Bank für Internationalen Zahlungsausgleich warnt vor Sorglosigkeit an den Märkten

Der neue Quartalsbericht der Bank für Internationalen Zahlungsausgleich ist auf dem Markt. Deshalb auch pünktlich zum offiziellen Launch bereits am Sonntagabend bei bto zu lesen.

Die BIZ ist diesmal nicht so deutlich alarmistisch wie in vergangenen Jahren. Erinnert sei an:

→ Die Warnung der BIZ vor dem globalen Margin Call

→ Die BIZ warnt vor dem Ende des Finanzzyklus

→ Die BIZ warnt vor der Eiszeit

Dennoch sind die Überlegungen zu den Entwicklungen an den Finanzmärkten so klar und deutlich, wie man es erwartet. Die Warnung ist überdeutlich, für jene, die es lesen wollen: Die Märkte sind sorglos, gehen übermäßige Risiken ein, dies auch noch auf Kredit und die Vergangenheit lehrt, dass es ähnliche finanzielle Rahmenbedingungen nur vor der nächsten großen Krise gab und nicht in einem Umfeld, was noch ein paar Jahre stabil bleibt. Ich sehe darin eine klare Bestätigung für die Empfehlung, das Haus wetterfest zu machen. 2018 könnte – muss nicht – das Jahr des großen Knalls sein. Das Timing ist schwer. Die Prognose nicht. Die ist glasklar:

Hier die Highlights aus dem Marktteil des Reports:

