Chinas wahre Staatsverschuldung verhindert mehr Konjunkturprogramme

Wird China in der Lage sein, wieder hohe Wachstumsraten zu erzeugen? Gerade mit Blick auf die Weltkonjunktur und die Rohstoffmärkte eine wichtige Frage. Wohl nicht:

- „Covid lockdowns, weak consumer demand, and brittle private sector confidence are causing major disruptions to the Chinese economy. Headline growth has slowed to a crawl and the economic reality may be even worse than what official statistics indicate. In the face of such a challenging environment, many observers have wondered why the Chinese government has not done more to stimulate the economy.“ – bto: Oder umgekehrt, ob die harten Lockdowns ablenken sollten?

- „Recent statements by Premier Li Keqiang confirm that some in China’s leadership view the economic situation as potentially worse than in 2020. This assessment is correct: China’s current situation is indeed more precarious than it was then. The real estate sector is weaker, the financial system is facing more severe risks, and the growth and dynamism of the private sector have been significantly damaged.“ – bto: Das ist gut mit Blick auf die Inflation, aber nicht unbedingt gut mit Blick auf das Wirtschaftswachstum in der Welt.

- „Given the current economic risks, then, why has China’s stimulus been so underwhelming? The answer involves the balance sheet constraints of the Chinese government and the ways in which they limit the scope of possible policy responses.“ – bto: Das ist interessant. Allerdings weiß man schon lange, dass China eine Verschuldungspolitik nach westlichem Vorbild betreibt – wie ich mal geschrieben habe – wobei die Schulden vor allem im Nicht-Staatssektor liegen (wenn man Staatsunternehmen nicht zum Staat zählt).

- „China has provided three major economic stimuluses over the past 15 years. Each program shrunk the fiscal space available to respond to the next crisis. China’s leadership was extremely concerned about the impact of the global financial crisis, which caused a precipitous collapse in global demand and large job losses in export industries in China. To help offset the effects of the crisis, policymakers announced a massive stimulus program that included 4 trillion Renminbi (RMB) in spending, focused primarily on infrastructure. Of the 4 trillion RMB in announced spending, the central government committed to financing only 1.22 trillion – just 30%. The remainder fell upon local governments, banks, and state-owned enterprises (SOEs).“ – bto: Das ist übrigens deshalb interessant, weil wir in Europa jetzt den gleichen Weg beschreiten: über Garantien die Kreditvergabe im Privatsektor beleben und steuern.

- „Local governments faced a dilemma. They were tasked with implementing the stimulus spending but were legally prohibited from directly issuing their own debt. To overcome this obstacle, they turned to off-balance sheet shell companies called local government financing vehicles (LGFVs) to finance their spending. The central government tacitly blessed this workaround, given the exigencies of the situation.“ – bto: Bei uns würde man es Sondervermögen nennen… Es sind faktisch Schattenhaushalte, die hier geschaffen wurden.

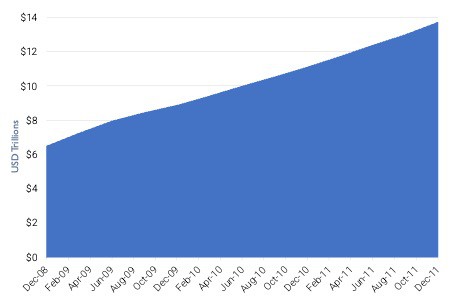

- „Financial regulatory standards were also loosened, as the government pressured banks to lend freely. This move led to a massive increase in debt, with the total stock of credit in the Chinese economy more than doubling between the end of 2008 and the end of 2011. LGFVs emerged as one of the largest borrowers from banks during this period. Through them, local governments would ultimately end up borrowing much more than the 3 trillion RMB in stimulus spending they were tasked with in 2008. Indeed, by the end of 2012, the stock of LGFV debt was estimated to exceed 9 trillion RMB.“ – bto: Es macht aber auch Spaß, billiges Geld auszugeben – insofern eine völlig normale Vorgehensweise, gegeben den Rahmenbedingungen.

FIGURE 1: Credit to the Non-financial Sector in China 12/2008–12/2011

Source: Bank for International Settlements

- „The approach created a massive debt hangover, however, with local governments and many industries struggling to work through a mountain of bad loans in the years following the stimulus.“ – bto: Auch das ist uns gut bekannt.

