Demografie und Aktien

Demografie war immer wieder Thema auf diesen Seiten. Doch wie wird sich die Entwicklung auf die Vermögenspreise auswirken? Negativ, so zumindest diese interessante Argumentation:

- “Japan’s population is expected to decline by 40% between 2020 to 2100, falling from 126 million to 75 million. (…) Japan is a harbinger of what’s to come across much of the world. And while fewer people may be good for the environment, it is terrible for civilization. Economic growth hinges on an expanding population. And the fabric that holds society together is always torn when the economy unravels.” – bto: Deshalb muss man eben alles versuchen, um die ökonomischen Konsequenzen dieser demografischen Entwicklung abzumildern.

- “This trend is also terrible for investors: Old people tend not to buy stocks. So what exactly is the relationship between stock markets and population growth? Why are demographic trends so critical for equity returns?” – bto: Das ist eine sehr interessante Frage, vor allem weil wir ja umgekehrt das erhebliche Risiko haben, dass die Schuldenprobleme uns – wie auch immer – auf die Füße fallen.

- “Simply stated, companies require economic growth to prosper, and gains in productivity and the working-age population are what drives that growth. We haven’t found a way to stop the aging process, so an expanding population is required to replenish and expand the number of workers who contribute to the economy. If that working-age cohort is shrinking, stagnation may set in and firms will have a harder time growing their revenues and earnings. As a consequence, their valuations will decline since they depend on expected growth.” – bto: Es sei denn, sie verlagern sich in bessere Regionen der Welt.

- “But there is more to this equation: Every transaction has a buyer and a seller. The young and middle-aged tend to buy more stocks: They have a longer investment time horizon and thus more capacity for the risk inherent in equities. In contrast, the elderly are net sellers as they de-risk their portfolios by moving from stocks to bonds. So, as the population ages, who will be left to buy stocks?”

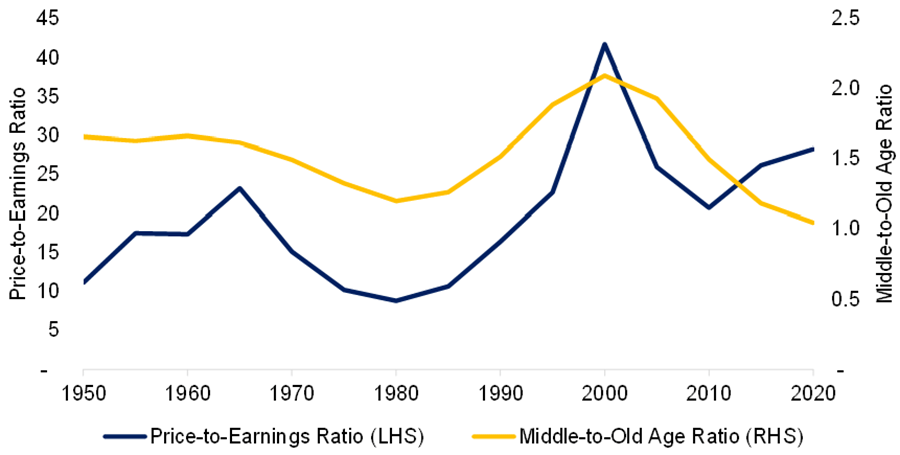

- “One way to visualize the impact of population changes is to calculate the middle-to-old-age and price-to-earnings (P/E) ratios. Zheng Liu and Mark M. Spiegel of the Federal Reserve Bank of San Francisco demonstrated this in ‘Boomer Retirement: Headwinds for U.S. Equity Markets?’. We replicate their approach by using the cyclically-adjusted P/E (CAPE) ratio, which shows that the valuation of US stocks between 1950 and 2020 was largely driven by population changes. When the ratio of middle-aged people, or those between 40- and 49-years old, increased relative to the elderly, or those between 60 and 69, stock valuations rose. In turn, the higher the valuation, the higher the stock returns.” – bto: Und das ist die Abbildung dazu. Leuchtet ein!

Price-to-Earnings and Middle-to-Old Age Ratios in the United States

Quelle: CFA Institute

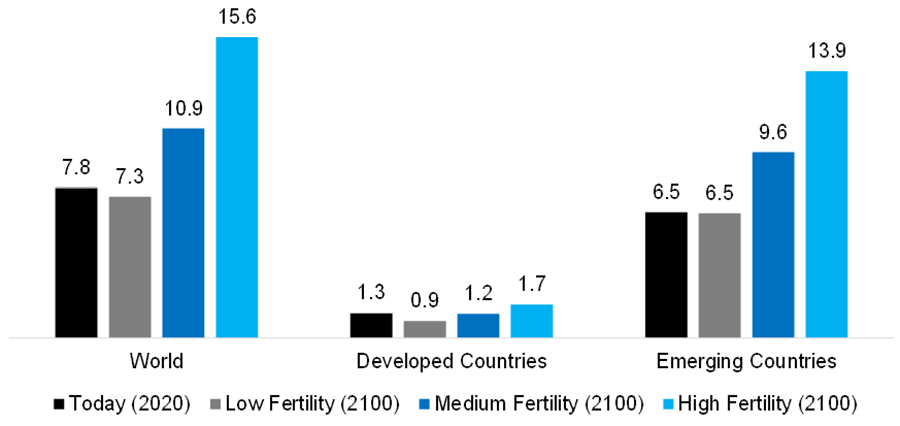

- “If population growth contributes to economic prosperity and stock valuations, United Nations (UN) population forecasts offer a glimpse of the future. A fertility rate of 2.1 — each woman bearing 2.1. children on average — is considered the replacement rate, or what’s required to maintain the current population level.” – bto: Und es unterscheidet sich natürlich erheblich regional.