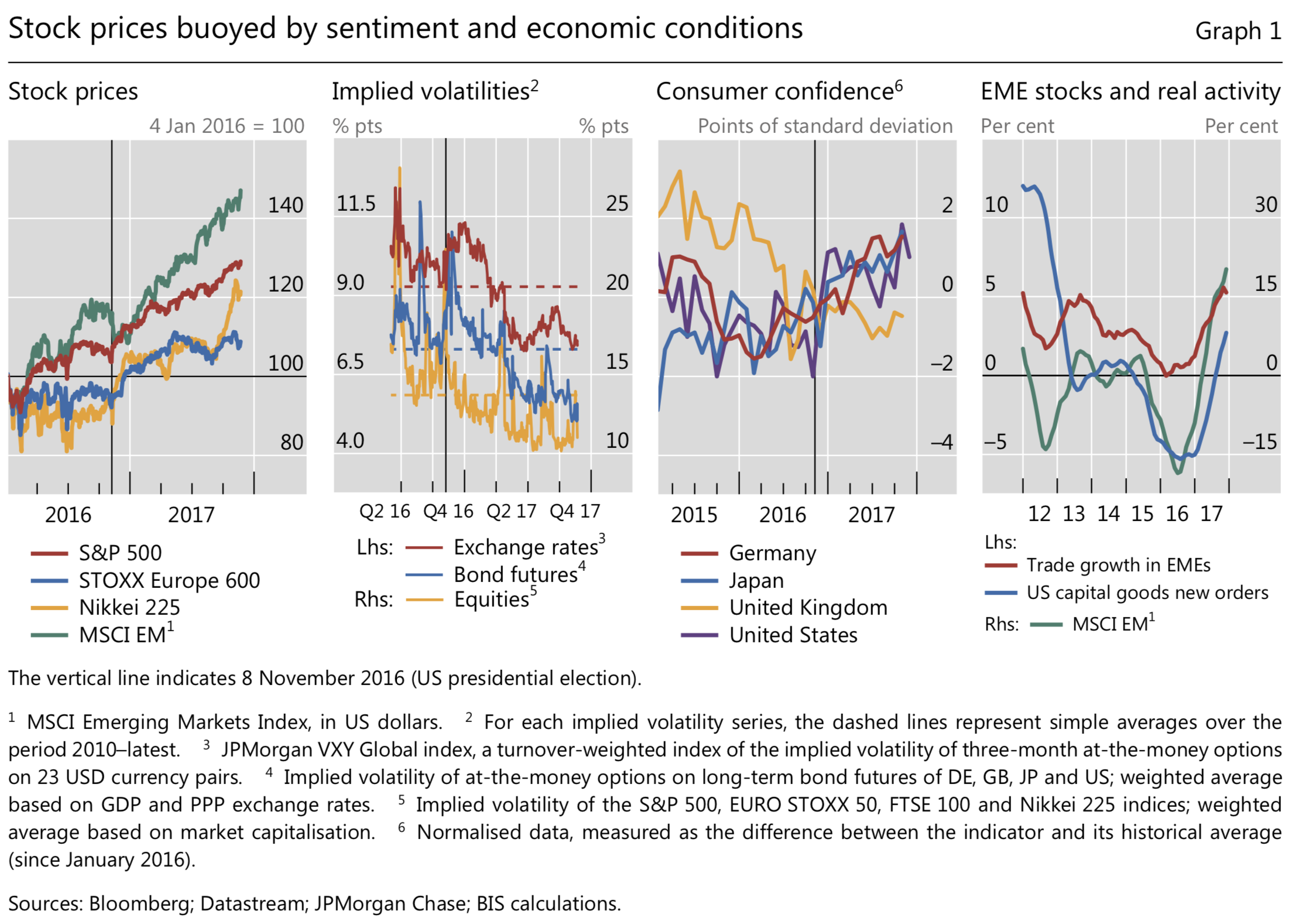

- “Amid further synchronised strength in advanced economies (AEs), mostly solid growth in emerging market economies (EMEs) and, last but not least, a general lack of inflationary pressures, global asset markets added to their year-to-date stellar performance while volatility stayed low.” – bto: Und wir alle freuen uns über die gute Konjunktur und boomende Börsen.

- “Even as the Federal Reserve implemented its gradual removal of monetary accommodation, financial conditions paradoxically eased further in the United States and globally. Only exchange rates visibly priced in the Fed’s relatively tighter stance and outlook, which helped stop and partially reverse the dollar’s year-long slide.” – bto: Die Märkte scheinen es nicht zu glauben. Sie wissen, dass die Verschuldung viel zu hoch ist.

- “As long-term yields remained extremely low, valuations across asset classes and jurisdictions stayed stretched, though to different degrees. Near-term implied volatility continued to probe new historical lows, while investors and commentators wondered when and how this calm would come to an end. Ultimately, the fate of nearly all asset classes appeared to hinge on the evolution of government bond yields.” – bto: Ich denke, es ist ein klares Warnsignal, dass wir nun am billigen Geld hängen. Vor allem darf man nicht daraus schließen, dass nie mehr fallen kann, eben weil die Zinsen nie mehr sinken.

- “By late November, the S&P 500 had risen almost 14 % since the beginning of the year, and more than 5% from early September. After falling sharply following the US presidential election, EME stocks outperformed their AE peers, surging almost 30 % in the year to date, and more than 4% in the period under review. Japanese equities staged a rally of almost 15 % from early September. European stocks lagged their peers with increases of almost 7 % in the year to date, most of which were recorded during the fourth quarter.” – bto: Es ist eine Superparty!

- “The ebullient mood coincided with renewed declines in implied volatility for equities, bonds and exchange rates. The implied volatilities of bond and equity markets in the United States, the euro area, Japan and the United Kingdom have been significantly below post-Great Financial Crisis (GFC) averages all year. In fact, they have touched the all-time troughs previously reached briefly in mid- 2014 and before the start of the crisis in mid-2007. Implied volatility in exchange rate markets is also compressed, nearing the lows recorded during the summer of 2014.” – bto: ebenfalls keine gute Situation. Im Gegenteil ein erhebliches Warnsignal.

- “This remarkable performance was once again underpinned by strong economic data. (…) Despite stronger activity, inflationary pressures remained remarkably subdued in most AEs. Inflation (…) edged up slightly in Japan while still remaining below target. Core inflation continued to be weak in the euro area, (…) stayed close to 2 % in the United States, (…).” – bto: eben weil die Kapazitäten nicht (genug) ausgelastet sind und der Druck der Schulden zu hoch. Außerdem unterliegt die BIZ wohl dem selben Messfehler wie die Fed, wie die Deutsche Bank so klar herausgearbeitet hat.

