehnten und auch hinter der Assetpreisinflation. Dies dürfte sich nun ändern, so zumindest ein bereits vor drei Jahren erschienenes Paper:

- “The global economy over the last 35 years has experienced three significant trends; a decline in real interest rates (supporting asset prices), a drop in real labour earnings in advanced economies (AEs), and, perhaps most startling of them all, a meteoric rise in inequality within countriesalongside a drop in inequality between them. All three trends have been researched extensively, but individually, locally and independently from one another.” – bto: Vor allem die Ungleichheitsdiskussion springt zu kurz – ich verweise auf meine Piketty Kritik.

- “(…) we believe all three trends need to be examined together in a global context. Specifically, we argue that demographic developments over the last 35 years have driven falling real interest rates, inflation and wages, and rising inequality within countries as well as some of the falling inequality between AEs and emerging market economies (EMEs). (…) If we include the integration of the gigantic labour forces of China and eastern Europe into the global economy, then global demographic dynamics do help to explain all three trends. But if that is correct, then the demographic reversal that the global economy will witness over the coming decades will also reverse the fall in real interest rates and inflation, while inequality will fall.” – bto: weil steigende Löhne folgen und höhere Zinsen. Beides reduziert Ungleichheit.

- “The combination of fertility and longevity were responsible for pushing dependency ratios lower. In addition to the decline in fertility, which came earlier, it is the increase in longevity that has created quite an impact. This combination of an earlier fall in fertility and, later, a rise in longevity pushed the dependency ratio lower to create the demographic sweet spot. How? Put simply, the ratio of those of working age rose sharply relative to the dependent young (since the birth rate was falling) and to the old (since the population was still growing fast and longevity was slower to increase as much).” – bto: Damit haben wir hier deflationäre Rahmenbedingungen.

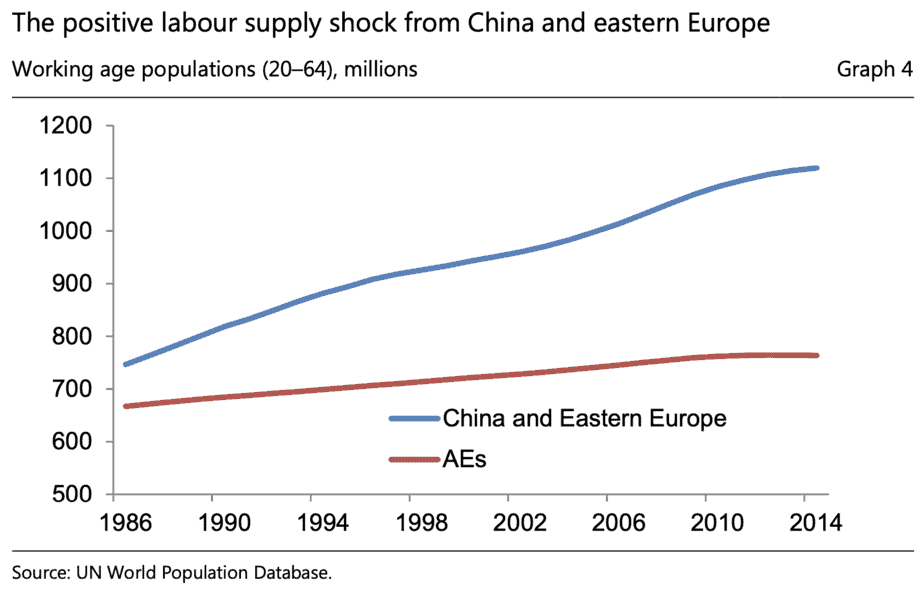

- Das hat vor allem mit der Integration Chinas in die Weltwirtschaft zu tun: “Counting just the potential workforce, the working population in China and eastern Europe (aged 20–64) was 820 million in 1990 and 1,120 million in 2014, whereas the available working population in the industrialised countries was 685 million in 1990 and 763 million in 2014 (Graph 4). That represents a one-time increase of 120% in the workforce available for global production.”

Quelle: BIZ

- “(…) demographic developments over the last 35 years help explain the fall in real interest rates thanks to a pickup in ex ante savings over investment. Expanding on that, if the supply of labour (relative to capital) rises, its price (the wage rate) will fall. This is highly important in regard to the developments that have taken place over the last 35 years. With supply increasing, not only will wages be lower, but the marginal productivity of labour will also be less. That is exactly what we saw in AEs as real wages there fell consistently. The two combined to raise inequality within the AEs. Declining real wages and a smaller share of labour in national output naturally meant that inequality rose. Thus, we attribute rising inequality, along with falling real interest rates, inflation and real earnings, to demographic dynamics in the global economy.” – bto: Das klingt zumindest nicht so fernliegend.

