BIZ: Geldmenge ist relevant

Am Sonntag (16. April 2023) geht es im Podcast um Geldmenge und Inflation. Unter anderem wird auf diese Studie der Bank für Internationalen Zahlungsausgleich eingegangen:

- „Does money growth help to explain the post-pandemic surge in inflation? Monetary aggregates have gradually lost relevance since the heyday of monetary targeting in the 1970s and 1980s as their link with inflation has weakened considerably. Consequently, they have largely disappeared from academic analysis, as well as from monetary policy design and implementation. More recently, however, they have enjoyed a certain revival, as the surprising resurgence of inflation has gone hand in hand with increases in the money stock in a number of jurisdictions prominent in economic debates….“ – bto: Das kann man wohl sagen. Es gab eine allgemeine Tendenz, die Geldmengen nicht mehr für relevant zu erachten.

- „In considering the link between money growth and inflation, it is useful to think of inflation as a two- regime process, with transitions from the low- to the high-inflation regime that are potentially self- reinforcing. Recent analysis has documented that inflation behaves very differently in the two regimes. In the low-inflation regime, ie when inflation has settled at a low and stable level, measured inflation mostly reflects the short-lived effects of largely uncorrelated sector- specific price changes – ie the importance of the ‘common component’ of price changes is low – while wages and prices are only loosely linked. As a result, the inflation process has certain self-stabilising properties. In the high-inflation regime, by contrast, sectoral price changes are much more correlated, inflation is more sensitive to changes in salient prices, such as those of food and energy, or the exchange rate, and wages and prices are more tightly linked. As inflation rises and the importance of thecommon component increases, price hikes become more similar and synchronised, acting as a kind of coordinating device for agents’ decisions. This, in turn, increases the likelihood of wage-price spirals.“ – bto: Es kommt also auf das Umfeld an. Auch das verwundert nicht.

Und dann haben sie es untersucht:

