China wirkt nicht mehr deflationär – eher inflationär

Die Highlights:

- „The yuan is now at its strongest in more than three years versus the U.S. dollar. (…) According to JPMorgan Chase & Co.’s estimate of the yuan’s real effective exchange rate, based on consumer price inflation, the yuan is its least competitive since the summer of 2015. (…) If Chinese stuff is more expensive, and Americans still want to buy a lot of it, that means inflation will go up.“ – bto: Das ist simpel und einleuchtend.

- „This is a potentially profound development. For a generation, China aroused American ire by effectively exporting deflation. Chinese workers would labor for far less than Americans, and so Chinese exports put a brake on price rises in the U.S., but also led to the hollowing out of much of the manufacturing-based working class. Now, just as the issue has turned to price rises, a stronger exchange rate would mean that China is effectively exporting inflation.“ – bto: Dafür spricht ebenso die demografische Entwicklung, wie immer wieder diskutiert.

- „(…)there is no sign that China is bothered by having a strong currency. Indeed, a less competitive yuan would make sense, as it’s part of China’s long-term ambition to grow less dependent on exports, and to build up its own currency as a separate pole to the dollar. (…) priorities in China have changed from creating jobs at any cost, to something else (…) I have argued that China’s new economic imperative has become dedollarization, which inherently means a stronger renminbi. And a stronger renminbi is deflationary within China, but inflationary for everyone else. In short, deglobalization, Western efforts to ‘reshore’ supply chains and China’s changed policy priorities would seem to lie behind today’s shift from disinflation to inflation.“ – bto: Diese Sichtweise leuchtet mir sehr gut ein.

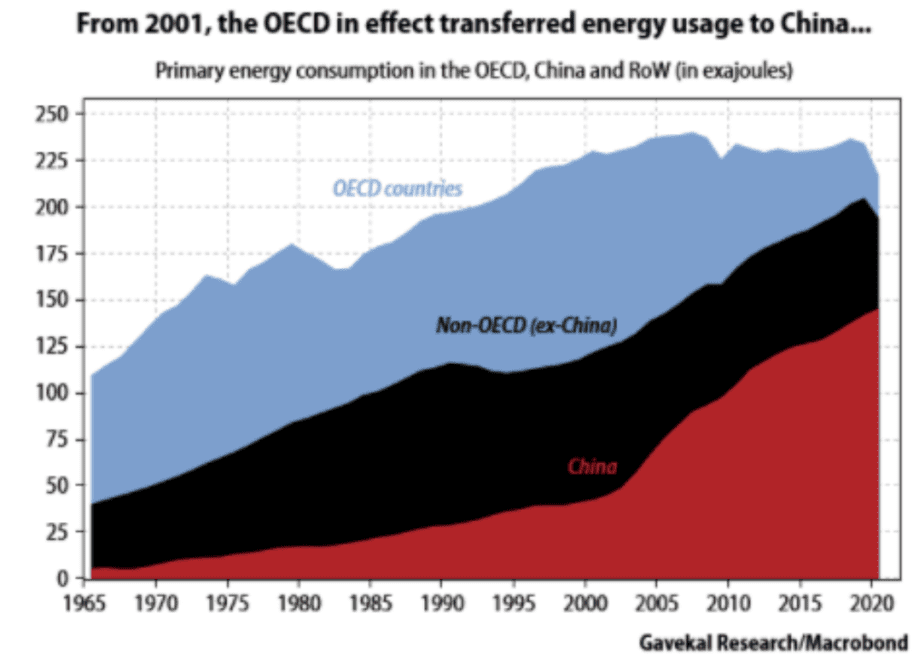

- „And there’s another way in which China has been kind enough to export deflation to the rest of the world (…). The two decades of China’s WTO membership have seen the country enjoy economic growth that has been mostly coal-powered. For many reasons, coal is a cheap way to produce energy. Meanwhile, the rest of the world has been trying to shift to other forms of energy, which tend to be more expensive. In effect, the world didn’t just outsource its labor force to China. It also outsourced use of coal:” – bto: Das Bild überrascht eigentlich nicht. Aber es lohnt, es sich vor Augen zu führen:

Quelle: Bloomberg

- „China now has an appalling pollution problem, and probably wants to stop burning so much coal. Its recent energy crisis is a sign of attempts to shift away from coal reliance. That leads to an uncomfortable conclusion: either China keeps polluting itself (and the rest of the world), or it doesn’t and other emerging countries do so instead. Or, none of them keep burning coal. In all these scenarios, that thereby increases the prices of the goods China sells to everyone else. You could argue that this is a price worth paying in the battle against climate change. (…) But the bottom line is that the rest of the world needs to get used to monitoring China as a potential source of inflation, not deflation.“ – bto: Und das ist, wie gesagt, keine gute Nachricht für eine Welt, die auf keinen Fall höhere Zinsen gebrauchen kann.