Basiert die Dollarschwäche auf falschen Inflationserwartungen?

Heute Morgen hatte ich eine Sicht auf die Schwäche des US-Dollars. Hier nun ein anderer Erklärungsansatz:

- “(…) the world’s reserve currency has now been falling fairly steadily for about a year, and almost every other currency has strengthened against it. Since this period of weakness represents a big change of direction compared with the robust rise in the dollar’s value from 2011-17, something fundamental must have changed.” – bto: weshalb ja auch das Ende des starken Dollars ausgerufen wird.

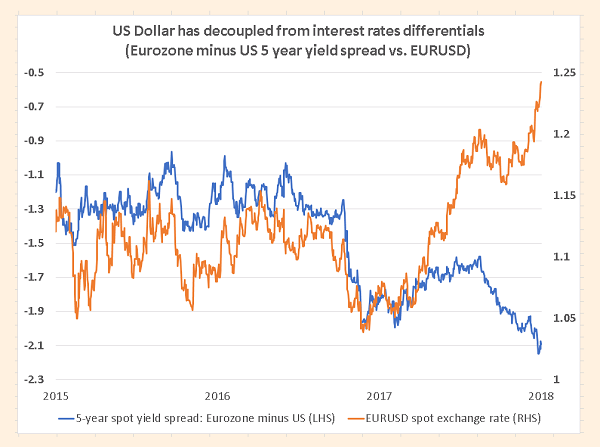

- “The dollar started to drop just as the Federal Reserve began to accelerate the path for US rate rises and to scale back its balance sheet. Meanwhile, the ECB and the Bank of Japan did nothing, keeping their policy rates fixed at zero. The dollar’s behaviour, especially against the euro, seems to have been the opposite of what might have been expected, given the change in relative monetary policy. The breakdown in the link between the dollar/euro exchange rate, and the five-year (spot) bond spread between the US and the eurozone is shown here.” – bto: Es ist wirklich gegen die Theorie, dass der Dollar fällt.

Quelle: FT

- “I am therefore attracted to an alternative view that (…) emphasises that it is the market’s expectation of future policy changes that matters, not the average level of rates over the next five years. After all, it is when the market changes its expectation of the path for future rates that we would expect the spot exchange rate to shift. And this factor does fit the recent behaviour of the dollar/euro exchange rate rather nicely.” – bto: Es sind also die erwarteten Zinsen, nicht die aktuellen.

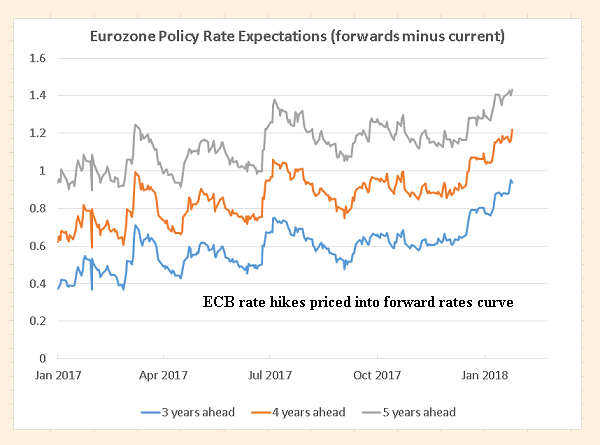

- “This shift in policy expectations in the US is in sharp contrast with what has happened in the eurozone. While the ECB has left spot policy rates unchanged at minus 0.4 per cent, and has continued to offer extremely dovish forward guidance about rates, the market has changed its view of what the ECB will do after the period of forward guidance ends. It believes increasingly strongly that the ECB will be normalising rates quite quickly, whatever Mr Draghi says today. Therefore the amount of monetary tightening expected over 3-5 years ahead has been marked up considerably.” – bto: Die Märkte erwarten steigende Zinsen in der Eurozone! Wie das möglich ist angesichts der ungelösten Probleme, ist mir allerdings schleierhaft.

Quelle: FT

- “These changes in monetary policy expectations have led to a sharp steepening in the eurozone (spot) bond yield curve from two to five years out. In the final graph, we compare the slope of the two curves (eurozone slope less US slope) with the dollar/euro exchange rate. The hawkish shift in expectations about ECB policy and the slight dovish shift in the US has increased the relative steepness of the eurozone yield curve, and this has been accompanied by a much weaker dollar, as would be expected. Therefore, changes in expected monetary policy have continued to be an important driver of dollar/euro, and probably many other dollar exchange rates as well.” – bto: Das leuchtet mir ein und wirft die Frage auf, wie es weitergeht.

- “If we translate this into more familiar economic language, the following is what has happened. In the US, the Fed had already mapped out a clear path for monetary policy normalisation by the beginning of 2017, with an equally clear estimate of the equilibrium rate (r*) that it intended to reach in the long term. This was mostly priced into the bond market, and little has changed since then, though r* has actually dropped a bit. The Fed has raised policy rates, but only as already anticipated by the market. In contrast, there was no clear path towards normal rates priced into the eurozone curve a year ago. Since then, the very large upward adjustment to GDP forecasts in Europe has induced the market to become much more confident that the ECB will normalise rates from 2019-22. This has not been triggered by any change in the ECB’s guidance about monetary policy in the period up to mid 2019 — that guidance has remained very dovish. But after that date, the market believes increasingly strongly that the ECB will be normalising rates quite quickly.

- “When viewed in this light, the decline in the dollar, at least against the euro, seems unsurprising. Monetary policy expectations have remained crucial, even though this does not show up in simple comparisons of spot two-year or five-year yields. Equally, we do not need explanations based on the balance of payments, currency valuations or the Trump dollar policy to explain all of the dollar’s move, even though they may be playing some role. Once the market has fully adjusted to stronger eurozone growth prospects, along with a more restrictive ECB, the fall in the dollar will lose one of its main driving forces. This could happen in the fairly near future.”

→ FT (Anmeldung erforderlich): “Dollar weakness driven by monetary policy after all”, 28. Januar 2017