“Capitalism Is Broken Because of Central Banks”

Man kann der Fachpresse nicht vorwerfen, sie würde das Problem nicht ansprechen. Ich erinnere an diesen Beitrag der FINANCIAL TIMES, den ich hier vor einigen Wochen hatte:

→ FT: Die globale Geldordnung ist am Ende

Heute schreibt Bloomberg, dass die Zentralbanken den Kapitalismus kaputtgemacht haben. Nicht schlecht. Vielleicht wäre das ein besseres Thema für Kevin Kühnert & Co.? Na ja, vermutlich zu kompliziert. Aber nicht für uns:

- “(…) while global stocks are at or near record highs, central banks around the world are increasingly abandoning their hopes of normalizing policy with economic growth slowing. On top of that, public and private debt levels are higher than ever. Some central banks are prepared to take drastic measures. In February, the staff at the International Monetary Fund published a guide to make even more negative interest rates work. Meanwhile, proponents of ‘modern monetary theory’ argue that governments should generate money and distribute it across the economy, until it reaches full employment.” – bto: einfach, weil die Politik immer mehr in eine Sackgasse geführt hat und nun zu einer immer radikaleren Fortsetzung zwingt.

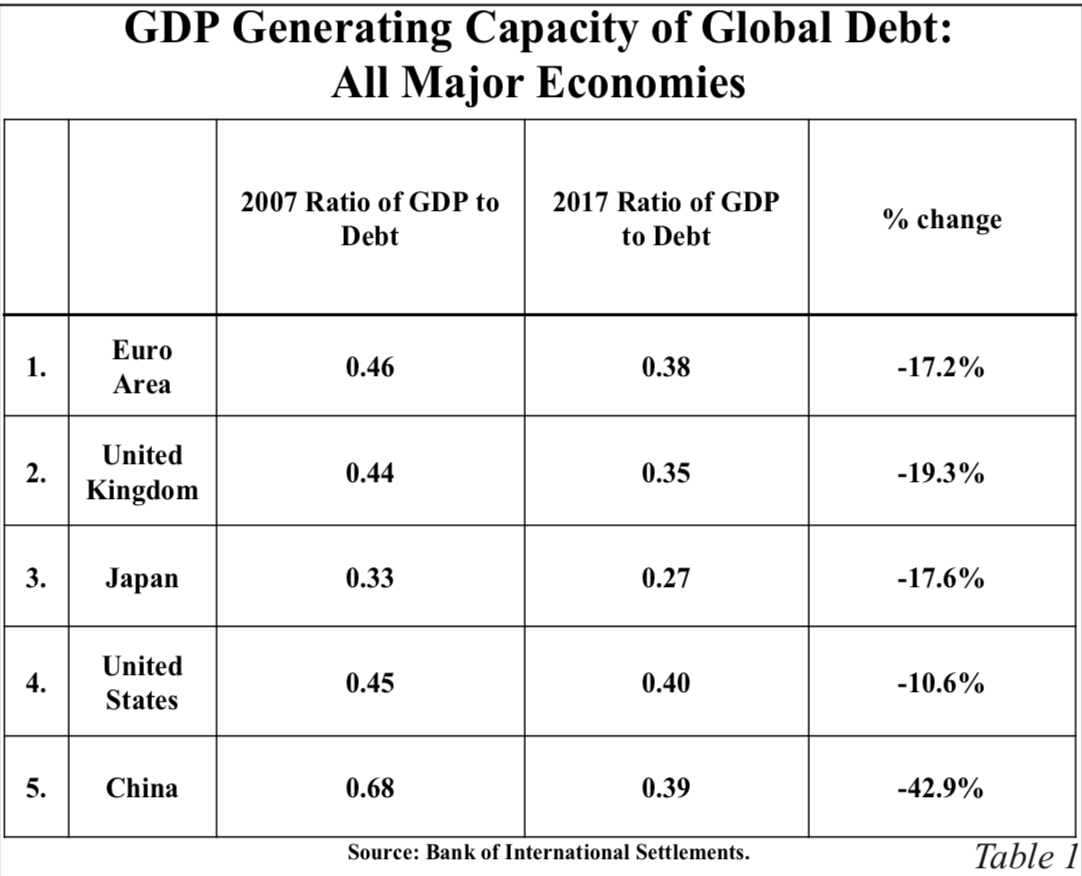

- “It’s clear that our growth model centered on credit and central bank support is broken, and the fix isn’t more money printing. While saving our economy from a deeper crisis, central bank liquidity injections only delayed this inevitable reckoning. (…) Private debt outgrew gross domestic product by four times in the U.S. since the 1960s. The Institute of International Finance says global debt stands at $243 trillion, more than three times worldwide gross domestic product.” – bto: Die Produktivität neuer Schulden nimmt schon lange ab. Zur Erinnerung die Analyse von Hussman, die ich hier schon mal hatte. Besonders stark ist der Rückgang in China, kein gutes Zeichen:

- “Persistent low interest rates have made the financial system more levered, encouraging risk-taking. They have also increased social and corporate inequality — making the rich richer and giving large firms an advantage through cheap funding in bond markets.” – bto: So ist es. Und damit ist das System immer gefährdeter.

Jetzt sagt der Autor, es gäbe Alternativen zu der Politik der Notenbanken. Schauen wir sie uns an:

- “(…) policy makers need to ensure a boom-bust financial crisis doesn’t happen again. This means reducing both the likelihood as well as the potential losses incurred. Asset-driven monetary policy does exactly the opposite: devaluing the purchasing power of money and inflating asset bubbles from government debt to property, art, collectibles, to growth and high-dividend stocks. Central banks should make financial stability and macro-prudential measures a primary mandate, and assess the long-term risks of each stimulus action (…)” – bto: Und was passiert mit den Blasen, die wir schon haben?