Global Population Growth Forecasts Based on Fertility Rates (in Billions): 2020 to 2100

Quelle: CFA Institute

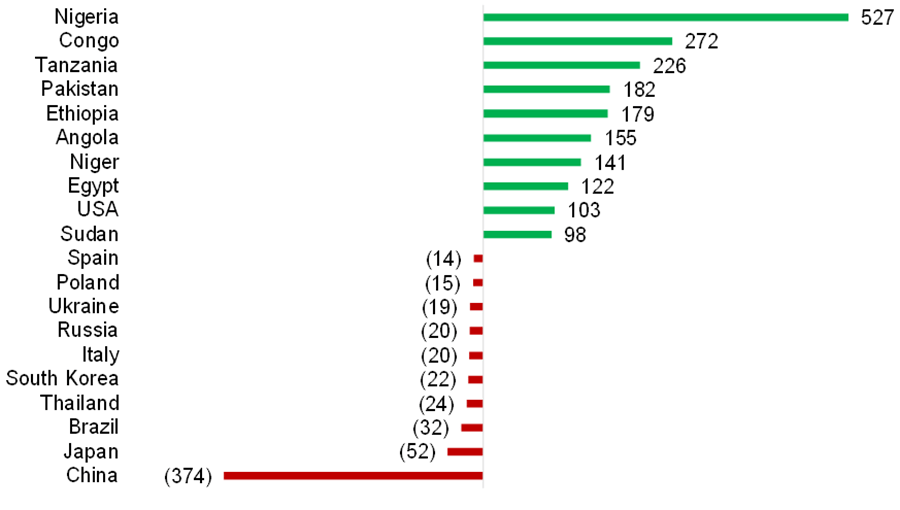

- “The only developed nation among the top 10 in expected population growth is the United States.”

- “(…) Perhaps this century will belong to Africa and the continent’s emerging economies will evolve into developed ones. Unfortunately, history suggests this is not altogether likely. Of the world’s most advanced nations in 1900, 90% were still among the most economically developed 100 years later. Japan and South Korea moved from poor to rich and Argentina went from rich to poor, but otherwise the ranks of the developing and developed remained largely static.” – bto: Es ist interessant, sollte aber nicht als Garantie angesehen werden, dass Deutschland und Europa nicht dem argentinischen Weg folgen.

- “Africa has struggled to realize its potential. None of its 54 nations has made a leap like South Korea, which was poorer than many African states in the 1950s, but developed into an industrial powerhouse. Offering cheap labor is a classic development model, but that hasn’t worked in Africa.” – bto: Das ist vor allem wegen des bevorstehenden technologischen Schubs wichtig. Ein Blick auf die Pisa-Leistungen in Afrika stimmt nicht optimistisch.

- “In such wealthy countries as Italy and Spain, the forecasts are especially stark. They are expected to lose 34% and 29% of their populations, respectively. The reverberations for the global economy will be severe as demographic decline sets in throughout many of the world’s wealthiest nations. Shrinking populations also make governing more difficult as public services like education and health care become more expensive.” – bto: vor allem, weil dafür überhaupt nicht vorgesorgt wurde!

Top 10 Population Gains and Losses by Country (in Millions): 2020 to 2100

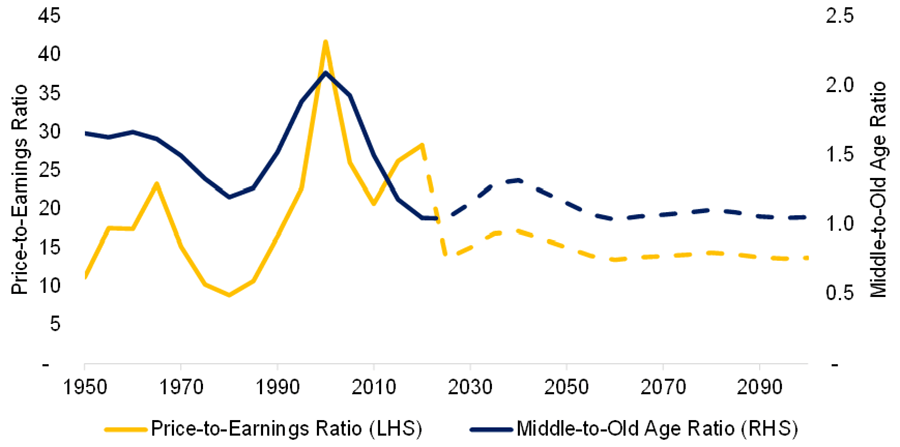

- “Naturally, the valuations-to-population interplay is not a linear relationship and currently the CAPE ratio is well above its historical average and isn’t where it should be based on population dynamics. But as more US workers retire, they will swap equities for bonds, which does not bode well for the long-term demand for stocks. Every seller needs a buyer.” – bto: Das kennen wir aus der Theorie, und wenn die Afrikaner dann nicht die Käufer sind, wird es schwer.

US Price-to-Earnings Ratio: Forecasting the Next 80 Years

- “Fortunately, most of the dramatic population declines are expected after 2050. Before that, only Japan is affected significantly. Perhaps it’s finally time to short Japanese government bonds? Otherwise, these forecasts make a strong case for not only selling stocks for the long-term, but also selling all asset classes that are bets on economic growth. That means bonds, real estate, and private equity.” – bto: Was man stattdessen kaufen soll, wird allerdings nicht gesagt …

→ blogs.cfainstitute.org: “Aging and Equities: Selling Stocks for the Long Term”, 21. September 2020