- “(…) the sweet spot is disappearing and will quickly turn sour. In particular, the dependency ratio – the ratio of workers to the elderly in the population – will worsen rapidly. We are at a point of inflection, and the rate of decline is predicted to steepen for AEs, EMEs and especially China and Germany, about now. The result of this is that the total working age population in the world, having grown fast between 1970 and 2005, will now grow much less rapidly. In the AEs and North Asia, not only will the working age population show outright declines, but the ratio of workers to the elderly will worsen sharply.” – bto: Damit ändert sich die Dynamik grundlegend.

Wie? Nun die Autoren sehen mehrere Folgen:

1. Die Zinsen werden wieder steigen

- “Rather than use growth as the determinant of the equilibrium real interest rate, we use the standard classical theory that in the medium and long run (after the temporary effect of central bank policy on local real short-term rates dissipates), real interest rates move to adjust differences in ex ante savings and ex ante investment, falling when desired savings are greater than desired investment, and vice versa. So the declining trend in real interest rates over recent decades, from 1980–2015, is prima facie evidence that ex ante savings have exceeded ex ante investment over this period.” – bto: Ich denke jedoch, dass die Politik der Notenbanken diesen Trend zusätzlich verstärkt hat – Vor allem durch die Ermunterung zur Spekulation.

- “Both health expenditures and expenditures on public pension transfers will continue to rise along with the ageing of AE societies. So far, measures to enforce participation in the labour force by raising the retirement age have not materialized, except in a handful of places which have enforced a modest increase in retirement age. Longevity, on the other hand, has gone up significantly thanks to medical advances and might go up further if the science of ageing makes rapid advances. As a result, the gap between longevity and the retirement age has been increasing in line with increases in longevity.” – bto: Damit gehen die Kosten für die ältere Generation nach oben.

- “Demographics will ensure that China’s extraordinary savings will fall. (…) Although a higher proportion of the old work in Asia than in Europe or North America, increasing longevity will increase the dependency ratio, in China and elsewhere. The result will be a decline in the personal sector savings ratio and in China’s current account balance; indeed, this has already begun. China’s ageing will also reduce excess savings among oil exporters. (…) With China’s growth declining, and with the need to shift from fossil fuels to renewables, the net savings and current account surpluses of the petro-currency countries are likely to erode. Indeed, all those countries which have had current account surpluses (large net savings) are either ageing rapidly (China and Germany), or are likely to see their relative advantage reduce (the petro-currency countries).” – bto: Klare Folge ist weniger Angebot an Ersparnissen.

- “(…) the corporate sector is likely to respond by raising the capital/labour ratio, ie by adding capital to compensate for labour, which is the factor of production that is getting scarcer and more expensive. (…) The resulting increase in productivity will somewhat temper the increase in wages and inflation. (…) Given significantly cheaper capital goods, the cost of accumulating a given stock of capital uses up a smaller amount of the economy’s stock of savings. To some extent, this can counter the savings deficit created by ageing demographics and somewhat temper the rise in both the interest rate and wages.” – bto: Außerdem vermuten die Autoren, dass die Nachfrage nach Immobilien hoch bleibt, weil die Alten nicht aus ihren Häusern ausziehen.

2. Folgen für Inflation, Ungleichheit und Politik

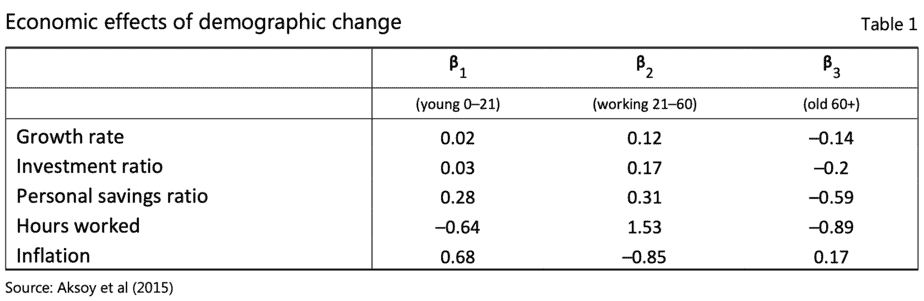

- “(…) a group of Birkbeck economists have undertaken an econometric and theoretical study of the consequences of such demographic changes. Since we largely accept both the direction of travel, and rough magnitudes, of most of their results, we have simply reproduced their main table:”

“These conclusions fit with our own thinking about the effects of demographics, in that:

- growth is the first and most obvious casualty, with a decline in overall growth, and total hours worked will inevitably fall.

- both higher proportions of young and old are inflationary, and it is only the working cohort that can be deflationary for the economy.

- both the investment and personal savings ratio will decline (…).” – bto: Das leuchtet auch mir ein.

