Alterung bedeutet Inflation

Vor einigen Jahren zitierte ich eine Studie der Bank für Internationalen Zahlungsausgleich, die angesichts der alternden Bevölkerung von höherer und nicht von tieferer Inflation und damit auch Zinsen ausgeht. Eine Argumentation, der ich sehr gut folgen kann. GAVEKAL unterstreicht das mit einem interessanten Blogbeitrag:

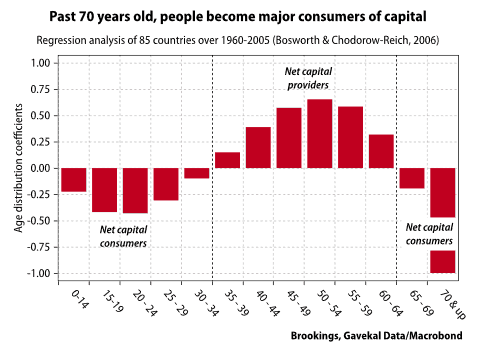

- “The demography of most Western and Asian countries is set to change dramatically over the coming years. Take the US as an example. Every year from now on, some 3mn people will turn 70 years old. (…) the reality is that at around that age, the direct contribution of most people to society shifts. From their 30s to their 60s, people are capital providers. Past 70, they become heavy capital consumers.” – bto: Das leuchtet ein.

- “(…) if we accept that in most countries most of the saving is done by people aged 35-64 years, we can come up with a ‘capital providers ratio’. This is a weighted coefficient of the numbers of people in the savers’ cohorts relative to the total population. For the world (or at least for the top 85 countries by GDP, which account for almost all global saving), the capital providers ratio looks something like this.” – bto: Ich finde das nachvollziehbar und auch spannend. Dann wären wir vor einem strukturellen Zinsanstieg, den wir uns aber angesichts der Verschuldung nicht leisten können.

- “(…) the world is now entering a new ‘dis-saving’ phase, as the baby boomers start to live off their past contributions into 401(k), pension plans and the like. History suggests this phase is likely to be inflationary.” – bto: Und die Zinsen müssen trotzdem tief bleiben, um die Entschuldung zu erleichtern.

- “Across emerging markets, a number of countries will continue to see improving capital providers ratios. But will China’s, India’s or Brazil’s excess capital flow to the US to fund excess consumption there? Or will it stay at home?” – bto: Die USA bleiben der sichere Hafen, da würde ich drauf wetten.

- “The counter example to this theory, of course, is Japan, where the capital providers ratio topped out in 2010 and where inflation has yet to make a significant mark. However, it is interesting to note that Japanese inflation bottomed out in 2010, just as the capital providers ratio topped out.” – bto: Und die Zinsen sind dort schon höher als bei uns!