Bitcoin als riskantes Spiel?

Am 14. November 2021 geht es in meinem Podcast um Kryptowährungen. Zu Gast ist (erneut) der österreichische Ökonom und Publizist Rahim Taghizadegan. Taghizadegan leitet die private Bildungseinrichtung Scholarium in Wien. Zur Vorbereitung ein paar Beiträge, die mir aufgefallen sind. Beginnen wir mit einem kritischen, was man schon am Titel erkennt: “Bitcoin is a ship of fools without a captain”:

- “(…) it’s a mark of the recognition Bitcoin and other cryptocurrencies are achieving that some retailers will now accept them as a form of payment. To the horror of the monetary authorities, they also seem to be attracting the attention of a number of mainstream investment institutions.” – bto: In der Tat werden Bitcoin und Co. zunehmend zu akzeptierten Geldanlagen.

- “According to some estimates, there are now more individuals in the UK who own some form of crypto than directly invest in listed shares – not so much the Thatcherite dream of a share-owning democracy as the bankers’ nightmare of a Bitcoin- dominated payments system, alive with fraud and criminality.” – bto: Es wird also gesagt, dass sich hier viele Briten auf ein riskantes Spiel einlassen.

- “This shouldn’t altogether surprise; the London Underground is plastered with advertisements for dodgy looking Bitcoin trading platforms. We seem indeed to be in the midst of a fully blown mania.“Fear of missing out” (Fomo) seems to be the primary motivation, particularly among the young. People buy because everyone else is buying, and seemingly making easy money from it.” – bto: Es wäre nur eine von vielen Blasen.

- “The “greater fool” theory has it that prices will keep rising as long as there is someone even more foolish than you willing to pay more. When there are no fools left, then the price will collapse. For now, however, there seems to be no shortage of them.” – bto: Im Gegenteil, die Tatsache, dass ich mich jetzt damit beschäftige, könnte man auch als ernstes Warnsignal sehen!

- “For true believers in the “liberating” qualities of cryptocurrencies – freedom, supposedly, from government and central bank devaluation of their money – last week marked a turning point in their still youthful life, bringing news of the first two US-based Bitcoin exchange traded funds – the ProShares Bitcoin Strategy Fund and the appropriately named Valkyrie Bitcoin Strategy Fund. Meanwhile, the Houston Firefighters’ Relief and Retirement Fund and the Ontario Teachers’ Pension Plan have poured further petrol on the flames by announcing they are vesting some of their members’ money into cryptos.” – bto: Es wird auch von immer mehr Experten empfohlen, dies zu tun.

- “Try as I have, and philosophically drawn as I might be to the idea of a privately constructed currency that is not the subject of seemingly perpetual manipulation by the governing central bank, it’s hard to see the point of Bitcoin or any of its clones. It’s too volatile to be useful as a reliable means either of exchange or store of value. Unlike gold, moreover, its gyrations bear no relation to what’s happening in the economy or in the price of other asset classes.” – bto: Es ist unkorreliert und damit eigentlich eine gute Diversifikation.

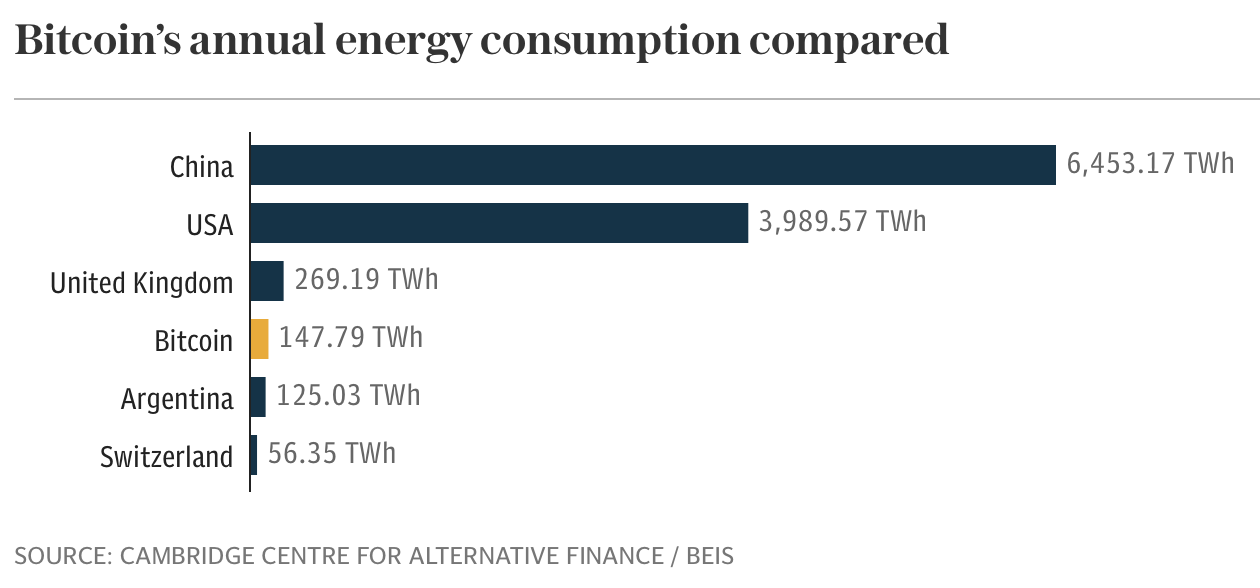

- “Worse, the business of mining these currencies uses up huge amounts of energy. Banning cryptos didn’t save China from its current wave of power cuts, but they might have been a great deal worse had Bitcoin mining been allowed to continue. As it is, the business migrated to the US, where it is widely thought to have contributed to the spike in electricity prices in towns where miners have settled.” – bto: In der Tat ist es sehr energieintensiv:

- “(…) the craze is causing growing concern among central banks, deposit takers, and financial regulators – and not just because it provides fertile ground for fraudsters, crooks, and financial loss. Cryptos also pose a threat to their own monopoly of money. As long as cryptos remain just another form of gambling, then they perhaps don’t have too much to worry about. (…) But the advent of so-called stable coins, which aim to remove the volatility of plain vanilla cryptos by pegging them to fiat money, is a different matter. The likes of Facebook’s mooted Libra might have real potential as an alternative payments system.” – bto: und dies mit einer deutlichen Überlegenheit: Daten!

- “The Bank of England and US Federal Reserve are chasing hard, but worry about the potential for e-cash to create financial instability through bank runs and the implications for credit allocation. (…) Physical cash is none the less dying on its feet almost everywhere, so it is incumbent on national authorities to provide some kind of digital alternative. If they don’t, then maybe the cryptos are in with a chance after all.” – bto: also eine sehr skeptische Sicht zum Anfang.