“China Inc.’s $17 Billion Global Asset Selloff Is Far From Done”

Die chinesische Schuldenblase ist immer wieder auf der Agenda bei bto. Dabei hat das Thema der Auswirkungen auf die Weltwirtschaft immer eine Rolle gespielt, vor allem die Sorge vor einem deflationären Schock durch eine Abwertung der Währung stand im Raum. Ebenso interessant ist der Verkaufsdruck auf den Assetmärkten durch den Druck chinesischer Firmen bei der Liquiditätsbeschaffung:

- “The global retreat by some of China’s biggest and most-indebted conglomerates shows no signs of stopping — even after more than $17 billion of asset sales. A unit of HNA Group Co. this week missed payments on a 300 million yuan ($44 million) loan, illustrating how the once-acquisitive Chinese company will need to unload more properties and shares to overcome liquidity challenges.” – bto: was wiederum eine Art Margin Call ist, mit entsprechenden Wirkungen auf Assetpreise.

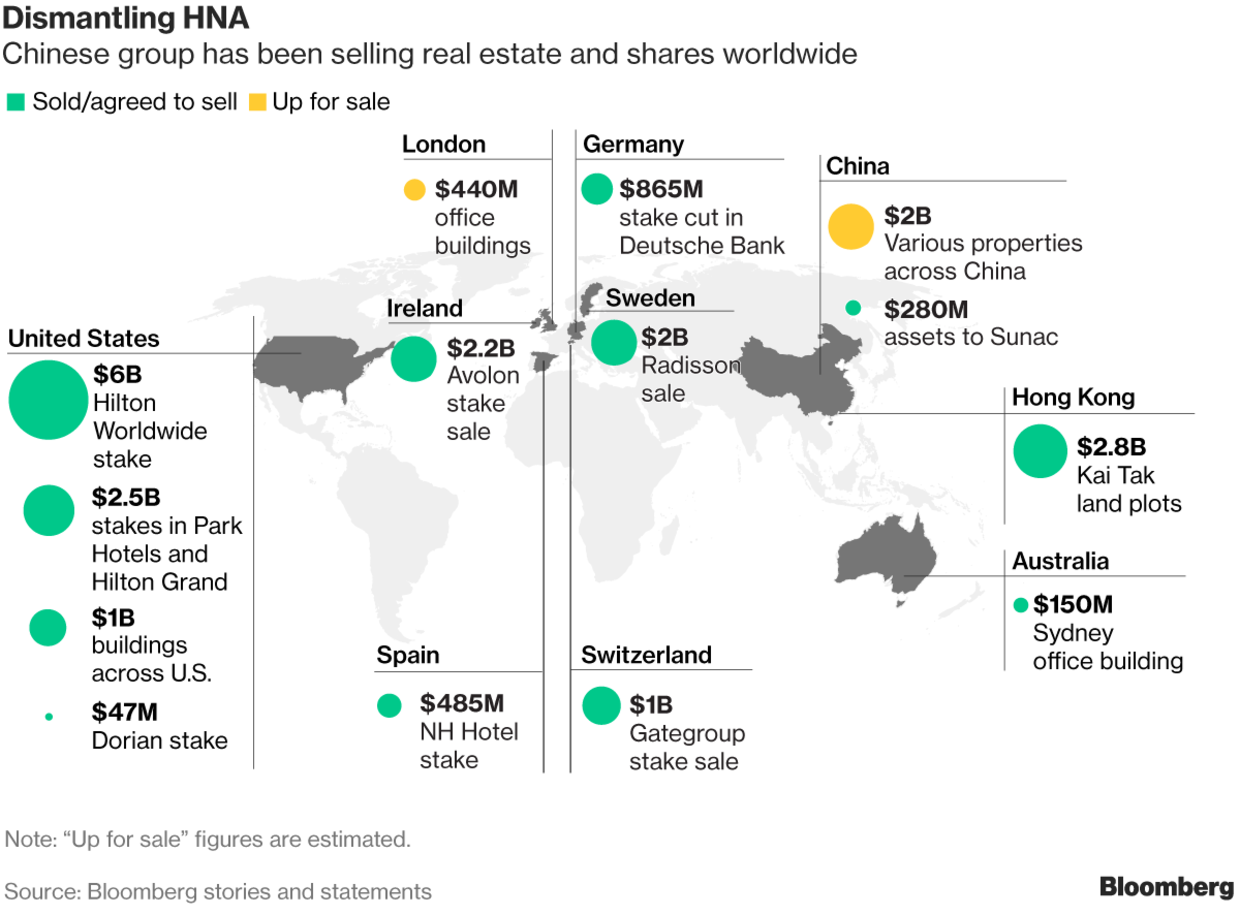

- “HNA is planning to exit its investment in Deutsche Bank AG, is seeking a buyer for its container-leasing Seaco business, plans to surrender eight floors of office space in Hong Kong and is selling stakes in various Chinese units, people familiar with the matters have said. What’s more, HNA is said to be dangling billions of dollars in real estate in the U.S., London and China in front of prospective buyers.” – bto: erinnert an die japanischen Notverkäufe in den 1990er-Jahren.

Quelle: Bloomberg

- “All in all, the company that was once at the forefront of China’s massive global buying binge has more than $17 billion in further asset sales planned, according to a tally by Bloomberg, as HNA tries to shrink back to its aviation roots. But as the missed payments show, there’s plenty of turbulence lying ahead for the conglomerate, which is saddled with one of the biggest debt piles in corporate China.” – bto: Verkäufe im Wert von 17 Milliarden. Wow.

- “HNA is in a Catch-22 situation right now because although it needs to divest its assets urgently to raise cash and shore up its balance sheet, the current market sentiment is weak, (…) “Financing for large acquisitions is becoming more difficult and more costly for potential buyers of HNA assets, and they may tend to low-ball HNA in terms of valuations.” – bto: So ist es. Man darf nie in der Situation sein, dass man verkaufen muss.

- “Behind HNA’s troubles are its debts, which by the end of June totaled 541.6 billion yuan ($79 billion). That amount, one of the highest levels for a non-financial company in Asia, is more than triple what fellow Chinese conglomerate Fosun International Ltd. owed. HNA also continues to pay some of the highest interest expenses in the world, according to data compiled by Bloomberg.” – bto: Wenn der Markt funktioniert, muss das auch so sein.

- “Consequently, HNA units have struggled to regain the confidence of bond investors, despite of signs that the group clinched the support of the government. (…) In another red flag, HNA Ecotech Panorama Cayman Co. said in September that it pushed back the redemption of $105.6 million in notes by eight weeks.” – bto: Natürlich, auch das muss so sein!!

- “Events such as the missed debt repayment are indications of the financial stress the company is under, exacerbated by the high level of short-term debt, but not necessarily a sign that the group is at imminent risk of collapse (…) The disposal of assets and deleveraging is likely to be a prolonged process.” – bto: Noch mag man das für einen Einzelfall halten. Es ist aber auch ein Warnzeichen für China gesamthaft.

→ bloomberg.com: “China Inc.’s $17 Billion Global Asset Selloff Is Far From Done”, 14. September 2018