- “The 10-year Treasury yield received a boost in early September when the beginning of balance sheet normalisation appeared certain, but its momentum fizzled out as the quarter progressed. The response was stronger at shorter tenors, with the two-year Treasury yield increasing about 50 basis points from early September (right-hand panel). Yields at both ends of the term structure barely moved in the euro area and Japan, underlining the overall stability of policy expectations.” – bto: Es könnte allerdings auch bedeuten, dass die Märkte eben nicht an die Reflation glauben, sondern eher an einen Rückfall in die deflationäre Grundtendenz.

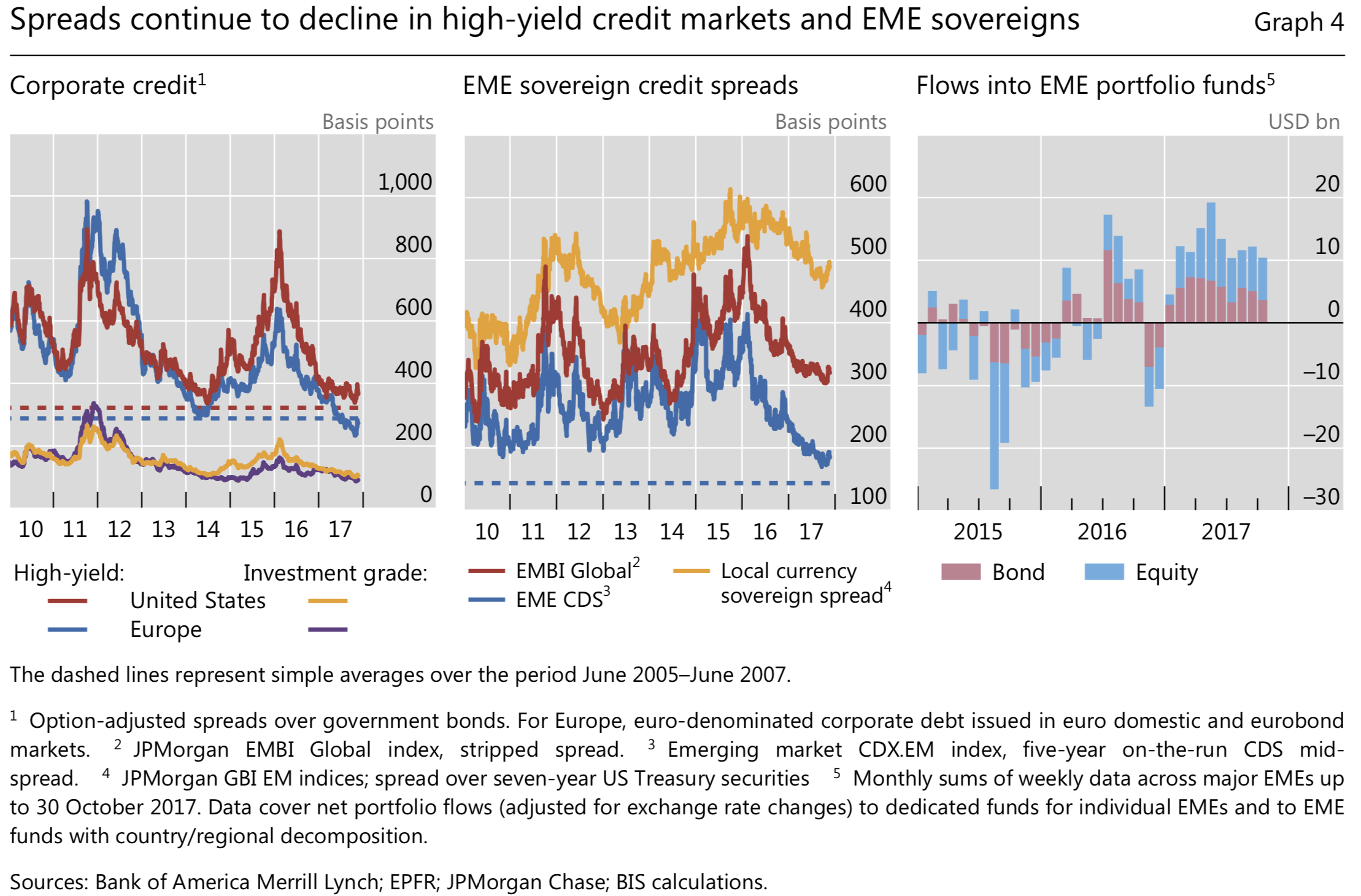

- “Corporate credit spreads continued to narrow, reinforcing the bullish message of equity markets. (…) Before that, the US high-yield market had been plumbing spreads in the low 300s, a level breached only in the run-up to the 1998 Long-Term Capital Management crisis and again almost 10 years later just before the outbreak of the GFC. (…) European high-yield spreads had been lower only occasionally during the period prior to 2007.” – bto: Alarm! Oder stehen wir heute so viel besser da als 2007? Ich denke, nicht. Die Schuldenblase ist noch größer, die Munition der Notenbanken (teilweise?) verbraucht.

- “Overall, global financial conditions paradoxically eased despite the persistent, if cautious, Fed tightening. Term spreads flattened in the US Treasury market, while other asset markets in the United States and elsewhere were buoyant.” – bto: stimmt. Die globale Liquidität (genauer, der Überschuss) sind weiter gewachsen. Das könnte sich erst ändern, wenn a) die Wirtschaft nachhaltig wächst, b) die Notenbanken wirklich bremsen.

- “Financial conditions have conspicuously eased in US markets over the last 12 months, despite the Federal Reserve’s gradual removal of monetary accommodation. (…) Two-year US Treasury yields have indeed risen by more than 60 basis points since December 2016, but the yield on the 10-year Treasury note has traded sideways. Moreover, the S&P 500 has surged over 18% since last December, and corporate credit spreads have actually narrowed, in some cases significantly.” – bto: Es ist eine Party, anders kann man es nicht beschreiben!