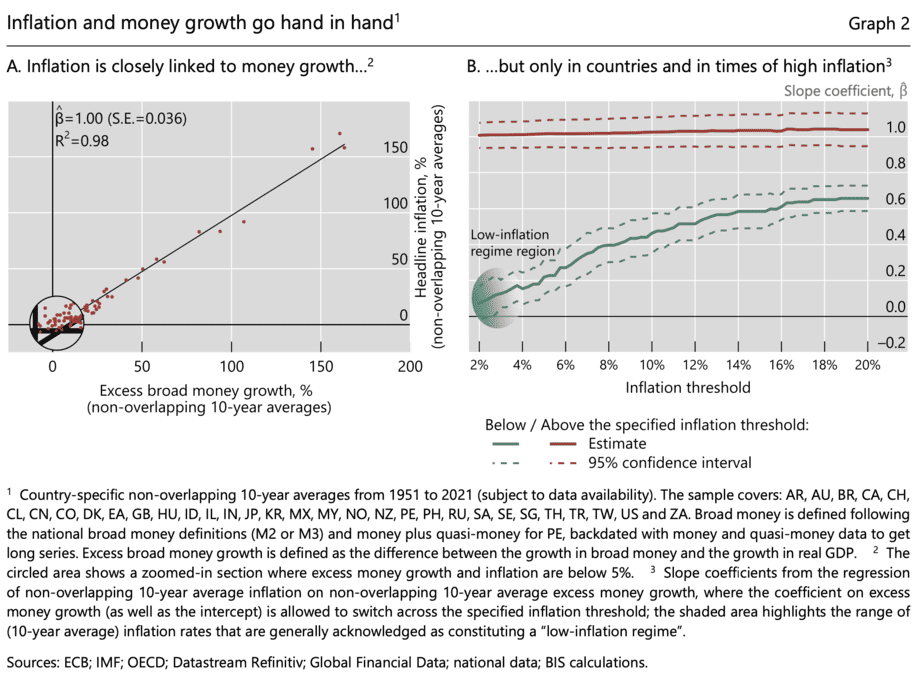

„Panel A illustrates the long-run relationship between inflation and ‚excess money growth‘ – the difference between money growth and real GDP growth – in a large sample of advanced economies (AEs) and emerging market economies (EMEs) for the period 1951–2021 using annual data. The graph displays the relationship between these two variables based on non-overlapping 10-year averages. When the observations from all countries are pooled, the standard relationship emerges clearly: there is a precisely estimated one-to-one link between excess money growth and inflation. But, as shown in panel B, if we split the observations into high- and low-inflation ones using different 10-year average inflation rate thresholds, we see that this relationship exists only when the inflation threshold moves out of the ‚low-inflation regime region‘. Moreover, as expected, the difference narrows noticeably as the inflation threshold increases further.“ – bto: Die Geldmenge spielt also nur dann eine Rolle, wenn die Inflation schon ins Laufen gekommen ist.

Quelle: BIZ

In einer Fußnote stellen die Autoren ergänzend fest:

- „Specifically, even if money turns out to have a close link with inflation whenever transitions are under way, there may be surges in inflation that are not followed by transitions. Indeed, this is what tended to happen during the low-inflation regime, when, for instance, money growth sometimes coincided with asset price ‚inflation‘ rather than inflation in goods and services.“ – bto: Genau das haben wir in den letzten Jahren erlebt.

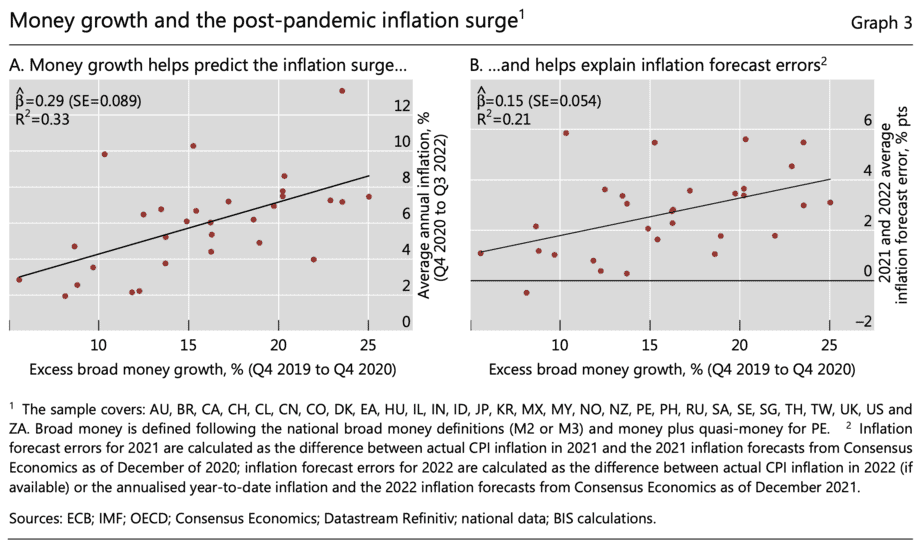

- „But the test can be made more demanding: could incorporating information about money growth have helped to improve the forecasts of professional economists? This is a tougher test because these forecasts presumably contained all the information available to forecasters when they were making their projections. The answer appears to be ‚yes‘. Across countries, there is a statistically and economically significant positive relationship between excess money growth in 2020 and professional forecasters’ misses of inflation in 2021 and 2022 (Consensus Economics forecasts) (Graph 3, panel B). That is, the underprediction of inflation was greater for those countries that saw higher excess money growth during the pandemic.“ – bto: … weil man nicht darauf geachtet hat.

Quelle: BIZ

Fazit: „(…) the findings are based on just one episode, albeit one that is broadly shared across countries. The acid test will come in the years ahead. Having said all this, the findings give pause for thought. Might the neglect of monetary aggregates have gone too far? In the end, only time will tell.“ – bto: Die Geldmenge wird als Indikator wieder an Bedeutung gewinnen.

→ BIS Bulletin No 67: „Does money growth help explain the recent inflation surge?“, 26. Januar 2023