- „China’s economy faced a perilous situation again in 2015. The previous year, the housing market – one of the drivers of economic growth – had begun to slow. (…) Given excess inventory and falling demand, the housing market – and the industries linked to it – were expecting a potentially steep decline. (…) After a speculative run-up in prices, the Chinese stock market plummeted. The government organized large bailout funds (the so-called national team) to support the stock market, but the effort failed to stem the decline and equity prices continued to fall into 2016. By January 2016, the Shanghai Composite Index had lost almost half its value relative to the high the previous July.“ – bto: Was bei uns nicht so viel Beachtung fand, würde ich sagen.

- „To revive the economy, the government increased spending via a variety of programs. One was a massive slum redevelopment campaign, financed by the China Development Bank, under which local governments tore down millions of old and substandard housing units and built new developments. The program provided much-needed support for the real estate market by generating new demand for housing units and soaking up excess inventory.“ – bto: Das ist so gesehen keine falsche Politik. Man verhindert einen Einbruch. Andererseits müssten wir auch zugeben, dass Immobilien immer eine unproduktive Investition sind und wenig zum künftigen Wachstum beitragen.

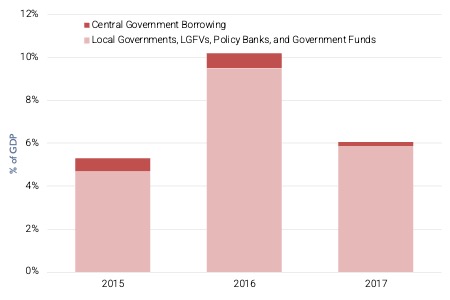

- „As in 2008, the central government directly financed very little of the spending. Local governments, LGFVs, policy banks, and government funds were responsible for the bulk of stimulus expenditures; the central government was responsible for only a small fraction of the government debt incurred during this period.” – bto: Das Problem ist nur, dass im Falle einer Schuldenkrise diese Nicht-Staats-Schulden letztlich doch zu Staatsschulden warden. Siehe Japan, aber auch Spanien.

FIGURE 2: Annual Increase in Chinese Government Debt, by Source 2015–2017

Sources: International Monetary Fund, CEIC, Seafarer

- „The credit intensity of growth – a measure of how much new credit is required to produce additional economic growth – had deteriorated significantly: in 2015–2016, three times more credit was required per unit of economic growth than in 2007–2008.“ – bto: Einen ähnlichen Rückgang der Kredit-Produktivität haben wir auch erlebt.

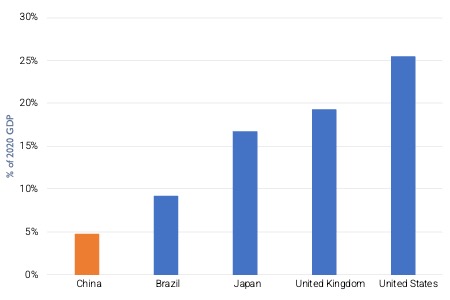

- „In response to the economic shock from the pandemic, the central government announced a stimulus package. (It) was small by global standards. As a share of gross domestic product (GDP), for example, the U.S. federal government spent five times as much as China’s central government did.“ – bto: Wobei die USA, wie wir wissen, damit übertrieben hat und die Grundlage für die Inflation schuf.

FIGURE 3: Covid-related Fiscal Spending by the Central Governments of China and Selected Countries As of 9/27/21

Source: International Monetary Fund

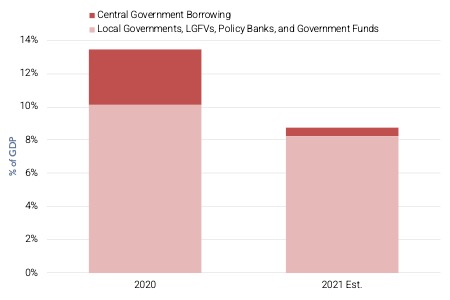

„As before, the bulk of stimulus spending occurred outside the central government’s balance sheet. Beijing permitted local governments to issue trillions of renminbi worth of additional special-purpose bonds, a type of bond used to fund infrastructure that exists in parallel to general local government debt. In 2020, for the first time, the total amount of special-purpose debt exceeded general debt. In addition, LGFVs continued to incur large amounts of debt off-balance sheet. Borrowing in 2020 by local governments, LGFVs, government funds, and the policy banks was three times higher than that of the central government and equivalent to 10% of GDP.” – bto: … was nun doch ein größerer Stimulus ist.

FIGURE 4: Annual Increase in Chinese Government Debt, by Source 2020 and 2021 (Est.)