- “In many respects, the current tightening cycle has so far been reminiscent of its mid-2000s counterpart. During the first year of that cycle, stock markets rose, while long-term Treasury yields and credit spreads dropped in the face of slightly more forceful Fed action (…). At the time, Federal Reserve Chair Alan Greenspan had characterised the fall in long-term yields as a ‚conundrum‘.” – bto: Wenn das keine eindeutige Warnung der BIZ ist, dann weiß ich es nicht! Raus aus den Märkten, war meine Schlussfolgerung.

- “A decomposition of 10-year US Treasury yields into a future rate expectations component and a term premium suggests that declining term premia drove long-term rates lower both now and during the mid-2000s ‚conundrum‘ episode. In both cases, the drop in estimated term premia more than offset the upward revision in expectations about the future path of short-term interest rates.” – bto: Diejenigen, die damals auf die langfristigen Anleihen gesetzt haben, hatten letztlich recht. Es kam die Krise und mit ihr deutlich sinkende Zinsen, die dann die nächste Blase (Immobilien) aufgeblasen haben!

- Die BIZ lobt dann ausdrücklich die Vorgehensweise der Fed: “In addition to being perceived as gradual, policy decisions in the current cycle were well anticipated. Little or no additional market information was transmitted by the actual policy rate decisions. (…) The balance sheet policy was also carefully and extensively communicated.” – bto: Wobei ich denke, die Marktreaktion widerspiegelt mehr die Erwartung, dass es eben nicht möglich sein wird, ohne Crash und Krise die Zinsen zu erhöhen, weshalb am Ende noch aggressivere Maßnahmen der Fed und der anderen Notenbanken stehen werden.

- “(…) research has investigated the various ways in which predictable central bank actions, by removing uncertainty about the future, can encourage leverage and risk-taking. Indeed, while investors cut back on the margin debt supporting their equity positions in 1994, and stayed put in 2004, margin debt increased significantly over the last year.” – bto: für Leser dieser Seiten keine Neuigkeit, aber ein erhebliches Warnsignal.

- “Central bank balance sheets have continued to expand while yields and term premia have remained low in most of the major AEs. As a result, despite the Fed’s move towards tightening, the global search for yield has supported buoyant asset prices in the United States.” – bto: was ein erhebliches Problem darstellt, weil wir alle einseitig positioniert sind.

Dann fragt die BIZ: “High valuations: market complacency?” – bto: Die Antwort ist für mich klar: JA. Doch was denkt die BIZ?

