China steht so oder so im Zentrum der nächsten Krise

In den vergangenen Wochen habe ich mehrfach auf die Bedrohung hingewiesen, die von China für Weltwirtschafts- und Finanzmärkte ausgeht. Martin Wolf bespricht das Thema auch bei der FT und kommt dabei zu einem bedenklichen Fazit: Die nächste Finanzkrise könnte China im Zentrum haben. Hier seine wesentlichen Argumente:

- “(…) the Chinese economy is, to cite the celebrated words of former premier Wen Jiabao, ‚unstable, unbalanced, uncoordinated and unsustainable‘. That was true in 2007, when he said it. It is truer today.” – bto: Dazwischen lag die Finanzkrise, die China mit einer Schuldenwirtschaft ungeahnten Ausmaßes bekämpft hat.

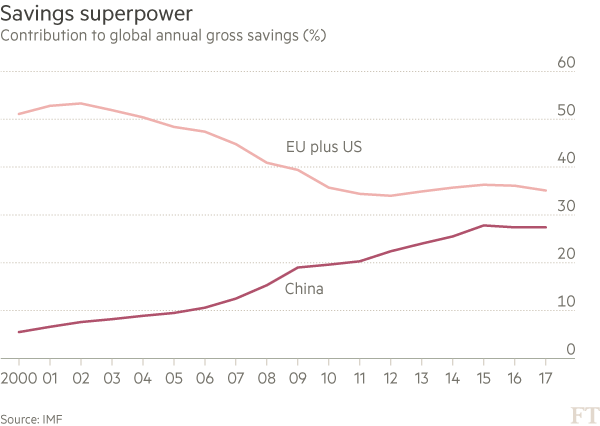

- “Annual gross savings in the Chinese economy amount to 75 per cent of the sum of US and EU savings, at over $5tn last year. China’s gross investment, at 43 per cent of gross domestic product in 2015, was still above its share in 2008, even though the economy’s rate of growth had fallen by at least a third.” – bto: Das Land ist zum Investieren verdammt, um das Problem nicht noch weiter zu vergrößern.

Quelle: FINANCIAL TIMES

- “China saves more than it can profitably invest at home. In 2015, gross national savings were 48 per cent of GDP. (…) International comparisons suggest that economic growth of 6 per cent warrants investment of little more than a third of GDP. This indicates that China’s surplus savings — surplus, that is, to domestic requirements — may be as much as 15 per cent of GDP.” – bto: Das sind Dimensionen, die die ganze Weltwirtschaft destabilisieren können. Es ist – zur Erinnerung – das gleiche Problem bei uns. Allerdings “nur” neun Prozent vom BIP.

- “Where might such surpluses go? The answer is abroad, in the form of current account surpluses. (…) It is likely that this is what would also happen now if the government relaxed exchange controls and brought credit and debt growth to a halt. Capital would pour out, the renminbi would tumble and, in time, a globally unmanageable current account surplus would emerge.” – bto: 15 Prozent Handelsüberschuss vom chinesischen BIP? Da dürfte nicht nur Trump ausrasten.

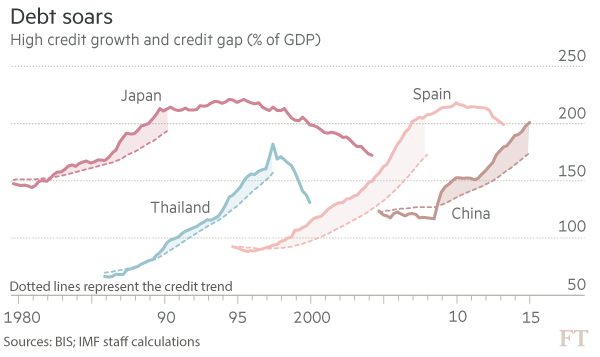

- “Today’s credit growth and consequent financial fragility are a direct consequence of the desire to prevent this from happening. It has been the way to keep investment up at uneconomic levels.” – bto: Und das mit immer mehr neuen Schulden. Das Land bekämpft die Imbalance mit immer mehr Schulden.

Quelle: FINANCIAL TIMES

Im Vergleich mit anderen Schuldnern:

Quelle: FINANCIAL TIMES

- “The Chinese authorities are in a trap: either halt credit growth, let investment shrink and generate a recession at home, a huge trade surplus (or both); or keep credit and investment growing, but tighten controls on capital outflows.” – bto: also entweder eine Schuldenblase im Inland oder eine Exportoffensive in ungeahntem Ausmaß mit einer enormen deflationären Wirkung auf die Weltwirtschaft. Spätestens dann ist der Euro Geschichte.

- “Suppose the Chinese authorities adopted, instead, the alternative policy of rapid liberalisation of both inflows and outflows, while relying on credit expansion to sustain domestic demand. (…) that would also cause three headaches. First, the domestic macroeconomic imbalances would persist. Second, the financial sector would become still more fragile. Finally, this vast, complex and fragile financial system would become fully integrated with the rest of the world’s, itself still far from fully stable. Instead of the Chinese financial crisis that many now think imminent, this would enormously increase the likelihood of another global crisis with China, not the US, at its heart.” – bto: Na, das ist doch mal was. Und dann soll noch jemand sagen, bto wäre pessimistisch.