Chinas Hebel im Handelskrieg

So richtig sicher bin ich nicht, wie es nun mit dem sich abzeichnenden Handelskrieg weitergeht, ob es wirklich so weit kommt oder nicht. Bekanntlich sehe ich die deutschen Überschüsse ebenfalls kritisch, vor allem aber aus unserer ureigenen Sicht.

Martin Sandbu sieht die Amerikaner als Verlierer:

- “The story of the week is how the EU’s retaliatory tariffs — which Brussels introduced in response to Trump’s tariffs on steel and aluminium imports from Europe — has prompted Harley-Davidson to move production for the European market out of the US to avoid import duties it says will add $2,200 to the cost of each motorcycle. It not the only example of domestic casualties from Trump’s trade aggression.” – bto: was allerdings die Frage aufwirft, ob diese Verlagerung nicht ohnehin schon in der Pipeline war.

- “(…) retaliatory import duties are just one of three ways Americans are hurt by their president’s protectionism.”

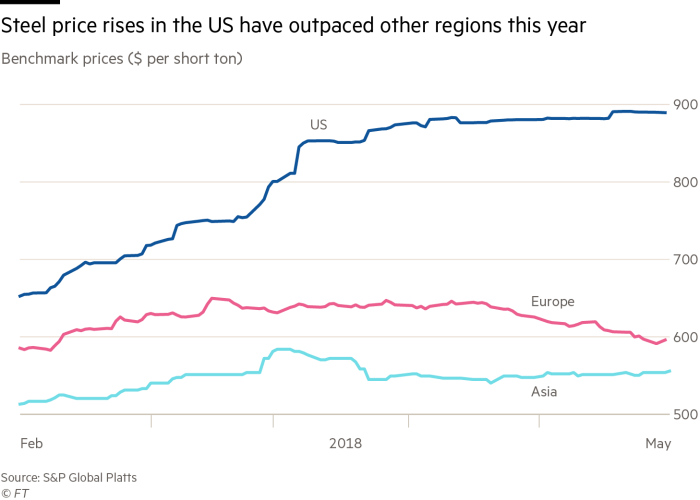

- “There is also the higher cost of steel and aluminium he has engineered, which hits the bottom line of Harley-Davidson and other metals-consuming industries directly.” – bto: sicherlich ein Nachteil für jene, die nicht vor Ort produzieren und für alle Abnehmer von Stahl.

Quelle: FT

- “(…) if other countries lower trade barriers between them in a liberalisation that does not include the US, American exporters become less competitive in those markets. That is what is happening. For example: Japanese motorcycles, the EU import duty on which is being eliminated, now stand to gain market share from American ones.” – bto: Das ist in der Tat ein Effekt, den ich auch übersehen hätte.

- “Brad Setser has looked at what else China can do to make Americans suffer from Trump’s trade war against it. Focusing mostly on the threat to sell off Beijing’s huge stake of US government bonds, he concludes that the answer is ‚not so much‘. As he correctly points out, the Federal Reserve could easily buy whatever stock of bonds China decides to sell so as to keep interest rates moderate.” – bto: Und das würde die Fed auch machen, wenn doch sonst die Geldpolitik zu sehr verknappt.

Quelle: FT

- “If China shifts its holdings from low-paying bonds to higher-yielding assets, or pursues a policy of not to finance the US economy at all, then the American economy will need to pay more to finance its current account deficit, or run down its international investment position. Such a dent in the American ‚exorbitant privilege‘ of guaranteed cheap external borrowing rates could easily be self-reinforcing in that others will demand a higher yield for holding US assets.” – bto: Das kann sein, andererseits dürfte die Kapitalflucht aus anderen Regionen – Euro! – eher noch zunehmen.

- “If this leads to a fall in the dollar and smaller deficit, that could be sustained and might just be in line with what Trump sees as desirable. But his government is not about to tighten its belt, so it would have to be the private sector doing so. That means either less investment by companies or lower consumption for households.” – bto: Allerdings führen mehr Staatsschulden auch zu mehr Geld, siehe die Diskussion des Themas von James Montier auch bei bto.

- “Trump may conclude from the fallout of the trade war that tariffs work as intended. If the EU’s retaliatory duties can make Harley-Davidson move production out of the US, surely Trump’s own protectionism can make other production move in. And his supporters, for now, seem to agree. The explicit goal of some of the president’s advisers is to repatriate supply chains. They — and Trump, and his supporters — may think a world in which each economy (at least each large economy) produces mostly for its own domestic market would be a better one than the interdependent global economy we have now.” – bto: was natürlich jeder Erfahrung widerspricht. Es gibt Vorteile der Arbeitsteilung.

- “The rise of global production chains has transformed the nature of trade since the 1980s. For good reason: continental or global-scale production is more efficient than national-scale. The upshot is to be careful what you wish for. If Trump achieves a self-sufficient US economy, it would be a much less productive American economy (than it could be, and than its rivals). That would mean squeezed living standards, an increasing awareness of falling behind global leaders and a less harmonious society that squabbles over how to divide a smaller pie. In the end even his voters might get tired of so much winning.” – bto: Dennoch haben wir das reale Risiko, dass Politik Ökonomie schlägt. Erleben wir in Europa auch jeden Tag.

→ ft.com (Anmeldung erforderlich): “Trump’s trade war carries a winner’s curse”, 27. Juni 2018