- “Market commentary has increasingly focused on the degree of asset price inflation that unconventional monetary policies may have instilled in different asset classes. Stock market valuations have come under particularly close scrutiny. (…) At the root of these uncertainties are questions about how the compression of term premia in core sovereign bond markets may affect other asset valuations.”– bto: “may”? definitiv!

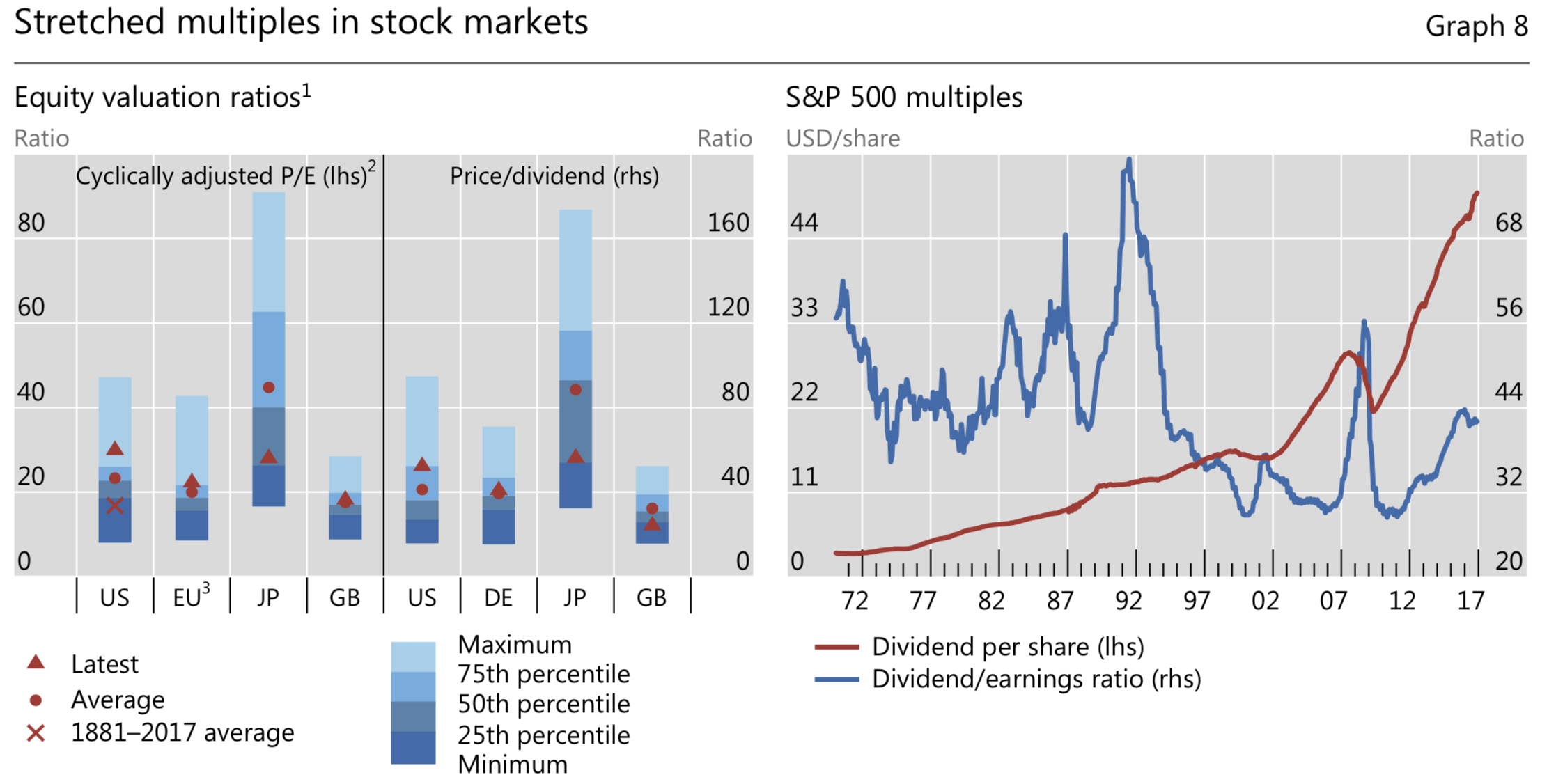

- “According to traditional valuation gauges that take a long-term view, some stock markets did look frothy. At its recent levels in excess of 30, the cyclically adjusted price/earnings ratio (CAPE) of the US stock market exceeded its post-1982 average by almost 25 %, comfortably sitting in the highest quartile of the distribution. Admittedly, this is still short of the extraordinary peak of 45 reached during the dotcom bubble of the late 1990s. But it is almost twice the long- term average computed over the period 1881–2017. While the available series do not stretch as far back for European and UK equities, their CAPEs were at their post-1982 averages. Meanwhile, the CAPE for Japanese equities was less than 50 % its available long-term average. Price/dividend ratios conveyed a similar message.” – bto: Das bestätigt nochmals, was viele Stimmen auch hier sagen: Europa o. k., Japan relativ billig. USA sehr teuer. Allerdings dürften sich diese Märkte von einem Einbruch in den USA nicht abkoppeln können.

- “The share of net income paid out in dividends has increased by more than half over the last five years. (…) High dividends per share were also supported by stock repurchases. Except for a short interlude in 2008–09, share repurchases have been very large since the early 2000s (bottom left-hand panel). When and if interest rates begin to rise, corporates may have the incentive to tilt their capital structure back to equity, or at least to reduce stock repurchases, which could raise further questions about stock market valuations.” – bto: Die US-Unternehmen haben das billige Geld zur Spekulation und nicht zur Investition genutzt und sind pro-zyklisch. Wenn Aktien teuer sind, kaufen sie. Wenn Aktien billig sind, verkaufen sie.