Source: International Monetary Fund

- „Even in dire economic situations, China’s central government is unwilling to incur large amounts of debt to directly stimulate the economy. There are two principal reasons why the central government is reluctant to do so. First, the central government guards its balance sheet carefully because of large contingent liabilities. Second, to increase its control, Beijing has created a skewed fiscal system that keeps local governments cash-strapped and dependent on the central government for transfers.“ – bto: Ersteres würde für langfristiges Denken sprechen. Unsere Staaten dürften gar keine Schulden machen in dieser Hinsicht.

- „From afar, the balance sheet of China’s central government looks impeccable. China appears to have significantly lower debt levels than major advanced economies and even other emerging markets with similar levels of GDP per capita.” – bto: Und das ist in der Tat positiv zu sehen.

FIGURE 5: Ratio of Debt to GDP of China’s Central Government and Selected Countries 2021

Sources: The World Bank, CEIC, Seafarer

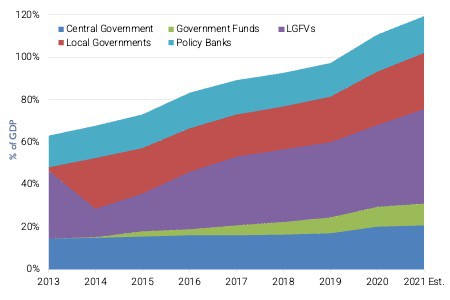

„This impression is misleading, however. Lurking behind the central government’s sterling balance sheet lies a vast array of contingent liabilities, including the following:

- Debt issued directly by local governments

- Borrowing by local government financing vehicles

- Government-backed spending funds: special construction funds and government guidance funds

- Debt borrowed by China’s enormous state-owned policy banks (China Development Bank, Export-Import Bank of China, and the Agricultural Development Bank of China)

Taken together, they are nearly five times larger than explicit central government debt.“ – bto: Da geht es noch nicht einmal um die gigantischen verdeckten Verbindlichkeiten für eine auch in China alternde Gesellschaft.

FIGURE 6: China’s Total Government Debt, by Source 2013–2021 (Est.)

Sources: International Monetary Fund, CEIC, Seafarer

- „(…) the International Monetary Fund (IMF) estimates that China will need to vastly increase pension and healthcare spending to keep pace with an aging society.“ – bto: Ein globales Problem, das in den kommenden Jahren die Industrieländer treffen wird und eben auch China.

- „Chinese policymakers have a long memory of the consequences for governments that compromise their financial strength. During the Asian Financial Crisis, China saw many neighboring countries thrown into economic turmoil and forced to request bailouts from the IMF. (…) Beijing’s precautionary approach of preserving its financial strength in the face of unknown risks has been a core tenet of its fiscal management for a quarter century.” – bto: Wobei man nicht wirklich von vorsichtiger Politik sprechen kann, wenn die Regierung andere Sektoren zwingt/ermuntert, Schulden zu machen.

- „China’s approach to stimulus is running out of steam; pushing large amounts of stimulus through local governments is becoming less and less feasible. With debt in excess of 70% of GDP, local governments have become significantly encumbered. They cannot stimulate the economy without taking on more debt – but doing so increases the possibility that local governments, or their affiliated LGFVs, fall into financial distress. This situation risks making many of Beijing’s implicit liabilities explicit. Being forced to bail out even a modest number of local governments and LGFVs would quickly affect the central government’s own balance sheet. Although Beijing still has a significant amount of fiscal space and faces no immediate limitation on its ability to borrow cheaply, it will no longer be able to maintain its extraordinarily low levels of debt.“ – bto: Letztlich wurden so nur die verdeckten Schulden transparent.

- „Recognition that the current system is approaching its breaking point appears to be growing in Beijing, where reforms to the fiscal transfer system that would better balance revenues and expenditures for local governments are under discussion. If these reforms involve a net shift in financial resources to local governments, the central government will run a high budget deficit going forward unless it increases taxes.“ – bto: Das zeigt, dass China eben nicht so eindeutig gut dasteht, wie gerne behauptet.

- „China’s best path forward is to raise the economic growth rate and grow its way out of debt. Doing so will require a recommitment to economic growth – a goal recently usurped by concerns over national security and control.“ – bto: Da haben wir ihn wieder, den Traum vom Wachstum. Auch für China ein erhebliches Problem!

→ seafarerfunds.com: „The Balance Sheet Constraints on China’s Economic Stimulus“, August 2022