Brechen die BBB-Bonds nach unten durch?

Schon mehrfach habe ich mich an dieser Stelle kritisch mit der gestiegenen US-Unternehmensverschuldung und den sich daraus ergebenden Risiken beschäftigt:

→ „GE steht symptomatisch für die Krise des Systems“

→ Unternehmensschulden: Problem oder nicht?

→ Ist die US-Unternehmensverschuldung doch kein Problem?

Heute nun eine Analyse, die nochmals aufzeigt, auf welch dünnem Eis wir uns befinden:

- “Corporate bond investors (…) are typically handcuffed with legal and/or self-imposed limits based on credit quality. For instance, most bond funds and ETFs are classified and regulated accordingly by the SEC as investment grade (rated BBB- or higher) or as high yield (rated BB+ or lower). Most other institutions, including endowments and pension funds, are limited by bylaws and other self-imposed mandates. The large majority of corporate bond investors solely traffic in investment grade, (…).” – bto: Witwen- und Waisen-Papiere nannte man das mal.

- “Often overlooked, the bifurcation of investor limits and objectives makes an analysis of the corporate bond market different than that of the equity markets. The differences can be especially interesting if a large number of securities traverse the well-defined BBB-/BB+ ‘Maginot’ line, a metaphor for expensive efforts offering a false line of security.” – bto: wobei es weniger eine Maginot-Linie ist als ein Staudamm, der, wenn er bricht, zu einer Sturzflut führt.

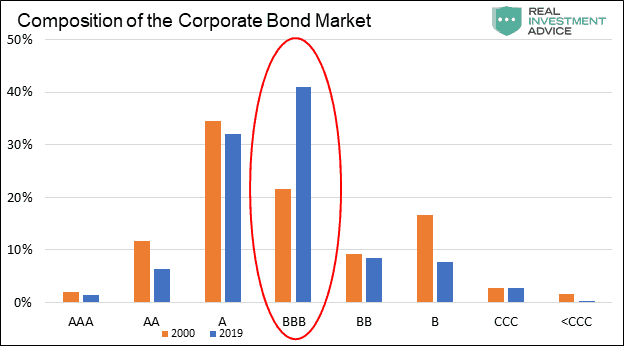

- “The U.S. corporate bond market is approximately $6.4 trillion in size. Of that, over 80% is currently rated investment grade and 20% is junk-rated. (…) Since 2000,(…) the corporate bond market has grown by 378%, greatly outstripping the 111% growth of GDP. The bar chart below shows how the credit composition of the corporate bond market shifted markedly with the surge in debt outstanding.” – bto: kurzgefasst – mehr und schlechter.

Quelle: Real Investment Advice

- “If only 25% of the BBB-rated bonds were downgraded to junk, the size of the junk sector would increase by $650 billion or by over 50%. – bto: Was zu diesen Fragen führt:Are there enough buyers of junk debt to absorb the bonds sold by investment-grade investors?If a recession causes BBB to BB downgrades, as is typical, will junk investors retain their current holdings, let alone buy the new debt that has entered their investment arena?Will retail investors that are holding the popular junk ETFs (HYG and JNK) and not expecting large losses from a fixed income investment, continue to hold these ETFs?

Will forced selling from ETF’s, funds, and other investment grade holders result in a market that essentially temporarily shuts down similar to the sub-prime market in 2008?”

– bto: Die Antworten auf diese Fragen liegen auf der Hand und sind nicht erfreulich. Es wäre wie in einem Kino, in dem jemand laut “Feuer!” schreit. Die Panik könnte nur von der Fed aufgehalten werden. Dazu kommt der – auch von mir immer wieder gebrachte – Punkt, dass die Rating-Agenturen wie schon vor der Subprime-Krise nicht streng genug beurteilen. In Wirklichkeit ist schon viel mehr Junk, obwohl es nicht so eingeordnet ist:

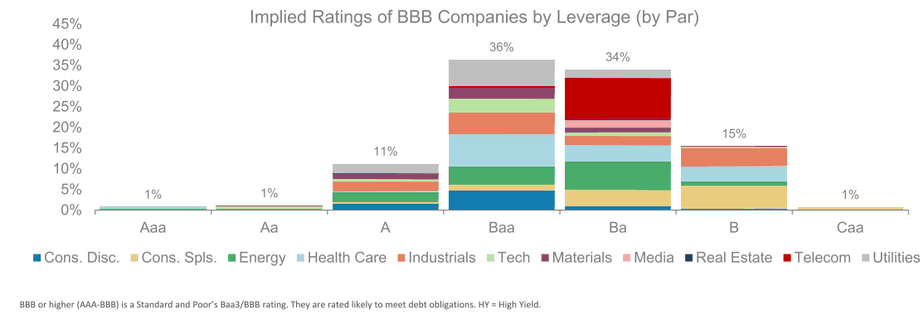

Quelle: Real Investment Advice

Quelle: Real Investment Advice

- “The graph shows the implied ratings of all BBB companies based solely on the amount of leverage employed on their respective balance sheets. (…) The graph shows that 50% of BBB companies, based solely on leverage, are at levels typically associated with lower rated companies. If 50% of BBB-rated bonds were to get downgraded, it would entail a shift of $1.30 trillion bonds to junk status. To put that into perspective, the entire junk market today is less than $1.25 trillion, and the subprime mortgage market that caused so many problems in 2008 peaked at $1.30 trillion.” – bto: Die Subprime-Krise war ein Spaziergang dagegen.

→ realinvestmentadvice.comReal Investment Advice: “The Corporate Maginot Line”, 22. Mai 2019