- “Listed corporates’ net income has grown rapidly, in fact much more rapidly than US GDP, since the mid-1990s: the ratio of corporate net income to GDP rose from an average of 1.5 % in the 1980s to 5.5 % by the mid-2000s, and has fluctuated around that level ever since. If net income continued growing at this more modest pace, in lockstep with nominal GDP, corporations would not be able to continue growing dividends at current rates while keeping payout ratios constant.” – bto: Tja, auch die BIZ kann rechnen und nicht nur Analysten wie GMO. Es ist mathematisch unmöglich, dass sich die Trends fortsetzen.

- “Doch dann kommt auch die BIZ mit dem Vergleich zum Bondmarkt: ‘Stock market valuations looked far less frothy when compared with bond yields.‘ (…) Meanwhile, since the GFC, real Treasury yields have fallen to levels much lower than the dividend yield, and indeed have usually been negative. This comparison would suggest that US stock prices were not particularly expensive when compared with Treasuries.” – bto: Wir vergleichen einen völlig überbewerteten Wert mit einem anderen völlig überbewerteten Wert und finden Letzteren dann fair bewertet … O. k., habe ich schon an anderer Stelle zerlegt.

- “Some froth was also present in corporate credit markets even in relation to core sovereign bonds. Credit spreads appeared to be rather compressed, especially in the high-yield space. Looking at the last 20 years of data, both US and European investment grade corporate spreads were below their long-term averages. In the high-yield segment, European spreads almost touched their all- time lows, whereas US spreads were only at the door of the lowest quartile of the distribution.” – bto: als wäre die Welt perfekt! Sie ist es aber nicht. Es ist nur die Folge des größten geldpolitischen Experiments der Weltgeschichte (denke ich).

- “In spite of these considerations, bond investors remained sanguine. The MOVE index suggested that US Treasury volatility was expected to be very low, while the flat swaption skew for the 10-year Treasury note denoted a low demand to hedge higher interest rate risks, even on the eve of the inception of the Fed’s balance sheet normalisation (Graph 9, right-hand panel). That may leave investors ill-positioned to face unexpected increases in bond yields.” – bto: nicht nur Investoren. Wenn es dreht, platzt die gesamte Blase. Margin Call eben!

Die BIZ ist diesmal zurückhaltend. Natürlich kann sie schon aufgrund ihrer Rolle keinen Crash vorhersagen, zum anderen ist es nicht schön in der Rolle des ewigen Mahners zu sein, um dann zu sehen, wie die Party weitergeht. Kann ich gut verstehen. Die Signale sind eindeutig und die Geschichte gibt auch hier der BIZ recht.

Hier der Link zur ganzen Studie: