Corona-Depression statt V?

Kürzlich hatte ich bereits einen skeptischen Blick auf die Weltwirtschaft in Corona-Zeiten aus den USA. Nun kommt TIME Magazin mit einem ähnlich skeptischen Blick auf die Lage:

- “(…) those expecting a so-called V-shaped economic recovery, a scenario in which vaccinemakers conquer COVID-19 and everybody goes straight back to work, or even a smooth and steady longer-term bounce-back like the one that followed the global financial crisis a decade ago, are going to be disappointed.” – bto: eine skeptische Sicht, die ich teile.

- “(…) there are three factors that separate a true economic depression from a mere recession. First, the impact is global. Second, it cuts deeper into livelihoods than any recession we’ve faced in our lifetimes. Third, its bad effects will linger longer.” – bto: Eigentlich gilt das schon für die Finanzkrise, von der wir uns auch nicht richtig erholt haben.

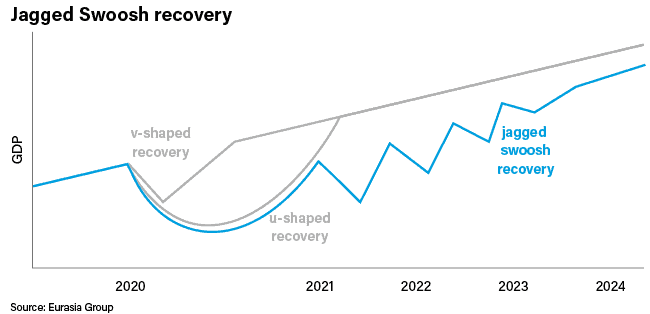

- “A depression is not a period of uninterrupted economic contraction. There can be periods of temporary progress within it that create the appearance of recovery. The Great Depression (….) included two separate economic drops: first from 1929 to 1933, and then again from May 1937 into 1938. As in the 1930s, we’re likely to see moments of expansion in this period of depression.” – bto: Und wir werden massive staatliche Interventionen sehen.

- “Depressions (…) change the way we live. (…) COVID-19 fears will bring lasting changes to public attitudes toward all activities that involve crowds of people and how we work on a daily basis; it will also permanently change America’s competitive position in the world and raise profound uncertainty about U.S.-China relations going forward.” – bto: Das waren aber schon Themen vor Corona, sie werden jetzt nur verstärkt.

- “This is a synchronized crisis, and just as the relentless rise of China over the past four decades has lifted many boats in richer and poorer countries alike, so slowdowns in China, the U.S. and Europe will have global impact on our globalized world. This coronavirus has ravaged every major economy in the world. (…) middle-income and developing countries are especially vulnerable, but the debt burdens and likelihood of defaults will pressure the entire global financial system.” – bto: Ein Problem, dass es bekanntlich schon vorher gab.

- “Signs of corporate economic distress are mounting. And second and third waves of coronavirus infections could throw many more people out of work. In short, there will be no sustainable recovery until the virus is fully contained. That probably means a vaccine. Even when there is a vaccine, it won’t flip a switch bringing the world back to normal. Some will have the vaccine before others do. Some who are offered it won’t take it. Recovery will come by fits and starts.” – bto: Die Hoffnung liegt in der Tat auf dem Thema Impfstoff. Ich denke, die Überzeugung ist da, dass wir diesen brauchen, um die Wirtschaft wieder zum Laufen zu bekommen.

- “The Congressional Budget Office has warned that the unemployment rate will remain stubbornly high for the next decade, and economic output will remain depressed for years unless changes are made to the way government taxes and spends. Those sorts of changes will depend on broad recognition that emergency measures won’t be nearly enough to restore the U.S. economy to health. What’s true in the U.S. will be true everywhere else.”

Quelle: Eurasia Group, TIMES

- “(….) G-7 governments and their central banks moved quickly to support workers and businesses with income support and credit lines in hopes of tiding them over until they could safely resume normal business. The Fed, European Central Bank, Bank of England and Bank of Japan threw out the rule book to add unprecedented support to ensure markets could continue to function. This liquidity support (along with optimism about a vaccine) has boosted financial markets and may well continue to elevate stocks. But this financial bridge isn’t big enough to span the gap from past to future economic vitality because COVID-19 has created a crisis for the real economy. Both supply and demand have sustained sudden and deep damage. And it will become progressively harder politically to impose second and third lockdowns.” – bto: Diese Ansicht teile ich. Kommt es zu weiteren Infektionswellen, werden wir sie hinnehmen, was aber nicht bedeutet, dass die Wirtschaft dann nicht beeinträchtigt ist.

- “(….) governments could do more to coordinate virus-containment plans. But they could also prepare for the need to help the poorest and hardest-hit countries avoid the worst of the virus and the economic contraction by investing the sums needed to keep these countries on their feet. Today’s lack of international leadership makes matters worse.” – bto: Ich denke, es wird erst dann ein Problem, wenn klar wird, dass die Erholung nicht kommt.

→ time.com: “The Next Global Depression Is Coming and Optimism Won’t Slow It Down”, 17. August 2020