Und daraus folgt:

- “The ineluctable conclusion is that tax rates on workers will have to rise markedly in order to generate transfers from workers to the elderly. Workers, however, would not be helpless bystanders. Labour scarcity will put them in a stronger bargaining position. They will use that position to bargain for higher wages. This is a recipe for recrudescence of inflationary pressures.” – bto: Weil die Belastung der Arbeit nach oben geht, muss es inflationär wirken – und so die Alten indirekt doch belasten.

- “As Piketty and Atkinson have reminded us, inequality within most countries has risen in recent decades. Inequality between countries, however, has fallen as north Asia has caught up with Europe. The huge positive supply shock to world labour means that this was to be expected. Why? There are at least three reasons to consider:

- 1. A positive labour supply shock lowered AE wages and productivity. Thanks to the positive labour supply shock, the return to labour fell relative to the return to capital. This created greater inequality within an economy but greater equality between countries, with the marginal productivity (real wage) in China and eastern Europe rising relative to the West (and Japan).” – bto: Klar, es gab Lohndruck und dieser führt natürlich zu größerer Ungleichheit. Man konnte es noch verschlimmern, wenn man zugleich den Wettbewerb im Niedriglohnsektor durch Zuwanderung befeuerte.

- “2. The relocation of production led to higher inequality. Employers in AEs could and did relocate production to China or eastern Europe. Along with the downward pressure on the price of manufactured goods, this led to deflationary pressures, both on AE domestic demand and AE inflation. As a direct result, monetary policy became more expansionary, and nominal and real interest rates trended downwards. The process started around 1980–82, just after the turn of the demographic cycle. Lower yields raised asset prices, and exacerbated the increasing inequality of wealth within each country.” – bto: Wir wissen, dass es vor allem Immobilien waren, die im Wert gestiegen sind. Zum einen wegen des immer billigeren Geldes, zum anderen,” weil Banken nichts lieber beleihen.

- “3. Such relocation helped raise the savings rate in China and raised the returns to capital. (…) With fewer children to support them later in their old age, and an inadequate social safety net, the growing population of China (and eastern Europe) saved more voraciously than needed to match the high investment ratios, leading to massive export surpluses, and the well known imbalances and savings glut.” – bto: Auch das macht Sinn. Es kam alles zusammen.

- “Piketty is history, not the ineluctable future. If these global demographic trends drove inequality higher, then their reversal could lower inequality too. Labour had lost much of its power to command higher wages between 1980 and 2010. Now labour will become increasingly scarce. The labour share of income, having trended down in most AEs since 1970, is now likely to rebound.” – bto: Das sehe ich ganz genauso, wir bekommen höhere Löhne und auch höhere Zinsen.

Die Autoren diskutieren dann, ob Indien und Afrika den Rückgang der Erwerbsbevölkerung auffangen können und bezweifeln dies letztlich. Es hat zu tun mit den Rahmenbedingungen, der Möglichkeit, Unternehmen zu gründen und dem Bildungsniveau. Hinzu kommt, dass es auch nicht so leicht werden wird, den Anteil der über 65-jährigen Arbeitenden zu erhöhen. Zum einen gab es in den letzten Jahren hier schon Fortschritte, zum anderen sind die Rentenzahlungen zu großzügig.

Was zur nächsten Frage führt: Was tun mit der hohen Verschuldung?

- “The world is still awash with debt, and the increase in leverage has been encouraged by interest rates being pushed to historic lows in the advanced economies and in north Asia. If US real interest rates rise or threaten to rise quickly, debt servicing will become more difficult, in turn putting downward pressure on spending and real interest rates more generally.” – bto: Es würde zu einem Verfall der Assetpreise führen und damit auch die Ungleichheit reduzieren.

- “There are three main paths to deleveraging: inflating away debt, forgiving it, and making it permanent. Historically, the former two have played an important role, and while both will feature in this episode, we doubt they will play the lead role. A significantly high level of inflation will be needed to make a dent in the real burden of debt – this may be hard to generate quickly.” – bto: Das erleben wir seit Jahren schmerzhaft, denn wer hätte sie nicht schon gerne gehabt, die Inflation? O. k., wir haben sie bei den Assetpreisen seit Jahren erlebt, eine Entwicklung, die sich mit höheren Zinsen umkehren würde.

- “The demographic sweet spot is already behind us, and both the equilibrium real interest rate and inflation have probably already stopped falling. That removes an important support for the bond market after a 35-year stretch. (…) At some point, that increase in yields will prove to be exogenous from the point of view of those with excessive leverage. We therefore feel that leverage will have to be dealt with over the next three to five years thanks to this mix of structural and cyclical forces.” – bto: Der Beitrag wurde vor Corona geschrieben. Nun kann und muss man davon ausgehen, dass der Druck zur Entschuldung noch größer ist, angesichts der massiv höheren Verschuldung und der Zwang, die Zinsen tiefer zu halten und damit über finanzielle Repression die Geldvermögen/Schulden zu entwerten.

Damit haben wir einen Input zur Frage Inflation oder Deflation. Weitere werden kommen.