- “Debt-heavy capital structures are cheap to finance in good times, but become quickly unsustainable in a downturn and require a long period to de-lever, forcing policymakers to keep rates low for that time. More equity and flexible debt, such as ‘bail in’ or growth-linked bonds, mean investors can take losses in a downturn and borrowers can move on more quickly. GDP-linked debt has been endorsed by the IMF, the Bank of England and several groups of investors.” – bto: Das kann man alles machen, nachdem die bestehenden Probleme bereinigt wurden.

- “Second, we need to strengthen productivity and investment in the real economy. Capitalism isn’t capitalism without competition. Low rates have allowed inefficient firms to survive, and large firms to entrench into monopolies or oligopolies. Investment declined as CEOs focused on optimizing their firms’ capital structures. Corporate pre-tax profits have grown from 5 percent to 9 percent of U.S. GDP since the late 1990s, while wages shrank from 46 percent to 43 percent, according to Federal Reserve data.” – bto: Ja. Doch: a) Warum sollten die Unternehmen es plötzlich tun? b) Was machen wir, um die Anreize zu ändern? Und c), wie kommen wir vom Ist-Problem weg?

- “Third, we have to rebalance the inequalities generated by decades of debt-driven growth. There is no capitalism without meritocracy. Our education system, however, compounds inequality rather than improving it. Graduate admissions for new students remain highly dependent on their family’s wealth, and the postcode where you were born accounts for around 80 percent of your lifetime earnings. Tax systems are progressive from poor to middle-income earners, and regressive thereafter. Taxes paid by multinationals are 9 percent lower than pre-crisis, according to Financial Times estimates, while about 8 percent of the world financial wealth sits in tax havens, according to research by University of California-Berkeley economics professor Gabriel Zucman. This is equivalent to $200 billion in tax revenue lost per year.” – bto: Das stimmt auch bei uns. Aber hierzulande liegt es nicht an zu geringen Steuerzahlungen, sondern an der besonders schlechten Politik, die das Geld nicht in Bildung steckt.

- “Debt-driven growth, corporate entrenchment, lack of investment and rising inequalities have turned capitalism into a short-sighted game of kick-the-can. Central banks have bought us time, giving policy makers an opportunity to rebalance the system. If monetary policy remains the only game in town, we all lose.” – bto: Ja, doch wie kommen wir aus dem Problem raus, ist die Frage, die sich vor allen anderen stellt.

→ bloomberg.com: “Capitalism Is Broken Because of Central Banks”, 26. April 2019